As stable assets, stablecoins have an exciting appeal for crypto natives and more traditional investors trying to get into this market.

What are stablecoins 🤔

Stablecoins, just like the name implies, are coins with a stable price.

They create a bridge between fiat currency, such as the US dollar, and cryptocurrencies.

These price-stable digital assets have a behavior similar to fiat currencies while having the mobility and utility that crypto offers.

They are an excellent way for investors to hedge against the volatility the crypto ecosystem can have.

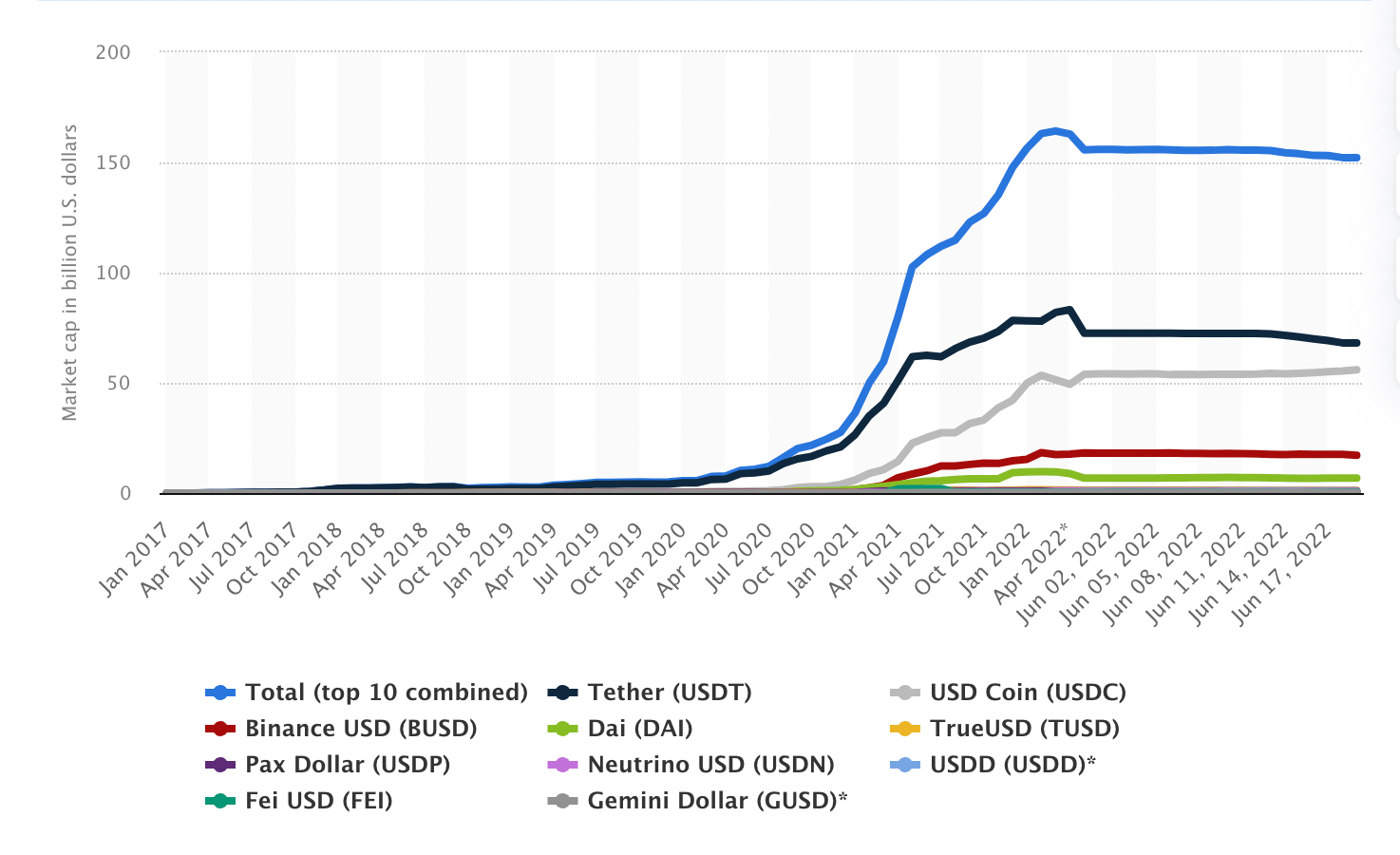

Depending on how the asset is built, there are four main types of stablecoins: crypto-backed, commodity-backed, fiat-backed (one of the most common ones), and algorithmic.

But how do stablecoins work? 🪙

Cryptos are an emerging asset class, and like all emerging markets, they are susceptible to market forces and volatility.

And this volatility is what keeps some investors from entering the ecosystem. However, stablecoins are looking to solve this issue.

These tokens function similarly to traditional assets because they hold a more stable value.

Depending on the type of stablecoin and how it's built, you can find options pegged to a fiat currency. So, for example, a USD-pegged stablecoin will have the same value as a fiat dollar.

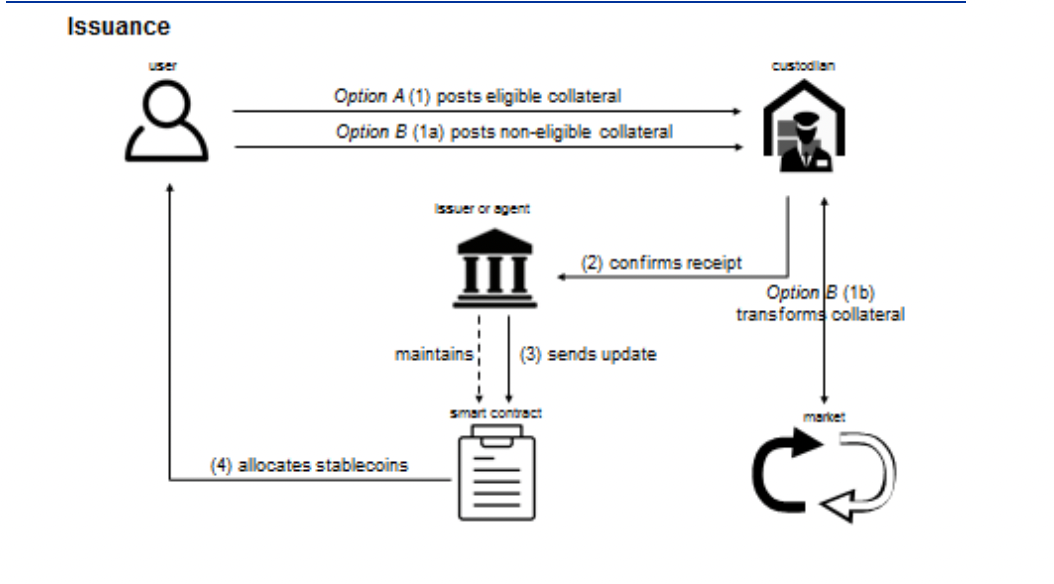

And how do they keep the value? They are collateralized. The way each stablecoin is collateralized will depend on the project, but usually, they will hold some assets in a treasury for every token they sell.

Fiat backed stablecoins

Fiat-backed stablecoins are probably one of the most popular stablecoins you can find in the market. They are backed 1:1 by fiat currency.

The good thing about this stablecoin is that it's considered an off-chain asset since the collateral is not living on the blockchain.

What the issuer does is that it holds the same amount of stablecoin tokens they want to issue in a fiat currency. So if, for example, they want to use 100 tokens for $1 each, they need to reserve $100.

Crypto collateral

Crypto collateralized stablecoins are backed by another crypto. They are also known as on-chain collateralized stablecoins since the process happens on-chain and through smart contracts.

When users buy this stablecoin, they lock crypto into a smart contract and, in change, get stablecoins for the same value.

DAI, a stablecoin issued by MakerDao, is probably one of the market's most well-known crypto-collateralized stablecoin.

These types of stablecoins are usually overcollateralized to hedge against price fluctuations. That means the issuer, for example, would block $1,000 worth of ETH into a smart contract and only issue $500 worth of DAI.

With that, if the ETH price goes down, they are still protected and don't need to liquidate positions.

Algorithmic stablecoins

Algorithmic stablecoins are, at the moment, a controversial asset. They don't use fiat or crypto as collateral.

So, where does their price stability comes from? It's the result of algorithms and smart contracts that automatically and through rules manage the token circulation.

Depending on how it's built, the system will burn tokens in circulation when the price falls below a specific price point and enter new tokens in circulation if the price exceeds the one set.

LUNA, the stablecoin created by the Terra ecosystem and that entered a death spiral earlier this year, was an algorithmic stablecoin.

Commodity-backed stablecoins

These are probably the least common ones from this list, but they are an exciting asset class. Commodity-backed stablecoins are collateralized through physical assets like metals or oil barrels.

Tether Gold (XAUT) and Paxos Gold are two examples of collateralized stablecoins pegged to gold.

The exciting thing about these stablecoins is that they can facilitate investment in regions where it might be challenging to purchase a particular commodity. They also have the same compelling characteristics of the whole crypto market, like a 24-hour operating window.

Commodity-backed stablecoins are exploring the tokenization of assets and how they can create on-chain transactions for off-chain products.

However, not all stablecoins are collateralized

Something interesting about DeFi and Web3 is that's ever evolving. A new project, Reflexer is launching a non-collateralized stablecoin.

And how can they not be collateralized and still have a stable price? If you think about it, it's the same as with most fiat currencies that aren't really pegged to anything but still hold their value.

If you are interested in how they work you can read more here.

And why they should be a part of a diversified crypto portfolio 💼

Stablecoins are highly liquid and have a stable price, making them a great asset to reduce volatility exposure.

They can also be a great investment tool for those interested in purchasing foreign currency but want the ease of access and liquid nature that crypto can offer.

Let's say that, for example, you live in Latam and hedge against inflation by purchasing US dollars. Instead of getting the fiat currency, investors could buy USDC and have a fiat-backed stablecoin that's pegged to the value of a dollar.

One of the most vital aspects of creating a crypto portfolio is using different tools and assets to build a portfolio adjusted to the investor's risk tolerance.

Stablecoins are one of these tools, and since they are price stable, they can reduce the exposure to volatility and bridge the gap between traditional markets and decentralized finances.

Also, check out: