GM Architects,

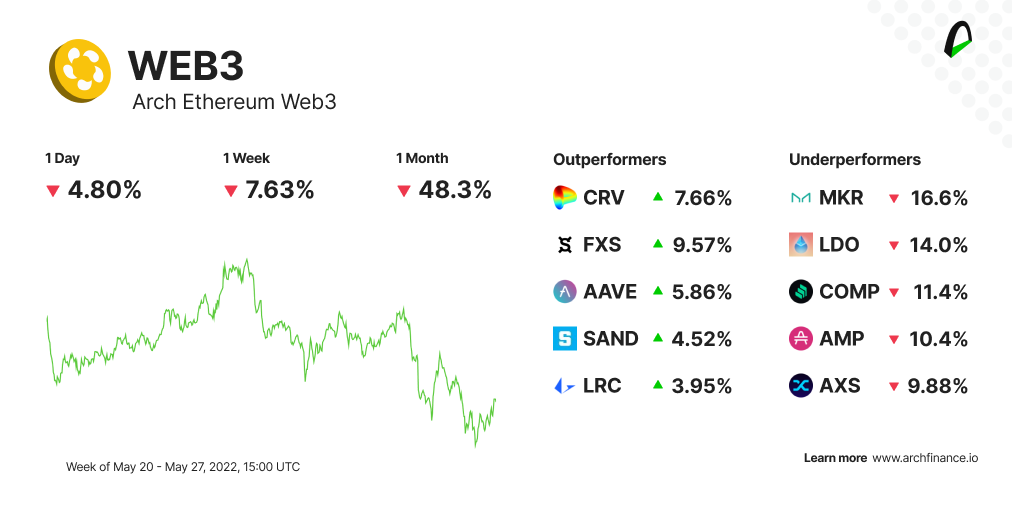

Bearish sentiments continue to prevail across markets, including crypto. The Arch Ethereum Web3 token ($WEB3) fell by 7.63%, marking its eighth week of continued decline.

Positive developments in TradFi

Inflation rates slowed down to 6.3% from their previous 8.5% published on the CPI in April, suggesting that inflation might have already peaked.

The news gave TradFi futures a boost this Friday. Nasdaq futures rose 1.2%, while the S&P500 futures gained 0.7%. Overall, the S&P500 is 4% higher, while the Nasdaq grew by 3.4% in the last seven days after strong retail earnings lifted the sentiment.

In crypto, the carnage continues. Ethereum fell by 9.88% partly due to a larger than average number of futures liquidations. At the time of writing, ETH hovers at $1,774, its lowest since July 2021. Bitcoin slid 1.9% in the last seven days, trading at $28.874, keeping a price similar to last week and showing a solid resistance.

📬 Like this weekly recap?

Every Friday we send a weekly recap about the Web3 ecosystem and how crypto markets, and markets in general, are moving. Share and subscribe!

In times of crisis, all correlations go to 1

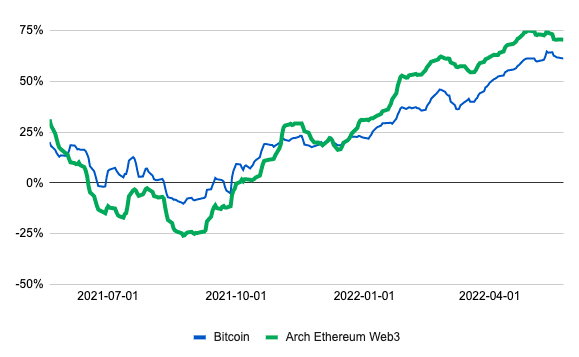

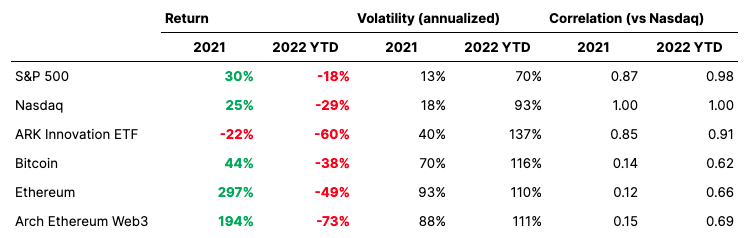

It's common knowledge that in times of heightened volatility, all correlations go to 1, meaning, asset classes start moving in tandem. In this year's case, everything is falling together. What's surprising is that crypto, traditionally the riskiest of the risky assets, has not been significantly more volatile than stocks, and its fall has not been much steeper.

Crypto is often hailed by its proponents as an uncorrelated asset class which can help investors diversify their portfolios. That may be true most times, but not when macro headwinds are pushing everything down. Last year, Bitcoin, Ethereum, and the Arch Ethereum Web3 index showed a correlation to the Nasdaq index of tech stocks, of between 0.12 and 0.15 last year, implying little correlation, with cryptos moving in some cases opposite to what markets were doing.

This year, those correlations have spiked to between 0.62 and 0.69. The same is true among stocks, with the correlation of the S&P 500 with Nasdaq spiking to 0.98 from 0.87 in 2021. Assets that move in total lockstep have a value of 1; those with no price relationship have a value of 0.

Diving deeper into how correlated crypto and stocks – particularly tech stocks – are becoming, Bitcoin and the Arch Ethereum Web3 index´s correlation with the Nasdaq climbed to as high as 75% this year, from as 14 and 15% last year.

Cryptocurrencies are also known to be many times more volatile than traditional asset classes but that's also unraveling in this environment. Stocks' volatility has jumped to the point of almost matching crypto with the Nasdaq's annualized volatility climbing to 93% from 18%, while volatility for the Arch Ethereum Web3 index rose to 111% from 88%.

The data shows crypto is behaving similarly to traditional asset classes. We believe this is due to the fact that digital assets are becoming an increasingly common piece in investors' portfolios, from individual traders to institutions. Changing global financial conditions, increased liquidity in the markets, low-interest rates, and an inflated risk for appetite and institutional adoption.

Crypto started to be treated like a speculative asset stock class, like early tech startups. The result is a more pegged price movement.

However, this pegging can be seen in some economic downturns and disappear once there's a more buoyant market outlook.

📉 Web3 continues to feel the heat

The Arch Ethereum Web3 token continues on a downturn during a week where Ethereum and small-cap tokens fell sharply, compared to Bitcoin.

- FraxShare (FXS) saw a strong rebound after feeling Terra's crash for the past two weeks. The rebound also comes after the launch of the Zenlink Hybrid AMM that will include a 4pool consisting of USDT, USDC, xcAUSD, and FRAX.

- CurveDAO (CRV) also saw some recovery after community members voted to terminate CRV releases from all TerraUSD pools ending all connections to the stablecoin.

- AAVE traded in the green after a week filled with good news for the protocol. The first reactions to the Lens protocol, a new social media powered by AAVE, were positive. Netcoins, an online crypto brokerage owned by BIGG Digital Assets, included AAVE on its trading platform. Finally, AAVE was also listed on polygon allowing AAVE tokens holders to get crypto collateralized loans.

- MakerDAO (MKR) was one of the underperformers. After a strong rally impulsed by Terra's crash, MKR is now seeing a normal retracement.

Learn more about Bit and BitDAO

BitDAO is one of the largest Decentralized Autonomous Organizations (DAOs) in the crypto ecosystem. The project aims to build a decentralized tokenized economy available to everyone while powering the DeFi ecosystem.

--> 📚🤓 Take a deep dive into BitDAO and the Bit token part of the Arch Ethereum Web3 Token.

👁️🗨️ Become a beta tester

Be an essential part of Arch's development. We want to hear your feedback about a new prototype we are testing. Let's meet!

- $WEB3 holders - Verify your assets to access the exclusive #architects-lounge channel.

- 🐦 Join our community on Discord and follow Arch on Twitter.

- Stay tuned for events, research, and exciting product announcements.

- ⚠️ Important: beware of scams, and please report any attempts. We will not message you first and will never ask for your keys.

Contribute

Join the core team or become a contributor. We want to hear from you:

💼 Open positions:

Learn more about open positions and working at Arch. If interested, please send us a note on Twitter or Discord.

Disclaimer: The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations. The views reflected in the commentary are subject to change without notice.