GM Architects, and happy Lunar New Year to those celebrating this weekend!

Bitcoin and Ether are holding their price and trading two digits higher than in the last seven days even after cryptocurrency lender Genesis Global, filed for Chapter 11, making waves in the industry.

Cryptocurrencies are up by 12.3%, while major protocols went up by 12.19%. In TradFi markets, the S&P500 went down by 1.98% in the last five days, while the tech-heavy Nasdaq Composite is down by 1.07%.

This newsletter edition covers this week's market movers, shares our research results about the future of bitcoin price, and deep dives into NuCypher.

☕️ This week in crypto

- =nil; Foundation - an Ethereum research and development firm - raised $22 million to build out its Proof Marketplace, allowing crypto protocols to outsource the production of zero-knowledge (ZK) proofs. You can read more about (ZK) proofs here.

- China - has enabled smart-contract functionality for its CBDC, the digital yuan, through the e-commerce app Meituan. The smart contracts will allow daily prizes to be distributed among users.

- Genesis - the crypto lender that filed for Chapter 11 bankruptcy, has over 100,000 creditors between the three companies that declared bankruptcy and owes over $3.5B. Gemini CEO Cameron Winklevoss threatened to sue Barry Silbert and his company Digital Currency Group for the repayment of a $900 million loan.

- Robinhood - the investing app, released Wallet, an İOS app that allows users to transfer and view owned crypto and NFTs. The self-custody wallet has a waiting list of over one million people and will only support Ethereum and Polygon networks at launch.

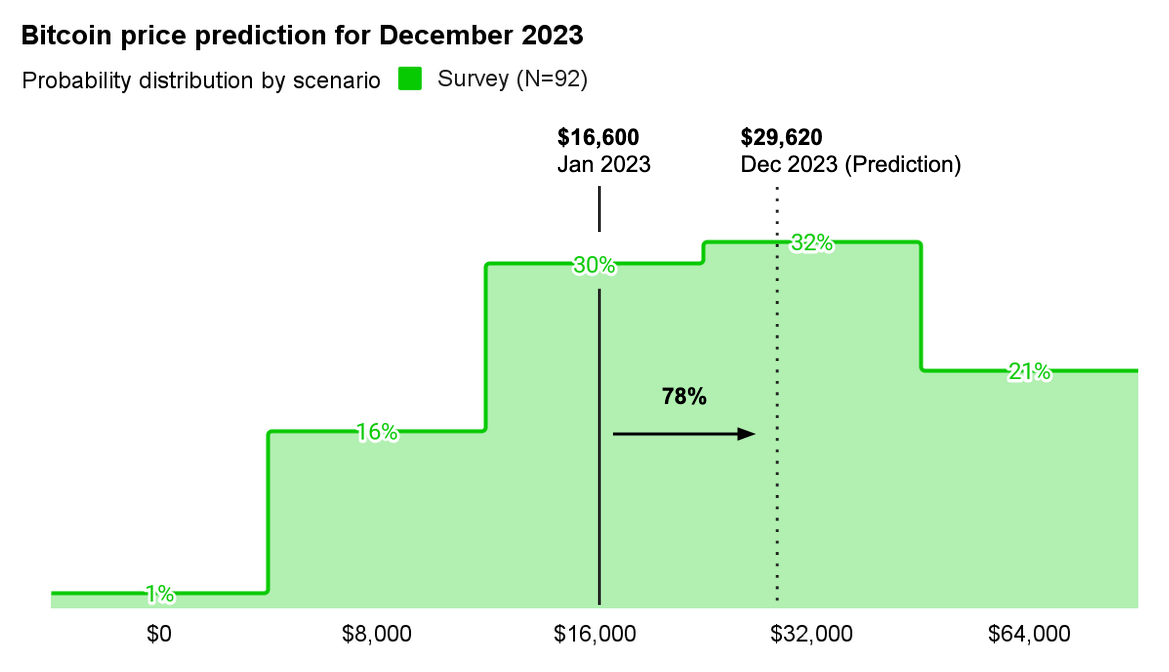

Arch Survey: Bitcoin could reach $30,000 by year-end

The average bitcoin's price prediction was USD 29,620, a 78% potential increase from the USD 16,600 market price when we sent the survey. This positive sentiment is consistent with other market metrics, including the call-put skew. More on this below.

In early January, we asked 92 industry experts from crypto and TradFi (traditional finance), plus everyday market participants to forecast a probability distribution for bitcoin's price at the end of 2023.

Beyond the point average, it's interesting (but not surprising), not even one respondent assigned a relevant probability to it being anywhere close to USD 0 or having a total price fall.

Moreover, we saw a mere 1 in 6 chance given to bitcoin ending the year under the then-current price of $16,600.

We looked into our results and found that respondents give a 45% change to bitcoin ending the year with a price over USD 30,000, vs 16% that predict the price being over USD 40,000.

Only a 5% probability was given to the price being over the USD 50,000 mark by December this year.

Findings Sustained by Call-put Skew

One of the most valuable and direct ways to measure the market sentiment (if bullish or bearish) is by checking the call-put skew.

The call-put skew tells us if the market sentiment is positive or negative according to the relative demand for calls and puts (as measured by the implied volatility). If the average investor is bullish, they will be more willing to pay more to have an upside in a call.

The market is showing a positive sentiment toward bitcoin's future price, which aligns with our survey analysis. The call-put skew turned positive since early January, reflecting higher call demand.

Keep reading the report and learn more about the call-put skew on our report 👇

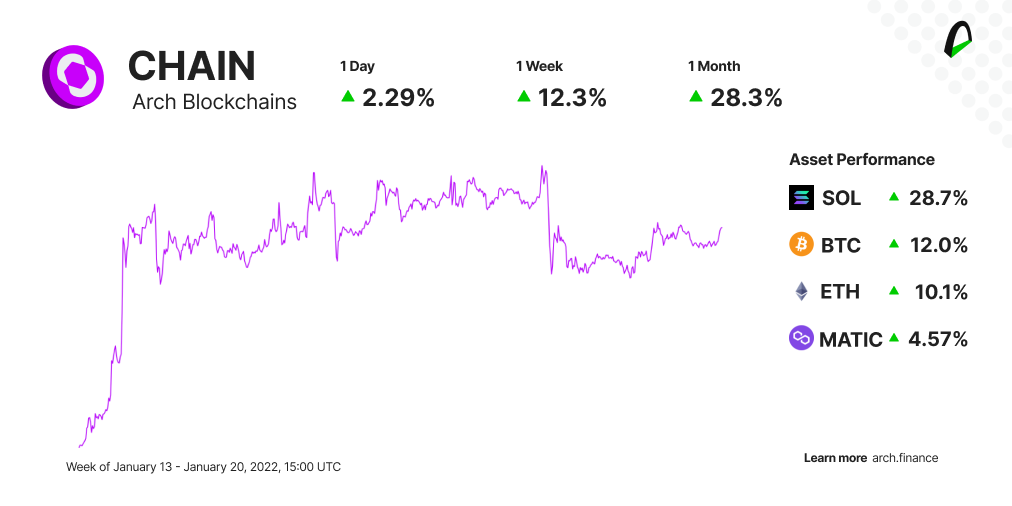

⛓ Cryptocurrencies: $CHAIN is up by 12.3%

The Arch Blockchains token (CHAIN) traded 12.30% higher than in the last seven days.

- Bitcoin (BTC) has been riding a wave of bullish momentum lately, with its 14-day relative strength index (RSI) rocketing to its highest levels in two years. On Monday, BTC hit a two-month peak, according to TradingView.

- Solana (SOL) has doubled its price since mid-December. The surge started after a favorable tweet by Ethereum co-founder Vitalik Buterin a couple of weeks ago. Some of the trading volume spikes come from the new dog token BONK, which acts as an easy entry point for users to the Solana ecosystem.

- Polygon (MATIC) is also having a positive week after Rarible, the NFT marketplace, announced that it is expanding its marketplace builder to include Polygon-based NFT collections.

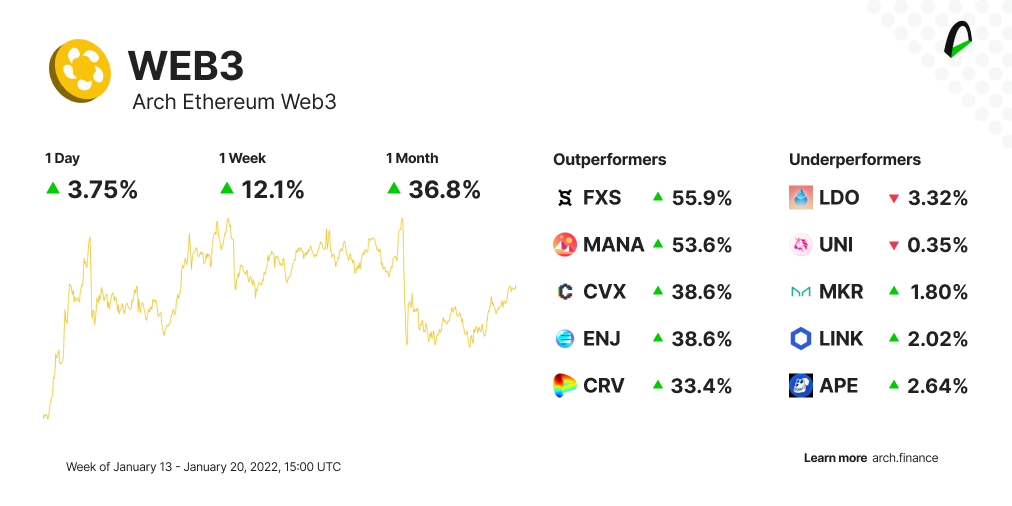

📈 Protocols: WEB3 is up by 12.19% with all tokens in the green

At the time of writing, The Arch Ethereum Web3 token (WEB3) traded 12.19% higher than last week.

- Synthetix (SNX) is having a positive season after the V2 launch of the perpetual platform on Optimism. The total value locked (TVL) on Optimism holds just under $600 million, with popular trading protocol Synthetix accounting for 18% of all this TVL. Synthetix allows investors to trade financial derivatives in global assets, like equities, at a low fee. After the launch of the perpetual platform Synthetix has seen daily active users more than double.

- Decentraland (MANA) is leading the metaverse rally, with the token trading over 53% higher than in the last seven days. Part of the rise is coming after the Decentraland announced their 2023 manifesto, claiming it will be The Year of the Creators.

- Frax Finance (FXS) is having major momentum. Data from Defi Llama says their liquid staking solution is booming, with users depositing more than $100M. Their lending protocol, FraxLend, also surged, and their exchange, FraxSwap, is also experiencing some positive action growing more than 36% since the beginning of the year.

🔐 NuCypher

NuCypher is an innovative software solution to bolster the security and safeguard user privacy of decentralized applications on public blockchains. With NuCypher, developers have a powerful tool for creating reliable and secure dApps with enhanced protection features.

Disclaimer: The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations. The views reflected in the commentary are subject to change without notice.