We made it Architects,

We are close to the end of a year that felt like a decade. And while we prepare our New Year's resolutions and champagne glasses, we would also like to take time to reflect on the lessons we learned this year in crypto.

This edition covers this week's market movers, shares our top learnings from this year, explores if Bitcoin can be a hedge against inflation, and deep dives into Solana. Read along.

Our Top 5 Lessons from 2022

Oh boy, did we learn a bunch this tumultuous year.

#1. Not your keys, not your coins. The old crypto adage remains true. Self-custody of assets is vital in crypto. What does this mean? That you, and only you, should have control of your tokens through a (self-custody) wallet, like Metamask (or Magic).

As Centralized Finance (CeFi) platforms imploded across the board this year, from Voyager to behemoths like FTX and Genesis, millions who trusted them with their crypto have been left recourseless.

Arch connects directly to your wallet so you don't need our (or anyone's) approval to transfer, sell, or redeem your tokens whenever you want. 24/7/365, rain or shine.

#2. When something looks too good to be true, it probably is. Celsius, a significant lender now defunct, offered up to 18% yields. Anchor, a program part of the Terra-Luna ecosystem, offered 20%. Those yields proved not to be as sustainable - DYOR.

#3. Decentralization is more critical than ever. Crypto was always meant to be decentralized, meaning no central party should have complete control and ownership over assets.

Things like a handful of participants gambling users' funds - like what happened with FTX - are more difficult, if not impossible, to occur in a decentralized space where all participants must cooperate unanimously. If we combine this with lesson #1 - self-custody of our asset - collapses will be less common and less impactful.

#4. Innovation and development continue during bear markets. We aren't seeing news about all-time highs, which might make the space feel stagnant, but nothing further from the truth. Innovation and development continue to thrive, with more "traditional" businesses getting into the space and partnering with blockchain protocols.

The Ethereum Merge, one of the main crypto events of the year, happened during a bear market. Countries - like Turkey and Japan - are looking to launch their digital currencies, and companies are making blockchain a part of their offerings (think Starbucks NFT loyalty program with Polygon and Visa teasing an Ethereum collab).

#4. The cult of personality needs to stop. Do Kwon of Terra, Su Zhu of Three Arrows Capital, SBF of FTX. The list will continue to grow.

Do Kwon was highly regarded and influential on Crypto Twitter. SBF had regular media appearances, secretely financed The Block, and even landed a Forbes cover, while dolling out tens of millions of dollars to politicians.

While it might be tempting to follow the loudest voices in the room, we must concentrate on great platforms and teams building real solutions. Remember: don’t trust; verify.

☕️ This week in crypto

- Markets - Cryptocurrencies dropped by 5%, while major protocols slid by 3%.

- Fidelity - filed trademark applications for various Web3 products and services, including an NFT marketplace and financial investment and crypto trading services in the metaverse.

- China - will launch its first regulated NFT marketplace and trading platform on Jan. 1, 2023.

- SBF - FTX's founder allegedly cashed out $684,000 from a crypto exchange in Seychelles while under house arrest. Bahamas Securities Commission confirmed that it still holds $3.5 billion of FTX's assets.

- Cathie Wood's Ark Investment purchased 158,116 more Coinbase shares on Thursday, showing solid confidence in the crypto sector.

- Kia's - first NFT launch raised $100,000 for the nonprofit, The Petfinder Foundation. The digital robo dog collectibles, priced at $20.22 each, covered the adoption costs of more than 22,000 pets.

⛓ Cryptocurrencies: $CHAIN is down by 3.32%

The Arch Blockchains token (CHAIN) traded 3.32% lower than in the last seven days.

- Solana (SOL) is trading in the single digits for the first time since February 2021. Two of the top Solana NFT projects - DeGods and Y00ts - would be leaving the Solana network. DeGods will be moving to Ethereum and Y00ts to Polygon early next year. However, Vitalik Buterin, Ethereum's founder, posted a tweet supporting the Solana network on Thursday, which helped the price rebound by almost 15%.

- Bitcoin (BTC) and Ethereum (ETH) continue to trade mostly flat.

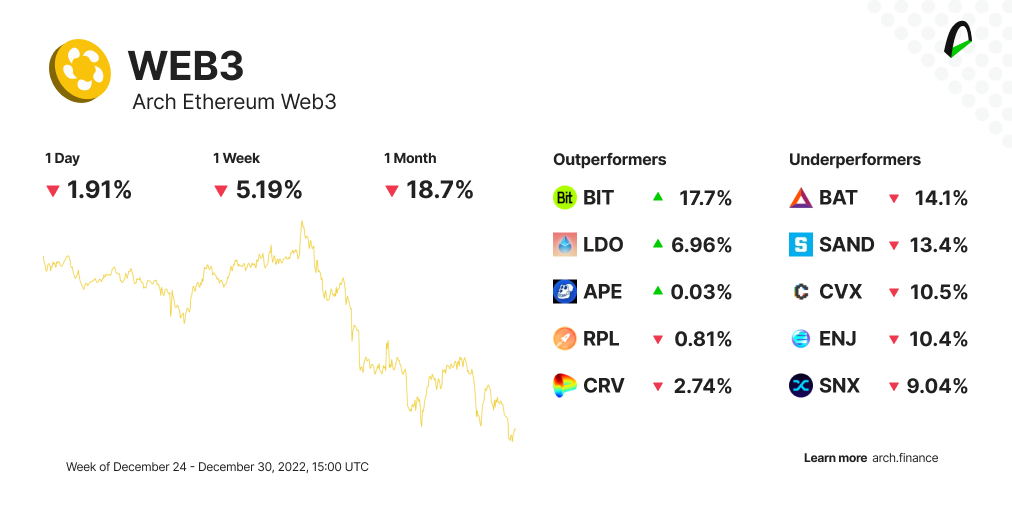

📉 Protocols: WEB3 is down by 5.19%

At the time of writing, The Arch Ethereum Web3 token (WEB3) traded 5.19% lower than last week.

- BitDao (BIT) was this week's top performer ahead of the expected approval of a $100 million buyback plan. The voting has passed the minimun treshold. The buybacks should begin on Jan 1., and the BitDAO will purchase BIT tokens at $2 million in USDT a day for 50 days.

- Uniswap (UNI) saw 68M transactions from 3M unique wallets that totaled over $620B in trading volume during 2022 showing a solid trading volume growth month over month.

- Decentraland (MANA) will be part of a $35 m Samsung investment to develop their metaverse offers to their Latam customers. Samsung launched its “House of Sam” experience in Decentraland in October.

₿ Bitcoin as a hedge against inflation?

🎨 What you need to know about Solana

Everything you need to know about Solana, from how it works to the issues it's looking to solve and everything about it's native crypto SOL.

Disclaimer: The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations. The views reflected in the commentary are subject to change without notice.