Gm fellow Architects;

ETH is going up. BTC is going up as well. And we are seeing crypto markets swimming in a sea of green. But why are markets soaring? That's what we cover in this newsletter edition.

• Join the market outlook deep dive

• Market is soaring

• VCs and institutional investors are going for crypto

Highlights from the Arch Web3 Market Outlook Q4 2023

As crypto markets continues to evolve amidst global economic shifts, understanding its dynamics is crucial for savvy investment decisions.

We are excited to announce that the "Arch Web3 Market Outlook Q4 2024" will be published this Tuesday, offering an in-depth analysis of the latest trends, performance metrics, and emerging sectors in crypto and Web3.

What to Expect in the Report:

- Macro-economic context: Discover how U.S. CPI rates and interest rate projections are impacting the market.

- Crypto performance: Gain insights into the performance of major cryptocurrencies like Bitcoin and Ethereum, including their significant recoveries earlier in the year and subsequent downturns in Q3 and recent upticks.

- Web3 evolution: Explore the changes in the make up of Web3, which protocol categories are driving TVL inflows and how Real World Assets and SocialFi are changing the narrative

- Investment trends: Understand the current investment landscape, with insights into hedge fund and family office investments in digital assets.

This report is not just a collection of numbers and trends; it's a comprehensive guide to help you navigate the complex and ever-changing world of crypto.

Join Our Webinar for a Deeper Dive

We invite you to join our exclusive webinar. This session will provide a platform for detailed discussions and insights from our experts.

Enroll Now:

Don't miss out on this opportunity to stay ahead in the dynamic world of cryptocurrency investment. We look forward to sharing our findings and helping you make more informed investment decisions.

It's Beginning to Look a Lot Like a Bull Market

Following a strong performance in October, where the consolidated market capitalization of cryptoassets soared by 17% and reached $1.35 trillion—the same level as in May 2022, before Terra/Luna collapse—the positive momentum continues to gain steam in November.

But Why?

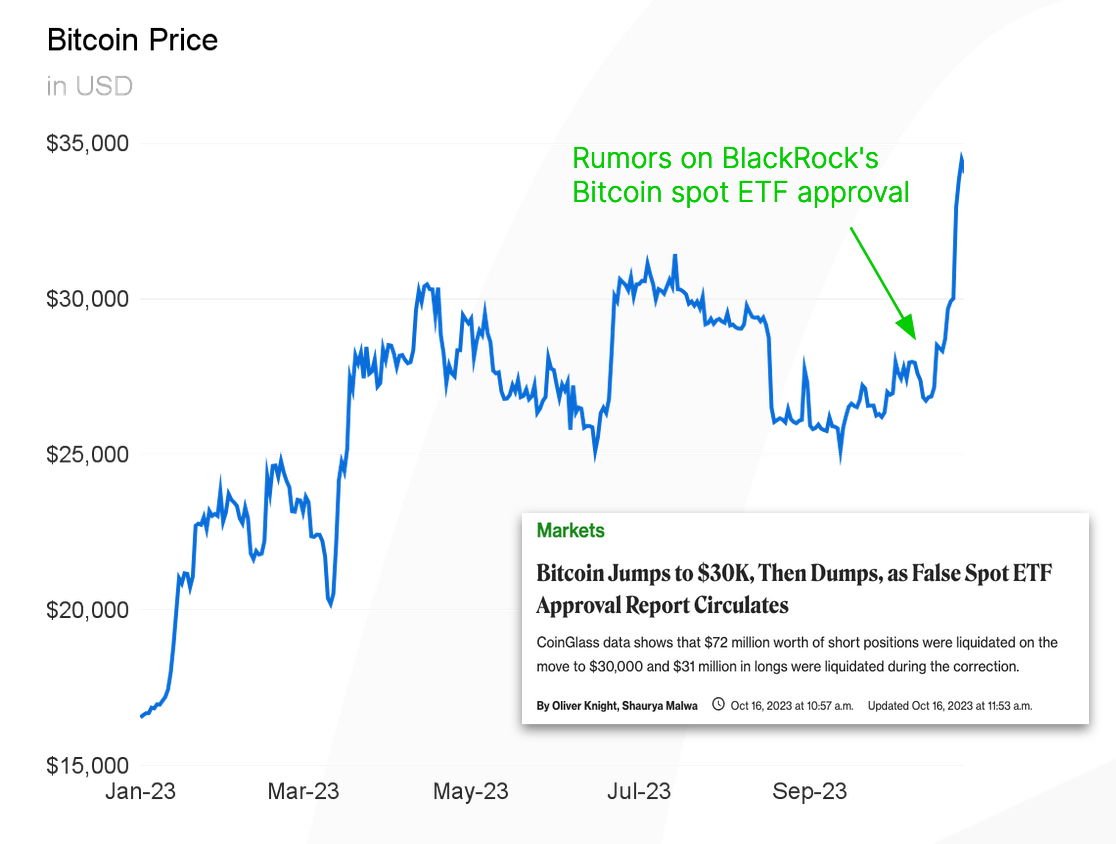

This time, optimism about the future of digital assets has been reignited by the news that BlackRock is registering documents with the state of Delaware for an iShares Ethereum product. This development has fueled expectations for an ETF from the world's largest asset manager, signaling that cryptoassets are definitely on their radar.

In response to this news, Ether, the second-largest crypto, experienced an immediate increase of 10% and has maintained a solid +8.9% performance since the announcement.

Additionally, the news triggered price corrections in several smaller smart-contract platforms, that could be seen as natural candidates for more crypto ETFs. Notably, Solana (a component of our Arch Blockchains token) surged 19%.

Show Me the Numbers

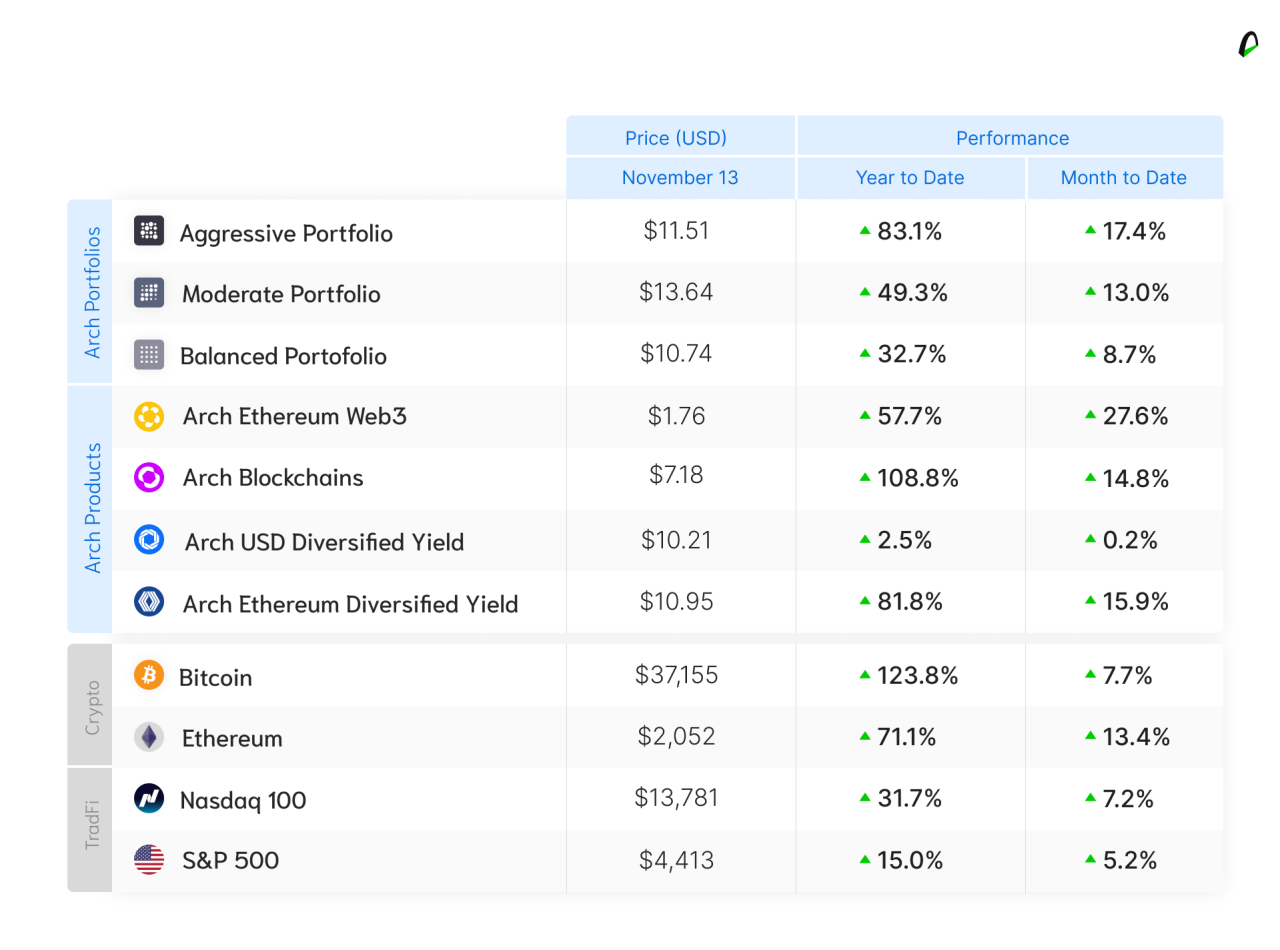

Both Bitcoin and Ethereum have recently reached new yearly highs, with Bitcoin trading at levels around $37,100 (+123.8% year-to-date) and Ethereum at approximately $2,050 (+71.1%).

The Arch Blockchains token (CHAIN), accumulates a 14.8% performance in the month, and a 108.8% performance year-to-date.

In the world of traditional risky assets, November has been marked with early optimism after signalization from the Fed's chairman that the central bank was done raising interest rates.

The more benign tone sparked positive market reactions, with S&P 500 gaining 4.5% in the first week of the month. However, the more the market indulges itself in the idea of a policy pivot, the harder the Federal Reserve pushes back, and in the last market communication, a “rates higher for longer” tone was back, reverting part of the gains. The S&P 500 accumulates 15.0% performance year-to-date, while Nasdaq +31.7%.

📰 VCs and Institutional Investors are Coming for Crypto

⏱ If you only have time for the quick and dirty

- VCs are funding crypto startups, again

- Institutional investors have investing in 6 weeks more than all they invested last year in crypto

- "Bitcoin risk-reward is in a different universe" according to Jurien Timmer, the director of Global Macro at Fidelity, one of the largest asset managers in the world.

☕️ If you want the full scoop

💰 About VCs funding crypto startups: Venture capital funding is booming this week in the crypto world, with LightSpeed Faction, Standard Chartered's SC Venture and SBI Holdings, and Maven collectively launching funds worth over $485M. This surge indicates a promising outlook for the industry, as increased capital in VC funds fuels crypto startups with more resources for innovation and growth.

💸About institutional investors going big on crypto: Institutional investors are strengthening their presence in the crypto market, pouring over $250M into digital assets over six consecutive weeks, surpassing the total inflow for the previous year. Bitcoin takes the lead, attracting $229M in inflows, while Ethereum experiences its largest inflow since August 2022. Meanwhile, other projects like SOL, LINK, and MATIC, are on the rise as well. This surge in institutional interest is attributed to the increasing likelihood of a U.S. spot-based ETF and concerns over weaker macroeconomic data, prompting questions about U.S. monetary policies.

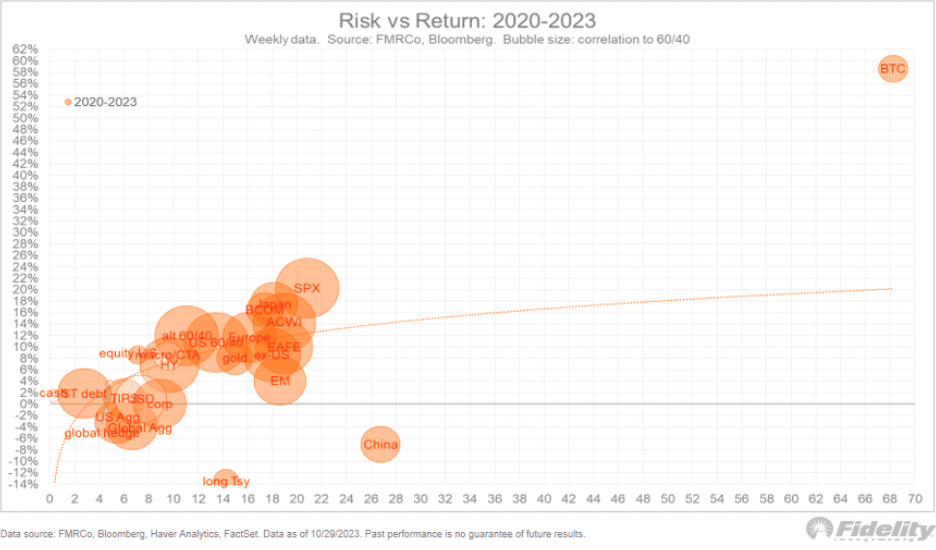

🎢 About Bitcoin risk-reward being on a different universe: Fidelity's Director of Global Macro, Jurrien Timmer, recently unveiled a risk-reward chart for various investment assets, including Bitcoin, and the conclusion is striking.

Bitcoin's risk-reward profile, as he puts it, is "in a different universe." Despite being down 54% from its two-year high, it has surged 84% from its low, leaving government bonds and many other asset classes in its rearview mirror.

Disclaimer: The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations. The views reflected in the commentary are subject to change without notice