Gm Architects;

Investors have different alternatives to stake their tokens and earn yield. We explore some of those options and dive into how the last couple of (very intense) months affected crypto prices.

📧 In today's installment:

- Alternatives investors have to earn yield on (their) crypto.

- How the bank crisis sky-rocketed Bitcoin's price.

- A free Web3 Architect NFT and an airdrop of up to 100 $WEB3 tokens.

💸Earning Yield in Crypto Through Staking

- There are several ways an investor can earn a yield on their investment in crypto: staking, lending, yield farming, dividend-paying tokens.

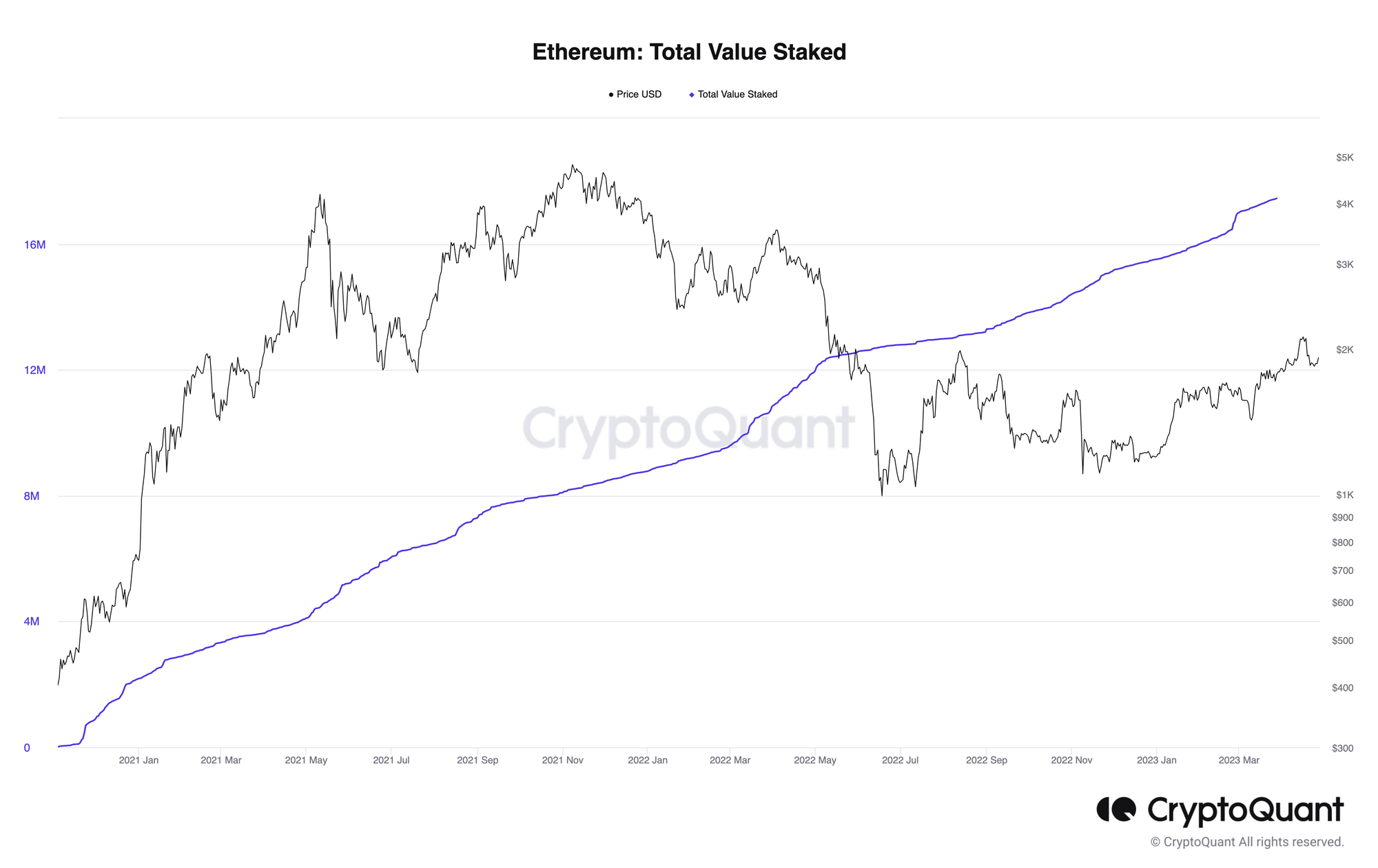

- Ethereum is the largest and most relevant protocol offering staking yield (currently around 4.7% per year).

- Staking involves holding a certain amount - in the case of Ethereum, it requires 32 ETH or roughly USD 64,000 - of crypto assets in a wallet to help secure the network.

- You don't need all the ~ USD 64,000 to take advantage of the staking yield. Investors can use many attractive alternatives to commit to their long-term investment in Ethereum and guarantee a better return.

- Many staked-yield protocols work as a shared pool where investors combine their resources to meet the minimum threshold for staking. In return for their asset, they receive a receipt (the protocol token) that accrues in value daily and is redeemed by their original asset (plus yield) at any time.

📈 Bitcoin (and CHAIN) sky-rocket

The last couple of months were intense in the crypto world 🗞

- Ethereum upgrades: Protocol-specific, we had the Chapella upgrade in the Ethereum network. This significant and long-awaited event would have dominated all the news if it wasn't for the US-bank chaos and its vast consequences.

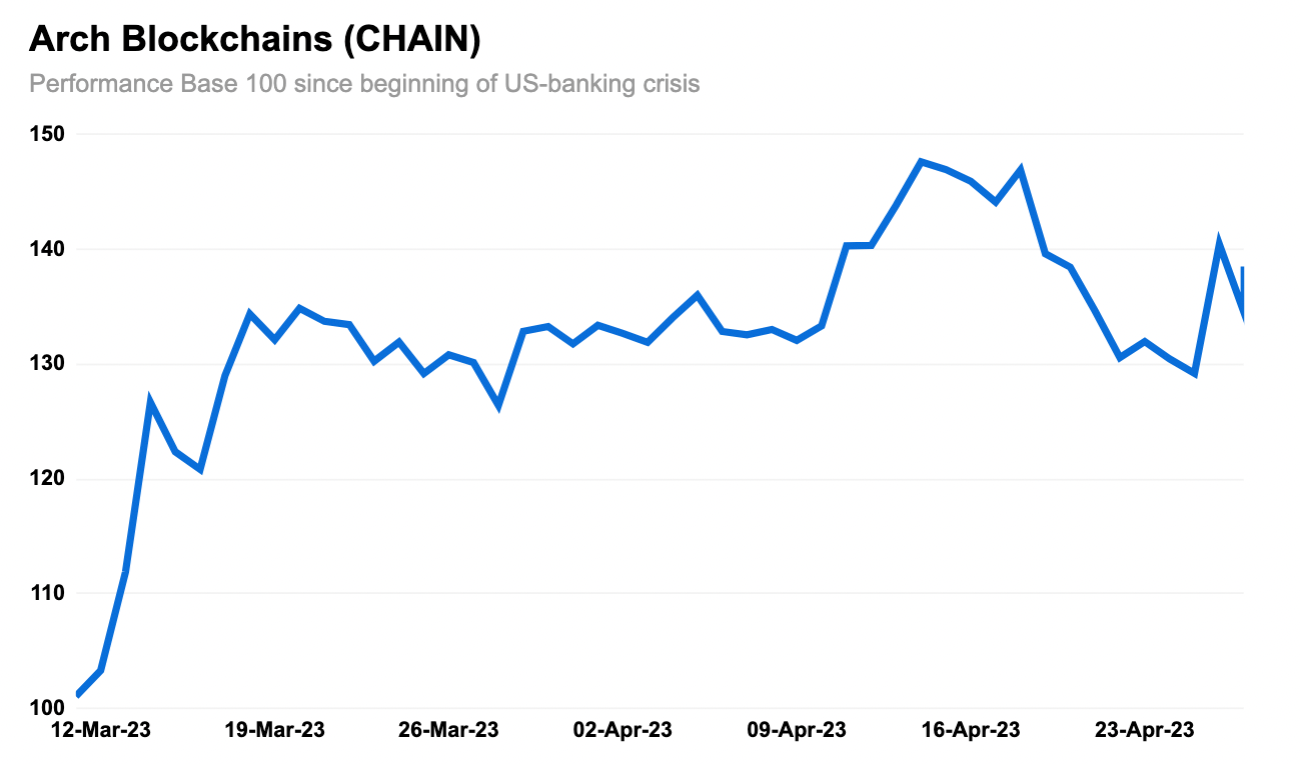

- Banks experience a crisis: In March, the US sighted the 2nd largest bank bankruptcy in its history when Silicon Valley Bank suffered a government intervention and a subsequent forced sale. The episode, combined with growing worries about the healthiness of other small institutions, sent negative shock waves in all traditional asset classes.

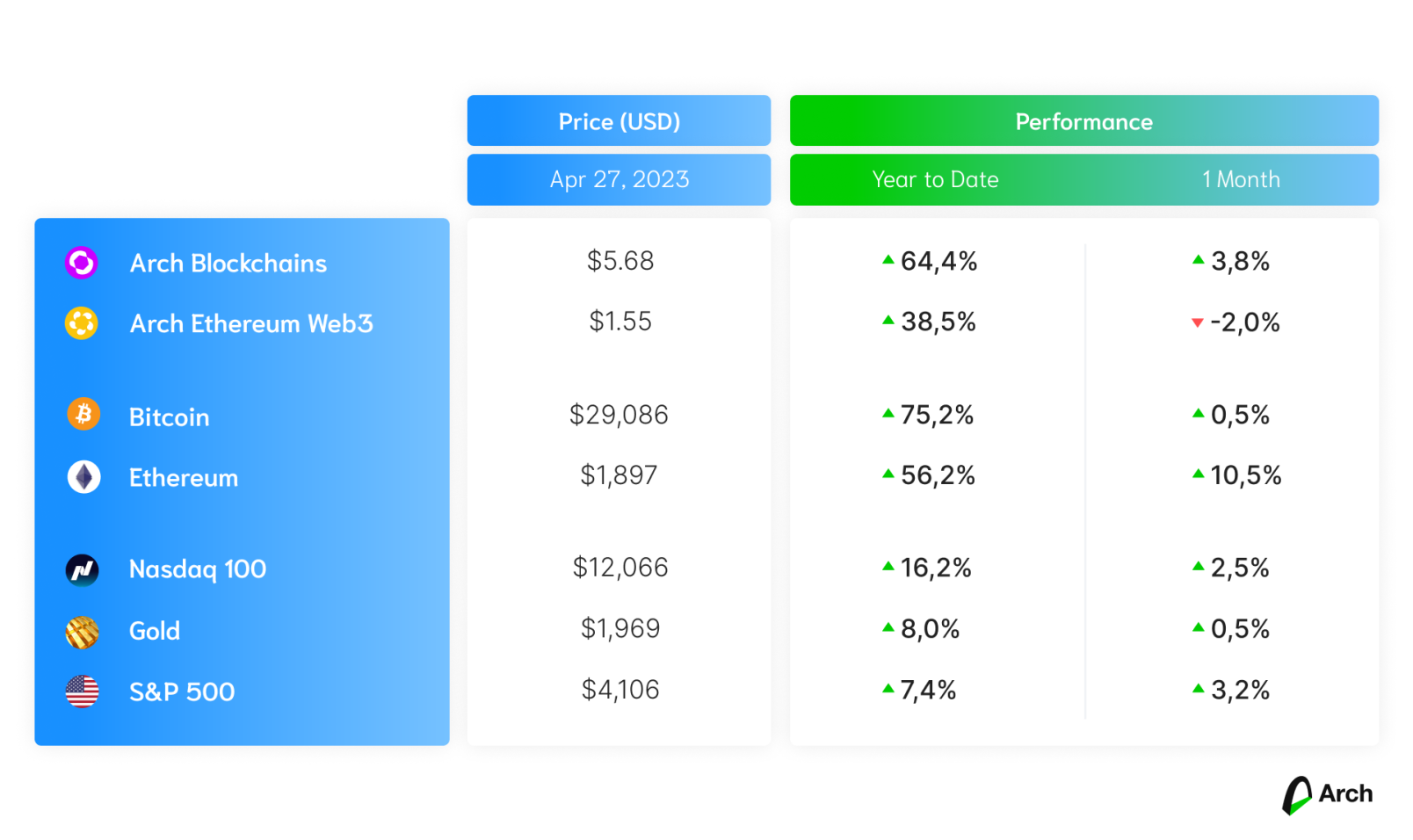

- Bitcoin rises: Interestingly, in mid of the turmoil, we witnessed a sky-rocketing rise in Bitcoin's price - surging 50% from ~USD 20,000 to the actual ~USD 30,000 - with crypto supporters arguing Bitcoin is finally being recognized as a true alternative for the financial system (and all its vicissitudes), while less-enthusiastic analysts noting it could be a mere consequence and reflex of a probably more benign scenario for the US interest rate.

The winning story is yet to be seen. Nonetheless, Bitcoin had a massive positive impact on our blockchain-dedicated product Arch Blockchains (CHAIN), which surged 38% from March 10th to April 27th.

🪂 Mint Your Free Web3 Architect NFT

And get an airdrop of up to 100 $WEB3 tokens 👇

The future of crypto is bright, and we're leading the way with $WEB3, the Arch Ethereum Web3 Index Token 🚀

— Arch (@Arch_Finance) April 24, 2023

🏆 With thousands of holders already on board, our passive, long-term investing strategy makes it easy for anyone to invest in #crypto.

Don't miss out on the future of… pic.twitter.com/UahzvIF24d

Disclaimer: The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations. The views reflected in the commentary are subject to change without notice.