GM Architects,

As the collapse of FTX (one the largest centralized exchanges in the world) continues to rattle markets, we are seeing users flock to the more transaparent, trustless alternatives DeFi (and Web3) provides, and overpass big names like Coinbase.

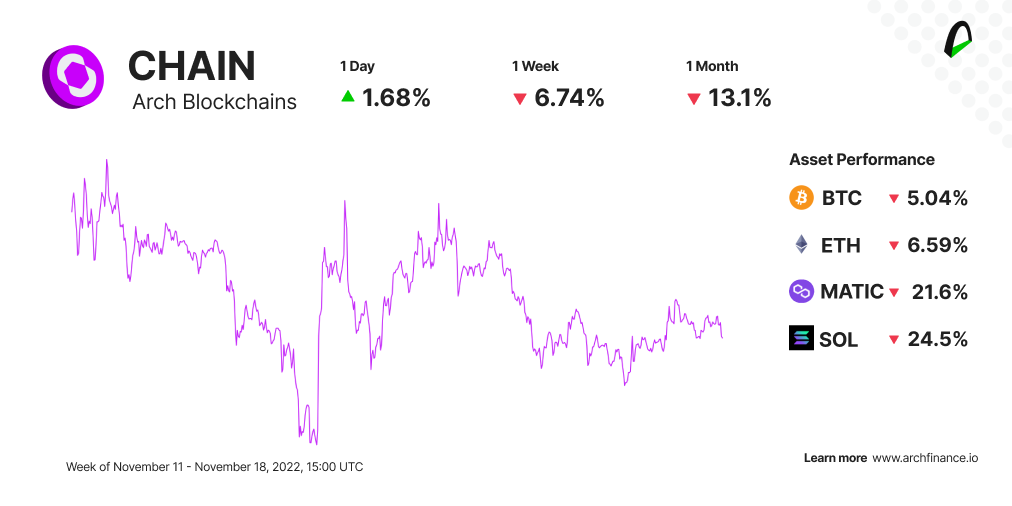

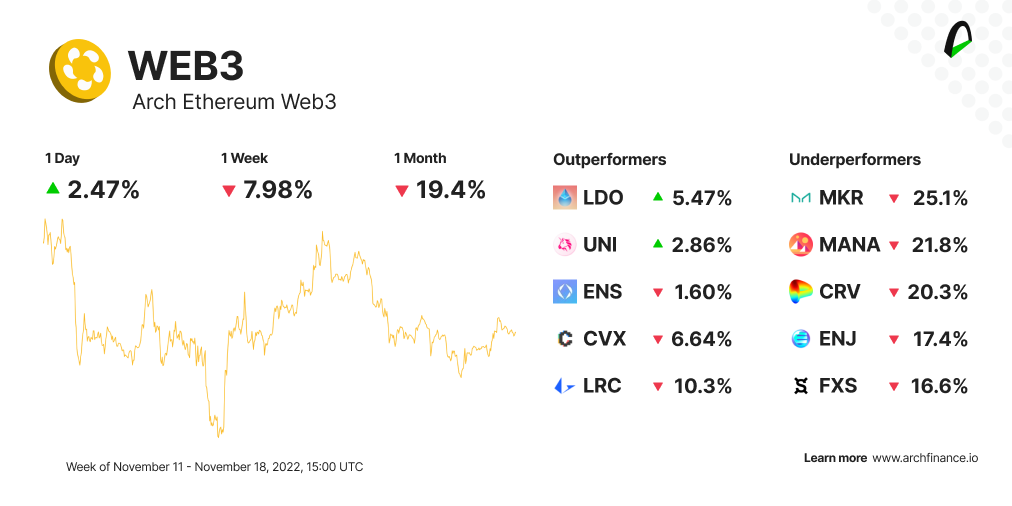

In all, the Arch Ethereum Web3 token traded 7.98% lower, while the Arch Blockchains token was down by 6.74%. Ethereum traded 6.59% lower, while Bitcoin was down by 5.04% over the previous seven days.

In this edition, we share the market movers, and discuss more decentralization is needed in crypto.

☕️ A quick weekly overview

- Major banks, like Citigroup, HSBC, BNY Mellon, Wells Fargo and Mastercard, as well as the Federal Reserve Bank of New York started testing digital tokens representing digital dollars to improve how central bank money is settled between institutions.

- According to data from Nansen, a blockchain analytics platform, DeFi protocols are seeing user increases in the double digits after the FTX collapse, but also seeing some important transaction activity. On November 14th, Uniswap saw more volume on ETH than any centralized exchange and nearly doubling the volume of Coinbase.

- Following the FTX collapse, the lending arm of crypto investment bank Genesis Global Trading is temporarily suspending redemptions and new loan originations. Following the announcement Gemini exchange said it was pausing withdrawals on its interest-bearing Earn accounts as a result of Genesis’ changes. Genesis is the lending partner for that program.

Collapses spark important conversations

Crypto exchange FTX collapsed into bankruptcy last week while the billions of dollars in assets vanished (for now). John Ray - responsible for managing Enron's bankruptcy - is now the head of FTX restructuring and had some pretty intense words to say about the previous FTX CEO, Sam Bankman-Fried.

And while the collapse is not a good thing, it's reinvigorating the conversation about decentralization, a critical topic in the crypto ecosystem (read more about this in the feature piece at the bottom).

It's also sparking some exciting conversations about Proof of Reserve - or PoR in short - as a way of showing exactly how many tokens are at any exchange that adopts the technique. Vitalik Buterin, Ethereum's founder, is looking to build a Proof-of-Reserve protocol with Changpeng Zhao (CZ), the CEO of Binance, saying Binance will be the "guinea pig" for the project.

Decentralization and self-regulation are two main talking points the crypto ecosystem has had this week.

In other news, stocks and crypto correlation showed increasing independence from one another with almost all crypto tokens falling while in TradFi, the Nasdaq Composite is trading 0.18% higher than the last five days, while the S&P500 is down by only 0.43%.

⛓ CHAIN is down by 6.74% with all the tokens bearing the brunt

The Arch Blockchains token (CHAIN) traded 6.74% lower than the last seven days.

- Solana (SOL) is continuing to feel market pressures. Binance and OKX temporarily suspended support for the Solana blockchain versions of the two largest stablecoins – Circle's USDC and Tether's USDT, with OKX going as far as saying it was delisting the tokens. As a result, SOL is trading 24.5% lower than last week. However, Binance has since resumed deposits for USDT on Solana, and OKX updated its announcement saying that it halted support for the tokens instead of delisting them leaving investors confused.

- Ether (ETH) continues above the $1.200 resistance level, and holders remain strong. Data from Glassnode highlighted that ETH Number of Addresses Holding over 10,000 coins just reached a 1-month high.

- Polygon (MATIC) is trading around 21% lower than the last seven days after last week's rally. However, news around the protocol are bullish. Kraken Exchange is allowing users to send and receive MATIC natively on the Polygon Network; and according to on-chain stats, Polygon is one of the top-ranked DeFi projects in terms of revenue.

📈 Web3 is down by 7.98% but LDO is still going strong

At the time of writing, The Arch Ethereum Web3 token (WEB3) traded 7.98% lower than last week.

- Lido DAO (LDO) is trading 5.47% higher than last week. This rise is coming after Coinbase, one of the largest regulated crypto exchanges in the U.S. announced its support for the Lido DAO. According to the announcement, users can now access LDO through Coinbase. But there are other reasons LDO is performing so well; since the FTX implosion, the Ethereum blockchain saw a massive spike in network activity and the number of new validators. Lido DAO is the leading Ether liquid staking solution in the market.

- Uniswap (UNI) also saw some positive price action propelled by the FTX debacle that's shifting the market to DEXs. According to data provided by Messari, Uniswap's total revenue increased by 45% over the last 30 days. And its trading volume also increased by 40%. On the whales' front, UNI was one of the most widely held tokens by the top 100 Ethereum whales.

- Chainlink (LINK) is trading 13.8% lower than last week after they opened up early access to the initial beta version of Chainlink Staking (v0.1) in preparation for the launch on the Ethereum mainnet in December 2022. Following the first announcement of Chainlink Staking, LINK attempted a price rally and grew by 24% before the FTX collapse.

📬 Like this weekly recap?

Every Friday we send a weekly recap about the Web3 ecosystem and how crypto markets, and markets in general, are moving. Share and subscribe!

🌐 Why decentralization is more important than ever

One of the great features of the blockchain is its ability to be decentralized. The network doesn't function under a central authority, and power is distributed among (hopefully) thousands of nodes worldwide.

To maintain security and transparency and have the growth that we want to have in the industry, we must return to the initial proposal: decentralization.

Disclaimer: The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations. The views reflected in the commentary are subject to change without notice.