GM Architects,

After a turbulent 2022, traders seem cautiously optimistic as stock and crypto markets look to recover from losses incurred last year. More on that below.

Cryptocurrencies went up by 6.65%, while major protocols went up by 3.88%.

This newsletter edition covers this week's market movers, shares more about Bitcoin price cycles, and deep dives into Compound.

☕️ This week in crypto

- Funding for crypto startups - $670 million was directed into crypto startups during November 2022. Not as impressive when compared with $3.5 and $6 billion in November and December 2021, respectively.

- Coinbase - as part of a settlement agreement with NY regulators, the entity agreed to pay $100 million - with half going towards paying a fine and the other focused on upgrading its compliance practices. This is following a previous $6.5 million settlement making this one of the industry's largest settlements.

- The Fed's- board of governors issued a comprehensive analysis highlighting potential risks for banks engaging with digital assets. However, the statement never prohibited or discouraged financial institutions from interacting with digital assets.

- Microsoft's - exec, Henry Bzeih, says the metaverse will be part of the future of companies and that a hybrid model that combines metaverse solutions and in-person ones is likely to be the future of consumer and company relationships.

The January effect

The January Indicator is something that most traders look at when trying to predict market returns.

January is often considered a forerunner for the year's stock market performance, and in 2022 this proved true as stocks finished 5.3% lower at the end of January than they started — a sentiment that lasted till the end of the year, making it one of the worst Wall Street years in terms of performance since 2008.

And this year? We are seeing a positive start to the year following December's tax-loss harvesting with crypto and equities in green. But it's that all we need? The economic factors that caused prices to drop in 2022 - namely, the Federal Reserve policies, inflationary pressures, and slowing corporate earnings - need to be resolved.

The January Indicator it's not perfect, it has registered ten significant errors since 1950, but it still has an 85.7% accuracy ratio.

With the first week of January cautiously optimistic, all eyes are set on the following week's performance, and we want to know your opinion.

What do you think Bitcoin's price will be at the end of the year?

Let us know your opinion and learn what the market predicts 👇

⛓ Cryptocurrencies: $CHAIN is up by 3.88%

The Arch Blockchains token (CHAIN) traded 3.88% higher than in the last seven days.

- Solana (SOL) finally catches a break, trading 34.7% higher than last week. The main reason? BONK, a dog-themed token that recently debuted on the Solana ecosystem. BONK has been taking the crypto world by storm this past week, achieving an impressive uptrend of roughly 2,500% since its December 25 launch. This surge is mainly due to airdrops distributed among Solana developers and NFT collectors.

- Ethereum (ETH) developers have announced their exciting plans for the upcoming Shanghai upgrade in March, enabling users to withdraw staked ETH. Since the Beacon Chain's launch in November 2020 and The Merge that happened last year, a steady stream of Ethereum has been deposited into its staking contract. The sum now stands at 15.9 million ETH - roughly $19.8 billion – amounting to 13% of all currently available Ether. The Shanghai upgrade brings relief to stakers.

- Polygon (MATIC) announced that its streaming app, Savage, has secured a partnership with the tech giant Samsung. The Savage Smart TV app enables easy display connectivity and uploads of top-quality media from any marketplace.

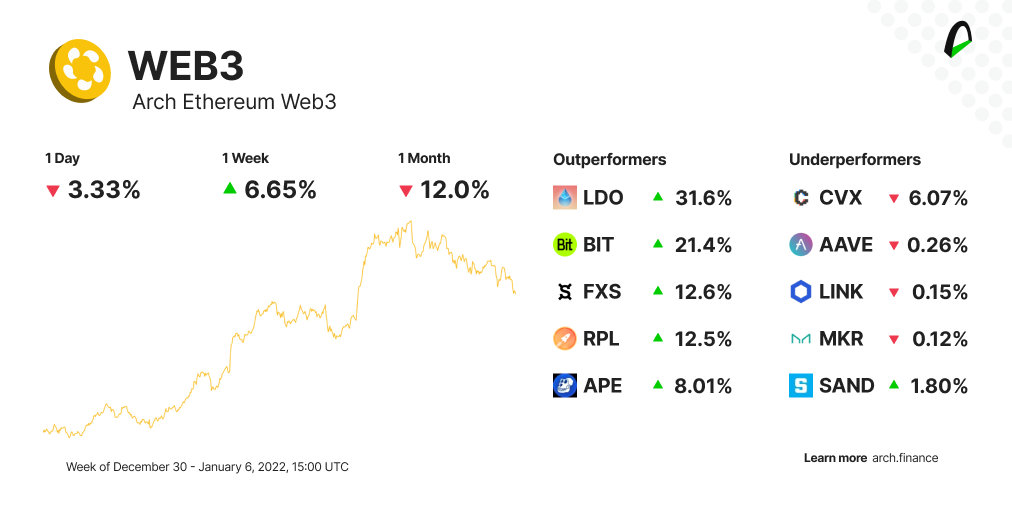

📈 Protocols: WEB3 is up by 6.65%

At the time of writing, The Arch Ethereum Web3 token (WEB3) traded 6.65% higher than last week.

- Lido (LDO) saw a massive spike, up by almost 32%. Whalestats recently reported LDO was one of the most used smart contract tokens among the top 5,000 ETH investors. Recently, Lido Finance surged as the largest DeFi protocol in terms of Total Value Locked (TVL).

- Rocket Pool Protocol (RPL) also saw a 12% price increase. Rocket Pool is a decentralized Ethereum staking protocol that allows users to participate in liquid staking.

- Frax Finance (FXS) is also seeing a significant uptick thanks to its liquid staking service. Liquid staking is now the third largest DeFi category by TVL, with Frax being the 11th liquid staking protocol by TVL. Lido is the first one, and Rocket Pool is the third one.

- ApeCoin (APE) finalized its Special Council elections, which saw five members elected to govern the future of the ApeCoin project. ApeCoin is the utility and governance token used in the Otherside, YugaLab's metaverse project. The Otherside - which is set to be an open, interoperable, and gamified ecosystem - hired Daniel Alegre as the CEO. Alegre was the former President and CEO of Activision Blizzard and spent 16 years as President across various divisions at Google.

🔁 How Bitcoin price cycles work

𓊍 What's Compound

With Compound, users can now borrow and loan crypto with ease — all while having the power to influence its future direction through the ownership of COMP tokens.

Disclaimer: The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations. The views reflected in the commentary are subject to change without notice.