Gm fellow Architects;

Staking and lending protocols are increasingly more popular. But is it really profitable, or do gas fees and the time spent actively managing positions eat up any potential gains? We explore it in this edition. (Hint: Passive wins)

• Chasing yield on Ethereum doesn't pay off.

• Diversified products display more resilience during price impacts

• Crypto is in the hot seat. Prices fall and bounce back

Turns out chasing yields is not as profitable as everyone thinks

Staking and lending protocols have become popular for earning passive income and preserving long-term savings. Staking ETH offers an APY reward in the form of new ETH tokens, and stakers contribute to network integrity by verifying transactions.

Lending ETH in DeFi platforms is another strategy for earning passive income and contributing to the lending protocol and ecosystem.

And what are my options to earn passive income?

Participants in Ethereum's passive income strategies have three options:

- Betting on a single protocol

- Constantly switching to the highest APY protocol

- Diversifying among protocols for long-term returns

Choosing a single protocol exposes participants to fluctuating APYs and risks of relying solely on one asset, jeopardizing long-term savings.

Constantly switching protocols based on APYs requires active market participation and careful evaluation of transaction costs, making it impractical for most participants.

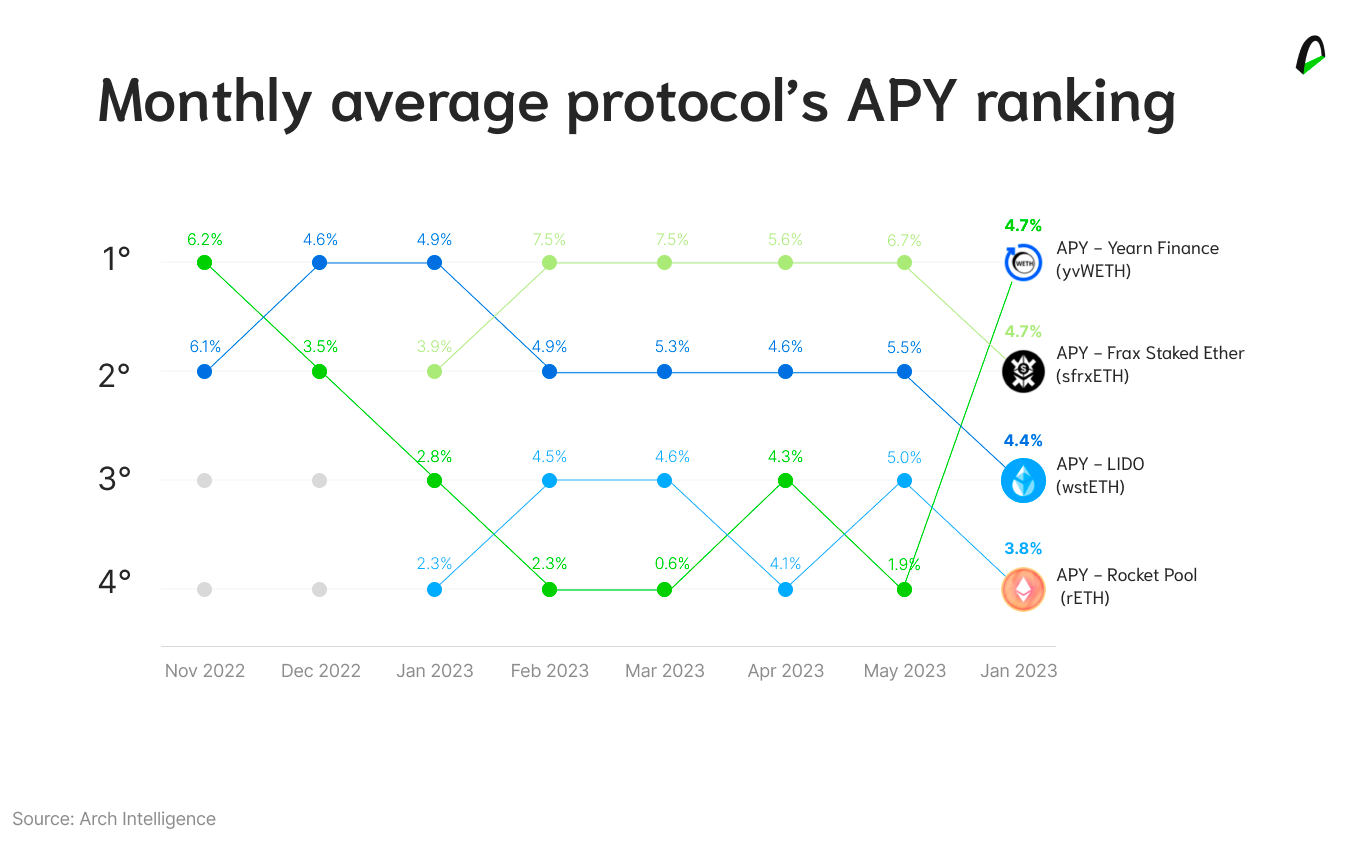

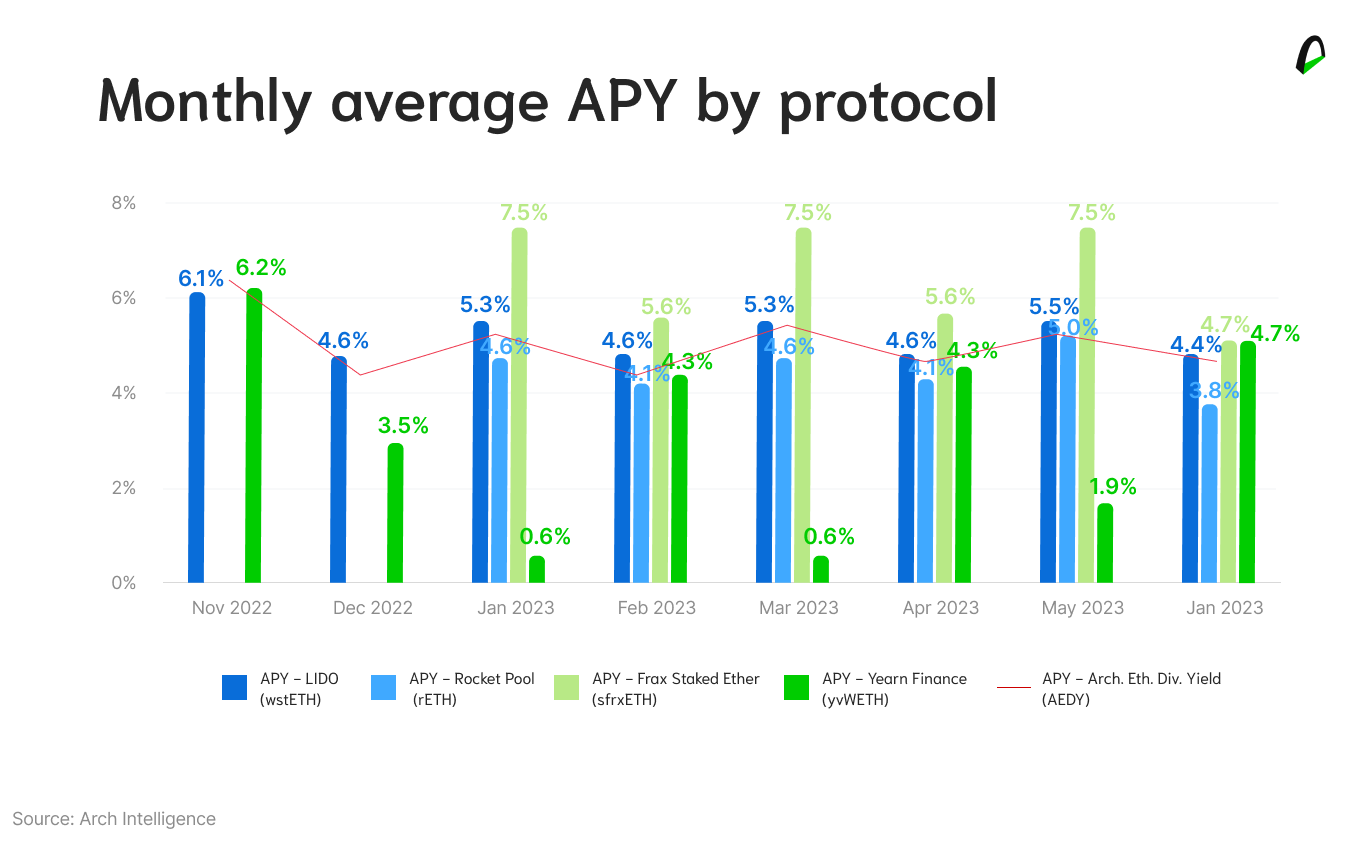

The ranking of top APY protocols has changed three times in the last eight months, adding complexity to the challenge and impacting returns for participants who fail to transition promptly.

So that means I should diversify, right?

Right. Diversification is the way, but it can be prohibitively expensive.

Diversification is a strategy that spreads APY rewards across different alternatives, reducing risk, volatility, and vulnerabilities in specific protocols. However, diversifying can be expensive, similar to chasing the highest APY strategy.

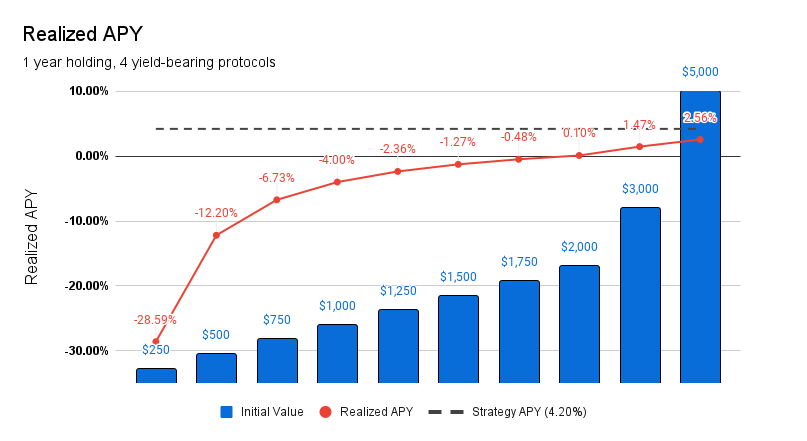

For instance, if you invest in four Ethereum staking protocols, each with a 4.2% APY, you should consider an approximate cost of $10 per transaction. To break even with these fees, you must invest at least $2,000 for a year.

Investments below this threshold or for a shorter duration would result in a loss due to gas fees exceeding earned rewards.

For example, if you invests $3,000 a year, you would only recover 35% of the stated APY (1.47% vs. 4.20%) due to substantial costs associated with entering and exiting the strategy.

Give me solutions, not problems

Well, that's why we created the Arch Ethereum Diversified Yield (AEDY) token.

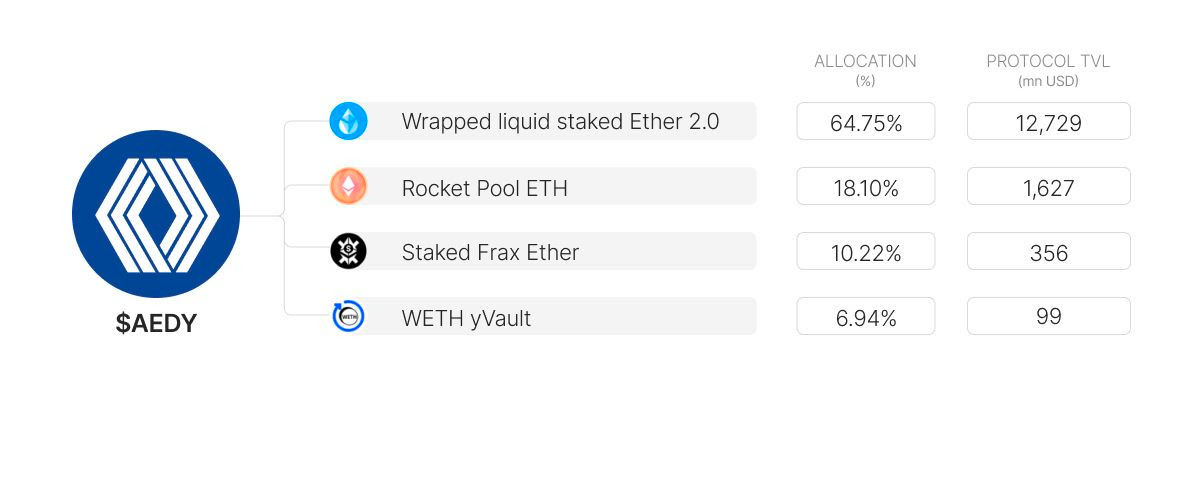

AEDY addresses the challenges mentioned by offering diversified exposure to yield-bearing protocols on Ethereum, minimizing APY volatility and protocol-specific risks. It seeks diversification through battle-tested protocols and undergoes periodic rebalancing.

AEDY simplifies the investor's journey and allows for rebalances when new strategies become relevant. It’s available on the Polygon Network, reducing gas costs significantly.

New protocols and strategies can be added if they meet specific requirements. The weights assigned to each strategy in AEDY are determined based on their square root TVL proportion, ensuring a balanced representation.

One important aspect of this token is that it doesn’t incur any form of leverage, which protects participants from having their returns seized in the eventuality of rate spikes in the borrowed assets.

AEDY is designed for individuals aiming to maximize the potential of their long-term Ethereum holdings through diversification, low transaction fees, and compounding.

Diversified products display more resilience during price impacts, data shows

After a calm May, with unusually low volatility in crypto assets, June kicked off on shaky ground, with the SEC taking action against major crypto exchanges and hijacking all crypto conversations.

Bitcoin and Ethereum experienced a sharp drop of around 6% within a few hours on Monday as news broke. Still, they recovered almost all of their losses within approximately 24 hours. Price volatility has persisted as participants digest the facts and speculate on potential outcomes.

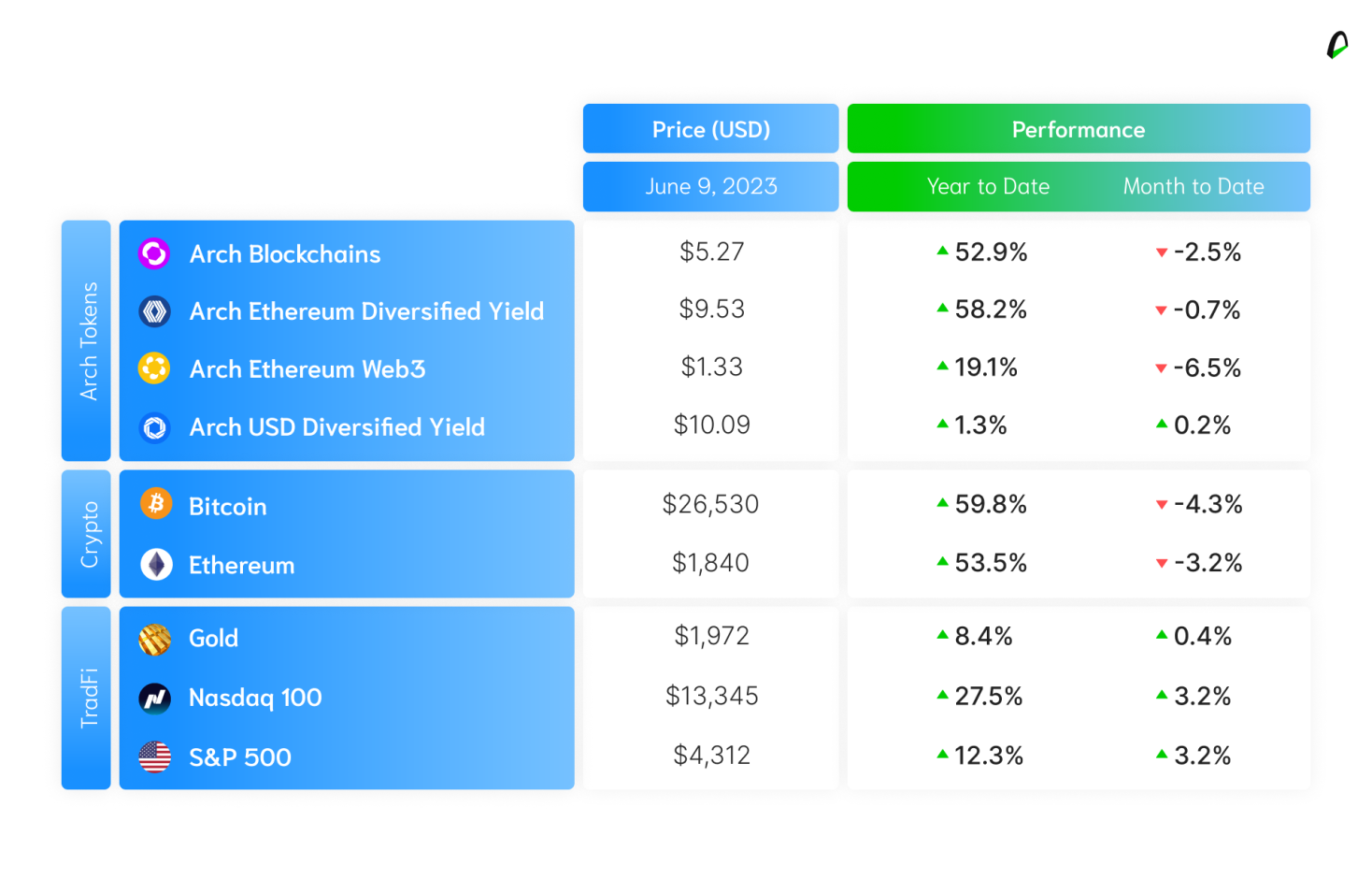

As of the time of writing, Bitcoin has recorded a performance of -4.3% in June, while Ethereum has seen a decline of -3.2%. Within Arch products, our Arch Blockchains ($CHAIN), comprising the main existing blockchain protocols, have displayed more resilience, with a performance of -2.5%, highlighting the value of diversification.

Meanwhile, traditional markets are poised to conclude another positive week (the 7th consecutive one for Nasdaq) following a favorable resolution to the US debt-ceiling crisis and encouraging inflation data.

Investors have never been more confident that we have finally reached the plateau for interest rates in the US, a notion that may be confirmed by the upcoming FOMC meeting in the next week and eventually keep driving positive momentum for risky assets.

📰 Let's take a look at the SEC saga

In a significant turn of events, Binance, the world's largest cryptocurrency exchange, and Coinbase, the leading player in the U.S., find themselves at the center of regulatory scrutiny.

The Securities and Exchange Commission (SEC) has leveled serious accusations against both exchanges, alleging misconduct and misleading practices.

⏱ If you only have time for the quick and dirty

- Binance got sued by the SEC

- Coinbase got sued by the SEC

- BTC dipped slightly on the news release, and bounced back rallying over 5% in the following hours

- $ETH followed BTC's footsteps, jumping around 4% in the hours after

You can read more about how price activity meets with volatility here.

☕️ If you want the full scoop

🟡 On Binance: The SEC's accusations against Binance are two-fold. First, the exchange stands accused of mishandling customer funds and engaging in deceptive practices by transferring billions of dollars to a separate company controlled by Binance's founder.

Additionally, Binance allegedly misled investors about its ability to detect manipulative trading and its efforts to restrict trading for U.S. users on its international platform. These allegations have raised concerns about the safety of customer assets and the transparency of Binance's operations.

🔵 On Coinbase: Coinbase, on the other hand, faces allegations primarily related to securities regulations. The SEC claims that the exchange-listed securities were without proper registration, failing to comply with regulatory requirements.

📰 On everything that's going on: While Coinbase's case focuses more on securities violations, the accusations against Binance involve broader issues, including potential diversion of funds and non-compliance with investor protection laws.

These cases represent a pivotal moment in regulating cryptocurrencies in the United States. With regulatory bodies intensifying their scrutiny of the industry, the outcomes of these cases will likely have far-reaching implications.

💸 On prices: Bitcoin (BTC), the top cryptocurrency in the market, has nearly erased its losses from yesterday and is currently experiencing a 3.7% increase, trading at $27,055. However, over the week, BTC has declined by approximately 3%, with its market cap slightly above $520 billion.

Ethereum (ETH), the second-largest cryptocurrency in terms of market cap, has displayed a similar performance. ETH has maintained its position outside the Securities and Exchange Commission's (SEC) list of securities, and it boasts a healthy market capitalization of over $225 billion.

📈 On what's happening with DEXs: Amidst the regulatory uncertainty and increasing scrutiny on centralized exchanges, the importance of decentralized exchanges (DEXs) becomes evident.

From June 5 to June 7, decentralized exchanges (DEXes) trading volume experienced significant growth. The top three DEXes, namely Uniswap and PancakeSwap, witnessed a remarkable surge of approximately $800 million, reflecting a substantial increase of 444%. Curve, another popular DEX, also observed a significant spike in trading volume, soaring by 328%.

DEXs offer several advantages to users in such an environment. Firstly, they enable trustless trading, allowing users to trade cryptocurrencies directly from their wallets without intermediaries, reducing the risk of mishandling funds. Secondly, DEXs prioritize privacy and anonymity, which is crucial for users seeking to safeguard their identity in an intrusive-regulatory environment.

Furthermore, decentralized exchanges resist censorship, ensuring uninterrupted trading even in jurisdictions with stringent restrictions on centralized exchanges.

🗞 In other news

Web3 is down. ETH is up. Time to buy $AEDY. The Defiant - one of the top crypto publications - published a report using our indexes.

🤔 So, how can Arch products fit into my portfolio?

Easy, book a call to learn how our investment products can fit into your portfolio. Schedule a meeting with Nicolas Jaramillo, our Co-Founder, who can answer any questions you may have.

Book a time that works for you using our scheduling link.

Disclaimer: The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations. The views reflected in the commentary are subject to change without notice