GM Architects,

The holidays are finally here, and we are wrapping up 2022 in a slightly different way from other years. December has historically been a good month for markets, but this year? Not so much. More on that below.

Cryptocurrencies went down by 1.45%, while major protocols went down by 6.26%.

This newsletter edition covers this week's market movers, shares why we think FTX and crypto are unrelated, and deep dives into Ethereum Name Service. Read along.

☕️ This week in crypto

- FTX - founder Sam Bankman-Fried was extradited to the U.S. from the Bahamas on Wednesday and released on a $250M bail secured by his parents.

- Visa - is exploring ways to allow automatic payments via Ethereum wallets without requiring manual transaction signs. Visa’s Head of Central Bank Digital Currencies and Protocols, Catherine Gu, emphasized that the company is focused on growing its “core competencies in Web3 infrastructure layers and blockchain protocols driving crypto development.”

- AAVE - will implement Proof of Reserve to protect bridged assets on Avalanche. The DAO approved Chainlink’s Proof of Reserve smart contract by a vote of over 99%.

- Christie’s - the auction house - is getting into 3D holographic technology to showcase both traditional and blockchain-based art in their global galleries.

- The Central Bank of Indonesia - published a whitepaper about developing the country’s Central Bank Digital Currency (CBDC). The Indonesian CBDC, according to the whitepaper, will be the settlement method for traditional and digital ecosystems, including DeFi, the metaverse, and Web3.

When good news are not good news

December has historically been a great month for financial markets, with US equities traditionally rallying during this month. Historically the S&P 500 has gained an average of 1.6% during December, the highest average of any month and more than double the 0.7% gain of all months.

But this year? Let's just say we are in one of those years that are the exception to the rule.

The S&P 500 is down by 5.09% compared to last month, while the tech-heavy Nasdaq Composite is down by 7.17%.

The reason? Strong economic data. Initial jobless claims of 216,000 were lower than the expected 225,000. And while this is good, it's not right for inflation, the FED's main enemy.

The on-the-surface-positive report raises the possibility that the Fed will continue attempts to slow overall job growth to keep wage increases in check.

The GDP is also higher, reaching 3.2% from the 2.9% estimate released on Nov 30, with the FED preferring to see a contraction of growth that will reduce the price increases.

The economy is doing well, but a little too well for what the FED hopes to combat inflation. This means investors expect a tightening economic policy that brings all asset prices down.

⛓ Cryptocurrencies: $CHAIN is down by 1.45%

The Arch Blockchains token (CHAIN) traded 1.45% lower than in the last seven days.

- Solana (SOL) is one of the most affected protocols this week. It's also one of the tokens that were hit hardest by the collapse of FTX since they had major exposure to FTX, which was also one of its most prominent investors. On more positive news, NFT activity on the Solana network has remained positive, becoming the number 2 ecosystem for NFTs, with some game titles being released on the blockchain next year.

- Bitcoin (BTC) is trading mostly flat, even on a day when stocks were heavily affected by macroeconomic data.

- Polygon (MATIC) Technology has a layer-2 solution developed especially for Ethereum that just launched its second public testnet, moving the layer-2 solution to its final stage before mainnet launch. The zkEVM testnet will trial a new upgrade called recursion, which it claims could result in exponentially scaling Ethereum.

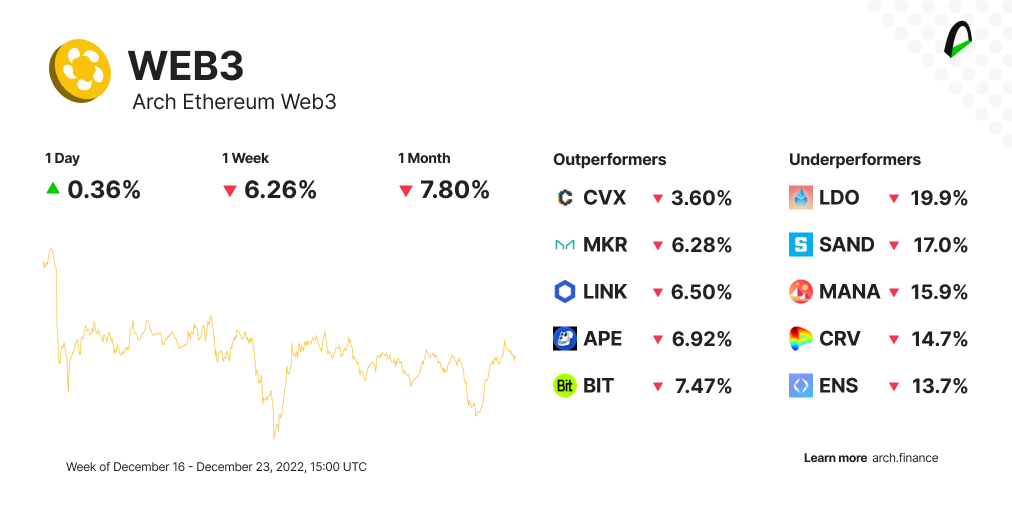

📉 Protocols: WEB3 is down by 6.26%

At the time of writing, The Arch Ethereum Web3 token (WEB3) traded 6.26% lower than last week.

- Uniswap (UNI) announced that users can now purchase cryptocurrencies with debit cards, credit cards, and bank transfers.

- Decentraland (MANA) launched Decentraland Worlds, personal virtual spaces separate from Genesis City and intended to serve as a place for Decentraland citizens to build, experiment, and host events and interactive experiences without having to own LAND. The world can host up to 100 visitors at a time.

- Frax Finance (FXS) liquid staking service continues to grow. Over the past 30 days, the total supply of frxETH has increased by 870%, and the total supply of sfrxETH has risen by 285%.

🏟 Why the FTX fraud is unrelated to crypto

👾 What's Ethereum Name Service

Ethereum Name Service (ENS) is looking to transform the Web3 user experience by creating an easy-to-remember domain name for the Ethereum blockchain

Disclaimer: The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations. The views reflected in the commentary are subject to change without notice.