Gm fellow Architects;

From Bitcoin's transaction frenzy to the cooling off of the crypto market (but a benign outlook for riskier assets) and a historical analysis of long-term investment strategies, this edition of our newsletter covers everything you need to stay on top of the crypto happenings.

• Bitcoin transactions sky-rockets as Ordinals increase in popularity.

• Crypto market is cooling down despite a more benign outlook for risky assets.

• No one who’s held bitcoin for 3 years has lost money, historical data shows.

🚀 Bitcoin transactions sky-rockets as Ordinals soar

Ordinals' project was launched on Dec/22 and has been referred to as an NFT equivalency for the Bitcoin network. It works by assigning a numerical value (an identity) to each satoshi (each bitcoin can be divided into 100 million satoshis, its atomic unit). You can read more about Ordinals here.

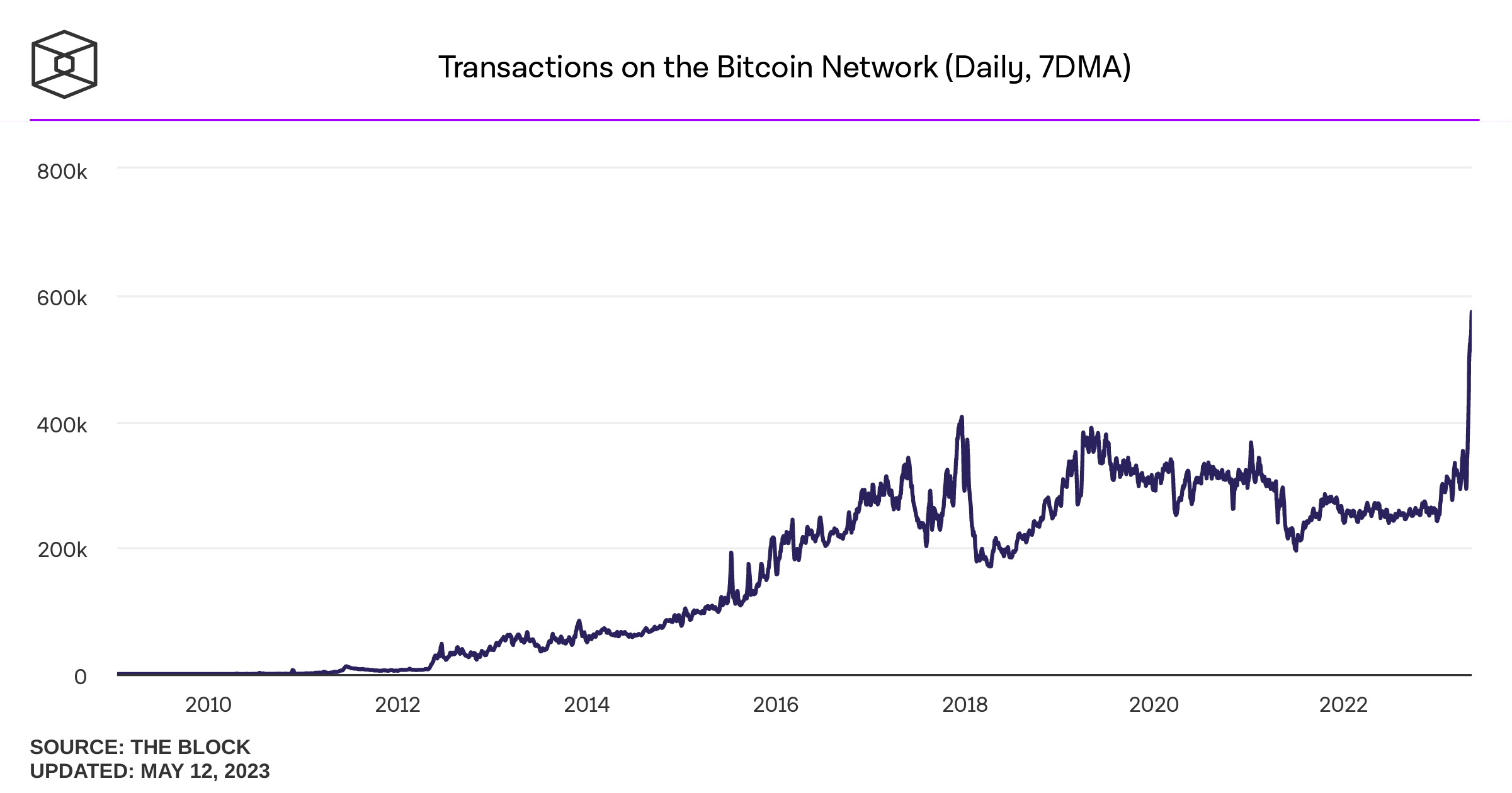

- Bitcoin's number of transactions sky-rocketed in the week, reaching levels unseen even in past phrenesis periods, when Bitcoin's price was constantly renewing its all-time highs.

- The reason for all activity is a new use for the longest and (assumed) safest blockchain: the creation of digital artifacts, an innovation brought about by the Ordinals protocol.

- With roughly 19.1mn bitcoins in circulation, there are about two quadrillion sats. Users are using Ordinals to earmark some of its satoshis with data (e.g., text messages, song lyrics, poems, audio, and images and memes).

- The use of Bitcoin's blockchain for alternative uses raises a lot of criticism by purists, that consider this more as an exploration of a code flaw than a truly useful feature. Anyways, all this new activity shows how effervescent the crypto environment is, bringing new uses (and creating demand) even for the most established protocol.

📊 Crypto market is cooling down despite the more benign outlook for risky assets

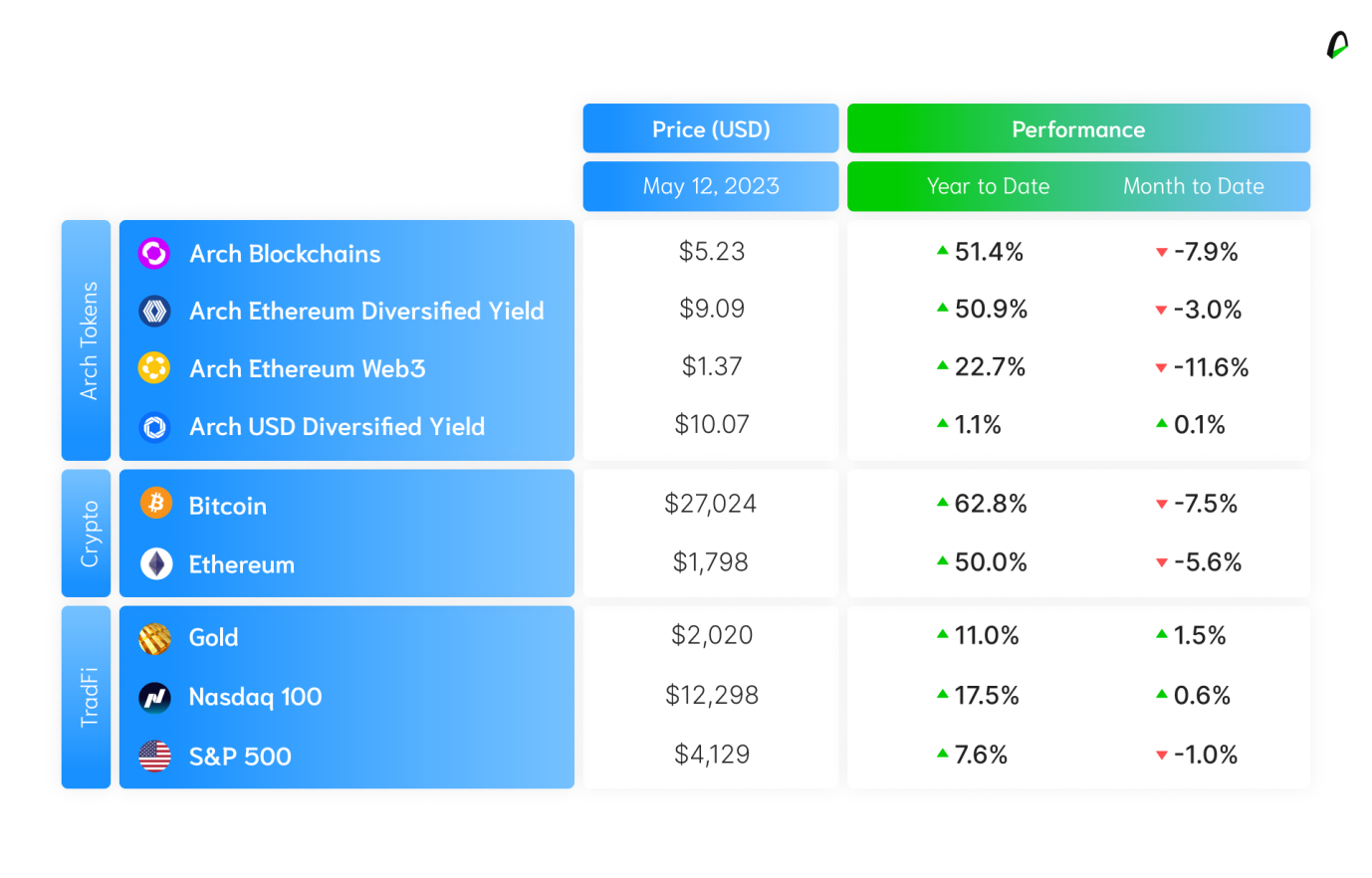

After a strong start to the year, with four positive months in a row with 50%+ in YTD returns and the flare of activity around Bitcoin, the crypto market has cooled down in May, with the Arch Blockchains accumulating a drop of 7.9% during the first weeks of the month.

These price adjustments have taken place despite a more benign market environment for risky assets: (i) the absence of adverse inflation data and (ii) the market's growing consensus that the US rate hike cycle has finally reached its end.

Architects have taken refuge in our defensive Arch USD Diversified Yield, clocking positive yield despite choppier market conditions.

🗞 What you need to know - Powered by The Defiant

- Bitcoin forks rally as fees spike on world’s most valuable blockchain

- ETH staking deposits exceed withdrawals after Shapella upgrade

- Sotheby's launches NFT marketplace

- Tether reports record surplus reserves

⏱ No one who’s held bitcoin for 3 years has lost money, historical data shows

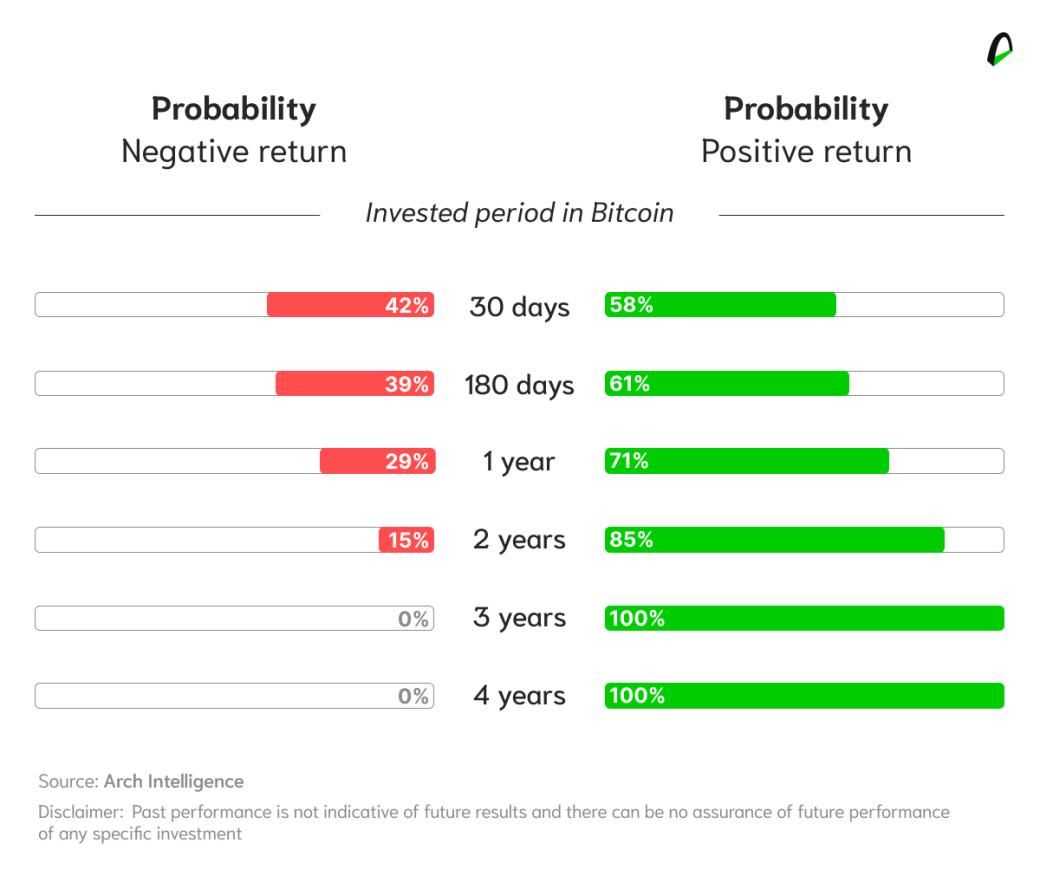

Our analysis of BTC prices between 01/01/2016 and 03/27/2023 reveals that while investing in cryptocurrency can be volatile, the time investors hold their investment is a critical factor in mitigating risks.

Specifically, we found that no investors lost capital when they held their investment for 3 years.

This historical analysis highlights the importance of adopting a long-term investment strategy. Rather than being deterred by the high volatility associated with the market, investors can mitigate risks by maintaining a long-term perspective.

Disclaimer: The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations. The views reflected in the commentary are subject to change without notice.