GM Architects,

Falling inflation, a weakening U.S. dollar, and predictions of slower Federal Reserve rate hikes allowed crypto, and markets in general, to continue the upward trend that's been ongoing since the start of the year.

Cryptocurrencies went up by 13.91%, while major protocols went up by 21.86%.

This newsletter edition covers this week's market movers, explores what happened in crypto during the week, deep dives into Rocket Pool, a liquid staking protocol, and explores what Zero-Knowledge Proof is.

☕️ This week in crypto

- AWS - partners with Avalanche to help scale blockchain adoption across enterprises, institutions, and government. "Looking forward, web3 and blockchain are inevitable," said Howard Wright, VP and global head of startups at AWS.

- The SEC - filed a lawsuit late on Thursday against the crypto exchange Gemini and the crypto lender Genesis accusing them of selling unregistered securities. What's going on with them? The Gemini Earn program offered yield on billions of dollars of user's crypto by loaning deposits to Genesis. Genesis closed lending withdrawals in November, leaving about $900 million in Gemini Earn users' crypto in limbo.

- SBF- the now disgraced former CEO of FTX - published a lengthy blog post on Substack denying stealing funds. He also claimed FTX and sister company Alameda Research collapsed because of the crypto market meltdown and inadequate hedging on Alameda's part. Bankman-Fried faces numerous federal charges.

- ARK - made another Coinbase buy Thursday. Coinbase is now the 12th-largest holding for the ARK Innovation ETF.

Inflation is cooling down. Markets are heating up

The US Consumer Price Index (CPI) has seen a decrease of 0.1%, the smallest 12-month increase in prices since October 2021. The main reason? Gas prices are going down.

The cooling down of inflation is favorable for markets. In TradFi, the S&P 500 is 4.18% higher than the last five days, while the tech-heavy Nasdaq Composite is 6.15%.

These numbers are even more positive in the crypto markets, with Bitcoin and Ethereum trading over 13% higher than in the last seven days. Just yesterday, Bitcoin prices rallied past $19K for the first time since the FTX collapse, and it's now up about 14% this year.

Last week we talked about the January Indicator, and so far, January is showing positive market activity. If this continues, this might be a good year for crypto, that is, if the January Indicator is right again.

⛓ Cryptocurrencies: $CHAIN is up by 13.91%

The Arch Blockchains token (CHAIN) traded 13.91% higher than in the last seven days.

- Ethereum (ETH) achieved another impressive milestone as its number of validators surpassed half a million. Validators are the core of network security and integrity, playing a pivotal role in verifying transactions. Operating through consensus-based decision-making, these specialized agents ensure that each transaction meets all the smart contract conditions. The increased number of active validators is a positive sign for the network. In other news, Ethereum is rapidly preparing for its upcoming Shanghai upgrade, with Etherscan's reports displaying a considerable influx of ETH deposits into the Beacon Chain staking agreement. 16 million ETH has been deposited, over $22 billion in today's price.

- Polygon (MATIC) announced a proposed hard fork for the network. If approved, the upgrade will take place on Jan 17, addressing gas spikes and chain reorganization. The gas price adjustment will create more consistent transactions on their blockchain, allowing for increased usage and reliability during peak activity times.

- Solana (SOL) continues on a positive trend despite BONK - the dog token that was in part responsible for the rally - falling. BONK saw a 3,300% increase, but in the last 24 hours, the price tumbled almost a 16%

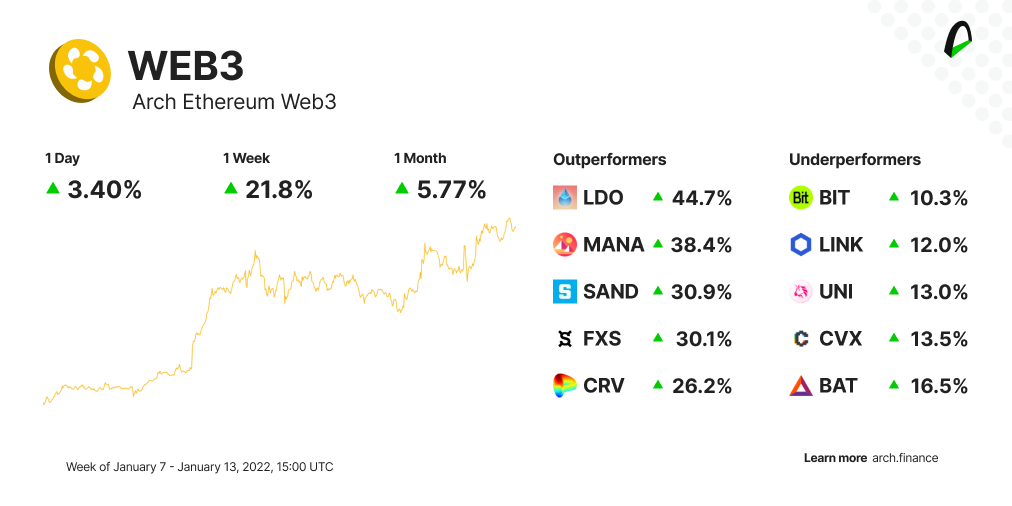

📈 Protocols: WEB3 is up by 21.86% with all tokens in the green

At the time of writing, The Arch Ethereum Web3 token (WEB3) traded 21.86% higher than last week.

- Decentraland (MANA) surged as metaverse tokens became the best-performing industry since the start of this year. Part of MANA's jump in prices came after Decentraland introduced new profile features and avatar functions for users on Thursday.

- Liquid staking continues to skyrocket, with Lido (LDO) leading the race. In March, Ethereum will go through the Shanghai update, making the withdrawal of staked Ether possible. Liquid staking provides better yield opportunities for stakers, and the staking native token can be used in other DeFi protocols, while ETH staked directly can't.

- ApeCoin (APE) is having momentum. On Thursday, the NFT collections of Bored Ape Yacht Club (BAYC), Mutant Ape Yacht Club (MAYC), and Bored Ape Kennel Club (BAKC) experienced a surge in popularity on OpenSea's marketplace following news of the upcoming free mint for Bored Apes NFT holders. The Sewer Pass NFT mint grants access to a game called Dookey Dash.

- Chainlink (LINK) is also seeing some positive price action. According to data from Santiment, this spike in price can be attributed to the growing number of addresses interacting with the Chainlink network.

🚀 What's Rocket Pool

Rocket Pool is a liquid staking service on the Ethereum Chain. Learn what it is, how it works and the benefits of liquid staking.

🤫 Zero-Knowledge Proof

Boasting improved transparency, immutability, and privacy - ZKPs are setting a new standard for trustless ledger systems by keeping confidential information secure in an unalterable format.

Disclaimer: The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations. The views reflected in the commentary are subject to change without notice.