GM Architects,

Crypto had a positive week, with most tokens experiencing an upswing. The Arch Ethereum Web3 token traded 3.11% higher, while the Arch Blockchains token was up by 3.43%. Ethereum also traded 3.46% higher, while Bitcoin was up by 3.02% over the previous seven days.

This edition discusses how digital assets navigate the challenging market environment and this week's market movers before deep diving into The Sandbox and its SAND token and Crecy, our Lunch & Learn guest.

Is this a recession? Crypto don't care 🦡

U.S. economic activity contracted by 0.6% in the second quarter, confirming that, technically, the United States has entered a recession, at least by the standard definition of "two consecutive quarters of negative GDP."

The U.S. gross domestic price index rose a record 9.1%, fueling the inflation narrative that has dominated markets. Personal consumption expenditures (PCE), an index that measures price changes in consumer goods and services, increased 7.3% against expectations of 7.1%. Real consumer spending, a measure of personal consumption, rose 2% versus estimates of a 1.5% increase.

Equity markets continue to suffer. The S&P500 lost 2.33% in the last five days, while the Nasdaq Composite was down by 1.96%.

However, crypto's correlation with equity markets appears to have weakened, when compared to the first months of this bear cycle. Correlation with some tech stocks seems to remain but not as close as before; the Nasdaq continues to falter, while large-cap cryptos like Bitcoin and Ethereum are holding their prices or seeing an uptick.

⛓ CHAIN is up 3.43% with Solana continuing its upward trajectory

The Arch Blockchains token (CHAIN) had a positive week, trading 3.43% higher than the last seven days.

- Solana (SOL) is trading over 4.44% higher than last week, with good news coming after good news. Last week, the Helium Foundation announced the migration of its decentralized wireless Internet of Things (IoT) network, the Helium Network, to the Solana blockchain. This week Yield Optimizer Dappio announced the launch of its new next-generation yield optimizer for DeFi and NFTs on the Solana ecosystem. Dappio would focus on simplifying Solana and attracting great developers to its ecosystem. Checking on-chain metrics shows that the protocol's positive news is impacting investors; SOL's trading volume hiked considerably over the past week – a positive signal.

- Polygon (MATIC) also had a positive price action, trading 1.32% higher than in the last seven days. This comes after Meta announced that its NFT collectibles support is now available to all Facebook and Instagram users. The feature supports collectibles from Ethereum, Polygon, and Flow and will support Solana in the future.

- Bitcoin (BTC) saw uprising action, too, with data showing Bitcoin's price is registering "higher lows," which might indicate a possible rise. The other indicator, "higher highs," hasn't happened yet, so bulls can't sing victory.

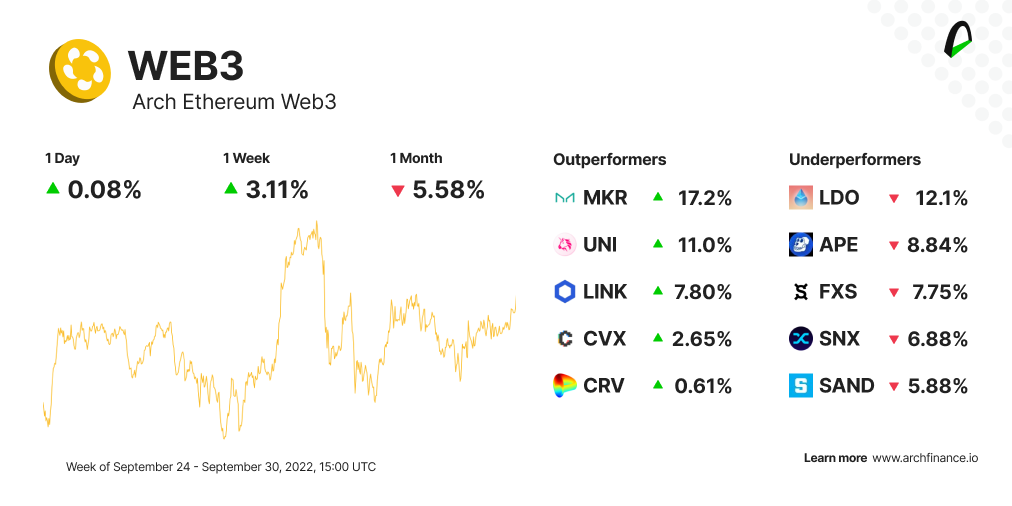

📈 WEB3 traded 3.11% higher than last week

At the time of writing, The Arch Ethereum Web3 token (WEB3) traded 3.11% higher with Maker being the top performer constituent.

- Maker's (MKR) price rose over 17% Gemini submitted a proposal on the MakerDAO forum to boost the adoption of the Gemini dollar (GUSD) in the Maker's ecosystem by paying a fixed yield on the GUSD balance in MakerDAO’s vaults. As part of the scheme, the proposal states that Gemini will pay a fixed annual interest of 1.25% on the total GUSD in the PSM vault. The annualized fixed rate will be evaluated and paid on a monthly basis. A condition of the payment is that the average GUSD balance in the vault is more than $100 million on the last day of the month. The GUSD volume in the vault rising to $100 million means that users are depositing GUSD to mint DAI.

- Uniswap (UNI) had an 11% price uptick after TechCrunch released information stating that the parent company of Uniswap, Uniswap Labs, is preparing for a new $100 million funding round to expand its offering. The news come with some speculation that the round would likely value the company at $1 billion. The new funding reportedly aims to bring more DeFi tools and NFT offerings to Uniswap.

- Chainlink (LINK) rised by 7.80% after some incredible news that SWIFT, or the Society for Worldwide Interbank Financial Telecommunication (the system that allows international wire transfers) is working with crypto data provider Chainlink to develop a proof-of-concept that will allow traditional financial institutions to integrate blockchain technology. At SmartCon, the Web3 conference by Chainlink, Sergey Nazarov, Chainlink's Co-founder, unveiled that its long-awaited staking rewards are set to go live in December.

🔷 What you need to know about The Sandbox

The Sandbox is a metaverse and gaming ecosystem built on Ethereum. Users can create experiences and games, interact with others and monetize their creations.

You can think of it as an utterly user-generated gaming and virtual experiences space where users entirely own their creations.

--> 📚🤓 Take a deep dive into what The Sandbox is and how it works

📬 Like this weekly recap?

Every Friday we send a weekly recap about the Web3 ecosystem and how crypto markets, and markets in general, are moving. Share and subscribe!

🧠 Check out our weekly Lunch & Learn session

Every week we discuss an interesting crypto project in Web3. This week we dive into Crecy, a crypto-backed credit card.

Disclaimer: The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations. The views reflected in the commentary are subject to change without notice.