Gm fellow Architects;

What if I told you you can now buy and sell the influencers you follow? And what if I told you that almost half of Chileans would invest in crypto as a form of savings? Yes, this edition has a little bit of everything.

• Social networks are getting a decentralized makeover

• Are we in "Uptober" yet?

• JPMorgan uses blockchain, Bitcoin could have smart contracts, and half of Chileans would invest in crypto as a form of savings.

Have you heard about Friend.Tech and SocialFi?

Crypto and Web3 have a new (very) interesting story. It's all about SocialFi and the new rising star protocol, Friend.Tech.

These platforms provide an avenue for content creators to monetize their social media following and engagement. Furthermore, the decentralized aspect brings significant advantages for creators as it ensures censorship resistance and the true ownership of their social media persona.

Wondering why this can be relevant? Well, the owner of the “X” account on Twitter lost it when Elon's company decided to change its name (spoiler alert: your social media account is not truly yours).

Sounds cool. Tell me more about Friend.Tech

Launched in August, Friend.Tech is a new Web3 social media where users purchase tokens from others users to get access to its exclusive content.

??

It's not as complicated as it may sound. A user connects their profile with their X account to verify profile ownership.

That initiates a group chat, similar to what you'd find on Telegram or WhatsApp. The unique aspect? To join a group and interact with the profile, one must purchase the user's token, named “keys” on the platform.

Once keys are acquired, users gain access to private in-app chatrooms and to exclusive content from the specific X user (aka, FinFluencer). If at any point a user decides to disengage (stop following), they have the option to sell their key.

So you are trying to tell me I can buy and sell my contacts?

Exactly! In fact, the platform markets itself as “the marketplace for your friends”. Whenever you get tired of following a friend, a company, or participating in a FinFluencer community you just sell it.

I need to know more about this

There are two key points that you need to understand:

- There's no cap on the number of keys and their price rises as more keys circulate (i.e., as an influencer gains more followers), and reduces as people unfollow.

- Each key transaction carries a 10% fee, divided equally between the content creator and the platform.

So I pay more if I go mainstream?

That's right. This model implies that joining larger, more popular communities comes at a premium, whereas entering smaller, lesser-known creators' circles is more economical. This dynamic unleashes the “investment” character a key has. Buying a key to access one's content is also an economic bet.

And what do creators win?

It all comes down to money. Content creators have incentives to enhance their reputation, provide valuable content, and engage with followers in order to grow their audience and receive higher fees.

And users?

It can also come down to money. Users might see potential in joining a community early, expecting to later sell their key for a profit.

However, users might not frequently switch communities due to considerable transaction fees (an immediate buy and sell of a key would leave you 20% worse off). Similarly, users might be hesitant to interact with low value-creation profiles, since it represents a deadweight capital or even a loss of money (in case the number of keys is reduced).

Show me the numbers

Since the emergence of decentralized protocols, numerous attempts have been made to empower the “creator economy”, after all, it's a HUGE market. Considering that an average person spends roughly 151 minutes daily on social media - that's the equivalent to 36 days per year in case you are doing the math - and only a small fraction of the money circulating through traditional platforms goes to content creators, the potential for wealth creation is huge.

The ability to redistribute value for creators is a central aspect of SocialFi and so far, Friend.Tech has definitely been the most relevant contender to show on the battlefield against Web2 companies

And how's Friend.Tech doing?

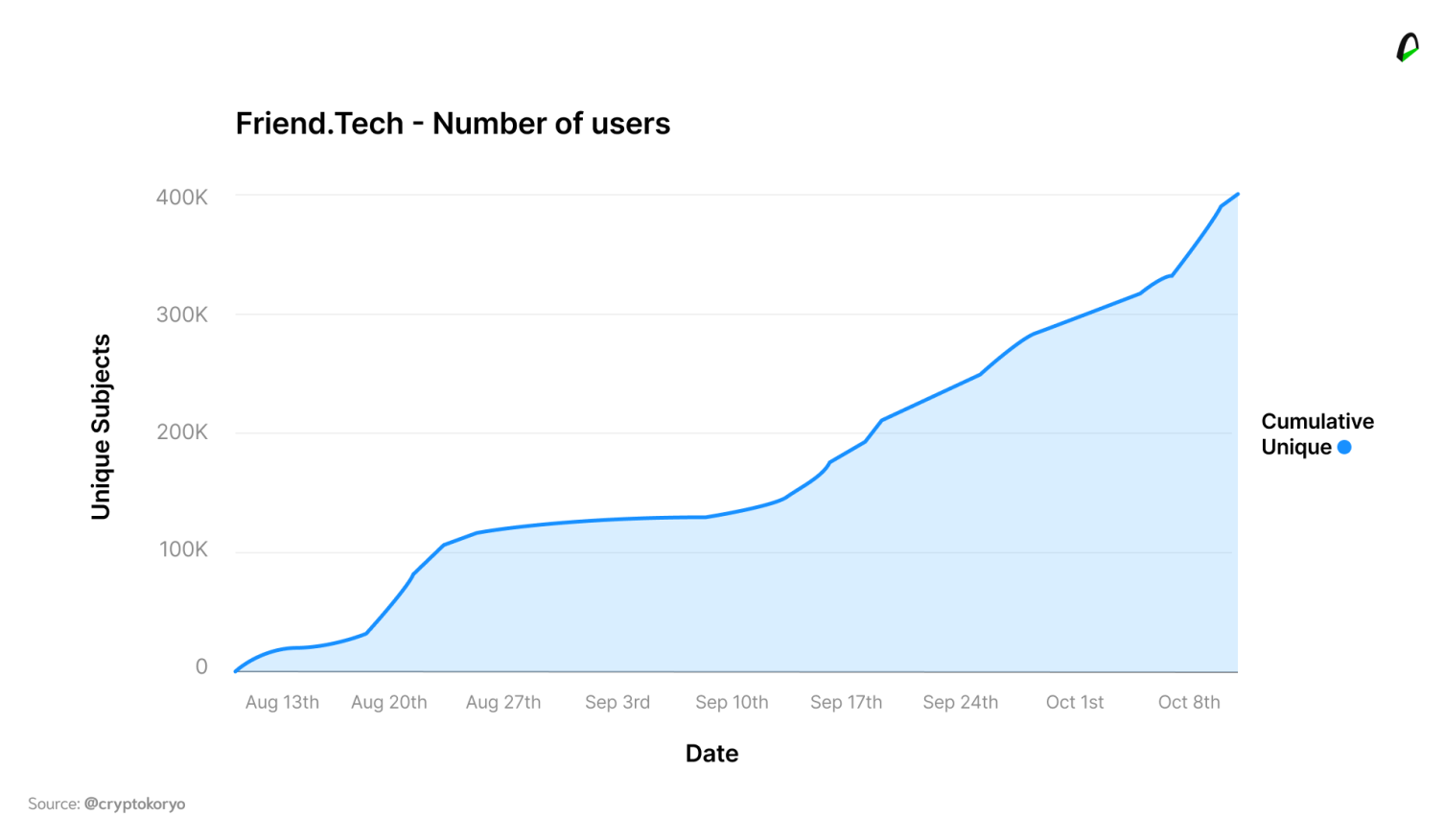

In just its first week, the platform amassed over 100,000 users. While it's currently in its beta phase and accessible only by invitation, it has crossed the 400,000-user mark, adding approximately 10,000 new members daily.

Equally impressively, the platform's revenues have overtaken some of the major established Web3 protocols like Aave and MakerDAO, totaling around $1 million per day—with half going straight to content creators.

How can I get in?

The Arch Ethereum Web3 Token ($WEB3) offers the simplest way for investors to be exposed to the most innovative protocols in crypto, in a solid and diversified way.

Are we in Uptober yet?

October has started but hasn't quite lived up to its “uptober” reputation. Historically, out of the past ten trading years, eight saw a rise in crypto prices during October, with only 2014 and 2018 showing reductions.

However, 2023 has seen a full pipeline of negative events that have put risky assets in a difficult corner. Noteworthy among these are:

- The deflagration of a large conflict in the Middle East and its potentially negative effects on energy costs worldwide.

- Persistent US inflation released data coupled with signs of a surging job market.

- The looming risk of a US government shutdown.

- China's muted economic response to stimuli and the management of the Evergrande collapse.

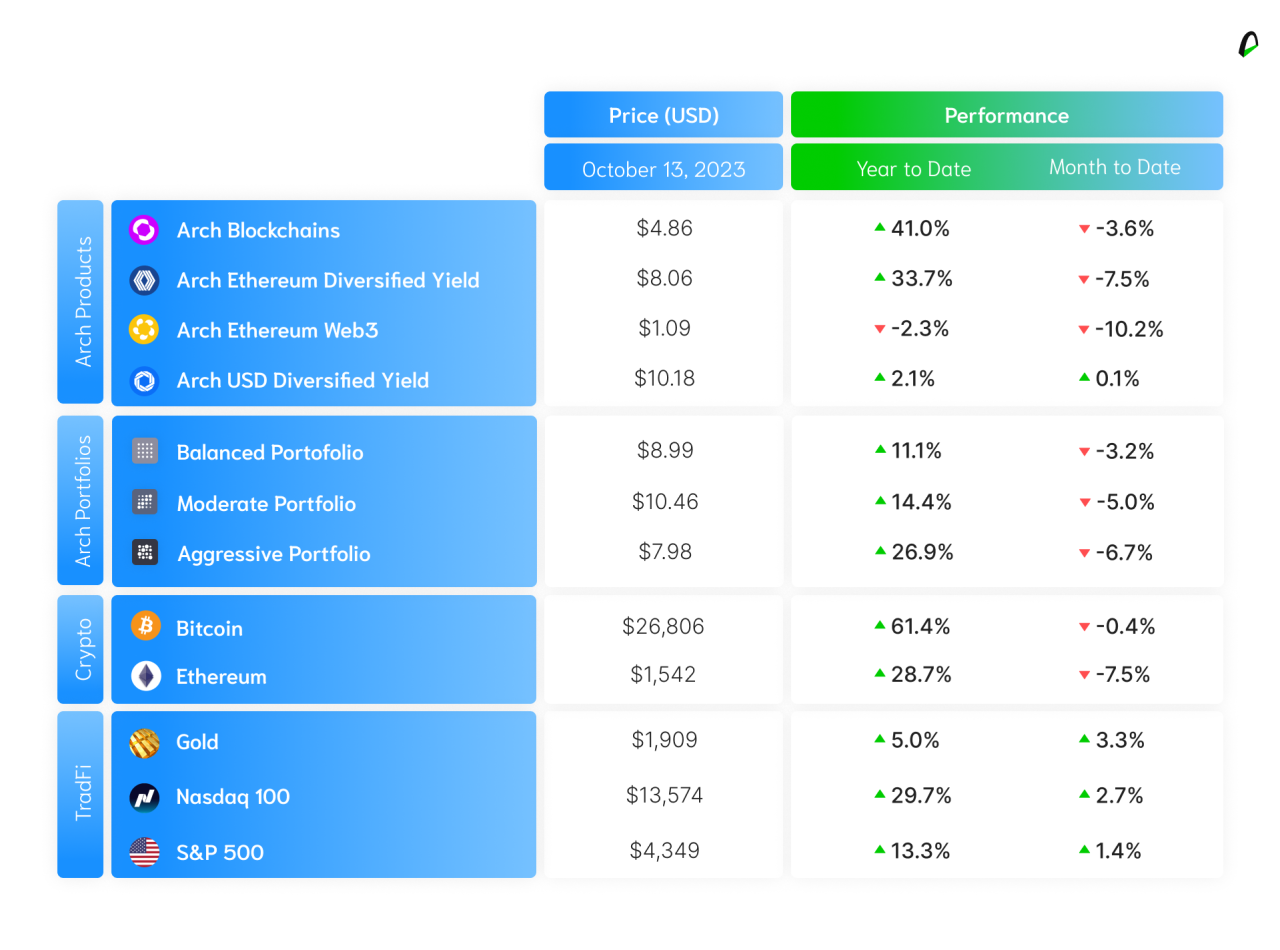

So far this month, Bitcoin has recorded a marginal decline of 0.4%, while Ethereum has dipped by 7.5%. Arch Blockchains ($CHAIN), which aggregates dominant blockchain protocols, is trailing at a moderate -3.6%.

In traditional risk-asset indices, the S&P500 has edged up by 1.4%, and the Nasdaq has risen by 2.7%. This can be attributed to Federal Reserve officials expressing concerns about the escalation of the Israel-Palestine war, which has been interpreted as a softening stance and a reduced likelihood of rate hikes in the near future.

📰 We all save in crypto

⏱ If you only have time for the quick and dirty

- 45% of Chileans would invest in crypto

- JPMorgan is now on blockchain

- Bitcoin researchers are investigating how to incorporate smart contracts

☕️ If you want the full scoop

🇨🇱 About Chile saving in crypto: According to Sherlock Communications' annual blockchain report, 35% of Latin Americans see crypto as a safe investment and 45% of Chileans would invest in crypto as a form of savings.

💸 About JPMorgan using blockchain: JPMorgan, the financial giant, carried out its first blockchain-based collateral settlement transaction. The explanation is a bit technical, but in summary BlackRock used JPMorgan's network (Onyx) and the bank's Tokenized Collateral Network (TCN) to tokenize stocks in one of its money market funds. The tokens were then transferred to Barclays as collateral in an OTC derivatives trade.

⛓️ About Bitcoin and smart contracts: Bitcoin researchers published a new concept called "Bitcoin Virtual Machine" (if it reminds you of something, it's because Ethereum has the Ethereum Virtual Machine). This machine would allow smart contracts in Bitcoin without having to make major changes to the network.

📺 Look mom, we’re on the news!

Talking about the new Bitcoin ETF

And talking about the interest institutional investors have on crypto

Disclaimer: The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations. The views reflected in the commentary are subject to change without notice