GM Architects,

Markets tumble as investors try to predict the Fed's next move. The Arch Ethereum Web3 token traded 7.02% lower, while the Arch Blockchains token was down by 1.99%. Ethereum also traded 2.01% lower, while Bitcoin was down by 1.05% over the previous seven days.

In this edition, we explore how to earn yield in DeFi, share the market movers, deep dive into stablecoins and why they are an important asset for investor's portfolios, and talk more about how Avalanche's gaming is growing with Andrea Vargas.

☕️ A quick weekly overview

- DeFi protocol giant and largest cryptocurrency lender, Aave, recorded massive community support for the deployment of Aave v3 on Ethereum.

- In October alone, $718 million was stolen from decentralized finance protocols, according to Chainalysis. This is the largest amount ever.

- Google announced that it has partnered with Coinbase to allow its cloud service users to pay for the service using crypto.

- In some bullish news, Ether (ETH) reached a milestone this week as it became deflationary for the first time since the blockchain switched to proof-of-stake after The Merge.

The worst year for TradFi markets in 50 years: not (that) bad for crypto

Analysts at Bespoke Investment Group determined 2022 has been the worst year for markets in at least five decades based on an analysis of stock and bond-market returns. This has been challenging for retail investors because bonds and stocks sold off in unison. In 2008 and 2020, for example, investors could at least hedge with bonds.

And while investors are waiting for the Fed and trying to predict its next move, the S&P500 traded 6.74% lower in the last month while the tech-heavy Nasdaq Composite was down by 9.16%.

The exciting thing is that the crypto market is somewhat de-pegging from TradFi markets. Bitcoin, for example, dropped only 1.98% in the same timeframe and held reasonably well the $20.000 psychological resistance level.

Another exciting aspect is that Bitcoin's annualized volatility based on the last 30-days of price action has fallen below 40%. The last time's volatility fell below the 40% line, Bitcoin's price experimented with a 20% movement.

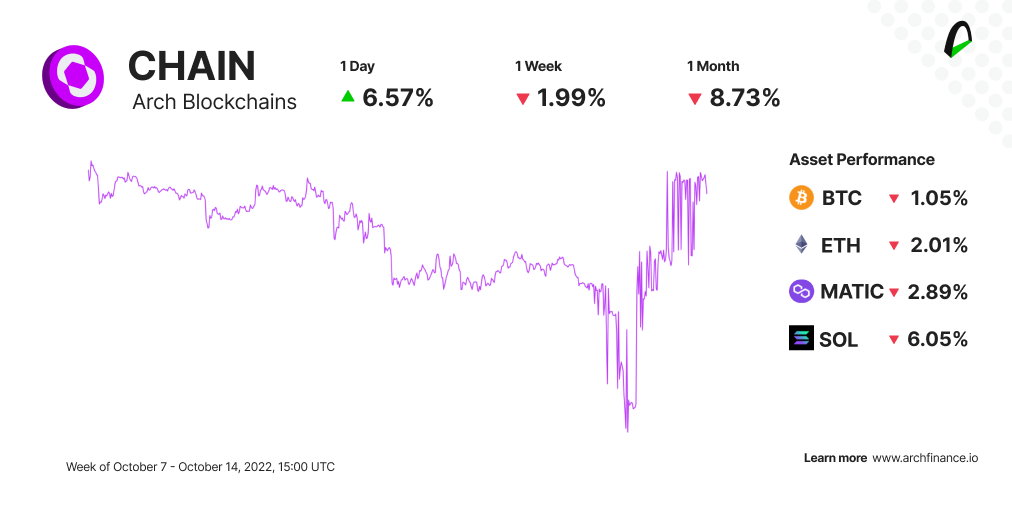

⛓ CHAIN is down 1.99%, with Solana trailing the pack

The Arch Blockchains token (CHAIN) followed the market, trading 1.99% lower this week.

- Solana (SOL) has taken one of the hardest hits of the market, dropping to a four-month low. Solana's TVL has declined from $1.3 billion to $1 billion after the Mango Markets, a Solana-based decentralized exchange, lost $104 million in an exploit. SOL is the native cryptocurrency of Solana, a layer-1 blockchain network used for decentralized apps and games, as well as DeFi and NFTs. The so-called "Ethereum killer" has gained prominence due to its ability to handle faster and cheaper transactions. And while it's down by 5.27% compared to the 2.01% Ethereum lost this week; it's still outperforming Ethereum in the NFT landscape, managing to grow by more than 100%, while Ethereum registered a negative 18% growth during the last 30 days.

- Bitcoin (BTC) continues to hold its position, trading sideways and relatively outperforming traditional markets and most crypto-assets, dropping just 1.98% over the past 30 days.

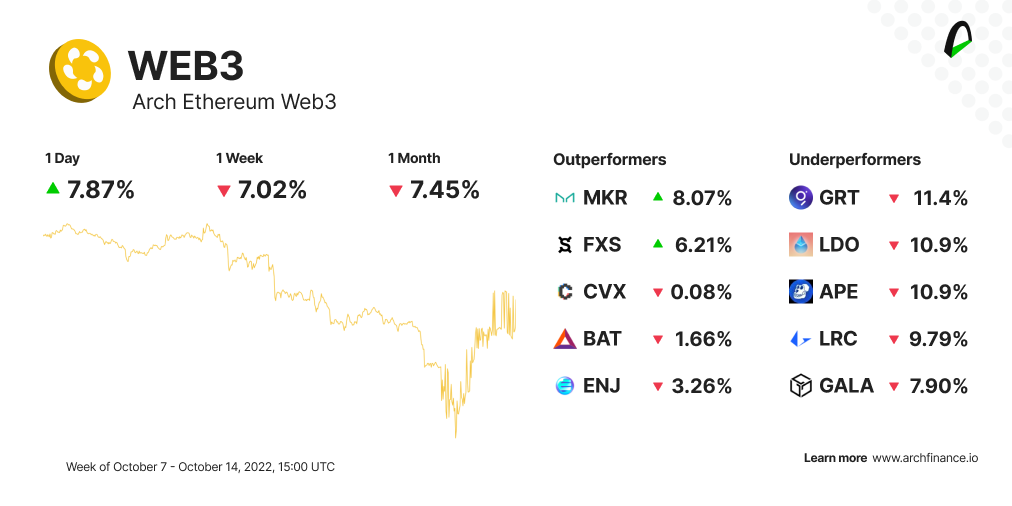

📈 Mixed bag: WEB3 dropped 7.02%, MKR is up 8%

At the time of writing, The Arch Ethereum Web3 token (WEB3) traded 7.02% lower with Maker being the top performer constituent.

- Maker (MKR) continues being one of the top DeFi's performers, continuing to ride the waver after the Gemini dollar launched and approving proposals that benefit the protocol. Maker Governance voted in favor of changing the GUSD PSM parameters.

- Frax Share (FXS) is trading over 6.21% higher than the last seven days and continuing the upswing it's been having since last week. This comes after the launch of frxETH, a liquid staking derivative that looks to give users a sustainable source of yield and aspires to dominate the ETH staking derivative landscape.

- On the other hand, the ApeCoin (APE) token is down by 9.95% after Yuga Labs, the creator of the Bored Ape Yacht Club NFT collection, is being investigated by the U.S. Securities and Exchange Commission (SEC) over whether sales of its digital assets violate federal law. The question is whether Yuga Labs' NFTs are closer to stocks and thus should follow the same disclosure rules than they are to art.

📬 Like this weekly recap?

Every Friday we send a weekly recap about the Web3 ecosystem and how crypto markets, and markets in general, are moving. Share and subscribe!

🧠 How the gaming sector is growing on Avalanche

Every week we discuss an interesting crypto project in Web3. This week Andrea Vargas joined us from Bogota to talk potential of subnets and the growth in gaming the Avalanche network has been experiencing.

🔁 Understanding yield in DeFi

Yield aggregators, DEXs, and lending protocols give investors tools to earn a yield on their assets.

Check out this post from Juan Pablo Schele that explores the different ways investors can passively earn yield in the DeFi ecosystem.

🪙 What you need to know about stablecoins

As stable assets, stablecoins have an exciting appeal for crypto natives and more traditional investors trying to get into this market.

These price-stable digital assets have a behavior similar to fiat currencies while having the mobility and utility that crypto offers.

--> 📚🤓 Take a deep dive into what stablecoins are and how they work

Disclaimer: The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations. The views reflected in the commentary are subject to change without notice.