GM Architects,

The collapse of cryptocurrency exchange FTX has been gut-wrenching for the whole industry (and probably sparked more than one awkward conversation at the Thanksgiving table). But what FTX demonstrates is that truly decentralized, self-custody, transparent, and open Web3 technologies can protect users and create a more fair and resilient digital financial system different from the one we had during the 2008 financial crisis. More on that below.

This edition shares the market movers and discusses the human factor in decentralized systems.

☕️ A quick weekly overview

- Bitcoin jumped about 1% after minutes from the Federal Reserve's November meeting, showing that most central bankers prefer slower rate hikes in the future. The number of addresses holding 1-10 BTC increased sharply in the last week, suggesting holders are taking advantage of the uncertainty in the market to accumulate and reach at least 1 BTC.

- Confidence in Ethereum continues to rise. Liquid staking protocol Lido Finance continues to set all-time highs in liquid staking while the amount of staked ETH in the platform reaches almost 30% of all staked ether.

- Crypto exchange Binance has allocated another $1 billion for its industry recovery fund, increasing the size of the fund to over $2 billion. Aptos Labs, Jump Crypto, and other companies joined Binance's initiative and will contribute $50 million to the fund.

This is exactly why we need DeFi

Bitcoin, and the entire crypto industry, were born after the 2008 financial crisis, when banks overextended themselves, leaving thousands without houses and jobs.

With the FTX collapse, it can feel that the crypto industry is acting similarly to those banks in 2008. But this is precisely why we need a genuinely decentralized DeFi ecosystem, not just centralized financial institutions that want to capitalize on crypto.

Not your keys, not your cheese 🧀. With real DeFi solutions, protocols never take ownership over their users' assets. Only the user can access and use their funds at any time. It's impossible for decentralized, permissionless, and self-custodian protocols to "play" with their users' money behind their back. What this means is that an FTX case is near impossible in a real DeFi platform.

And while the conversations about a Proof-of Reserve are interesting (and necessary), the honest discussion is around how users can understand what the true core of crypto - and DeFi - really is and why that's what they are looking for beyond the hype and celebrity status of a couple of founders.

Following the conversation about PoR, exchanges such as Binance, KuCoin, Bitfinex, and Bybit made public their financial reserves, including the balances and wallet addresses they use to hold the tokens.

This week was quieter for crypto, and few developments made the news. But it is a positive one for TradFi. The Nasdaq Composite is trading 2.51% higher than the last five days, while the S&P500 is up by 2.76%.

⛓ CHAIN is down by 1.30% with Solana finally catching a breath

The Arch Blockchains token (CHAIN) traded 1.30% lower than the last seven days.

- Solana (SOL) recorded impressive mid-week price gains, up by more than 5% at the time of writing. After the FTX exposure and subsequent implosion, SOL's rally followed a previous massive crash. SOL recorded a sharp decline in development activity and negative weighted sentiment, as per Santiment. The pessimistic outlook based on weighted sentiment was reflected in the derivatives market as Binance funding rates fell into negative territory.

- Ether (ETH) continues around the $1.200 resistance level, with staked Ethereum reaching new highs. Developers have decided to consider eight Ethereum Improvement Proposals for its upcoming hard fork - Shanghai. The upgrade will unlock Beacon Chain staked ether (ETH) withdrawals, but there needs to be a consensus on the upgrade dates.

- Polygon (MATIC) is being picked as the network of choice by large brands. Meta is using Polygon to let Instagram users mint NFTs, Starbucks is building a loyalty rewards program on it, Reddit is minting unique NFT avatars, and Disney made Polygon part of its accelerator program.

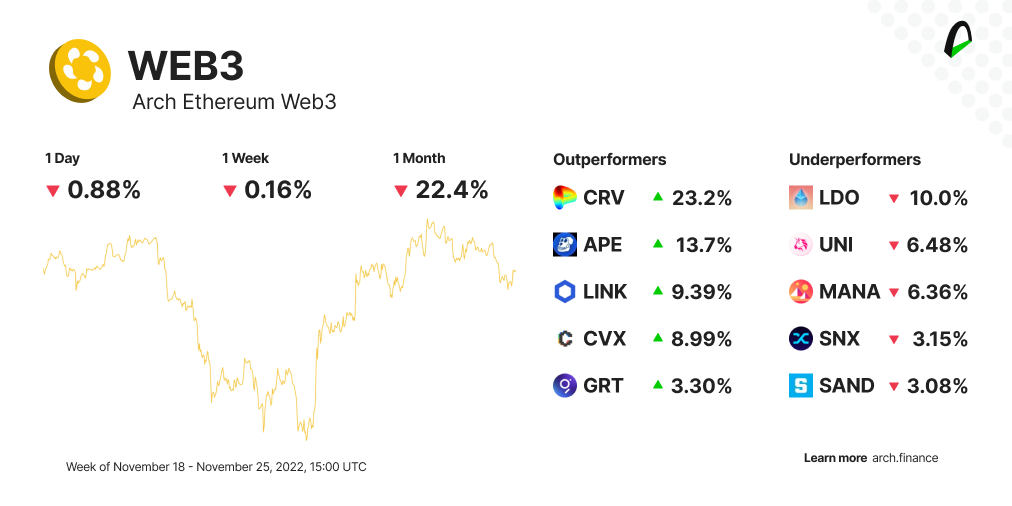

📈 Web3 is down by 0.16% with more than half of all tokens in the green

At the time of writing, The Arch Ethereum Web3 token (WEB3) traded 0.16% lower than last week.

- ApeCoin (APE) is trading 13.19% higher than last week. This came after ApeCoin announced its staking service would launch on December 12th. However, the United States will be geo-blocked from staking, and some users are already sharing how others can spoof their location. Meanwhile, some Bored Apes still fetch high prices even during the depths of crypto winter. An NFT from Yuga Labs' flagship Bored Ape Yacht Club (BAYC) collection sold for 800 Ether this week.

- Curve (CRV), one of the longest-living decentralized exchanges built on Ethereum, had a 25.7% price spike after they released the whitepaper detailing its upcoming stablecoin crvUSD. The idea of the new decentralized stablecoin is what the founder of Curve, Michael Egorov calls a lending-liquidating AMM algorithm, or LLAMMA. LLAMMA works by converting between the provided collateral and the stablecoin, depending on which is higher and which is lower.

- Chainlink's (LINK) price saw some positive price action. Active addresses soared to a high that was previously witnessed in May 2021. Recent testing by RoboVault revealed that Chainlink Automation was significantly more reliable than its alternatives.

📬 Like this weekly recap?

Every Friday we send a weekly recap about the Web3 ecosystem and how crypto markets, and markets in general, are moving. Share and subscribe!

🌐 Check more about the human factor in decentralized systems

Is DeFi a fully decentralized ecosystem? Well, not really. If you think about it, well-known protocols like Maker DAO, AAVE, Compound, Uniswap, or Yearn are based on smart contracts running on Ethereum.

So what's the main difference between a centralized and a decentralized crypto project? In my opinion, the main difference is transparency.

Disclaimer: The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations. The views reflected in the commentary are subject to change without notice.