GM Architects,

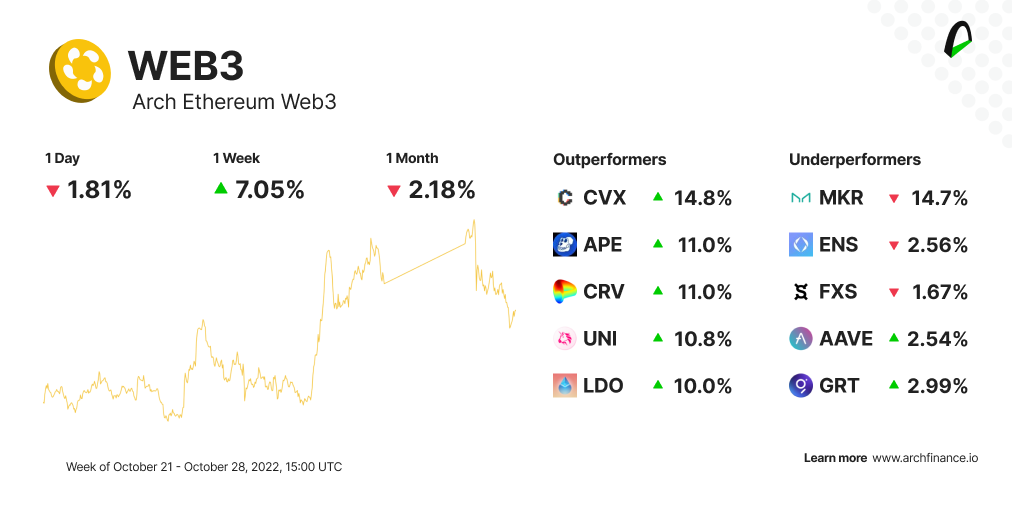

Crypto decoupled from major stock indices. The Arch Ethereum Web3 token traded 7.05% higher with almost all constituents trading in the green, while the Arch Blockchains token was up by 11.06% with Ethereum in the lead. Ethereum traded 19.4% higher, while Bitcoin was up by 7.30% over the previous seven days.

In this edition, we share the market movers, explore the role of self-custody wallets in Web3, deep dive into DEXs and talk about the EIP-1559 and how it has allowed the creation of a flat rate system on Ethereum.

☕️ A quick weekly overview

- Google introduces a cloud-based node engine for Ethereum projects. Google’s announcement signifies technology giants' growing attention to blockchain, crypto, and Web3 projects.

- Dogecoin's price jumped after Elon Musk completed the $44 billion takeover of Twitter, making it the top-performing crypto asset of the week with a market cap of $1B.

- Axelar, the cross-chain platform, announced a partnership with Polygon to deliver cross-chain communications to Polygon's Supernets. The partnership will serve as infrastructure for an interoperable internet of dedicated Ethereum Virtual Machine (EVM) blockchains powered by Polygon Edge.

Crypto outperforms boomer-coins (stocks)

Bitcoin, Ether, and other major tokens have outperformed stock indices over the past three months, breaking crypto /stocks correlation that was so persistent at the start of the year.

In TradFi, stocks slid along with U.S. equity futures after disappointing earnings results from tech giants. Futures for the Nasdaq-100 declined by 1.1%, and S&P 500 futures fell by 0.6% on the news.

The U.S. government shared a report showing that an inflation gauge closely monitored by the Federal Reserve rose slower than estimated last month, boosting large-cap crypto like Bitcoin.

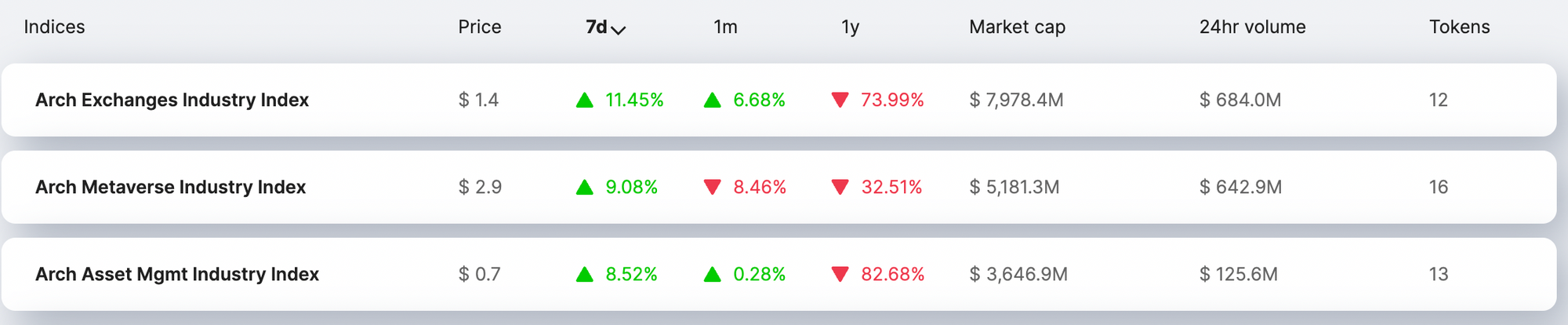

When double-clicking specific industries and sectors, the Arch Exchanges Industry Index was the outperformer, trading almost 8% higher than the last week, closely followed by the Arch Metaverse Industry Index. This is interesting because it's happening the same week Meta Platforms' latest financial results suggest the company is struggling with its pivot to the metaverse.

⛓ CHAIN is up 11.06% with Ethereum leading the charts

The Arch Blockchains token (CHAIN) traded 11.06% higher this week

- Ethereum (ETH)is up 19.4%, and it's now trading at one of its highest points since mid-September. This comes after crypto and the TradFi market decoupled on Wednesday amid the largest liquidation of short positions in 15 months. This also comes after Ethereum recorded its first deflationary month in history.

- Polygon (MATIC) continues its upward trend, up by 14.1% in the last seven days and spending the entire month of October in the green. The reason? A combination of new partnerships, community engagement, and new launches. On-chain data showed a notable spike in the number of active addresses on the network. There has also been a significant increase in the MATIC exchange outflow, indicating that users focus less on trading and more on using the tokens on the various dApps and services built on Polygon.

📈 Web3 is up with almost all tokens in the green and Convex Finance (CVX) leading

At the time of writing, The Arch Ethereum Web3 token (WEB3) traded 7.05% higher, with Convex Finance being the top performer constituent.

- Curve DAO (CRV) is trading 11% higher this week. The Total Value Locked (TVL) surged incredibly as of 22 October. This also came after the launch of the Frax ether token - an ether-pegged stablecoin meant to be equated to 1 ether - Users can deposit ETH into the Frax ETH Minter contract and get an equivalent amount of frxETH, unlocking the liquidity of ether staked. The frxETH tokens can be used to provide liquidity on Curve.

- Continuing with the exchanges rally, Uniswap (UNI) is up by 10.8%. After a successful funding round, raising over $165M in a series B round and a governance proposal to deploy on the zkSync Layer 2 network following a vote on Oct. 14, Uniswap became the No. 5 DeFi protocol by TVL.

- ApeCoin (APE) is up 11% compared to last week; this comes after Greg Solano, Yuga Lab's Co-Founders, announced a new game will be added to the Otherside Metaverse around 2023. The surge is also coming after the AIP-112 proposal passed the community vote. The AIP proposes free-to-claim luxury products for ApeCoin holders (both digital and physical) produced by the Forever Apes team.

📬 Like this weekly recap?

Every Friday we send a weekly recap about the Web3 ecosystem and how crypto markets, and markets in general, are moving. Share and subscribe!

🌐 The role of self-custody wallets in Web3

Self-custody wallets are the door to Web3 and the future of the internet.

Check out this post from Nicolas Jaramillo that explores what a self-custody wallet is and the key differences with custodial wallets.

🔁 What's a Decentralized Exchange and how are they different from Centralized Exchanges?

Decentralized Exchanges (DEXs) are one of the cornerstones of the DeFi movement and one of the sectors performing better this month.

The Arch Exchanges Industry Index grew by 5.22% this month, with Sushi (+51% in one month) and WOO Network (+25% in one month) leading the charts.

In this post, we dive deep into what a DEX is, how they work, and the main differences with its centralized counterparts.

--> 📚🤓 Take a deep dive into what a DEX is

Disclaimer: The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations. The views reflected in the commentary are subject to change without notice.