Gm fellow Architects;

Is rendering the future of crypto? Well, not exactly. However, the Render Network is taking the crypto ecosystem by storm. But what exactly is rendering? And how can you benefit from it? We answer those two questions in this edition while exploring the macroeconomic environment and how it’s impacting asset prices.

• There’s a new token in town. Meet the Render Network (RDNR)

• Facts: Diversification pays off. Even when the crypto market is down

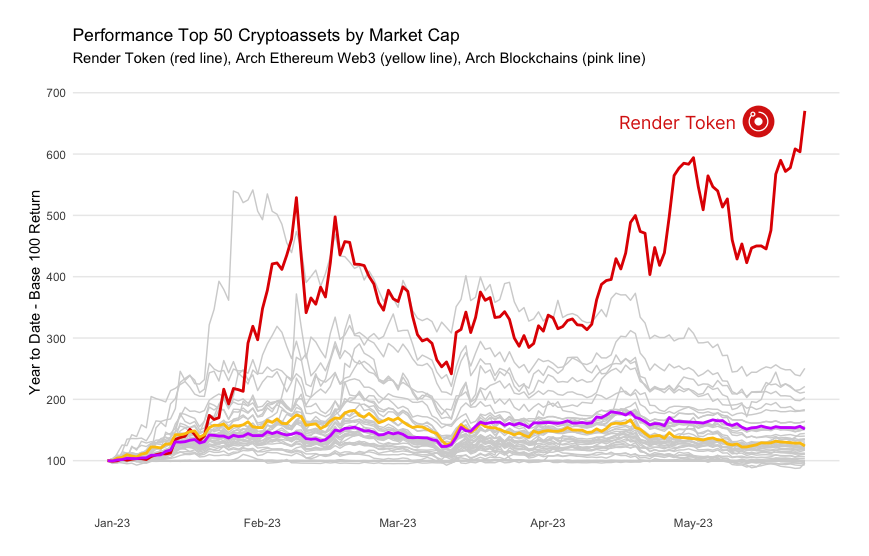

Crypto rendering: Render Token is outperforming the largest 50 crypto protocols

A new token premiered in our Arch Ethereum Web3 ($WEB3) token: Render Network. This groundbreaking protocol is helping digital creators deal with rendering and have risen roughly 500% year to date.

And what exactly is rendering?

Before digging into the protocol, let's take a step back and explain what exactly rendering is and why it is crucial for digital businesses and creators.

- As one can imagine, the more realistic a digital image or video is, the more quantity of data used to generate it, and the more computational power is provided to solve the puzzle.

- The use of digital models and objects encompasses many sectors and activities. From industrial design and architecture to entertainment (animations) and even modern medicine (with the help of virtual reality).

- The amount of data to render increases exponentially if an object model is in motion (like special effects in a movie) and increases even more if you need it in real-time (online video games, metaverse, or virtual reality), making it crucial to find scalable and cost-effective solutions that can provide the necessary computational power to digest complex models.

Cool, but what does a render look like?

Like this one from BVLGARI. Neat, right?

Tell me again what Render Network is doing

- Render Network allows any user to connect to its network (blockchain) and provide its computational power in exchange for RNDR (the Render Network token).

- By harnessing the collective computational power of its users, Render Network efficiently utilizes idle capacity already in existence, saving creators the acquisition of expensive computing capacity. Also, Render Network is inherently flexible and scales on demand, providing immediate additional resources to attend peak of use.

- Render Network, joins the ranks of projects like Brave, using crypto to solver real-world problems.

Interesting, how can I gain exposure to $RDNR?

RDNR token can be found on major DEXs on Ethereum. Render Network token is also the newest addition to our $WEB3 token.

The Arch Ethereum Web3 Token ($WEB3) offers the simplest way for investors to be exposed to these highly innovative projects. The token is periodically rebalanced to incorporate new tokens as they gain market share, thereby mirroring the evolving state of Web3 and the decentralized world in a single token.

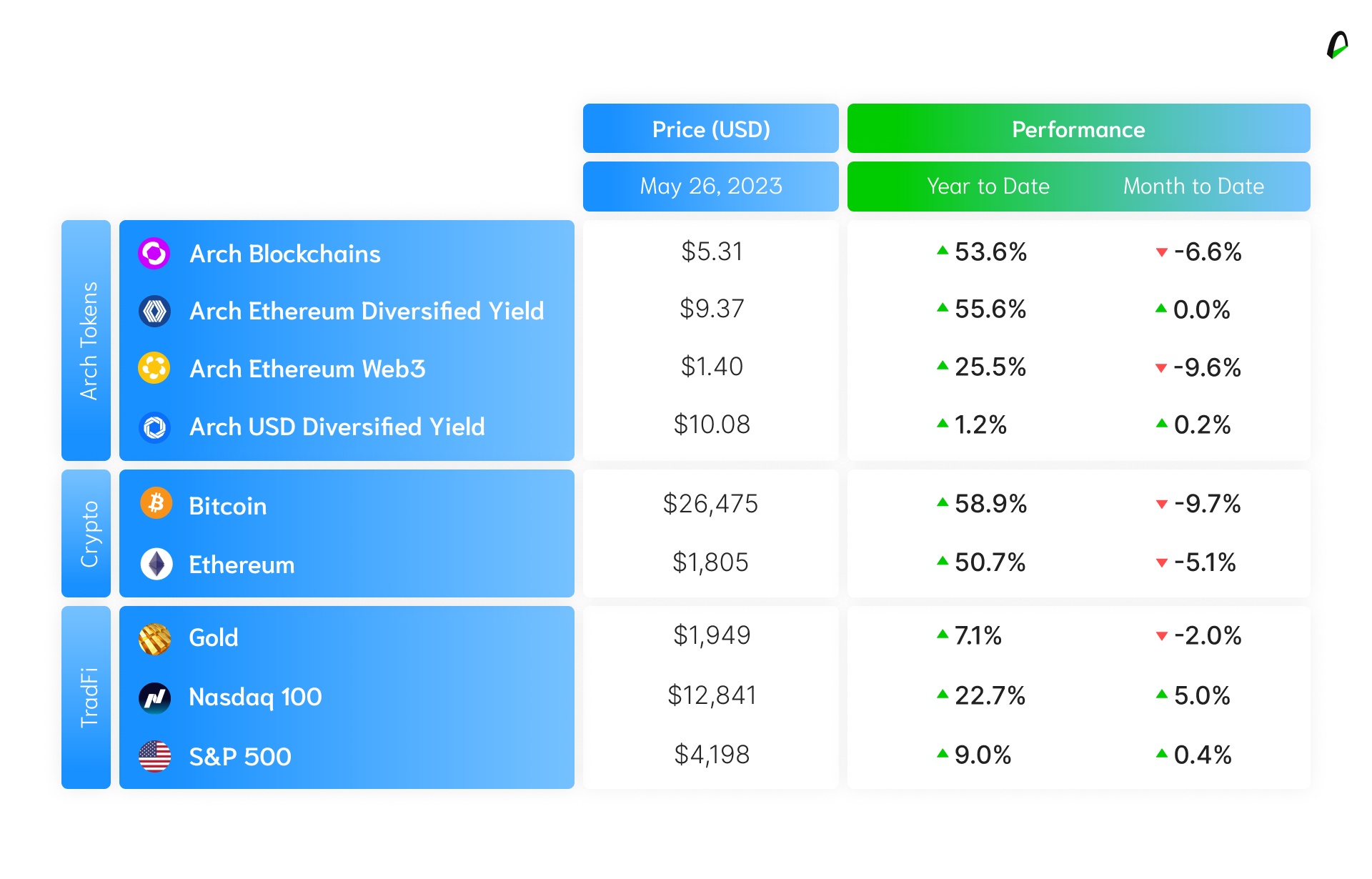

Debt-ceiling crisis spills over to crypto

After a positive performance during the first four months of 2023, crypto has taken a negative turn in May, with BTC down 9.7% and ETH down 5.1% month to date, despite more favorable inflation data and a relatively stable macroeconomic environment.

Investors are closely monitoring the progress of political negotiations aimed at raising the legal expenditure level of the US government. Failing to reach a deal could result in the default of maturing debt as early as the beginning of June, as stated by Treasury Secretary J. Yellen. Consensus suggests this impasse will be resolved in the coming days, improving the short-term outlook for risky markets.

In the Arch product family, our Arch Ethereum Diversified Yield ($AEDY) demonstrated resilience and the value of protocol diversification, having had a flat performance in the month despite Ethereum depreciation.

🗞 What you need to know - Powered by The Defiant

- Crypto Rallies As US Debt Ceiling Talks Continue

- Tokenized Bonds Surpass $200M In Market Capitalization

- Fed Data Shows Most Crypto Holders Stuck Around in 2022 Bear Market

- Solana Launches ChatGPT Plugin

📺 Look mom, we’re on the news!

As one of the top 15 cryptocurrency startups that are revolutionizing the future.

And also on here and here teaching what the top crypto terms mean.

🤔 So, how can Arch products fit into my portfolio?

Easy, book a call to learn how our investment products can fit into your portfolio. Schedule a meeting with Nicolas Jaramillo, our Co-Founder, who can answer any questions you may have.

Book a time that works for you using our scheduling link.

Disclaimer: The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations. The views reflected in the commentary are subject to change without notice