Welcome fellow Architects!

In the second issue of our Newsletter, we want to explore the parallels between large companies and DAOs. There’s something that decentralized organizations can learn from their traditional counterparts.

Arch Ethereum Web3 Token ($WEB3) is now listed on Uniswap v3 on the Polygon Network.

The Arch Ethereum Web3 index went down 10.5% during February aligned with the World economy.

Let us know what you think. Join our Discord or DM us on Twitter.

Latest from Arch

Arch Ethereum Web3 Token ($WEB3) is now listed on Uni V3

Arch Ethereum Web3 token is now available on Uniswap on the Polygon Network. Uniswap is one of the top decentralized crypto trading protocols.

The pool has around $200.000 in liquidity and with Uni V3 we can set the expected price range to be +20% and -20%. With this set up you can do swaps for more than $10,000 with a price impact lower than 2%.

Arch Ethereum Web3 token

The Arch Ethereum Web3 gives the broadest exposure to the Ethereum Web3 ecosystem. Its constituents cover roughly 70% of the total market capitalization.

🚀 Polygon raises $450M

Polygon has raised $450 million in a new venture financing round as the firm, with a market cap of about $13 billion, aggressively expanding its portfolio of Ethereum scaling solutions and working to attract the larger developer ecosystem. We are happy Arch Ethereum Web3 token is now available for trading on Polygon dexes.

Market intelligence

🔻Web3 went down 10.5% in February

The Web3 index dropped 10.5% during the last month and 37% YTD. The underperformers sectors were Exchanges (-12%) and Derivatives (-16%) and the best sectors, in terms of returns, were Lending and Entertainment outperforming the general index.

From a token point of view, the last month was primarily in red. Over the 286 tokens of the Arch Ethereum Web3 Universe, 53 went up and 233 went down during the last 30 days. Learn more on Arch Intelligence.

💰 What large companies do with their liquid assets, and what DAOs can do with them

The effect of low-interest rates - driven by more than ten years of monetary policies - drove companies to have cash levels bigger than ever before.

Large tech companies like Apple, Amazon, Alphabet (Google), and Microsoft have more than $415B in liquid financial assets.

This amount is equivalent of two times all the money invested by VCs in the world. Or eight times the market cap of all Ethereum protocols combined. And these companies are not the only ones with significant investments, quite the opposite.

Most large and publicly traded companies have their liquid assets invested in different financial instruments. In this way, they can diversify their risk and increase their returns. Most large companies invest their liquid assets following a formula similar to this one:

- 20% in Cash or Money Markets

- 66% in Fixed Income Securities - like government or corporate bonds

- 14% in riskier and more volatile assets like stocks and derivatives.

🕴️ So, large companies invest their money. The question is, what are DAOs doing with the funds available in their treasury?

Well, that’s the question we wanted to answer. So we analyzed the 25 protocols with the most prominent available treasury.

In total, they have $7.5B of available funds, 73% of these funds, or $5.5B, are invested in their Governance Tokens. We get extreme examples, like Uniswap, which has 99.8% of its liquid assets in UNI tokens.

But we also found more diversified protocols like Yearn Finance. Yearn Finance only has 15% of their liquid assets in their native token, and the rest is divided into more than 15 tokens in their treasury.

Of the 25 protocols we analyzed, only 3 have more than 50% of their liquid assets in tokens other than their Governance Token. They represent less than 5% of the total analyzed sample in terms of liquid assets.

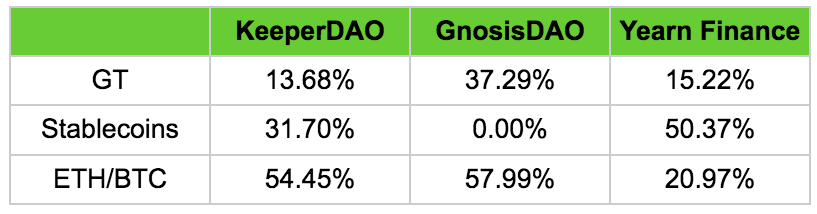

Here’s how these 3 protocols diversify the treasury:

This answer brought a bigger question.

🤔 Why are the protocols of the decentralized economy not diversifying their treasuries to reduce their risks?

There are a couple of theories of why DAOs might not be diversifying:

- A significant percentage of their liquid assets is working capital. That’s money they have to use to encourage the adoption and growth of their protocols. Their tokenomics. However, we found that most protocols keep larger volumes than necessary on their Governance Token.

- There’s a lack of financial instruments to diversify on the decentralized economy. This is not correct. DeFi has developed a significant number of alternatives to diversify treasuries. From stablecoins that lower volatility to products diversified by nature like our $WEB3 token or other index tokens like $DPI from Indexcoop the decentralized economy has a wide selection of financial instruments available.

- The communities leading the DAOs don’t see value in diversifying their assets. And while this is a clear possibility, it is also a terrible mistake. The $7.3B that protocols have available on their treasuries accounts for 33% of their market cap. A sharp loss in the value of their treasuries is also a severe blow to their market value.

We see that protocols like Yearn Finance, GnosisDAO, and KeeperDAO have decided to diversify their assets. This means fewer risks and better financial performance.

📈 Then what do other decentralized organizations need to follow this path?

Tokens that give a diversified exposure to different protocols, like our WEB3 token, simplify diversification and make it almost a no-brainer decision.

All that’s left is for DAOs to decide when they want to get started. Protecting their liquid assets also protects their protocols and the impact they can create.

So the question is not a how, but a when.

⚔️ Want to become an early adopter?

We are looking for testers. Sounds like you? Sign up here

📣 Join our community on Discord and follow Arch on Twitter.

- Stay tuned for events, research, and exciting product announcements.

- $WEB3 holders — Verify your assets to get access to the exclusive #architects-lounge channel.

- ⚠️ Important: beware of scams and please report any attempts. We will not message you first and will never ask for your keys.

Contribute

Join the core team or become a contributor. We want to hear from you:

👩💻 Open positions:

Learn more about open positions and working at Arch. If interested, please send us a note on Twitter or Discord.

Disclaimer: The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations. The views reflected in the commentary are subject to change at any time without notice.