Synthetix (SNX) is a protocol built on Ethereum that enables the issuance and creation of synthetic assets.

This protocol brings to the crypto ecosystem non-crypto assets, creating a more mature financial market that can be less volatile.

Synthetic commodities like gold and silver, cryptos, indexes, and fiat currencies are supported on SNX.

Synthetix is part of the Arch Ethereum Web3 Token and it's also part of the Arch Derivatives Index

What is Synthetix

Synthetix is an Ethereum protocol for creating synthetic assets.

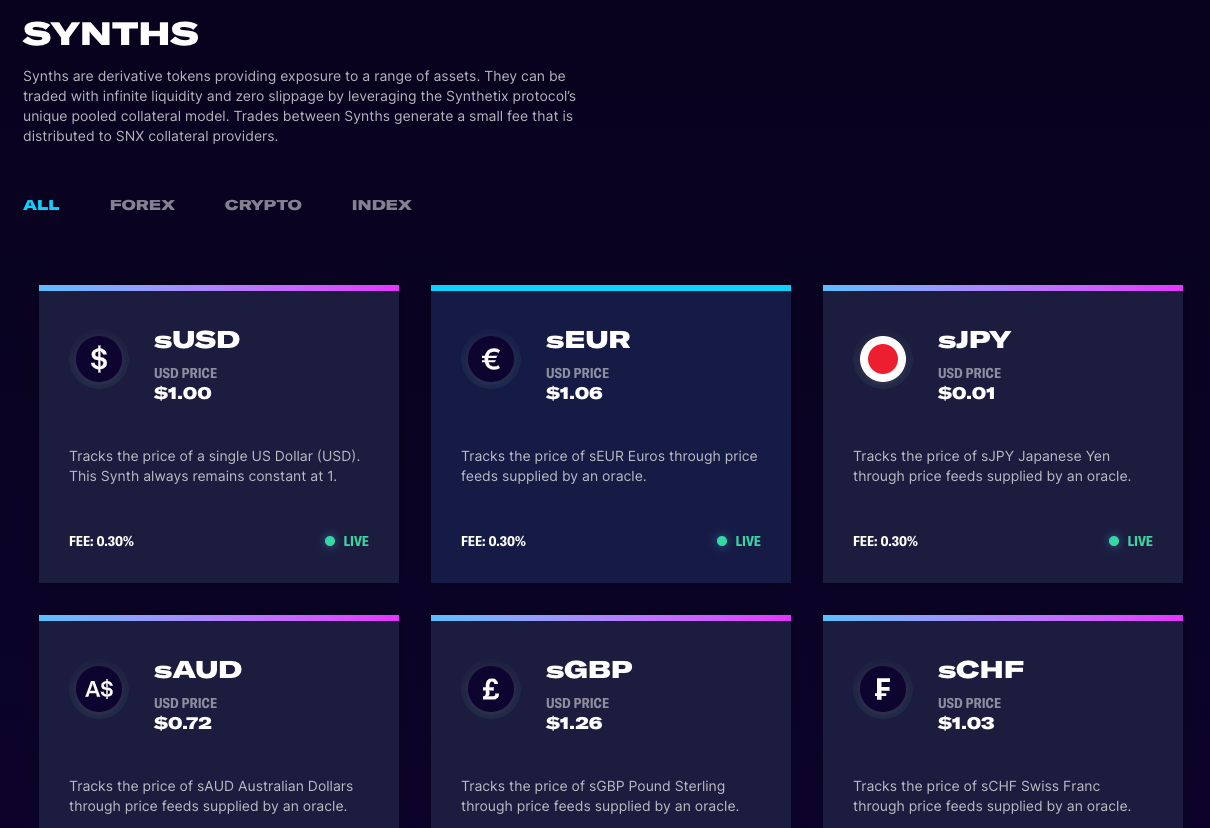

Synthetic assets, also known as synths, are tokenized derivatives that act and feel like traditional financial derivatives; they track an asset and provide the same returns and losses without holding the actual asset. In Synthetix, these synths are instruments in the form of ERC-20 tokens.

Synths can be anything from cryptos to real-world assets, like silver and indexes and inverses.

The SNX token is the protocol's native token and is used to provide collateral.

Understanding how Synthetix and synths work

Synths are tokenized derivatives that, through decentralized oracles, track the prices of different assets. Users can buy, hold and exchange synths, getting the same returns but without the need to hold the actual underlying asset.

Through synths, crypto investors can get exposure to traditional assets that aren't part of the crypto world - like silver - getting the same efficient trading experience that the crypto ecosystem brings.

Since synths are built on Ethereum is possible to interact with DeFi platforms like Uniswap, earning interests in return.

Synthetix aims to bring a more mature market, giving investors a way to protect themselves against volatility.

There are five different asset classes on Synthetix

- Fiat money

- Commodities

- Cryptos

- Inverse cryptos

- Crypto indexes

Fiat assets include sUSD, sEUR, and sKRW, among others. Commodity prices include synthetic gold and synthetic silver; both measured per ounce.

Cryptocurrencies include sBTC, sETH, sBNB, with many more.

There are also inverse assets that inversely track the price of any of the available cryptocurrencies, which means that when the price of BTC decreases, the price of iBTC increases.

Indexed crypto assets are sDEFI and sCEX (and their inverses), which track a basket of DeFi assets and a basket of tokens on centralized exchanges.

The value of all synthetic assets is currently determined by oracles introducing on-chain price feeds.

They use an algorithm with various sources to determine the added value for each asset.

Price feeds are currently supplied by independent Chainlink and Synthetix node operators.

SNX holders are incentivized to stake their tokens through the Proof-of-Stake consensus. They are paid a proportionate share of the fees generated through activity on the Synthetix Exchange based on their contribution to the network.

The SNX token

The SNX token is the foundation of the Synthetix protocol as it acts as collateral to support the creation of any synthetic or synth asset on the platform. The minting of Synths by SNX holders is done through the Mintr app.

SNX tokens that are staked during minting will remain locked in a smart contract, and the user will receive one-eighth of the value of their funds in sUSD in return. For example, if you stake SNX for $1.600, you'll get $200 sUSD in return.

The optimal collateralization ratio (C-ratio) is 800%, so the user must actively maintain this ratio. The incentives for holders to deposit and lock their SNX, and mint Synths, are mainly two:

- Each operation within the Synthetix exchange generates a commission sent to a fee pool. These fees are between 10-100 bps (0.1% - 1%, though usually 0.3%) and will show up on all trades on the Synthetix exchange. Fees can be claimed later by stakers, based on the percentage of SNX they have deposited.

- The other incentive for SNX holders to stake their tokens and mint new Synths is SNX staking fees, which come from the protocol's inflationary monetary policy. From March 2019 to August 2023, the total supply of SNX will increase from 100,000,000 to 260,263,816, with a weekly decay rate of 1.25% (from December 2019). In September 2023, there will be terminal 2.5% annual inflation in perpetuity. These SNX tokens are distributed to SNX stakers weekly on a proportional basis as long as the collateralization ratio does not fall below the optimal threshold.

The above mechanisms ensure that SNX stakers have incentives to keep their Collateralization Ratio (C-Ratio) at the optimal rate of 800%.

This ensures that Synths are backed with enough collateral to absorb significant price shocks.

If the value of SNX or Synths fluctuates, each player's C-ratio will fluctuate.

If it falls below 800% (although there is a small buffer that allows for minor fluctuations), they will not be able to claim commissions until they re-establish the ratio.

The C-ratio can be adjusted by minting Synths back into Mintr if the ratio is above 800% or by burning them if their ratio is below 800%.

What is Kwenta

Kwenta is the decentralized exchange (DEX) that allows users to trade synths. While synths can also be exchanged in other DEXes, Kwenta leverages the Synthetix protocol, so there's no need to create an account or lose control of the assets, making it permissionless and non-custodial dApp.

One of the main differences of Kwenta is that it doesn't have an order book. All trades are executed against smart contracts with oracles providing price feeds.

There's also infinite liquidity, so there's no counterpart matching, no pairing trade restrictions, and there's also zero slippage because there's infinite liquidity.

Synthetix allows investors to get exposure to crypto and non-crypto assets while allowing them to interact in DeFi platforms without having to own DeFi assets.