GM Architects,

We are closing a mixed week for markets in general after a brief uptick in prices. And while inflation seems to be receding, the Fed is looking to hold its hawkish stance into 2023. Cryptocurrencies went down by 3.2%, while major protocols went down by 8.6%.

This newsletter edition covers this week's market movers, explores the idea of blockchain without crypto, and deep dives into Convex Finance. Read along.

☕️ This week in crypto

- FTX - founder Sam Bankman-Fried was arrested in the Bahamas this Monday.

- MetaMask - integrated with PayPal. This means MetaMask Mobile users will now have an on-ramps way of purchasing crypto. The wallet plans to enable some US users to fund their wallets with ether by transferring funds they hold on PayPal or by purchasing it using Paypal-linked bank accounts.

- Starbucks - is launching the Starbucks Odyssey program that will reward users who complete journeys with a Polygon-based NFT collectible that also acts as access passes to prizes and experiences like a trip to a coffee farm in Costa Rica. This shows how NFTs can become the new loyalty programs.

- Uniswap - is looking to upgrade its governance process by giving users more time to discuss proposals before approving them. Currently, the process involves three different steps, with the first lasting three days. The Uniswap Foundation has submitted replacing the first three-day poll with a seven-day “Request for Comment” (RFC) period while raising their quorum threshold of the second step. With this, they want to drastically reduce the chances of lower-quality proposals moving to the final phase.

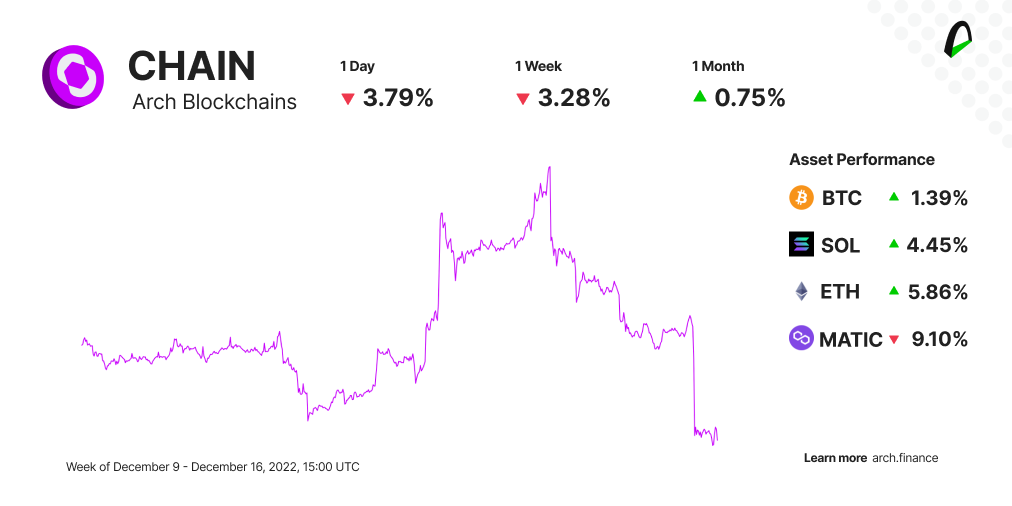

⛓ Cryptocurrencies: $CHAIN is down by 3.28% with all tokens in the red

The Arch Blockchains token (CHAIN) traded 3.70% lower than in the last seven days.

- Solana (SOL) is trading 4.45% lower than last week, and it's seeing institutional investment interest. According to CoinShares' latest Digital Asset Fund Flows report, investment products focusing on Solana saw inflows of $400,000 last week, up from $200,000 the week before.

- Bitcoin's (BTC) implied volatility - often equated with the degree of uncertainty or fear - has declined to a two-year low of 38.2%, according to data source Amberdata. The metric peaked at 145% on Nov 9 and has been falling since.

- Polygon (MATIC) is trading 9.10% lower than last week after weeks of an upward trajectory. And while the token is experiencing some market flux, the project is also demonstrating signs of increased adoption. Polygon's NFT market reached new all-time highs thanks to its collaborations with name-brand companies like Reddit. The surge comes even as NFT ecosystems on other chains, such as Ethereum and Solana, have a decreasing number of users.

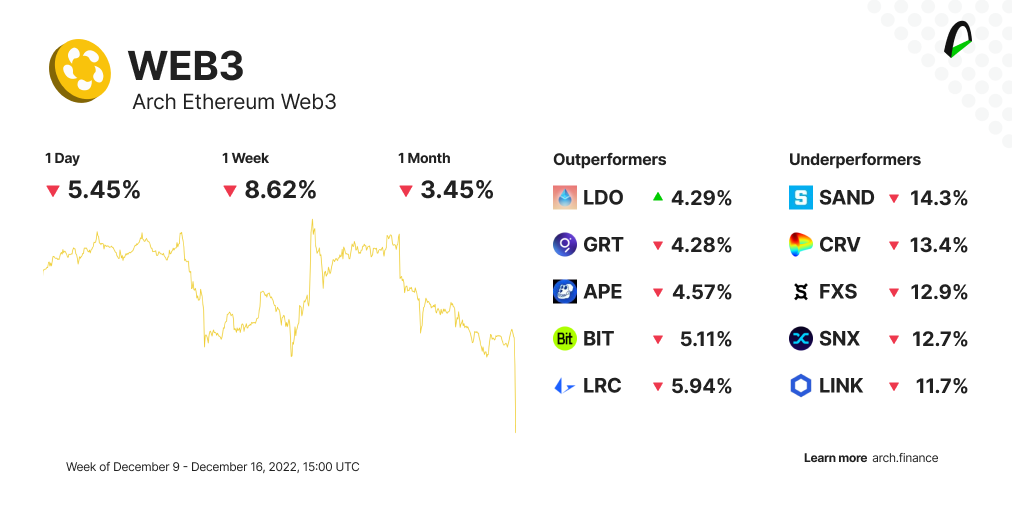

📈 Protocols: WEB3 is down by 8.62%

At the time of writing, The Arch Ethereum Web3 token (WEB3) traded 8.62% lower than last week.

- Chainlink (LINK) announced in a Dec 15 blog post that it is now offering floor price feeds for Ethereum-based NFTs. The feature will bring “high-quality price data to the NFT economy” by delivering data to developers and introducing new use cases.

- ApeCoin (APE) launched its staking services on Dec 6, as we already reported in previous newsletter editions. The staking gave the active address a surge. The BAYC NFTS also saw action; according to Dapp Radar, BAYC witnessed a spike of 146%.

- The Sandbox (SAND) partnered with Forbes. According to the official announcement, Forbes will use The Sandbox to roll out its metaverse hub. This includes access to metaverse offerings tailored for the festive season.

🔗 Blockchain, without crypto? Nope.

©️ What's Convex Finance & how it works

Convex makes optimizing liquidity on Curve easy and increases CRV rewards by achieving mass liquidity mining, minimizing the risks of impermanent loss.

Disclaimer: The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations. The views reflected in the commentary are subject to change without notice.