GM Architects,

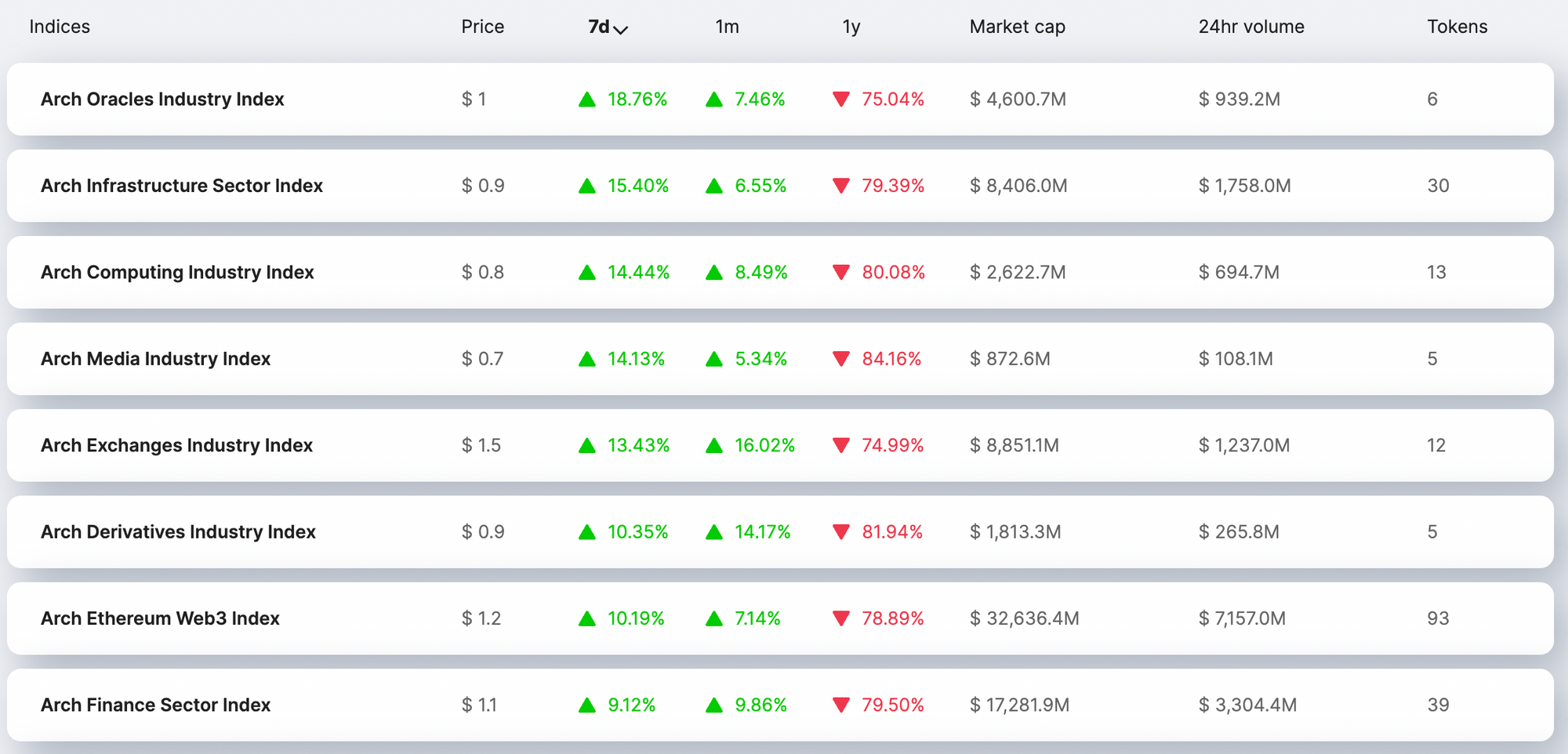

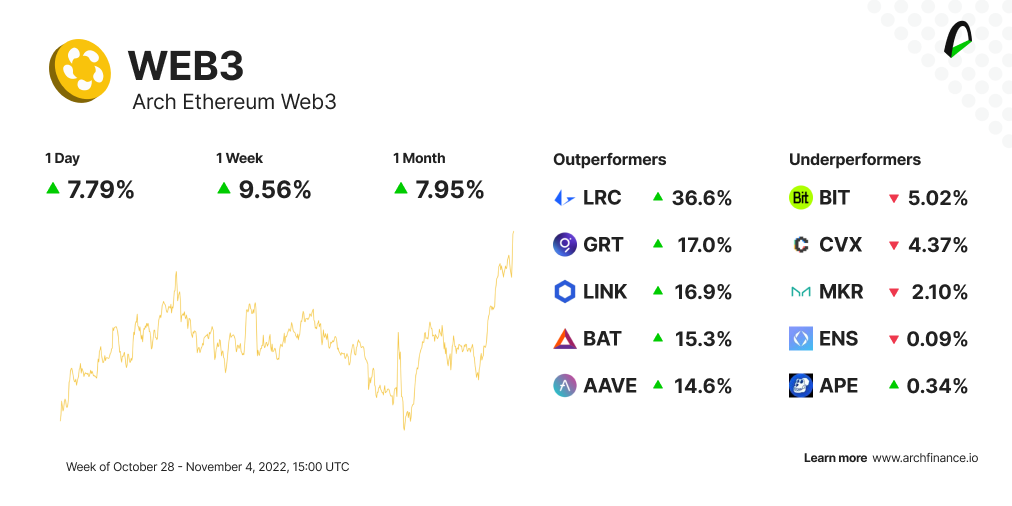

Another positive week for Web3. The Arch Ethereum Web3 token traded 9.56% higher (with some of its constituents trading +15% vs. last week), while the Arch Blockchains token was up by 4.33% with Polygon in the lead (up 24%). Both tokens are trading 7.95% and 10.6% higher than the last month, respectively.

Ethereum traded 3.6% higher, while Bitcoin was up by 1.06% over the previous seven days.

In this edition, we share the market movers, explore the use cases of Web3, and deep dive into Audius, a blockchain music streaming project.

☕️ A quick weekly overview

- JPMorgan successfully executed its first decentralized finance trade on Polygon. The transaction occurred as part of the Monetary Authority of Singapore (MAS) Project Guardian pilot, and it's a tokenization experiment that's monumental to DeFi.

- Arbitrum, a layer-2 rollup for Ethereum, has seen surging activity since deploying a network upgrade in August and now counts for 62% of all Ethereum transactions.

- Matter Labs' (the development team behind zkSync) proposal to deploy Aave on the testnet for its Ethereum scaler zkSync has been approved unanimously.

Bitcoin, Ether, and Web3 continue to defy the TradFi slump.

The U.S. economy added 261,000 jobs in October, while the unemployment rate rose to 3.7%. In TradFi, the Nasdaq Composite is trading 3.93% lower than the last five days, while the S&P500 fell by 2.32%.

And while macroeconomic uncertainty reigns, blue chip crypto like Bitcoin continued to hold tight comfortably and even rise.

When double-clicking specific industries, all Web3 sectors are performing positively this week, with the Oracles Industry Index being the top performer. followed closely by the Infrastructure Sector Index. The Oracles Industry Index rallied thanks to Chainlink's (LINK) performance and you can read more about it in the $Web3 section of this Newsletter.

⛓ CHAIN is up 4.33% with Polygon leading the charts

The Arch Blockchains token (CHAIN) traded 4.33% higher this week.

- Polygon (MATIC) continues rising for the third week in a row, this time, it's up by 23.98% and reaching a six-month high. The climb has lifted the cryptocurrency's cumulative gain since the end of June to 270%. This new rise is coming after Meta's decision to launch a toolkit allowing users of the social media platform Instagram to mint and sell Polygon-powered NFTs.

- Ethereum (ETH) price continues to hold, coming as a shock for many market participants that expected downside pressure after the U.S. Federal Reserve reiterated its hawkish stance.

📈 Web3 is up with almost all tokens in the green and Loopring (LRC) leading

At the time of writing, The Arch Ethereum Web3 token (WEB3) traded 9.56% higher, with Loopring being the top performer constituent.

- Loopring (LRC) is up by 36.6%. The reasons? The recent launch of GameStop's NFT marketplace which ImmutableX powers. The launch happened a few months after GameStop launched its NFTs on Loopring, making investors believe this will also benefit LRC. Some of the price action can also be attributed to the upcoming upgrade of Band Protocol. Band Protocol is a smart oracle that provides services to Loopring. The upgrade will increase the MaxGas per block, and it will also increase the throughput for the oracle module.

- The Graph (GRT) is trading 17.0% higher this week. This is coming after the announcement that The Graph now supports Solana making it easy to access historical Solana data with the power of substreams. It will also help developers build faster dapps on the Solana chain.

- Chainlink (LINK) is also up by 16.9% compared to last week, with the staking v.01that will launch in December getting closer. To prepare for this, Chainlink undertook a crowdsourced audit on code4rena. This contest will help further tighten the security of the v0.1 codebase even further. In other bullish news, whales also showed interest in LINK, and it's on the list of cryptocurrencies that the top 200 ETH whales hold.

📬 Like this weekly recap?

Every Friday we send a weekly recap about the Web3 ecosystem and how crypto markets, and markets in general, are moving. Share and subscribe!

🌐 The practical use cases of Web3

While we are still in the early stages of transitioning to Web3 there are many practical use cases and industries that benefit from Web3.

Check out this post from Nicolas Jaramillo that explores the top use cases of the future of the internet.

🎧 What's Audius and how it works

Spotify meets blockchain sounds like a great combination. A decentralized service where artists and musicians can get a fair reward for their work can be industry-disrupting.

Part of the Arch Media Industry Index, which grew by 13.5% this week, Audius is leading the index, trading over 17.9% higher than the last seven days and with a $205.000.000 market cap

In this post, we dive deep into what Audius is, how it works, and everything you need to know about the AUDIO token.

--> 📚🤓 Take a deep dive into what Audius is

Workshop: What is Web3 and why does it matter? (in Spanish)🇪🇸

Disclaimer: The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations. The views reflected in the commentary are subject to change without notice.