GM Architects,

Markets had a positive streak of gains early this week, which then moderated on Thursday when U.S. Federal Reserve Chairman Jerome Powell suggested in a speech that interest rates may rise by an additional 50 basis points. In all, cryptocurrencies and protocol tokens had a positive week, rising 4% and 8%, respectively.

The U.S. economy added 263,000 jobs in November, more than expected, and the unemployment rate remained steady at 3.7%, sustaining the expectation of higher rates. Bitcoin and other tokens' prices slipped on the news.

This edition covers this week's market movers, our call for on-chain transparency, and deep dives into Loopring. Read along.

☕️ This week in crypto

- Ankr - a distributed node operator for proof-of-stake networks - was hacked in the early hours of Friday, with the attacker leveraging the smart contract for the aBNBc token that allowed them to create an infinite amount of them. The decentralized finance protocol said it will reimburse the users impacted by the $5 million exploit.

- Larry Fink - the CEO of the world's largest asset management firm, BlackRock - believes the reason why FTX failed is that it created its own FTX Token, which was centralized and at odds with the "whole foundation of what crypto is" adding that he believes crypto and blockchain technology will be revolutionary.

- Porsche, the German luxury car manufacturer, suggested it will be significantly ramping up its Web3 efforts after sharing an upcoming NFT project consisting of 7,500 customizable tokenized vehicles. The NFTs will be launched in January, and users will be able to customize various aspects of the cars.

Too good to be true

Just earlier this year -which feels like eons away- crypto was parading sky-high APRs. The whole space was under the impression that those high APRs were the best way to drive adoption, and users loved them. You could see Reddit post after Reddit post claiming to find an endless money supply method, while CeFi projects shared ways you could earn a 10% interest just by handing them your funds.

Were those numbers too good to be true? Probably. And as the old Shakespeare saying goes, all that glisters is not gold.

We are seeing projects such as Nexo try to explain to their user base how their 10% interest is safe and sustainable, and KuCoin coming under scrutiny because its KuCoin Earn page boasts APRs of 233% on Ethereum, 253% on Bitcoin, and 100% on Tether deposits that now don't seem as safe or sustainable as they once seemed.

But this is positive. We are moving to an era of more transparency, as Kerman Kholi shared in his newsletter. And that means users are now questioning not only the returns but the transparency and sustainability of projects and protocols. And this is something where DeFi (and Web3 in general) can shine.

On-chain transparency should be the gold standard, and self-custody assets are becoming more critical than ever.

Bear markets, and crypto winters, can be complex. But the learnings that come with them have the power to propel the industry in the right way.

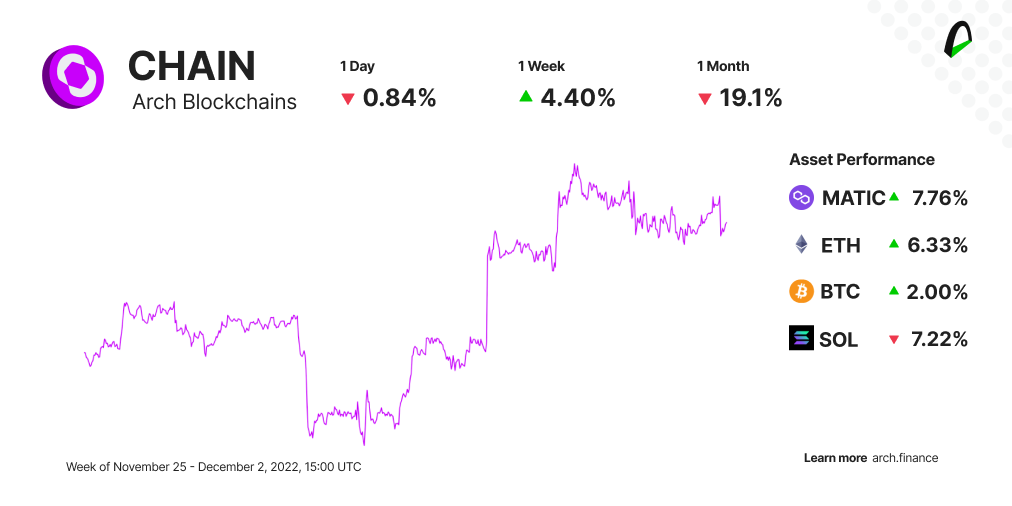

⛓ Cryptocurrencies: $CHAIN is up by 4.40% with Polygon leading the board once again

The Arch Blockchains token (CHAIN) traded 4.40% higher than the last seven days.

- Polygon (MATIC) continues on its upward trend. This is coming after the Graph - a decentralized protocol used to index Web3 data - introduced support for Polygon on The Graph Network, according to an announcement from Polygon. After years of relying on The Graph's hosted service, Polygon users will soon be able to rely on entirely decentralized APIs to power their decentralized applications. But that's not only it; per DeFiLlama, Polygon stood out as having the most new DeFi protocols listed.

- Solana (SOL), one of the blockchains that suffered the most after the FTX implosion, continues to have a rough week. This is coming after trading volumes are sitting at monthly lows.

- Ethereum's (ETH) price also saw some positive price action, and while some of it can be attributed to the FED, the network is also a part of exciting news. The decentralized exchange (DEX) Trader Joe will soon deploy on the Ethereum scaling solution Arbitrum as it looks to capture new user bases. Kiln, a startup that allows customers to receive rewards for helping secure the Ethereum blockchain and looking to offer staking as a service, raised 17 million euros in a Series A funding round. Finally, Casa, a famous Bitcoin self-custody firm, is adding Ethereum support to its platform.

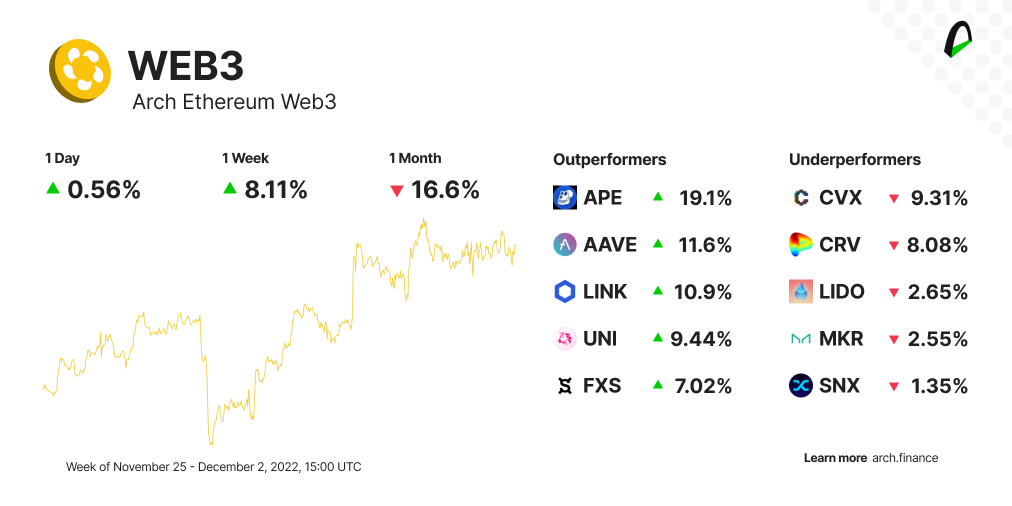

📈 Protocols: WEB3 is up by 8.11%

At the time of writing, The Arch Ethereum Web3 token (WEB3) traded 8.11% higher than last week.

- ApeCoin (APE) continues its upward trajectory and outperforms most major crypto projects this week. Let's remember that it was trading over 13% higher than this week's 19.1% higher than the last seven days. This is coming after Horizen Labs announced the launch details for ApeCoin staking, which will give APE holders and Bored Ape and Mutant Ape owners rewards for staking their tokens. But there is other news; last Wednesday was the launch of an official ApeCoin community NFT marketplace, which may also be responsible for ApeCoin's price action.

- Uniswap (UNI) had a 9.44% price uptick. Uniswap active address and network growth have touched a 19-month high to levels last seen on May 4th, 2021. The reason? Uniswap Lab's NFT aggregator platform went live with a $5 million USDC airdrop to Genie users. In the platform, users will be able to conduct NFT trading from across multiple marketplaces.

- Chainlink (LINK) is trading 10.9% higher than the last seven days after they tweeted on December 1st that the network would launch v2 of their staking protocol earlier than usual on December 6th. According to LunarCrush, a social analytics firm, Chainlink's social mentions increased by 18.3%, showing users' interest in their staking solution.

📬 Like this weekly recap?

Every Friday we send a weekly recap about the Web3 ecosystem and how crypto markets, and markets in general, are moving. Share and subscribe!

🌐 What's Loopring

Loopring is a protocol built on top of the Ethereum blockchain to help alleviate transaction congestion which powers up DEXs built on it.

Learn everything about what it is, how it works and the tokenomics behind its LRC token.

Disclaimer: The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations. The views reflected in the commentary are subject to change without notice.