GM Architects,

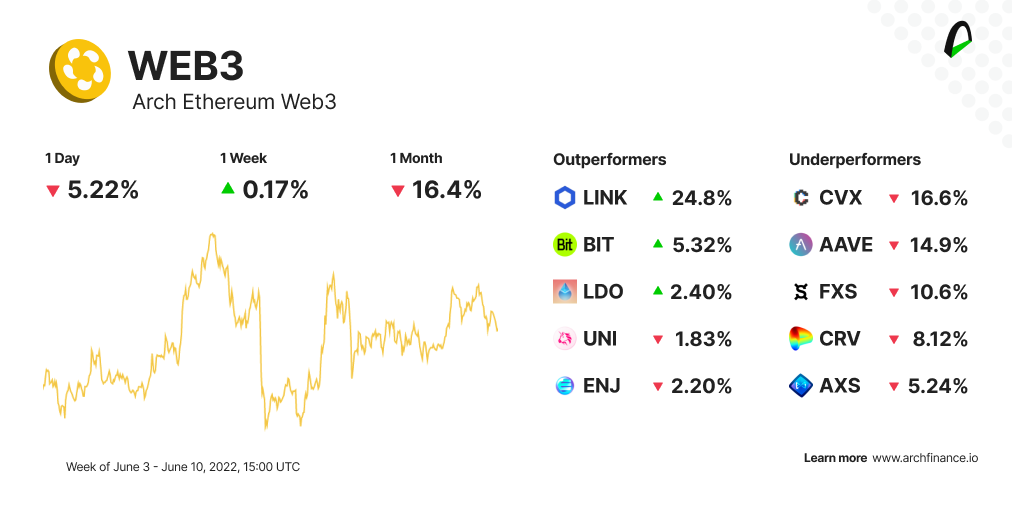

Another choppy week for financial markets after CPI metrics were published earlier on Friday. The Arch Ethereum Web3 token traded 0.17% higher than last week, making it's second positive week in a row.

In this edition of our Arch Newsletter, we explore how the market performed, provide a guide on the Polygon network and MATIC, and welcome Arch Blockchains token, $CHAIN to the Arch token family.

Inflation rises, stocks and crypto fall.

The Consumer Price Index (CPI), the most widely tracked benchmark for inflation, rose 8.6% on a year-over-year basis in May, topping expectations that it would decline to 8.2% from April's 8.3%.

Bitcoin (BTC) has taken a major hit as western central banks have begun tightening monetary policy over the past few months, dipping to $29,500 from $30,000 minutes after the CPI was published. Ethereum (ETH), on the other hand, fell by 3.9% in the last 24 hours.

Arch Ethereum Web3 token outperforms

The Arch Ethereum Web3 token held incredibly well during this pullback, trading 0.17% higher than the last seven days.

Overall crypto market capitalization dropped by 2.3% to $1.28 trillion, continuing a slide from over a capitalization of over $2.2 trillion in March 2022.

The S&P 500, Dow, and Nasdaq dropped sharply following the CPI report. The Dow Jones Industrial Average shed 1.5%. The S&P 500 fell 1.5%, while Nasdaq Composite sank 1.7%. The Dow is entering its tenth losing week, while the S&P500 and Nasdaq Composite are their ninth losing week.

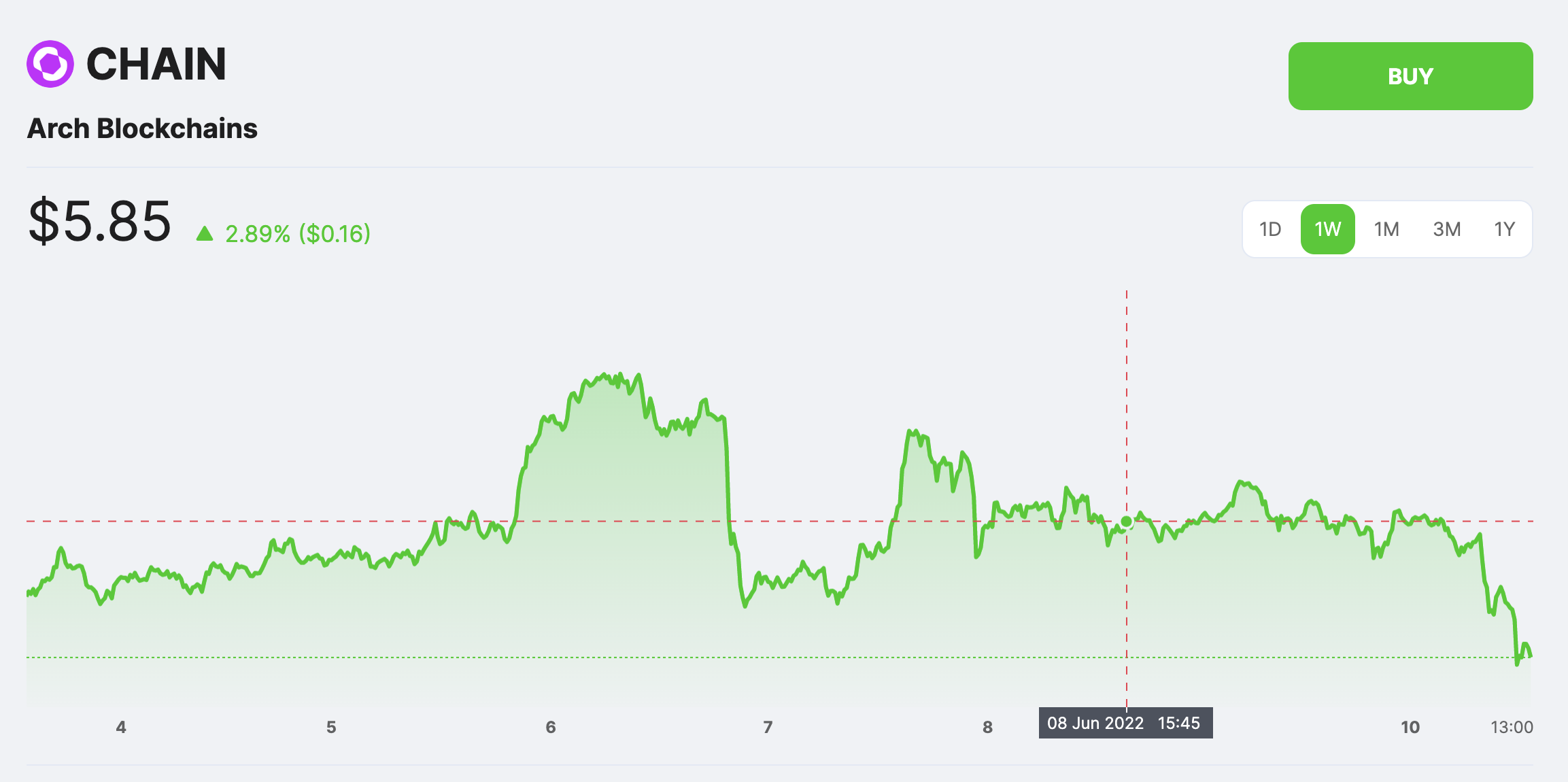

Introducing $CHAIN

We are thrilled to welcome the Arch Blockchains token, $CHAIN to our product family. Available on Ethereum mainnet and Polygon.

This new token is designed to provide exposure to the performance of the native tokens (cryptocurrencies) from leading blockchain networks.

Allocations are proportional to the square root of the market capitalization of eligible tokens, allowing for a wider representation of eligible network tokens.

The current make of the token; Bitcoin (54%), Ether (33%), Solana (8%), Polygon (5%) includes both base layer and scalability, and EVM and non-EVM networks, allowing holders to participate in the performance of a wider range of solutions.

—> ✅ LEARN MORE ABOUT THE ARCH BLOCKCHAINS TOKEN

🪂 Airdrop Alert: Earn an Infinite Machine Movie Collection NFT

Arch holders campaign, Earn an Infinite Machine movie NFT!!

— Arch (@archdefi) June 10, 2022

1. Hold +20 $WEB3 or $CHAIN Arch tokens.

Buy here: https://t.co/46KlE01Uep

2.Retweet this message to participate

3.Snapshot June 30th 13 pm ET#ARCH #WAGMAM #Ethereum #cryptocurrency pic.twitter.com/FOwZ7Jwhc6

📬 Like this weekly recap?

Every Friday we send a weekly recap about the Web3 ecosystem and how crypto markets, and markets in general, are moving. Share and subscribe!

📈 Web3 holds up after inflation hits a four-decade high

The Arch Ethereum Web3 token performed better than blue-chip cryptos, trading 0.17% higher than the last seven days. Ethereum, for example, fell by 2.3% in the same period, while Bitcoin fell by 1%

- Chainlink (LINK) rallied over 24.8% as plans for staking support and a significant Avalanche tie-up increased demand. LINK's significant gains over the past 24 hours were driven by the Avalanche blockchain expanding its integration with Chainlink. Two features of Chainlink- Keepers and Variable Random Functions (VRF) - were deployed on the Avalanche main network on Thursday.

- BitDAO (BIT) was also one of the top performers after rising by 5.3%. The price action came after Coinbase announced its support for the token. BIT will start trading on Coinbase Pro paired with Tether (USDT).

- AAVE saw a natural price retracement after a significant uptick last week.

- Convex Finance (CVX) continues to seem trapped between bulls and bears. Checking Total-Value-Locked (TVL), Convex Finance is the sixth biggest project with a TVL of $4.8B, according to DeFi Llama. However, this comes after dropping by 56.75% in the past month. During its highs in early January 2022, the project saw TVL levels above $21B.

- Axie Infinity (AXS) also saw a price drop after recent data showed that the index for the daily active user of Axie Infinity V2 suffered a 21% drop.

🔗 Learn more about Polygon

Polygon is a blockchain that seeks to improve the disadvantages of the Ethereum network by accelerating the network's transaction processing speed and reducing transaction costs. The protocol is looking to become the AWS for the Web3 world.

This week Polygon saw some exciting news with Circle, a USDC stablecoin issuer, incorporating the use of Polygon USDC into its payment system and the launch of Zoop, a digital collectible trading platform powered by Polygon and created by leading OnlyFans executives.

--> 📚🤓 Take a deep dive into Polygon, a protocol part of the Arch Blockchains token.

The Ethereum merge is closer than ever.

Ethereum developers activated the merge on the Ropsten test network merging the Proof-of-Work chain with the Proof-of-Stake chain. This test comes in preparation for the mainnet merge that should happen later this year.

The amount of Ether staked has been increasing weekly since January this year. More than 10% of all ETH in circulation is staked in the smart contract.

Of all the current staked ETH, more than 30% of the staking is done through Lido (part of the Arch Ethereum Web3 token).

👁️🗨️ Become a beta tester

Be an essential part of Arch's development. We want to hear your feedback about a new prototype we are testing. Let's meet!

- $WEB3 holders - Verify your assets to access the exclusive #architects-lounge channel.

- 🐦 Join our community on Discord and follow Arch on Twitter.

- Stay tuned for events, research, and exciting product announcements.

- ⚠️ Important: beware of scams, and please report any attempts. We will not message you first and will never ask for your keys.

Contribute

Join the core team or become a contributor. We want to hear from you:

💼 Open positions:

Learn more about open positions and working at Arch. If interested, please send us a note on Twitter or Discord.

Disclaimer: The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations. The views reflected in the commentary are subject to change without notice.