GM Architects,

A positive week for crypto markets made tokens trade in the green this week. Arch Ethereum Web3 token traded 10.5% higher than last week, while the Arch Blockchains token raised by 11.9%. Bitcoin grew by 11.4%, while Ethereum gained 15.7%.

This newsletter edition looks at the top gainer tokens this week and introduces ATCS, our new classification standard that helps traders and investors gather data and insights across different crypto industries, sectors, and token types.

🚀 Introducing ATCS: The Token Classification Standard for Web3

A straightforward, methodical system that works across different Web3 industries and sectors is more critical than ever.

Traders and long-term investors agree on the importance of devoting time and effort to analyzing data to gain relevant insights to decide how to allocate their funds. As crypto matures, the industry is becoming more significant, complex, and, therefore, harder to track.

Gone are the days when crypto was Bitcoin, its offshoots, Ethereum, and its ICOs. There are dozens of Layer-1 chains with their ecosystems. Stablecoins and derivatives. Plus, productive sectors, from exchanges to gaming, that mirror those in traditional finance and the so-called web2.

This unwieldy new landscape had not been organized, leaving investors to field for themselves in this jungle of tokens, until today. The Arch team has developed an in-house classification standard (Arch Token Classification Standard, or ATCS, in short) to fulfill this purpose.

ATCS is an exhaustive, objective, rules-based, and flexible measure. Every token can be classified using our system, and when they go through the process, each token will fall into one specific bucket (AKA MECE).

What's the purpose of ATCS

The ATCS is used to create Arch Indices and benchmarks to track and analyze the on-chain economy. These indexes become the base for Arch tokens and other investable products.

Information like that is essential to make better decisions when analyzing new projects or investment opportunities. In other words, it is a critical pillar of our research, and we will be able to use it too. 🔜

ATCS in Detail

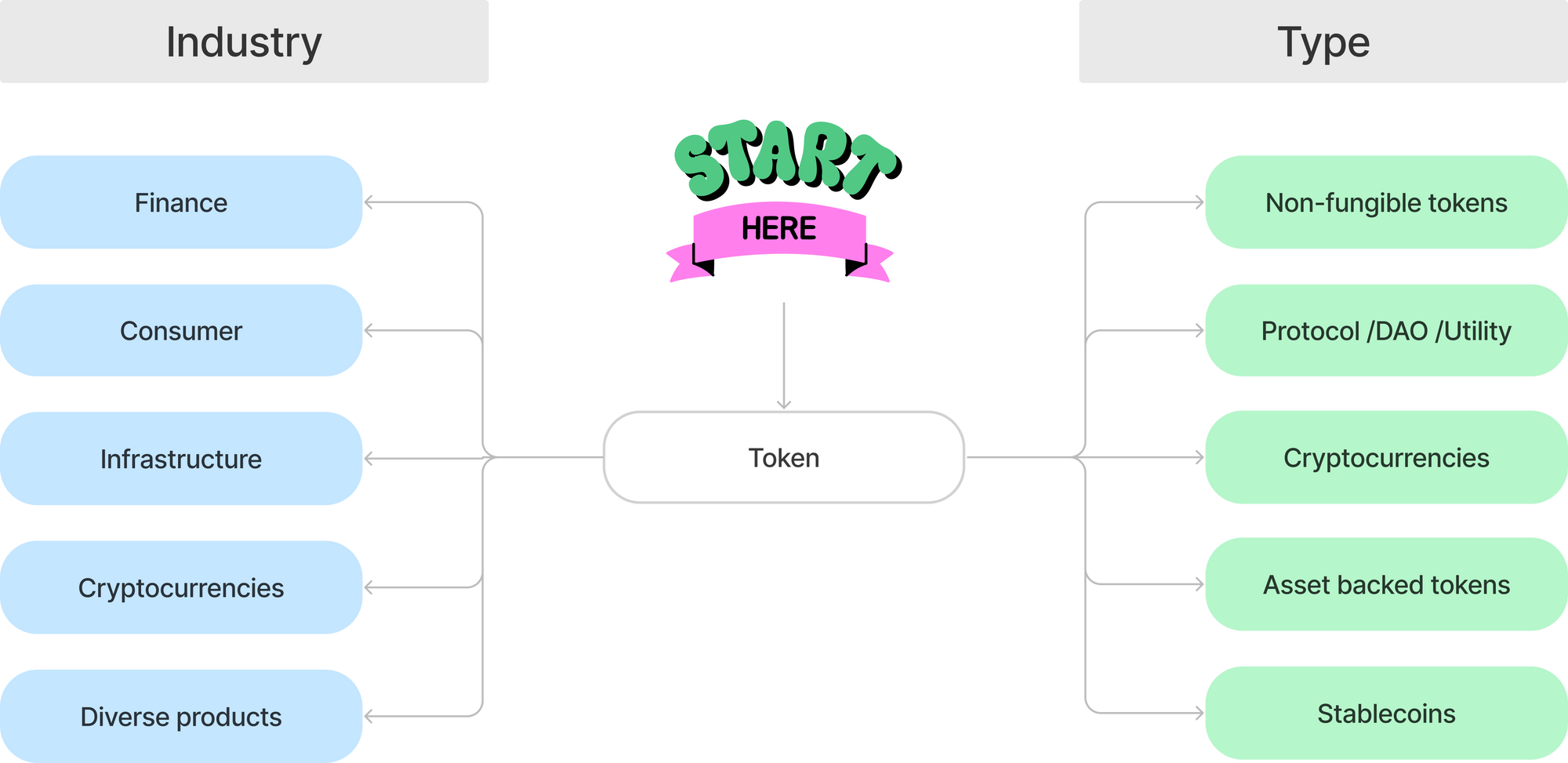

In ATCS, every token has two classifications, from an industry perspective and a type perspective. Classifying each toke by industry (for example, finance or infrastructure) and type (for example, NFTs or cryptocurrency) provides a solid foundation for our indexes and benchmarks.

Let's take, for example, LINK (Chainlink). From a type perspective, the LINK token is a protocol/DAO/Utility token because it's the protocol's core token. From the industry side, it's an infrastructure token because they make money by being the most used oracle network currently working on Ethereum or an infrastructure solution.

A broader view can be seen in the picture below.

The industry classification is defined by each token's primary source of revenue. For example, Uniswap's leading source of income comes from token swaps, so even if they buy an NFT marketplace, they will remain in the exchange industry according to our classification.

👨💻 Insights From ATCS

1. Stablecoin dominance grows in bear markets, ATCS shows.

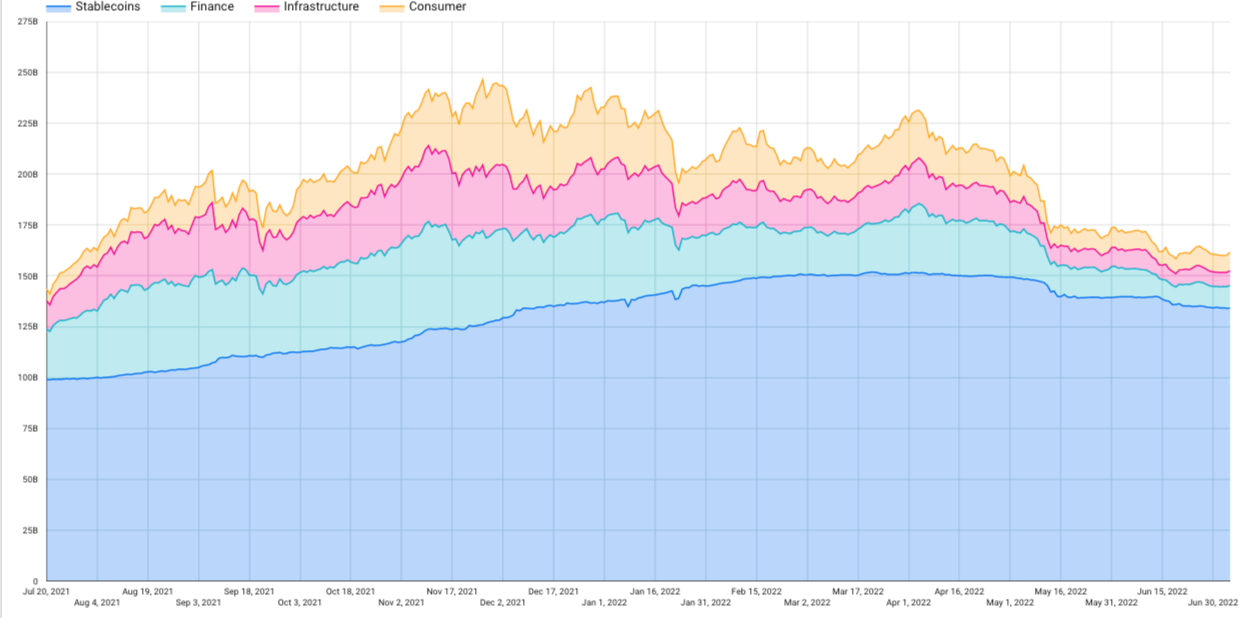

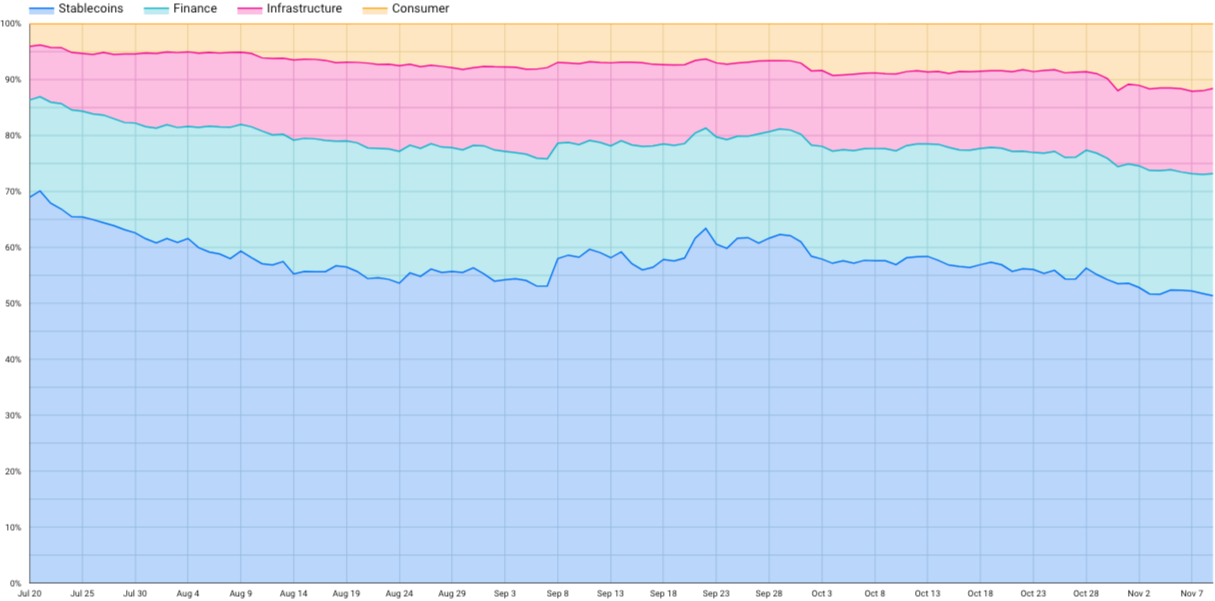

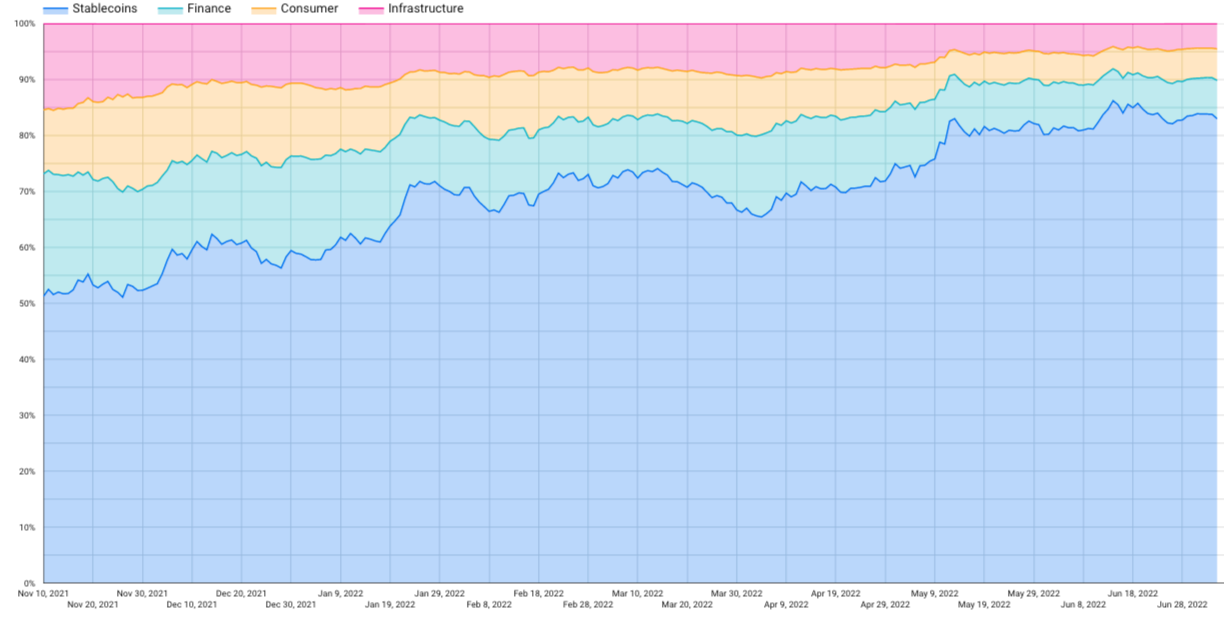

The last 12 months have been a rollercoaster for web3 assets. From July 2021 to the ATH in November, protocol tokens rose spectacularly and have since fallen (see chart below).

In relative terms, data shows that during the bull run (July - November 2021), protocol tokens could capture market share away from stablecoins. The opposite is true for the current market slump (November 2021 - today).

As common wisdom suggests, data shows stablecoins have become a haven for investors unwilling to cash out to fiat.

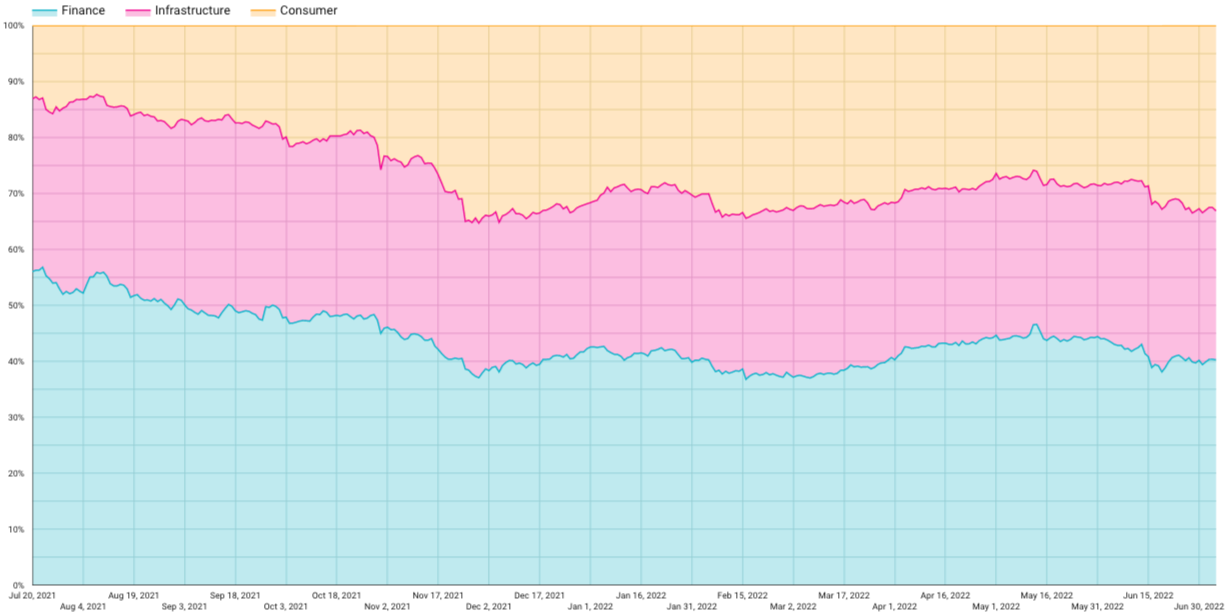

2. Consumer gaining share from DeFi

DeFi was Web3's first killer use case. Data from the Arch's ATCS confirms that Finance is still the largest industry in crypto. However, Consumer industry tokens (which include NFTs, Gaming, and Metaverse projects) are increasingly eroding its dominance.

While finance and consumers fight for the top spots, Infrastructure has remained relatively stable, with an ~30% share in the past year. This suggests that you have to have the correct data and rails no matter what you're building.

💸👷 Job market defies recession — Cryptos turn green.

Job growth accelerated faster than expected in June, indicating that the central pillar of the U.S. economy remains strong despite recession fears. Stocks ticked higher on Friday as investors reacted to stronger-than-expected jobs report that will likely keep the Federal Reserve on track for its aggressive rate hikes.

The crypto space performed better than the stock market. Bitcoin broke the $20.000 resistance, and it's now trading at over $21.743. This comes as short liquidations get washed out, triggering buy orders.

Bitcoin's bear cross seems to signal a bull revival. Historically, the crossover has marked an end of bear markets and paved the way for notable bull runs. m However, past performance is never a guarantee of future results.

📬 Like this weekly recap?

Every Friday we send a weekly recap about the Web3 ecosystem and how crypto markets, and markets in general, are moving. Share and subscribe!

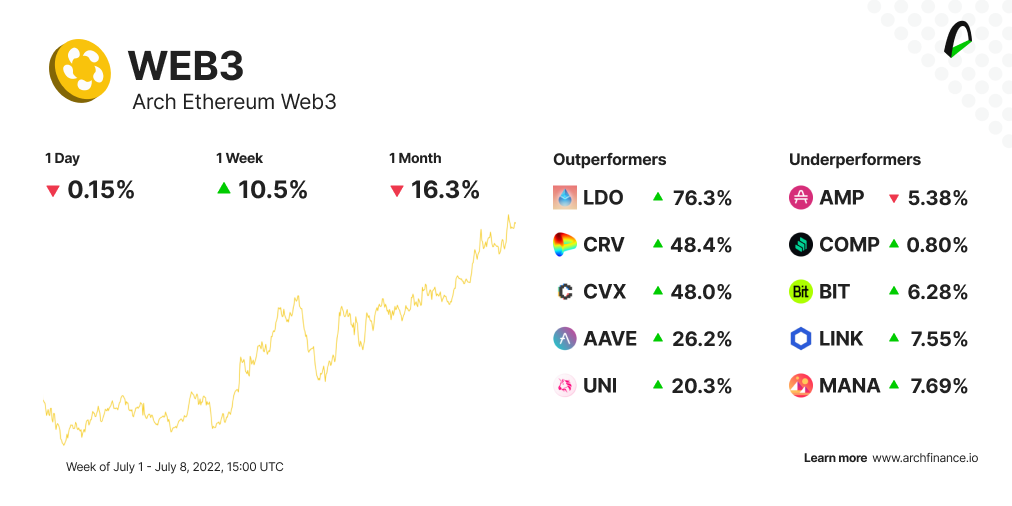

📈 Web3 traded 10.5% higher than last week

The positive price action for cryptos also affected the Arch Ethereum Web3 token, with almost all its constituents trading in the green.

- Lido DAO (LDO) native token has experienced a 76.3% price increase in the last seven days. After Lido's staked ether was at the center of the controversy last month after Celcius froze withdrawals; however, it has stabilized, prompting the token's price to skyrocket.

- Curve DAO (CVR) token had significant bullish momentum. The last time CRV achieved a bullish performance as substantial as this was in March.

- Convex Finance (CVX) was also one of the top gainers across all the crypto marketing, rising by 48.0% in the last seven days. . This comes after more than 27.4 million tokens were unlocked at the end of June. Despite the expectation that many CVX tokens entering the market would push prices down, the unlock has acted as a bullish catalyst for the protocol.

- AAVE unveiled plans to launch an overcollateralized stablecoin called GHO, subject to the community decentralized autonomous organization's (DAO's) approval. This prompted the AAVE token to trade at its December 2020 level. According to the governance proposal shared on Thursday, GHO would be an Ethereum-based and decentralized stablecoin pegged to the U.S. dollar that could be collateralized with multiple assets of the user's choice.

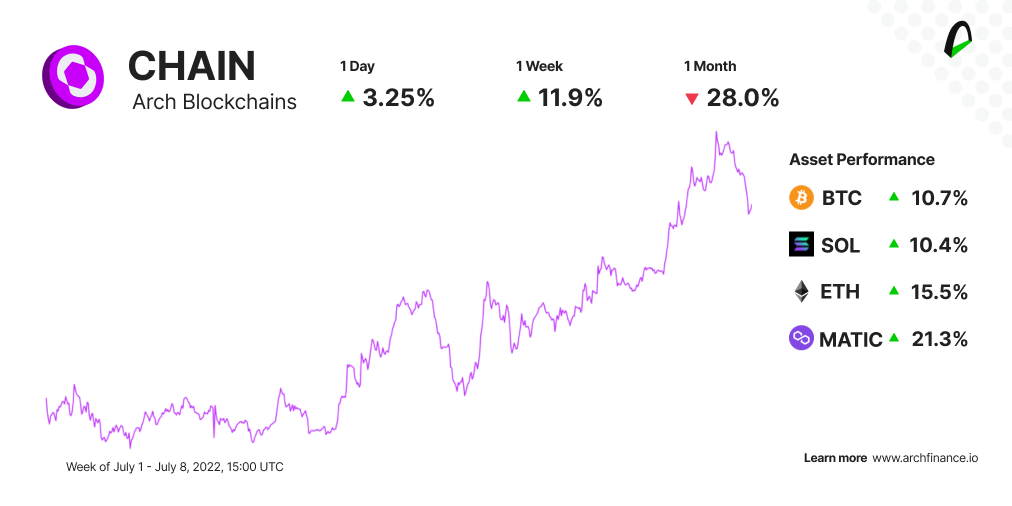

⛓ CHAIN grew by 11.9% in the last seven days

All tokens in the Arch Blockchain token traded positively after a positive week for cryptos.

Polygon (MATIC) was one of the top gainers after Reddit announced the launch of a new blockchain-backed avatar system on Polygon. The Collectible Avatars are a set of limited-edition artwork created by independent artists who are also users of Reddit. The official announcement states, "Collectible Avatars are currently stored on Polygon, a general-purpose, Ethereum-compatible blockchain. We chose Polygon for its low-cost transactions and sustainability commitments." MATIC is also one of the most purchased tokens by the top 5000 whales in the last week, according to WhaleStats.

The price of Ethereum (ETH) has continued to trade upwards over the past several days, after a dramatic reversal from the previous low that neared $1.000.

🧪 Become a beta tester

Be an essential part of Arch's development. We want to hear your feedback about a new prototype we are testing. Let's meet!

- $WEB3 holders - Verify your assets to access the exclusive #architects-lounge channel.

- 🐦 Join our community on Discord and follow Arch on Twitter.

- Stay tuned for events, research, and exciting product announcements.

- ⚠️ Important: beware of scams, and please report any attempts. We will not message you first and will never ask for your keys.

Disclaimer: The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations. The views reflected in the commentary are subject to change without notice.