MakerDAO (MKR) is a Decentralized Autonomous Organization (DAO) built on Ethereum. The protocol issues the Dai stablecoin and facilitates trustless loans.

MakerDAO allows users to open collateralized credit positions with cryptocurrencies - mainly ETH and other ERC20 tokens - to mint Dai, a stablecoin pegged to the US dollar.

Dai stability is not only achieved through a system that controls the collateralization threshold of open Collateralized Debt Positions or CDPs but also through autonomous feedback mechanisms and incentives for external actors.

Once generated, Dai can be freely sent to others, used as payment for goods and services, or stored as long-term savings.

To understand what MakerDAO is, you first need to understand Dai, the first product by Maker.

MakerDAO is part of the Arch Ethereum Web3 Token and it's also part of the Arch Lending Index

What is Dai

Dai is a stablecoin. The concept of stablecoin (stable currency) is quite simple: it is a token like Bitcoin or Ether. But unlike Bitcoin or Ether, it doesn't have the same volatility.

Dai is pegged to the US dollar, and each Dai is equal to one dollar. What makes this coin unique compared to other stablecoins out there is that each Dai is backed by Ether instead of a third party claiming to have the required collateral.

In general, stablecoins such as Tether, TrueUSD, and other stablecoin projects are backed by money stored in bank accounts.

The issue is that users have to trust that the third-party intermediary has the right amount of USD and does not generate artificial inflation.

On the other hand, Dai lives entirely on the blockchain. Its price stability is not tied to an intermediary, so there is no need to trust a third party. However, since Ether is volatile, maintaining the correlation with the USD raises exciting challenges.

How MakerDAO works

To explain it very simply, Maker works like this:

- A user deposits Ether or other tokens in the Maker smart contract, creating a CDP (Collateral Debt Position).

- The collateralization ratio is 150%, which means that the price of the ETH deposited must be 150% of the Dai that is lent. If we want them to lend us 100 Dai, it will be necessary to deposit $150 worth of ETH.

- As we mentioned before, ETH is a volatile asset, so its price can rise or fall in a relatively short time. If the price of Ether falls below the collateralization ratio, in this case, $150, the CDP will be closed. This ensures that there is always enough capital backing the amount of Dai lent.

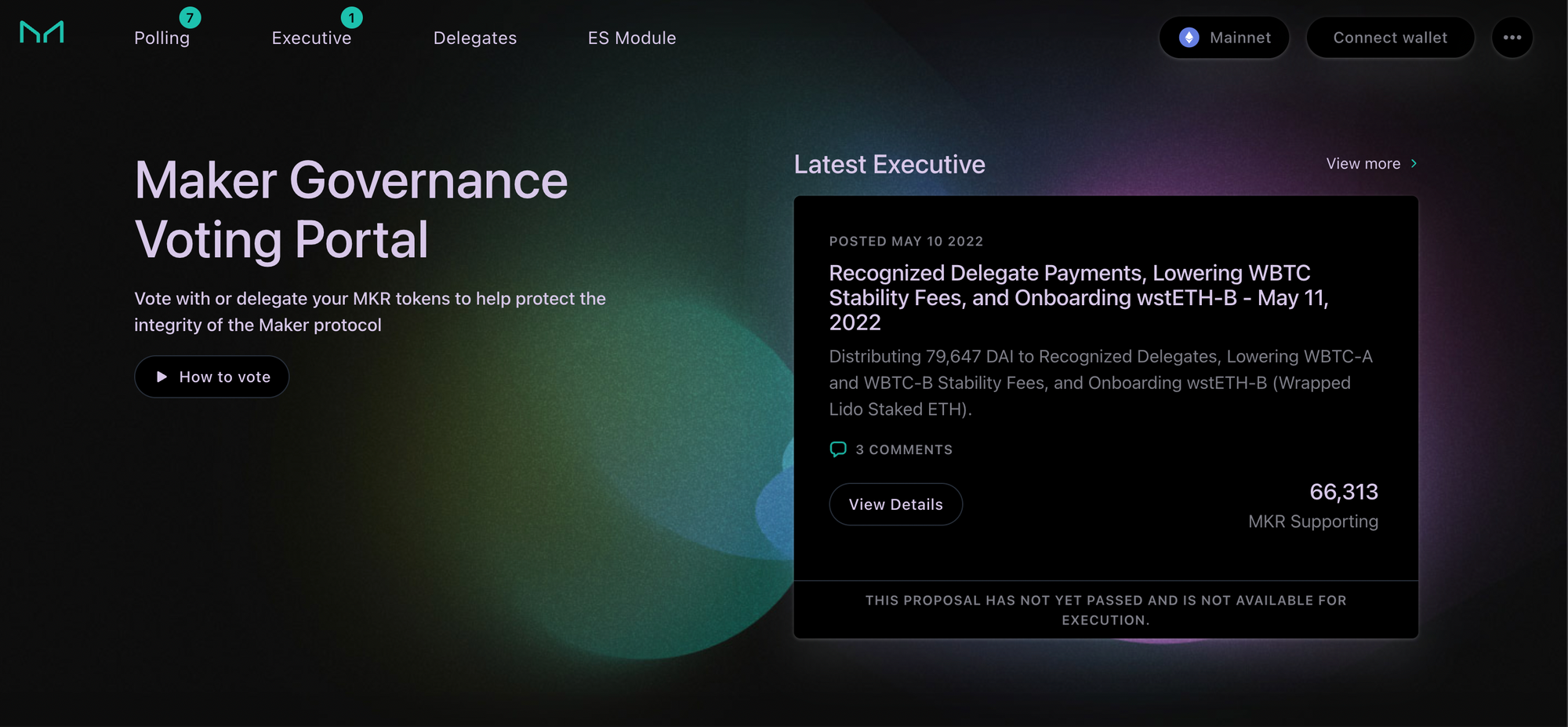

- There is another scenario in which the CDP is not closed because the collateralization ratio is maintained, and after the time the user considers, they can voluntarily close their debt position by repaying the borrowed Dai plus an interest called stability fee. This interest can fluctuate and is determined by the DAO after MKR token holders vote.

- The stability fee is used to keep Dai pegged to USD. Therefore it would act as a monetary policy instrument.

- If the supply of Dai increases its price in relation to the USD, the price will go down. In that case, the DAO could vote to increase the stability fee so that it's more expensive for users to generate new Dai, and the closing of CDPs is incentivized. With this, supply would be reduced, and the price would increase to reach the exact parity with the USD. The same could be done in the opposite case.

This mechanism has proven extremely versatile, allowing Dai to maintain its peg to the USD despite the January 2018 market crash and the volatility that followed.

There is yet another mechanism to control the flow of Dai and thus keep it pegged to the value of the USD, which is known as the Dai Savings Rate, or DSR.

The DSR is an interest rate applied to Dai deposits.

In November 2019, MakerDAO implemented a significant update. The update introduced several new concepts, including the Dai Savings Rate, an interest rate that applies to all Dai deposited in a particular smart contract.

This interest rate is paid with the funds generated by the stability fees, and its rate is also decided by voting through MakerDAO.

DSR provides MakerDAO governance with another tool. Instead of maintaining the Dai/USD parity through a supply reduction/expansion mechanism, it was now possible to use the DSR to influence the demand for Dai.

An increase in the Dai savings rate would increase the demand to buy Dai on an exchange, deposit purchased Dai into the DSR contract, and earn interests.

Conversely, lowering the rate would encourage users to sell Dai to invest elsewhere.

The role of the Maker Token (MKR)

MakerDAO is backed by a second token, MKR, whose value is not stable but is used to help maintain the stability of Dai.

MKR is a token built on the Ethereum blockchain (like the rest of the Maker ecosystem) and has governance rights over Maker smart contracts.

For example, the CDP collateralization fee, stability fee, and DSR handset by votes from MKR holders. In exchange for participating in the protocol, MKR holders are rewarded with fees.

However, there is an important consideration to know before owning MKR. In case the collateral deposited in the protocol is not enough to support the existing amount of Dai, MKR is used to increase the additional collateral needed, which is done by selling it on the market.

This provides a strong incentive for MKR holders to regulate the parameters in which CDPs can create Dai responsibly. Ultimately, their money will be compromised if the system fails.

Another critical aspect of how MKR works is that an equivalent dollar amount of MKR is purchased and then burned when the stability fee is paid.