GM Architects,

Another positive week for crypto. The Arch Ethereum Web3 token traded 0.89% higher, while the Arch Blockchains token was up by 0.67%. Ethereum also traded 0.9% higher, while Bitcoin was up by 0.7% over the previous seven days.

In this edition we explore why investing in Web3 while markets are down can be a good idea in the long run, share the market movers, deep dive into Brave's Basic Attention Token, and discuss stablecoins with Victoria Garcia from Reserve.

Inflation still looms, markets unphased

The monthly employment report released by the labor department showed U.S. employers added 263,000 jobs in September, slightly more than expected but still reflecting a weakening labor market and fewer jobs than the 315,000 added in September. Hourly earnings also rose 0.3%, a negative sign for the Fed since it indicates inflationary pressure.

The markets reacted positively, with the S&P500 trading 1.75% higher in the last five days and the Nasdaq Composite trading 1.19% higher.

Bitcoin dipped below the $20,000 psychological resistance, while Ethereum is slowly climbing as miner-selling-pressure subdues.

⛓ CHAIN up 0.67%, Polygon leads the pack

The Arch Blockchains token (CHAIN) had a positive week, trading 0.67% higher than the last seven days.

- Polygon (MATIC), the popular Ethereum layer-2 solution, is rallying, reaching a three-week high. On September 27, RobinHood, a popular brokerage, released its non-custodial wallet with MATIC to over 10k beta testers. Users can get MATIC from RobinHood's trading app and will be able to use its DeFi platform, which hosts dApps like Uniswap, Kyberswap, and others, on the Polygon network.

- Ethereum (ETH) is up by 0.9% compared to the last seven days. According to a tweet published by Santiment, an important on-chain data provider, Ethereum’s amount of new addresses being created is hovering around 70,000 per day again, the highest seen since early August. And after quite a bit of uncertainty around the mid-September Merge, the supply of $ETH on exchanges has dropped back to 14.6%.

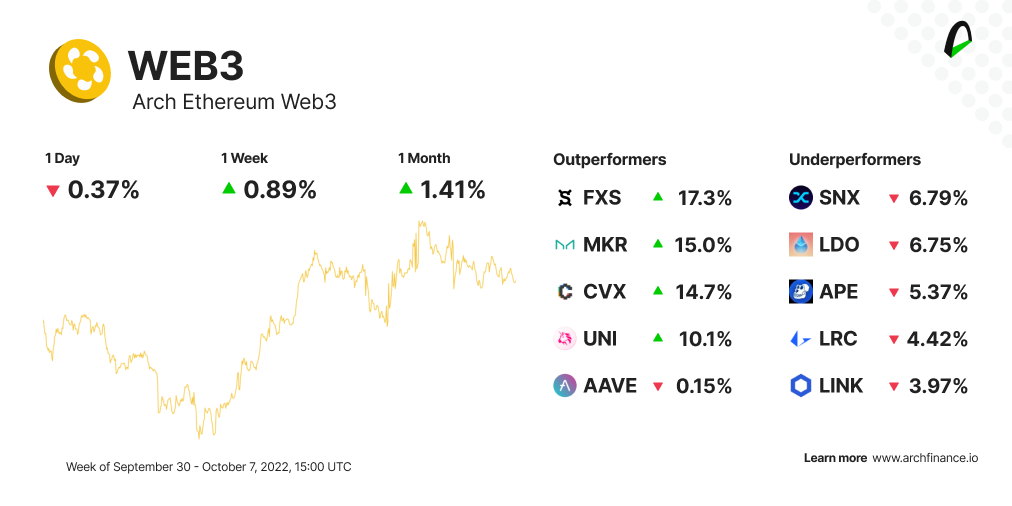

📈 WEB3 rose 0.89% this week

At the time of writing, The Arch Ethereum Web3 token (WEB3) traded 0.89% higher with Frax Share being the top performer constituent.

- Frax Share (FXS) is trading over 17.39% higher than the last seven days after announcing the launch of frxETH, a liquid staking derivative that looks to give users a sustainable source of yield.

- Uniswap (UNI) continues to rise with a 10.1% price uptick. This growth has placed it among the top-growing digital currencies in the crypto space. The boost results from news announcing the launch of a $100 million funding round, which will take the company's valuation (Uniswap Labs) to more than $1 billion.

- Maker (MKR) continues having positive moves trading more than 15% higher than last week, continuing to ride the wave after Gemini submitted a proposal on the MakerDAO forum to boost the adoption of the Gemini dollar (GUSD) in the Maker's ecosystem by paying a fixed yield on the GUSD balance in MakerDAO's vaults.

📬 Like this weekly recap?

Every Friday we send a weekly recap about the Web3 ecosystem and how crypto markets, and markets in general, are moving. Share and subscribe!

🧠 Watch out our latest Lunch & Learn session

Every week we discuss an interesting crypto project in Web3. This week we chat with Victoria Garcia about Reserve, an ecosystem of tools for people to create and use stable currencies around the world.

🤓 A Case for Investing in Web3 During a Bear Market

Almost $2 trillion of market value vanished from crypto in 2022. Is this a good opportunity to invest in Web3?

Check out this post from Anthony Chavez that explores the four main verticals of why Web3 makes an excellent investment opportunity.

🦁 What you need to know about the Basic Attention Token

The Basic Attention token, known for its ticker BAT, is the native utility token used within the Brave ecosystem.

Brave browser is a free and open-source browser looking to provide users with a faster and more private internet experience while democratizing the online advertising industry.

--> 📚🤓 Take a deep dive into what Brave and BAT is and how it works

Disclaimer: The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations. The views reflected in the commentary are subject to change without notice.