GM Architects,

Another week of market intelligence. The Arch Ethereum Web3 token decreased by 5.32% during the last week after a bull rally that ended on Monday.

This comes after the European Parliament votes for a bill that seeks to outlaw anonymous crypto transactions and bearish sentiment on the metaverse tokens.

It also follows the tentative plan laid by the Fed to shrink the balance sheet by $95 billion a month. The news shook the crypto and stock market starting a sell-off across different sectors.

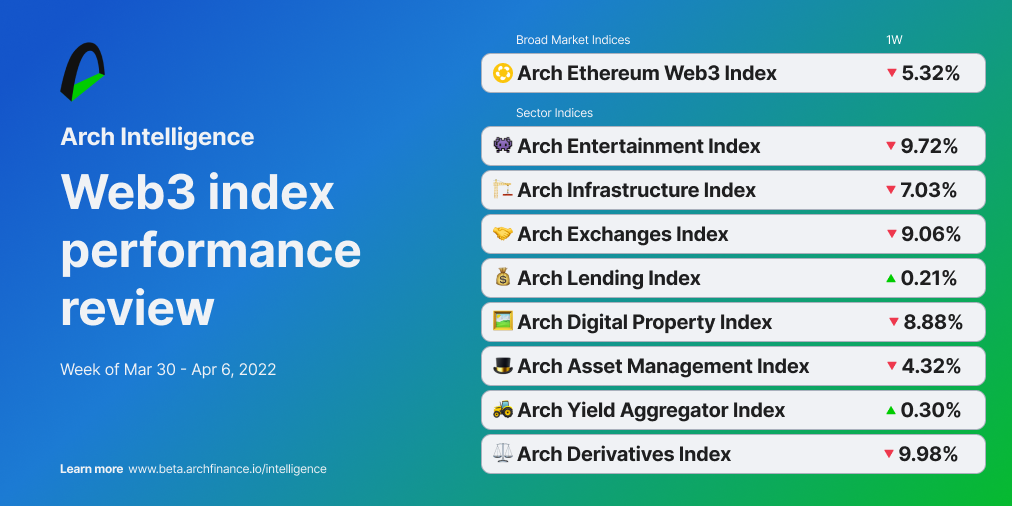

📉 Web3 Index performance review

- The Lending and Yield aggregator indices are the only ones trading upwards this week.

- The Sandbox (SAND) price has been consolidating for two weeks. This comes with a strong selling pressure that might further pull the token price down. SAND is part of the Entertainment Index, one of the most affected this week. Axie Infinity Shards (AXS) also lost more than 10% after a hack on the Ronin bridge worth more than $600 million.

- OGN was the underperformer of the Digital Property Index after a strong rally that lasted almost all of March. This can be due to a normal retracement of the market.

- UMA (UMA) has seen a sharp decline in its price and is trading on low volume. CoinCodex sets the price prediction for UMA on bearish.

- Loopring (LRC) price has taken a nosedive after a sharp reduction in transaction volume.

- The Yield Aggregator Index is up by 0.30% compared to last week. Convex Finance (CVX) is one of the tokens leading the race with bullish momentum on the rise.

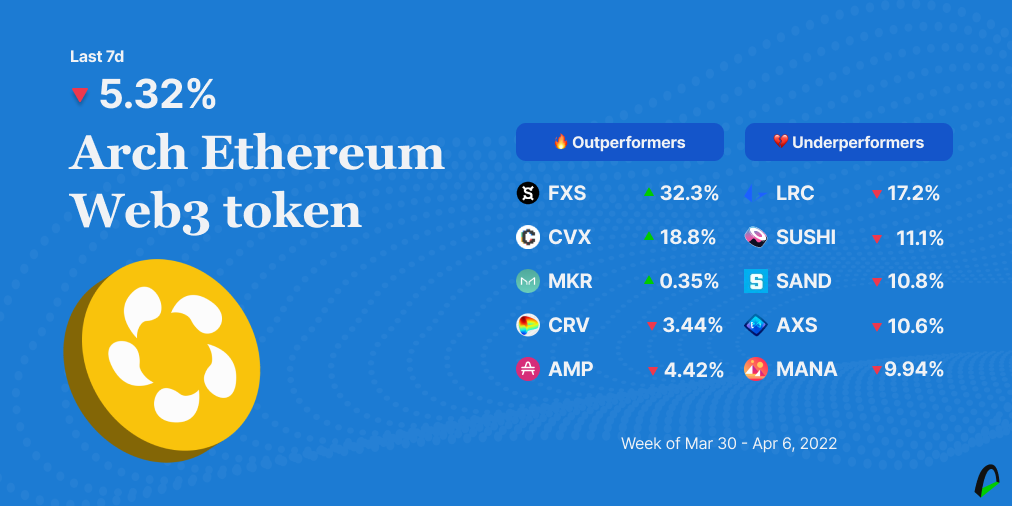

💔 Arch Ethereum Web3 Token Is Down by 5.32% in the last seven days

- The $WEB3 token is down by 5.32% in the last seven days, trading at $4.85

- Tokens in the entertainment sector were the underperformers, with AXS, MANA, and SAND trading in the red. For AXS, this comes after a week tarnished by the Ronin exploit.

- The exchanges sector was also affected, with SUSHI and LRC trading lower than last week after a bull rally for both tokens in the second week of March.

- FXS, CVX, and MKR were the only tokens trading in the green. The FXS uptick comes after Terra introduced the 4pool liquidity pool on Curve Finance, including UST, FRAX, USDC, and USDT, which resulted in positive sentiment among traders for increased utility for FXS tokens.

👁️🗨️ Become a beta tester

Be an essential part of Arch's development. Share your feedback about a new prototype we are testing. Let's meet!

- $WEB3 holders — Verify your assets to access the exclusive #architects-lounge channel.

- 🐦 Join our community on Discord and follow Arch on Twitter.

- Stay tuned for events, research, and exciting product announcements.

- ⚠️ Important: beware of scams, and please report any attempts. We will not message you first and will never ask for your keys.

Contribute

Join the core team or become a contributor. We want to hear from you:

💼 Open positions:

Learn more about open positions and working at Arch. If interested, please send us a note on Twitter or Discord.

Disclaimer: The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations. The views reflected in the commentary are subject to change without notice.