Hello Architects,

Macroeconomic and geopolitical unrest have been keeping traders on edge.

Inflation, stunted economic growth, and rising interest rates caused some investors to reduce their exposure to volatile assets like cryptos. The total crypto market-cap went down by 11% in the last seven days.

However, the past 24 hours have shown some recovery across all Arch Web3 indices, with smaller-cap and medium-cap tokens recovering better than blue-chip cryptos like Bitcoin and Ether.

Learn how the different indices moved this week and how token prices affected the Arch Ethereum Web 3 token.

💸 Inflation report affects all Web3 indices

- After a financial landscape marked by the worst inflation in the last decades, all sectors are trading in the red. However, some experts think the Consumer Price Index (CPI) report that showed inflation accelerating to 8.5% in March is actually the peak of the current inflation cycle and that it normalizes from here.

- The global crypto market cap grew by 3.4% in the last 24 hours according to CoinMarketCap, with tokens following suit of the stock markets. Nasdaq, for example, gained 1.3% at open.

- The Arch Digital Property Index was the least affected by the swings. Enjin Coin (EJN) kept the momentum going, increasing its price by 0.41% over the last seven days. The number of wallets holding EJN has been rising for the past three months, showing a solid trust in the asset.

- The Arch Derivatives Index was one of the most affected by the turmoil. Synthetix (SNX) has seen a drop in institutional interest and was, just this week, pushed out of the Grayscale portfolio for failing to meet market capitalization requirements creating doubts about its long-term price stability.

- Arch Infrastructure Index also took a hit, trading 10.1% lower than the last seven days, with Render Token (RNDR) being one of the underperformers. There's a strong bearish sentiment with this token. However, holder wallets remain at similar levels to last week.

- Small-cap cryptos, with market caps lower than $1billion had price surges of up to 24% in the last seven days. Unifty (NIF) is up by 4.5%, Orion Protocol (ORN) by 10.8%, Kyber Network Crystal v2 (KNC) by 24%, 0x (ZRX) by 1.6%, and APENFT (NFT) by 1.72%. Meanwhile, Bitcoin (BTC) is down by 6.12% and Ether (ETH) by 4.32%.

📉Good news during the last 24h move some tokens to trade in the green

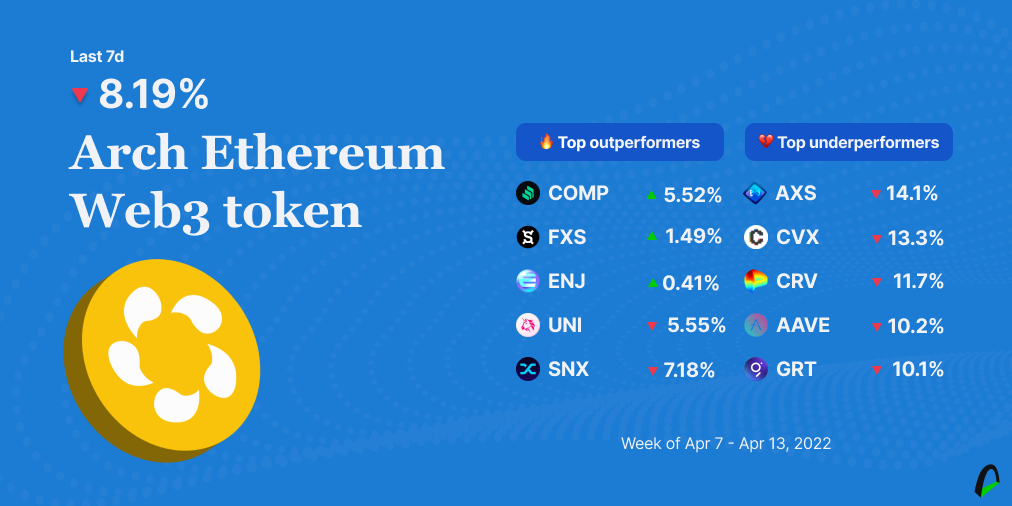

- Like the rest of the crypto ecosystem and the stock market, the Arch Ethereum Web3 token is down by 8.19% in the last seven days, trading at $4.28.

- Compound (COMP) was one of the week's outperformers after joining Robinhood's exchange. COMP is one of the four new cryptos added to Robinhood, along with Solana (SOL), Polygon (MATIC), and Shiba Inu (SHIB).

- Frax Share (FXS) continues its upward trend during a week tinted by market turmoil. FXS has been one of the most actively traded V2 market pools on Uniswap for Q1 2022.

- Axie Infinity Shards (AXS) is one of the underperformers. The price has fallen by nearly a 30% in the last two weeks after the Ronin exploit that lost the Play-to-Earn game $625 million. The token also sees little buying pressure breaking below the demand zone, indicating a strong possibility of lower prices.

👁️🗨️ Become a beta tester

Be an essential part of Arch's development. We want to hear your feedback about a new prototype we are testing. Let's meet!

- $WEB3 holders - Verify your assets to access the exclusive #architects-lounge channel.

- 🐦 Join our community on Discord and follow Arch on Twitter.

- Stay tuned for events, research, and exciting product announcements.

- ⚠️ Important: beware of scams, and please report any attempts. We will not message you first and will never ask for your keys.

Contribute

Join the core team or become a contributor. We want to hear from you:

💼 Open positions:

Learn more about open positions and working at Arch. If interested, please send us a note on Twitter or Discord.

Disclaimer: The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations. The views reflected in the commentary are subject to change without notice.