GM Architects,

In market news, the Arch Ethereum Web3 index increased by 14.3% during the last 30 days, opening discussion on whether the market has bottomed.

In line with its monthly rebalancing process, the composition of our Arch Ethereum Web3 token ($WEB3) was updated, with no new token additions and only a 1.5% reallocation. Chainlink and Maker increased their presence meanwhile Enjin, Curve and Frax decreased their presence in the token.

With the objective of building the Arch community in Latam, we went to the Ethereum.Rio Conference 🇧🇷. As a little token of appreciation (pun intended), we made a 1 $WEB3 token Airdrop to all conference-goers that minted the EthereumRio POAP 🇧🇷 👉 Check your wallet if you were there

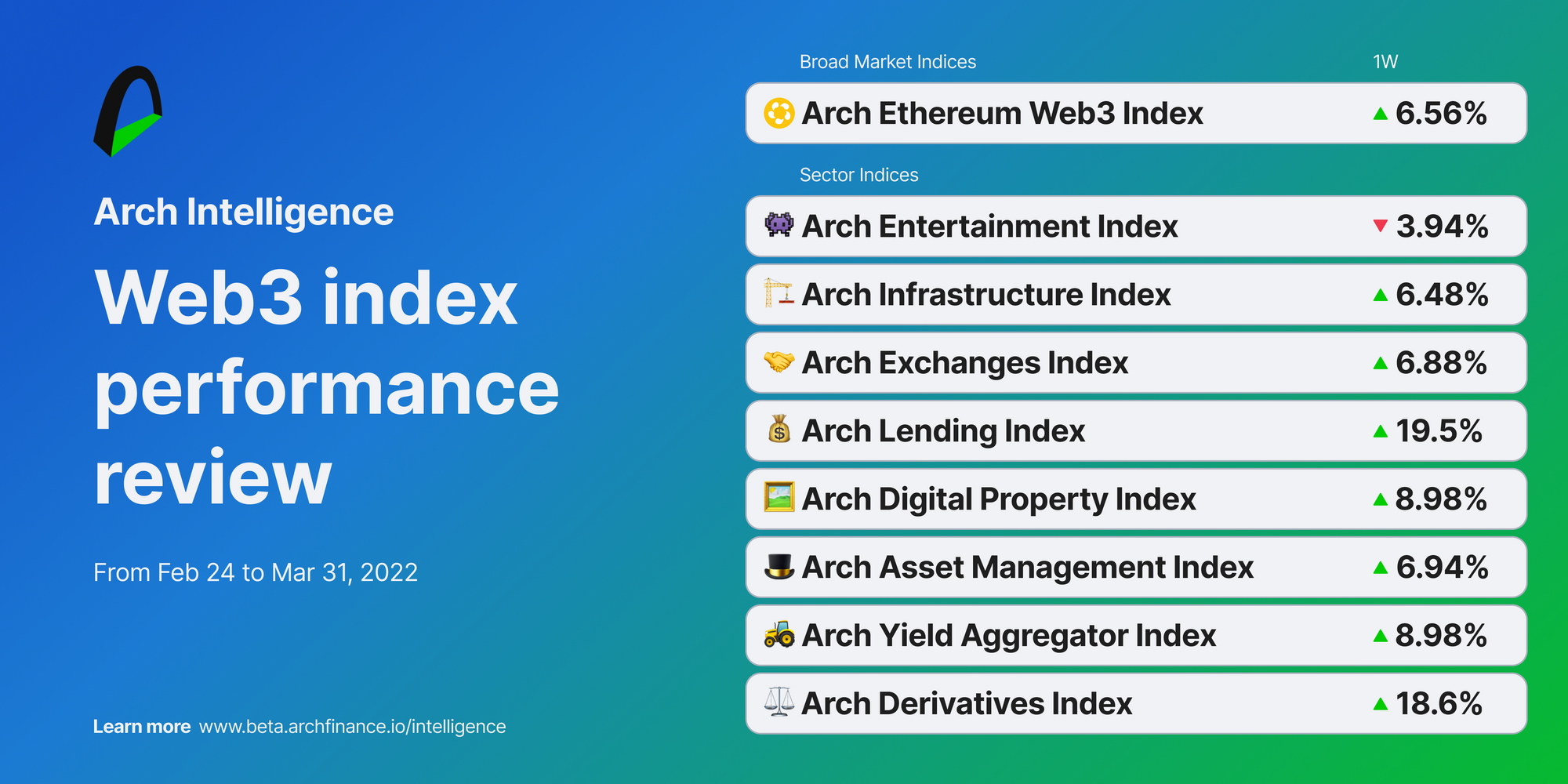

📈 Web3 Index performance review

- Aave's (AAVE) price rallies after the launch of its version 3 on March 16. Aave V3 trims load times and reduces gas fees by up to 25%. In-chain volumes and daily active addresses are at their highest levels since November. This is the first time volume, and daily addresses are this high since its last bull run.

- Synthetix (SNX) has also been trading upwards after merging L1 and L2 debt pools. This will enhance liquidity and give the protocol the ability to transfer synths between multiple chains efficiently. The project is also implementing pooled synthetic futures contracts with SNX at the core.

- Enjin Coin (ENJ), part of the digital property index, has been on a bullish trend. The launch of their parachain on the Polkadot network for NFTs and gaming.

- Compound (COMP) is another one of the outperformers going up 30.2%, reaching its highest price since the end of January. This comes after a proposal to reduce protocol rewards was approved. The end goal is to cut the rewards by 50%. Most COMP tokens being distributed with the past rewards program were instantly sold off.

- Maple (MPL), the governance token of the Maple protocol and part of the lending index, has been on a steady upward trend since the beginning of the year. Last week the price hiked even more after hitting the $1 billion mark in loans in 10 months. The token also got listed on Gemini on March 29.

- Convex Finance (CVX) has gone up after trading in the green since March 14. The token was listed on FTX, a crypto exchange, on March 16, which is one of the reasons the price has been climbing.

- OriginToken (OGN), part of the digital property index, enjoyed a price surge after announcing an upcoming airdrop and a new governance token for OUSD. OGN, the new governance token was approved by 99.93% of the proposal voters.

🔥 Arch Ethereum Web3 Token Is Up by 5.39% in the last 7 days

- The $WEB3 token is up by 5.39% in the last 7 days, reaching a price of $5.05

- Almost all the tokens have been trading in the green, with the yield aggregators with CVX at the head, followed by the lending sector with AAVE and COMP leading the race. SUSHI and SNX are also part of the market movers.

- Tokens in the entertainment sector were the underperformers, with AXS, MANA and SAND trading in the consolidation zone. After the Decentraland fashion week, and the support and adoption from name brands and designers, this comes as a surprise for investors that expected the price to rise more.

🤝 Test, hodl, chat

We are looking for testers. Sounds like you? Sign up here

📣 Join our community on Discord and follow Arch on Twitter.

- Stay tuned for events, research, and exciting product announcements.

- $WEB3 holders — Verify your assets to get access to the exclusive #architects-lounge channel.

- ⚠️ Important: beware of scams, and please report any attempts. We will not message you first and will never ask for your keys.

Contribute

Join the core team or become a contributor. We want to hear from you:

🛠️ Open positions:

Learn more about open positions and working at Arch. If interested, please send us a note on Twitter or Discord.

Disclaimer: The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations. The views reflected in the commentary are subject to change without notice.