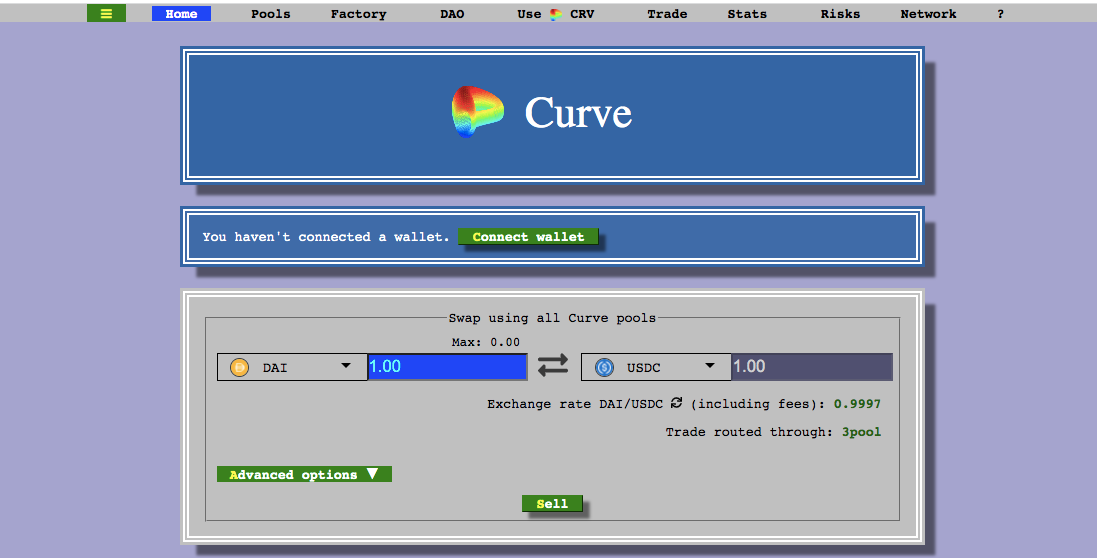

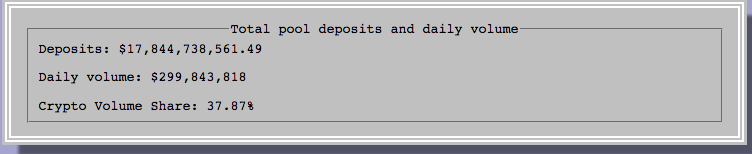

Curve (CRV) is a protocol built on Ethereum that offers a simple way to exchange and trade assets with low slippage and lower fees than other Automated Market Makers (AMM).

Curve offers pools of similar behaving assets and stablecoins favoring stability over volatility.

The Curve DAO token is part of the Arch Ethereum Web3 Token and part of the Arch Exchange Index.

What is Curve

Curve is an Automated Market Maker (AMM) protocol based on Ethereum and provides liquidity for similar behaving assets with low slippage-

It's similar to Uniswap or Balancer in the sense that all three projects are decentralized exchanges (DEX). However, by only working with similar trading pairs, Curve can offer the lowest impermanent loss, slippage, and fees than almost any other DeFi AMM.

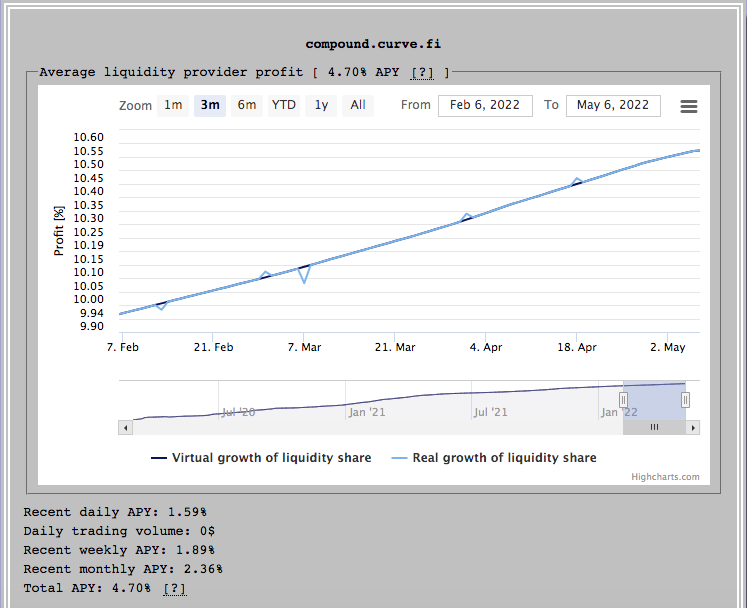

By providing liquidity, Curve Liquidity Providers can earn transaction fees and benefit from other DeFi protocols such as Compound, Yearn, Synthetix, RenBTC, etc.

Understanding what's an AMM

Unlike decentralized exchanges based on order books -in which professional market makers provide liquidity according to different price ranges and ongoing inventory management-, in an Automated Market Maker, any user can act as a liquidity provider - depositing their cryptocurrencies in pools that represent the different markets - and, in return, earn commissions.

Therefore, the price of the assets is no longer conditioned by the asks and bids placed in an order book by market makers but instead is determined automatically by an algorithm based on a set of predetermined parameters.

How Curve works

How does Curve achieve low slippage in transactions?

Curve uses an automated market maker (AMM) mechanism similar to Uniswap, using algorithms to mimic the trading behavior of traditional market makers and smart contracts acting as counterparts.

The main focus of Curve is providing liquidity pools for similar trading pairs, mostly stablecoins, reducing volatility and speculation and favoring stability.

Unlike other protocols like Balancer, Curve doesn't try to keep the values kept in different pools equal or proportional to each other.

This flexibility allows Curve to concentrate liquidity near the ideal price for similarly priced assets (in a 1:1 ratio) and have liquidity where it is needed the most. With this, Curve can achieve a much higher liquidity utilization.

Curve doesn't work only with stablecoins; it also offers versions of wrapped bitcoin and tokenized bitcoins. And while both assets are incredibly volatile, they behave similarly, making them ideal candidates for Curve.

Composability between projects

One of the other defining characteristics of Curve is the composability, or the ability to interact with different protocols and projects from the platform.

With most AMMs, like Uniswap, participants earn fees whenever a transaction is made.

Curve, on the other hand, offers lowers transaction fees. However, and because it's composable, users can also earn rewards from outside of Curve.

For example, let's say you are participating in Compound. You lent DAI and in exchange, go cDAI tokens.

With the cDAI tokens, you have the right to withdraw the DAI you loaned and the interests that accumulated in that time.

With Curve, you can also provide cDAI liquidity by participating in a cDAI liquidity pool and earning a return.

The same principle applies to other projects like Synthetix, for example.

DeFi participants can earn even more significant returns from the same investment.

How the CRV token works

Curve's governance token is CRV. Curve is a DAO, or a Decentralized Autonomous Organization. CRV token holders can participate in decision-making and vote on new ideas, projects, and proposals.

Curve DAO Token's (CRV) objective is to encourage liquidity providers on the Curve Finance platform and get the most significant number of users involved in the protocol's governance.

- Governance: CRV token holders can vote on DAO proposals and pool parameters by staking their CRVs in a voting escrow and receiving veCRV (voting escrow CRV) tokens. These veCRV tokens can be used to vote on various proposals.

- Staking: CRV can be staked to earn Curve protocol trading fees.

Curve allows participants to interact with other DeFi players, earning more returns from their same initial investments.

Lower fees and slippage and a focus on stability also help differentiate this AMM from other projects.