GM Architects,

Crypto had a mixed week. The Arch Ethereum Web3 token traded 2.3% lower, while the Arch Blockchains token declined by 6.5%. Ethereum took a massive 11.6% hit, while Bitcoin was down by 4.0% over the previous seven days.

In this edition, we discuss ETH's woes and this week's market movers before taking a deep dive into Uniswap and its UNI token.

🗞️ TradFi still struggling

The Fed raised interest rates by 75 basis points for a third consecutive time on data that showed inflation stubbornly high and the economy slowing more gradually than the bank had hoped, including a still torrid job market. The Fed hopes to lower inflation to 2% from its current, near four-decade high of over 8%. The Bank of England boosted its interest rate for a seventh straight time, and the banks of Switzerland and Norway also announced rate hikes.

Equity markets suffered after the news broke. The S&P500 lost 3.17% in the last five days, while the Nasdaq Composite was down by 2.93%.

Crypto also reacted adversely to the news, compounded by the aftermath of the Ethereum merge selloff. More on this follows.

⛓ CHAIN is down 6.5% amid miner ETH selloff

The Arch Blockchains token (CHAIN) had a rough week, trading 6.51% lower than the last seven days, with all the constituent tokens in red.

- Ethereum's (ETH) price continues to tumble and is 11% down this week. Not only affected by the Fed interest hike, Ethereum is also feeling the impact of last week's Merge, one of the most talked about crypto upgrades. Ethereum saw some important price rise as expectations about The Merge grew, so this seems like a case of "Buy the rumor. Sell the news". Blockchain data by OKLink also shows that miners are starting to sell down their stashes dumping over 16,000 ETH from Sept. 12 to Sept. 19. The decline reduced the miners’ combined balance to about 245,000 ETH.

- Once again, Bitcoin (BTC) was the least affected, trading only 3.09% lower and changing hands at $18.951, below the psychological $20.000 resistance level. However, it's showing some early signs of recovery, roughly back to the level it was early Wednesday before the Fed announced it would raise its benchmark rate by 0.75 percentage point.

- Solana's (SOL) price is also trading lower than last week. However, there is good news surrounding the project. The Helium Foundation announced Thursday the migration of its decentralized wireless Internet of Things (IoT) network, the Helium Network, to the Solana blockchain.

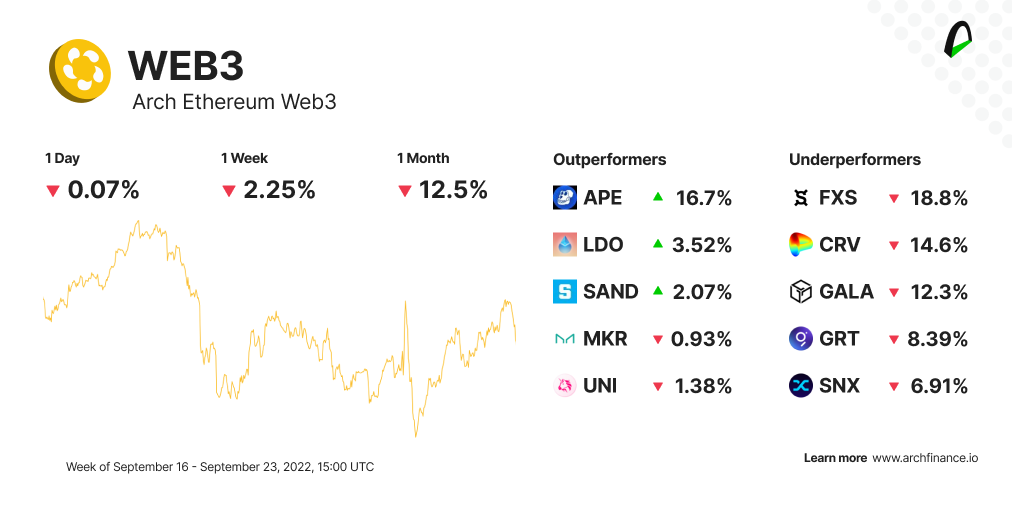

📉 WEB3 traded 2.25% lower than last week

At the time of writing, The Arch Ethereum Web3 token (WEB3) outperformed Ethereum, trading 2.25% lower than the last week.

- ApeCoin (APE) continues with a strong momentum, trading over 16.7% higher than last week. Just the previous week, it sold around 15.42% higher. The price action comes after Horizen Labs, a blockchain technology company, announced the final date for APE staking. Ape Staking is tentatively scheduled for October 31, as reported in a tweet.

- Lido DAO's (LDO) price is also seeing some positive price action trading over 3.52% higher than the last seven days. This comes after the top competitor in liquid ETH staking saw over $33 million get into stETH and astETH (Aave's equivalent token).

- The Sandbox (SAND) also had a positive week after hosting its first ever metaverse wedding. While the bride and groom were physically present at a real-world venue, their digital avatars were also present within The Sandbox and could be seen by guests who joined remotely. The event was officiated by The Sandbox co-founder and chief operations officer Sebastien Borget in a digital avatar form.

- Gala (GALA), on the other hand, had a more bearish week. The price broke below the $0.049 demand zone that has been holding up the price for the past month. Gala is a blockchain gaming platform that allows players to earn crypto tokens and NFTs through gameplay.

🦄 What you need to know about Uniswap

Uniswap is a simple concept that seeks to provide automated on-chain liquidity for cryptocurrency traders allowing users to exchange assets in a decentralized way within a certain blockchain technology

Uniswap has contributed to the DeFi boom that has taken the crypto market by storm as one of the main decentralized exchange protocols (DEX).

--> 📚🤓 Take a deep dive into what Uniswap is and how it works

📬 Like this weekly recap?

Every Friday we send a weekly recap about the Web3 ecosystem and how crypto markets, and markets in general, are moving. Share and subscribe!

Ethereum Santiago: Sharing the future of DeFi

If you're attending the conference, please come say hi and claim your Arch POAP :)

Event streaming here 🍿: https://www.youtube.com/watch?v=Z1i9BPdhm_U

Disclaimer: The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations. The views reflected in the commentary are subject to change without notice.