GM Architects,

A turbulent week for crypto after the FTX's collapse. The Arch Ethereum Web3 token traded 21.3% lower, while the Arch Blockchains token was down by 18.2%.

Ethereum traded 19.4% lower, while Bitcoin was down by 15.6% over the previous seven days.

In this edition, we share the market movers, analyze how the market has been performing since last year's ATH, and dive deep into Nest Protocol, a project that seeks to quickly and accurately deliver prices to other DeFi protocols.

☕️ A quick weekly overview

- FTX, a crypto exchange once valued at as much as $32 billion earlier this year, filed for Bankruptcy Protection in the US and its CEO, Bankman-Fried, resigns. Binance offered to buy it but later in the week took the offer down, citing, "the issues are beyond our control or ability to help." The fallout has raised questions about the importance of more decentralization, self-custodial assets, and transparency in the industry.

- Ether (ETH) has turned deflationary for the first time since the token's parent blockchain Ethereum changed how it processed transactions nearly two months ago. The annualized inflation rate has dropped to 0.029%, indicating that the blockchain is burning more ether than what's being minted.

- MetaMask released MetaMask Bridges, allowing users to transfer their assets directly from their wallets across blockchains.

The FTX drama shook the market

A turbulent week for crypto that started with the FTX drama bringing most of crypto tokens down. However on Thursday crypto prices cooled down from the saga.

The price action came after an unexpectedly positive Consumer Price Index report indicated the U.S. Federal Reserve’s recent stance of 75 basis point interest rate hikes were working towards reducing a year-long bout of high inflation.

In TradFi, the Nasdaq Composite is trading 5.37% higher than the last five days, while the S&P500 grew by 5.03%.

⛓ CHAIN is down by 18.2% with Polygon defying the crypto turmoil and trading 12.8% higher than the last seven days

The Arch Blockchains token (CHAIN) traded at 18.2% lower than the last seven days.

- Polygon (MATIC) is on a roll and continues rising; this time, the price it's up by 12.8%. The positive news continues to flow with a new partnership with Disney announced this week.Polygon is developing a proof of concept for exclusive digital collectibles to recognize Disney employees during special occasions.

- Solana (SOL) is continuing to feel market pressures. This comes after theories about the connection to FTX’s impending insolvency seemed to hold traction with investors. Co-founder Anatoly Yakovenko responded briefly on Twitter, stating that Solana did not have any FTX assets but FTX and Alameda Research were both large holders of Solana driving investors to unstake their tokens. A record 31 million of the Solana blockhain’s SOL tokens were unstaked Thursday from the blockchain.

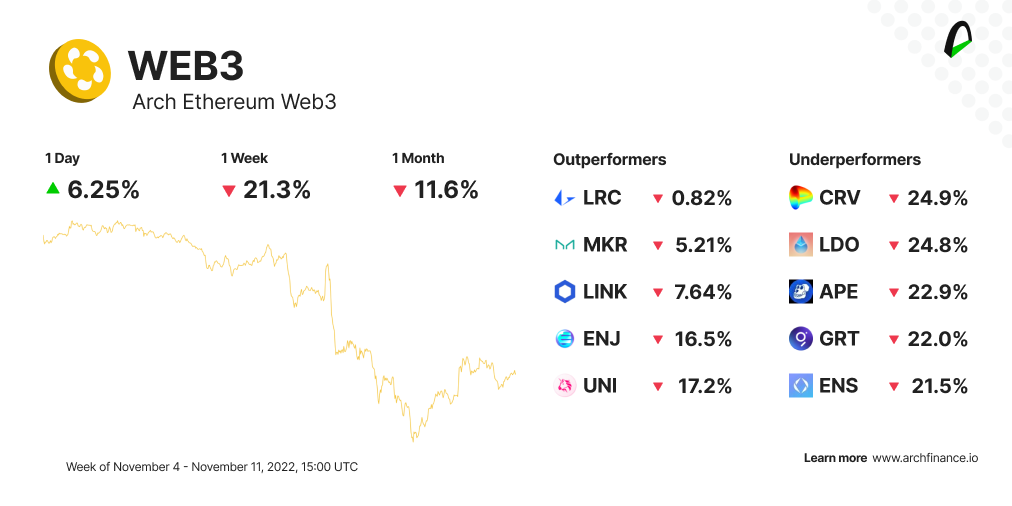

📈 Web3 is down by 21.3% with all tokens feeling the turmoil

At the time of writing, The Arch Ethereum Web3 token (WEB3) traded 21.3% lower.

- Loopring (LRC) is the least affected, trading only 0.82% lower than the last seven days. LRC recorded its highest daily volume traded in the past six months just last week, and yesterday they announced on Twitter that LRC Staking is coming to Loopring L2. And while more centralized assets and blockchains are feeling more of the FTX's heat, decentralized and self-custody solutions, like Loopring, are being looked at as a haven.

- Chainlink (LINK) is trading 7.64% lower. Chainlink Labs offered its proof-of-reserve product to solve future trust issues in the crypto exchange market. Their proof-of-reserve (PoR) product is said to be useful "for verifying centralized exchange asset reserves, off-chain bank account balances, cross-chain collateral, real-world asset reserves, and much more."

- MKR, the native token of the Maker Protocol, is somewhat undisturbed despite the most recent market downturn, with significant technical indications predicting bullish advances in the near future.

📬 Like this weekly recap?

Every Friday we send a weekly recap about the Web3 ecosystem and how crypto markets, and markets in general, are moving. Share and subscribe!

🌐 Analyzing the performance of the main crypto sectors

A week like this a year ago, the crypto market - mainly Ethereum - reached its ATH. 365 days have passed, and the price has fallen drastically. But are all the crypto sectors the same? And are all the projects performing equal to each other? Short answer: No.

We analyzed more than 1.000 tokens using Arch Intelligence and made some compelling discoveries.

🇳 What's NEST Protocol and how it works

Nest is a protocol that seeks to quickly and accurately deliver prices to other DeFi protocols.

Part of the Arch Oracles Industry Index, Nest in the index's top performing, trading over 25.7% higher than the year and with a $70.000.000 market cap

In this post, we dive deep into what Nest is, how it works, and everything you need to know about the NEST token.

--> 📚🤓 Check our what the NEST Protocol is and how it works

Disclaimer: The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations. The views reflected in the commentary are subject to change without notice.