GM Architects,

The Web3 market, selloff continues with assets trading downwards after an agitated Thursday. Ethereum (ETH) was down 5.93%, while Bitcoin (BTC) was trading 7.57% lower than last Friday.

This comes after the U.S published the jobs report showing America added 428.000 new jobs in April. It might seem good news, but fuels the fears about the Fed raising interest rates.

The DeFi sector was one of the most affected, losing 34% in April compared to Bitcoin's loss of 17%. This has been a recurring theme in the past couple of weeks as investors look for more consolidated assets amid volatility and uncertainty.

The crypto sector is not the only one affected. The stock market got hit hard as Wall Street and tech stocks significantly plummeted. The S&P500 was down by 4%, and the Nasdaq 100 Index tumbled 5.1%. These volatility levels were last seen during the start of the Covid pandemic.

Web3 token is at an all-time low (since inception)

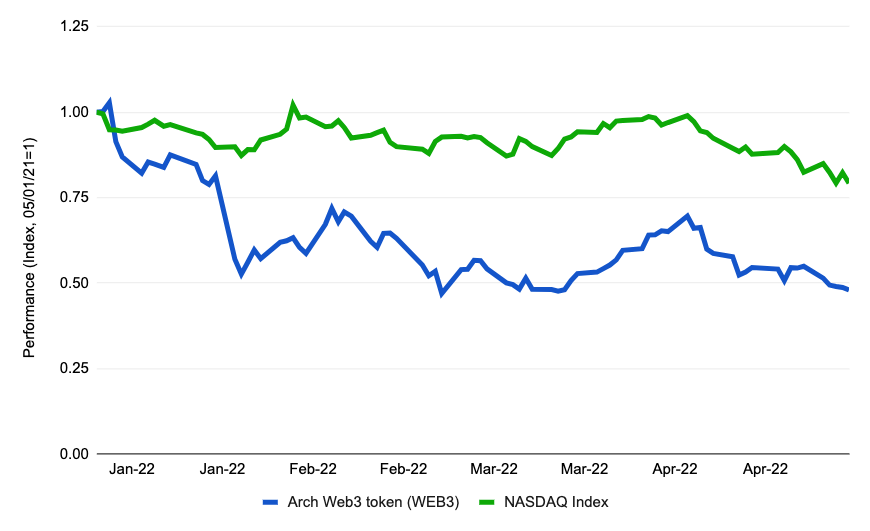

Since its inception in November 2021, the Arch Ethereum Web3 token (WEB3) is now down +65% (and +50% down YTD), pushing asset prices to levels, not since January 2021.

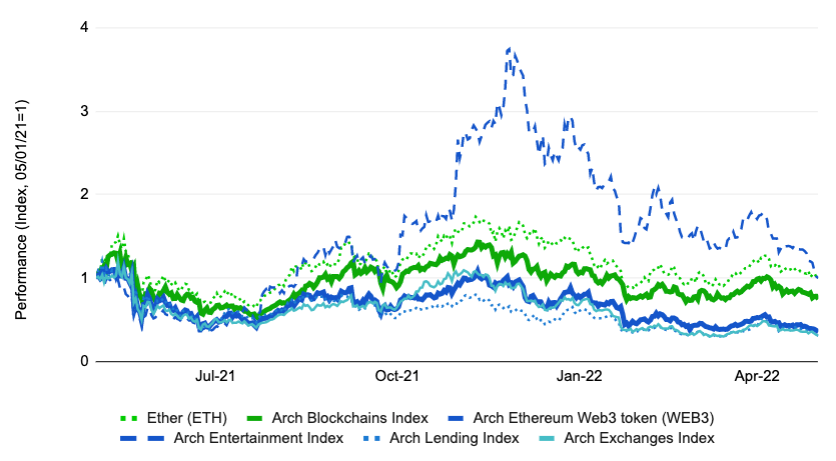

Performance is poor across the board, protocol-tokens in DeFi-related sectors (Lending and Exchanges) have been hit the hardest. Blockchain native-tokens (tracked by our Arch Blockchains Index) are also in the red this past twelve months, with Ethereum's Ether (ETH) barely breaking even. Sectors that were comparatively late to bloom, like Entertainment (which includes metaverse assets), have gone full circle in a true rollercoaster ride (see chart below)

What's unique about Web3's recent woes is that it's not alone. Tech assets (and the markets in general) have also been hit hard since the start of the year. The NASDAQ index just had its worst one-day plunge since 2020 and is down a staggering 23% this year. It's said that in times of crisis, all correlations go to 1. In our following issues, we'll dive further into this question and see what lessons investors can leverage.

📉 Web3 tokens down across the board

- Frax Share (FXS) had a 23% rally after the popularity of 4pool, a new Curve stablecoin liquidity pool developed by Terra, gained strong momentum. On May 3rd, the trading volume increased by 200%. However, the Thursday shake-off affected its price, trading 4.8% lower than the last seven days. FXS is part of the Arch Lending Index.

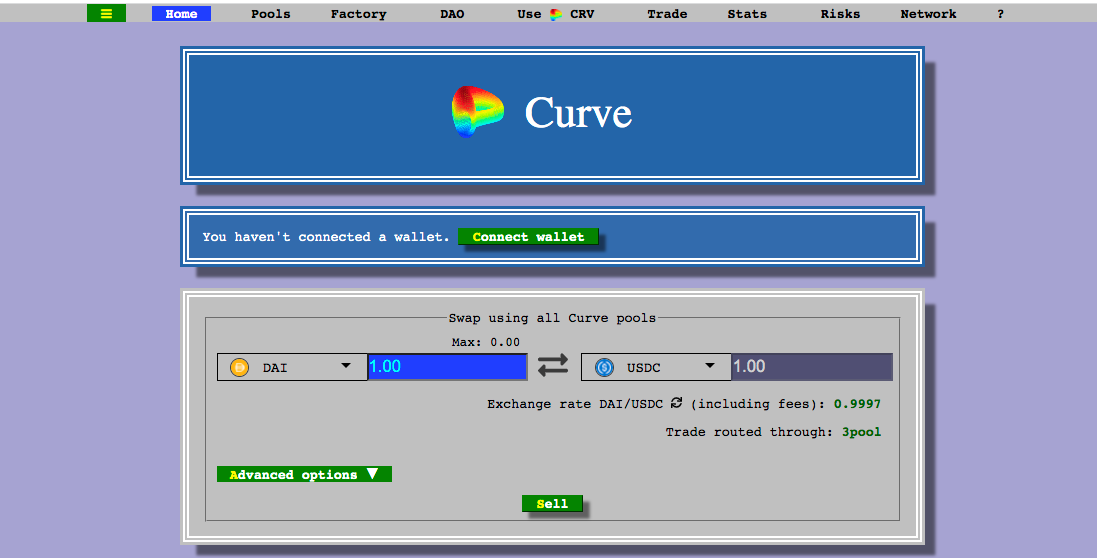

- CurveDAO (CRV) was one of the least affected tokens, showing a solid resilience. Last week CRV was one of the few tokens that traded in the green. The price surged 17% after Terra's 4Pool launch. CRV is also part of the Arch Exchange Index.

- Uniswap (UNI) has had a positive last 24 hours after CoinShare listed it on Germany's Stock Market Xetra. Chainlink (LINK) was also listed. CoinShare, the largest European digital asset investment management firm, has seven crypto ETPs listed and manages over $4.5 billion in clients' assets. Historically, higher amounts of institutional trading in crypto have always driven significant gains in prices. UNI is part of the Arch Exchange Index, while LINK is part of the Arch Infrastructure Index.

- Loopring's (LRC) price has been falling firmly since its all-time high in November. However, it's been experimenting with some buying pressure that might indicate minor signs of recovery. LRC is also part of the Arch Exchange Index.

🌈 Learn more about Curve

Curve (CRV) is a protocol built on Ethereum that offers a simple way to exchange and trade assets with low slippage and lower fees than other Automated Market Makers (AMM).

Curve offers pools of similar behaving assets and stablecoins favoring stability over volatility.

--> 📚🤓 Take a deep dive into Curve, and the CRV token that's part of the Arch Ethereum Web3 Token.

👁️🗨️ Become a beta tester

Be an essential part of Arch's development. We want to hear your feedback about a new prototype we are testing. Let's meet!

- $WEB3 holders - Verify your assets to access the exclusive #architects-lounge channel.

- 🐦 Join our community on Discord and follow Arch on Twitter.

- Stay tuned for events, research, and exciting product announcements.

- ⚠️ Important: beware of scams, and please report any attempts. We will not message you first and will never ask for your keys.

Contribute

Join the core team or become a contributor. We want to hear from you:

💼 Open positions:

Learn more about open positions and working at Arch. If interested, please send us a note on Twitter or Discord.

Disclaimer: The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations. The views reflected in the commentary are subject to change without notice.