Learn everything about what Loopring is, its main characteristics and everything about the LRC token.

As the number of decentralized finance (DeFi) protocols on Ethereum increases, so do the transaction fees.

In February 2021, the average fee for a transaction in ETH reached an all-time high of almost $40. This is what Loopring is trying to correct by offering a digital economy that empowers users while continuing to give them complete control over their assets.

With Loopring, people no longer have to sacrifice efficiency and affordability to take advantage of Ethereum's network security.

But what's Loopring? Let's deep-dive

Loopring is a protocol built on top of the Ethereum blockchain. Ethereum is a layer-one solution, and Loopring is a second-layer network protocol designed to improve the first layer. These updates include improving the user experience and making transactions faster and cheaper.

Think of second-layer networks like Loopring as a road built parallel to the main one you can use to bypass the traffic in the main one.

According to its developers, Loopring helps the protocol reach throughput (the speed with which a blockchain processes transactions) roughly a thousand times faster than Ethereum. They also claim that Loopring can manage over 2,000 transactions per second (TPS).

Since transactions on Loopring follow a different route, they are much faster and cheaper than those on the Ethereum network.

Understanding the role of the zk-rollup

The zero-knowledge rollup, also known as the zk-rollup, is the method used to process transactions privately. It works by proving the information on the transaction is valid without providing much information about the transaction.

ZK-rollups are critical for protocols in the crypto space that want to keep the information private from third parties or central authorities in case something goes wrong. In short, this avoids filtering or giving out unnecessary information.

Now, you may be wondering how ZK-rollups work. As the name implies, ZK-rollups "roll up" the collected groups of transactions into a single transaction and execute them on the main chain, like the Ethereum network. This way, costs are reduced, and the processing time is accelerated since several transactions can be carried out simultaneously.

The pros of Loopring

According to its whitepaper, Loopring's main pros are security, high performance, and low transaction fees. Let's quickly go over each of these features:

Security:

Loopring, according to its website, is an "open source, audited and non-custodial payment and exchange protocol." Both parties can trust the other within their ecosystem without needing a third-party centralized entity to approve or verify anything.

With Loopring, the ZK-rollups are the ones that take care that the assets are always under the user's control.

Performance:

Loopring processes off-chain transactions and payments for a batch of thousands of requests. This improves transaction processing speed and removes Ethereum's chain's bottleneck.

Lower costs:

Since most trade settlements and transfers occur outside Ethereum's first-layer network, gas consumption and overall transaction costs decrease.

Now that we've learned about the essential features let's check what LRC is and its role.

Everything about LRC

LRC is the Ethereum-based token of the Loopring network, introduced in 2017.

It has been a part of the Loopring protocol since inception and it's used to reward the zk.rollup operators and well as liquidity providers.

It's also been used to incentivize new developments in the Loopring ecosystem.

A little about their tokenomics:

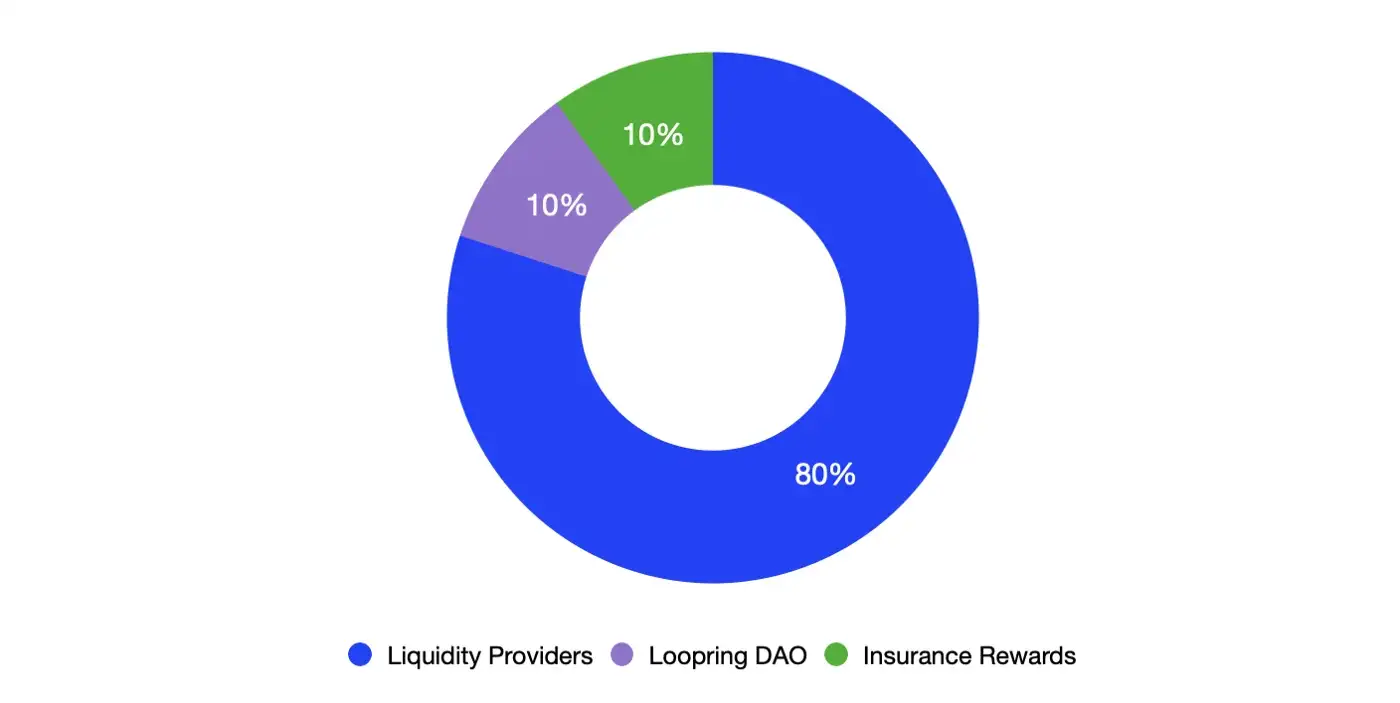

Protocol fee distribution is configurable by the forthcoming Loopring DAO but will be distributed to participants in the following manner:

- 80% distributed to liquidity providers (LPs) on Loopring order books and AMM. At least 50% of this portion goes to LRC-related liquidity.

- 10% distributed to insurers — users who put capital into a safety insurance fund.

- 10% to Loopring DAO — the DAO decides how to spend these funds: buyback and burn, impermanent loss protection, further liquidity incentives, grants, etc.

Loopring is powering Ethereum-based DEXs through faster and cheaper transactions. And with new developments coming up, it has positioned itself as an integral player in the Web3 ecosystem.