Crypto markets and the most important players and sectors in this ecosystem continue to evolve and change. From a speculative asset to an investment vehicle, the value and use cases continue to develop.

Crypto has been around for more than a decade and has experienced many changes throughout its life. From tech forums and pizza days to a speculative asset and a meme frenzy and through a deep technology and financial revolution.

This evolution has been taking place through the ebbs and flows of market cycles. And with each cycle, an aspect has changed. We've seen cycles of incredible support and relevance and cycles of a more lukewarm approach. But one thing is clear: there's no stopping.

And not only have the tech and the use cases been evolving, but the players involved have also changed during these cycles. We started with a deep focus on retail investors and now see solid institutional adoption.

⚾ The players in the crypto game

One of the most important aspects of analyzing any market is understanding who the players are.

The participants that have been a part of the crypto ecosystem have been evolving for the more than ten years that crypto has been around.

And here's what we can see.

In the early starts of crypto, only a handful of people invested in the asset. Most people who were familiar with that tech liked that punk aspect of the space.

The narrative centered on its peer-to-peer nature and how it was an anonymous and almost untraceable payment method.

But around 2012, Bitcoin experienced a substantial change. Silk Road became a thing, and the number of wallets holding bitcoin grew. However, the narrative was still centered around untraceability.

The infrastructure began to grow. Wallets and exchanges began to appear and with them the first VC investments in the industry. We saw accelerators, such as YCombinator, invest in companies and startups offering crypto solutions.

And with this first approach of institutional investors, we saw the first long-term investors too.

In 2015 the institutional investment officially started with players such as Ark entering the space. Large transaction volume (those transactions of over $100.000) also grew, which indicates that institutions and large investors were interested.

From there, the large transactions ranged between 5% and 85% of all Bitcoin transactions. You could see news and posts about how institutional adoption was coming to the space, which also helped fuel the prices.

In 2020, the large transaction volume represented a large percentage of transactions showing the dominance of institutional players in the space.

Hedged funds traded bitcoin and started treating it like a high sentiment beta asset (a representation of small startups that haven't achieved considerable market value but have high potential).

We also see some of the world's largest investors, like SoftBank and Sequoia, vouch for tokens in the space.

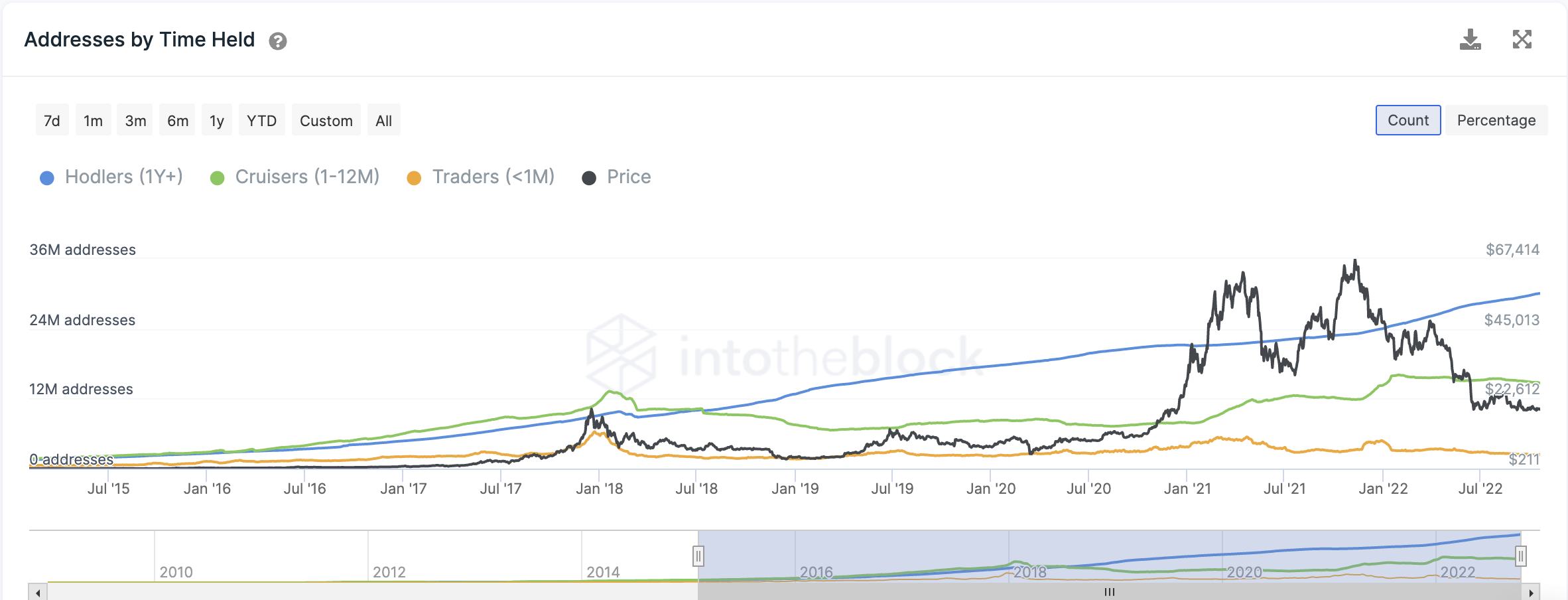

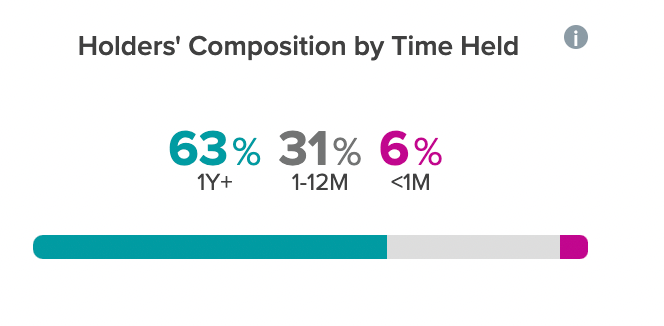

And with this, we have seen the narrative change from peer-to-peer money meant to be spent quickly to growth in wallets holding their bitcoins for more than a year.

Holders - those hodling their bitcoins for more than a year - cyclically grow their portfolios during the price corrections of 2014, 2018, and 2022, creating a four-year cycle that has been the basis of the Bitcoin cycles theory.

This also goes hand in hand with the halving of mining rewards. So, what's happening is that investors have been holding onto their assets more while large transactions grow and the issuance drops.

But this strong correlation between miners and cycles is diminishing. Miners went from being the leading sellers to accounting for less than 1% of the total volume.

And that's why cycles will probably be more challenging to predict and will also go from a market driven by supply to a market driven by demand.

With large institutions propelling the space and more than 60% of wallets holding bitcoin for more than a year, we are entering a new and more illiquid market space that will move forward through demand, large-scale factors, and regulations.

Also check out: