Gm fellow Architects;

It does turn out that 'time in the market' beats 'timing the market', and we bring the data to prove it. We also dive into what happened with asset prices yesterday (ahem: it was a bloodbath).

We bring all the intel you need to talk about crypto like a pro.

• If you get in and out of the market actively, chances are you are losing money.

• We saw $1B in crypto liquidations and explored why that happened.

• Stablecoins are the new it product.

Buy low, sell high is not as easy as it seems

Being a market trader seems simple, right? Buy low, sell high, pocket the profits, and start over.

Generally, people think that financial markets are volatile - especially in crypto - so there are plenty of opportunities to trade and make a living from it. Well, we have bad news for you.

Oh no, what are those bad news?

Risky markets are expected to yield strong returns over the long term, but the way they work is not linear, accumulating little by little each day.

There are numerous price swings, and especially, there are rallies, which are moments when there's a shift in the price level of trading, which are vital to long-term returns.

And why should I care?

Losing any or some of these shift moments can harm performance and undermine long-term investment strategies. This is essentially the risk of being active and frequently entering and exiting the markets.

But what if I miss the bad days?

It's true that not always being in the market also allows an investor to dodge some bad days and bear market periods.

However, since it's impossible to predict when the market will turn, an investor risks missing the recovery, which ultimately reflects poorly on long-term results.

Furthermore, investing while prices are continually falling is psychologically painful, and most people defer the investment until "things get calmer," which very often turns out to be too late. When you realize, you missed the rally.

So you are saying I can see better results if I stay in the market?

Short periods of pain in market swings should be seen as opportunities to deploy additional capital rather than invitations to actively trade.

Historically, staying invested through the highs and lows while continuously incrementing investments has generated the most competitive returns in the long run.

Show me the money

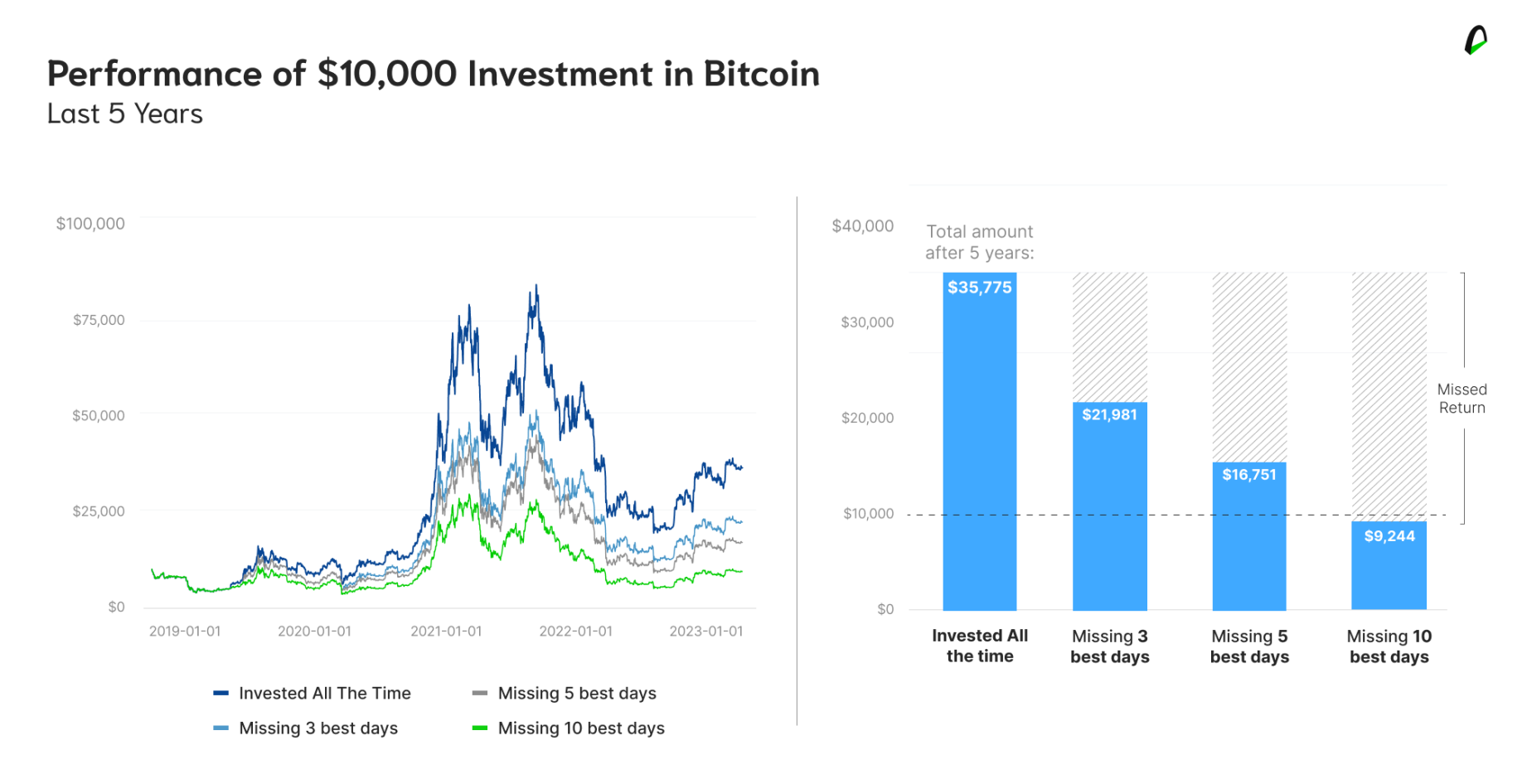

Taking Bitcoin as an example, remaining invested all the time over the past five years (roughly 1840 days) would have yielded a return of 257.7% (an annual compounded return of 28.8%). It means that $10,000 invested 5 years ago would have raised to $35,775.

If a trader had missed the three best-performing days in this period, their return would have been 54% lower, amounting to $21,981. Though not a bad performance, the large discrepancy highlights the dangers of attempting market timing.

So that means that...?

Missing ten best-performing days - a mere 0.5% of the total trading days - would have resulted in a -7.6% performance, amounting to $9,244.

And in traditional markets?

Not surprisingly, the same consequences occur in traditional risk markets.

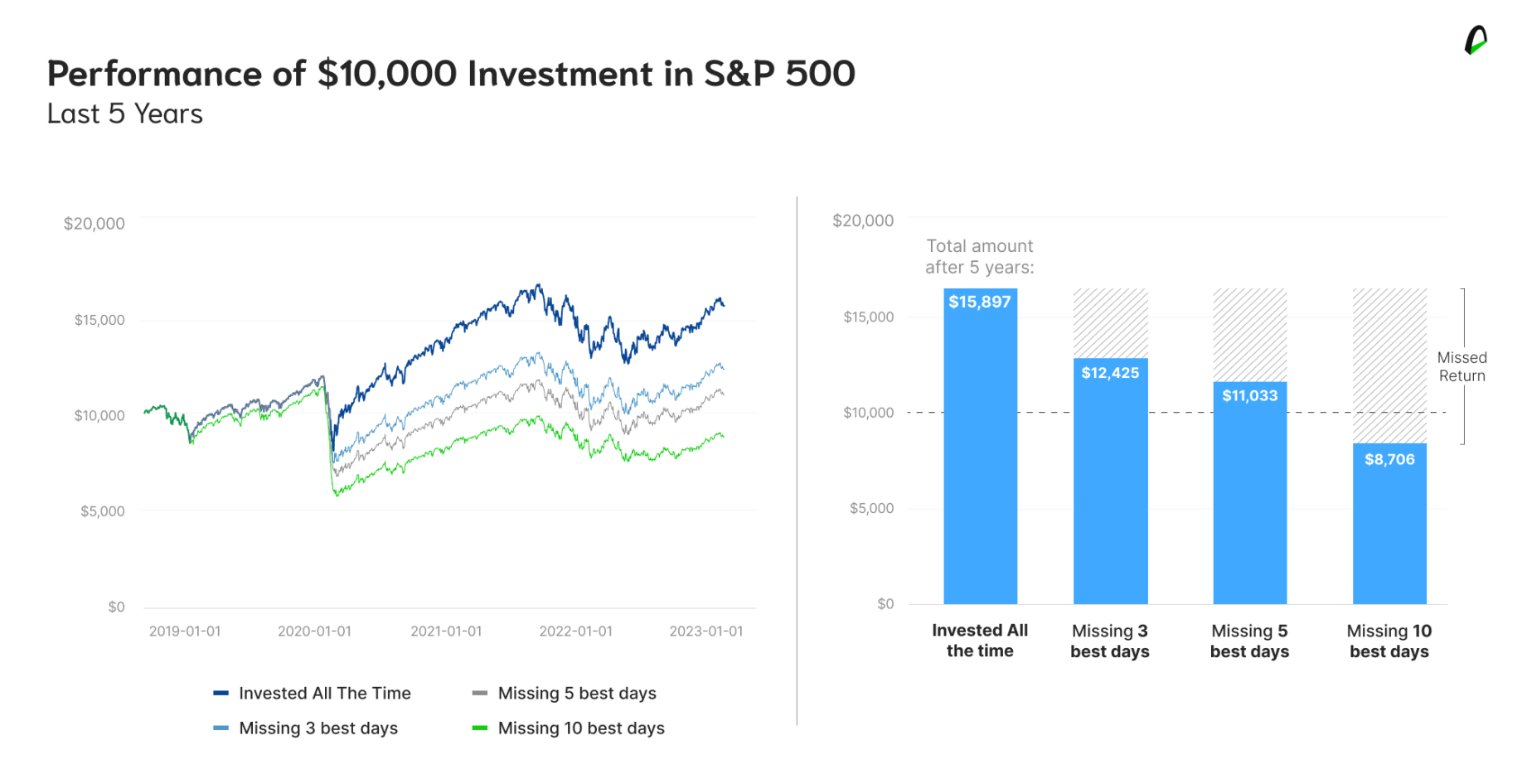

Taking the S&P 500 as an example, an investor who stayed invested all the time would have achieved a decent performance of 59% (9.6% annual compounded return) over the past five years. So a $10,000 invested 5 years ago would have raised to $15,897.

A trader who missed the three best-performing days would have witnessed only 41% of this performance: 24% of the return (or 4.4% annually), amounting to $12,425.

If the trader missed the ten best-performing days, the performance would be a depressing -13%, for a total $8,706.

I think I just need the TLDR

Missing even a few critical trading days can dramatically impact overall performance.

The historical evidence advocates for a long-term investment strategy, staying invested through various ups and down-turns.

By avoiding the temptation to trade actively, investors can avoid significant potential downsides and position themselves to capitalize on the long-term growth markets have historically provided. Ultimately, the adage of "buy and hold" (or HODL) may still be the best approach for many investors.

Hang on tight for the rollercoaster ride

August began with a lot of news about the unusual lack of volatility for the significant crypto assets. Effectively, all volatility indicators broke records for all-time lows over the last few weeks.

The following analyses were in the direction that this lack of volatility was a reflection of consolidation and accumulation by participants who are already in the market, eagerly awaiting the end of the crypto winter and potential gains ahead.

The scenario changed a bit in the last 24 hours. We once again witnessed the full force of the volatility that crypto markets offer to their participants.

And it has to do with SpaceX

A story in The Wall Street Journal about SpaceX's - Elon Musk's aerospace company - finances detailed that the company write-off a $373 million position in Bitcoin from its balance sheet and sold an undisclosed portion of the coins.

The news was followed by an intense wave of selling that, in turn, triggered the closing of leveraged positions in the futures market, further exacerbating the effects on the price, which dropped roughly 10% within a few minutes.

The total outcome for investors was the forced elimination of positions amounting to $1 billion (80% of which was in long posts).

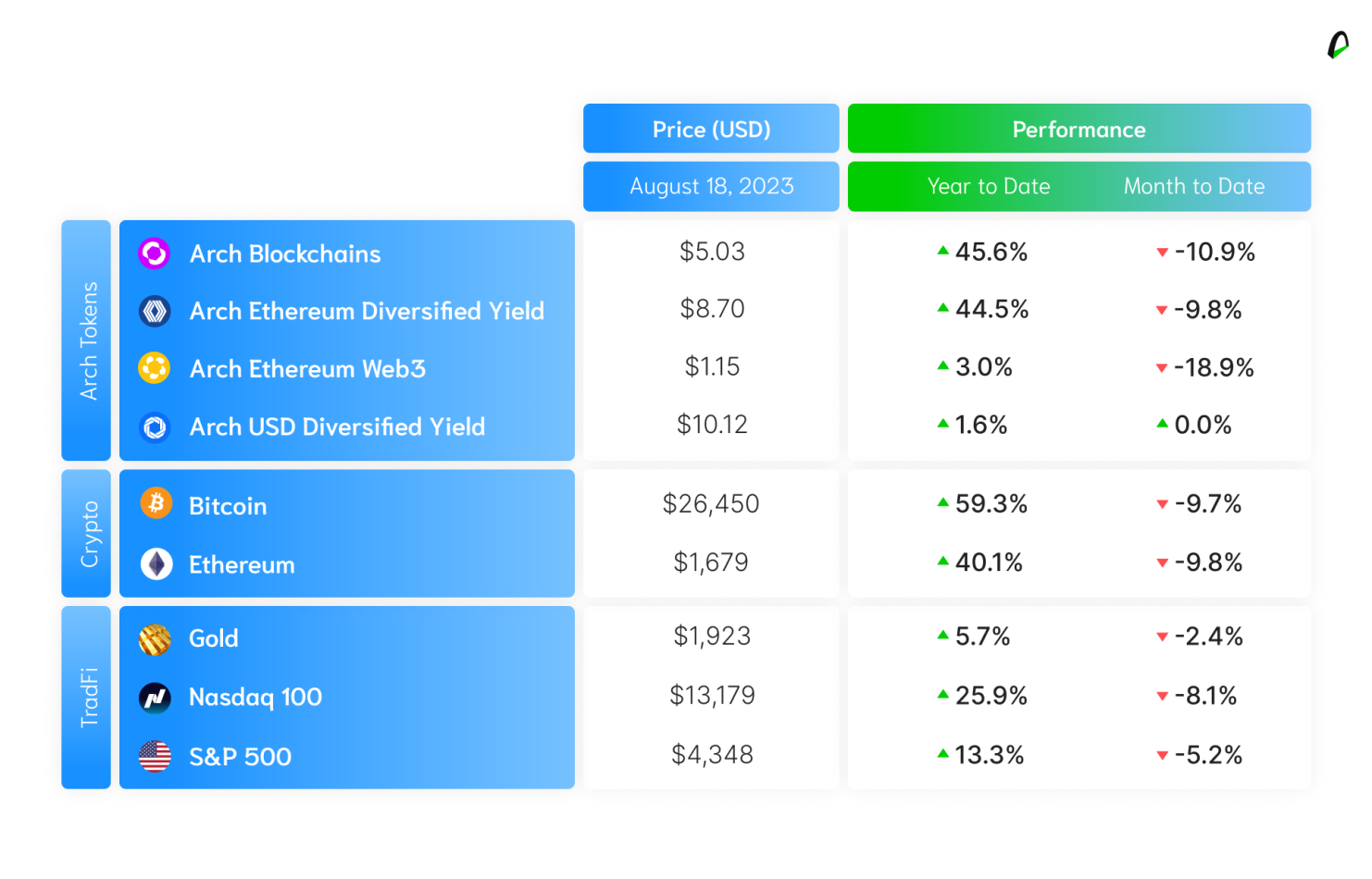

Amid the high volatility of crypto protocols, ADDY, our cash token that offers diversification and yield in dollar-pegged stablecoins, remained flat during the month and has shown a performance of 1.6% during 2023.

📰 Stablecoins just became mainstream

We had quite a day. Prices crashed yesterday, and $1B in crypto was liquidated, so much so that yesterday saw more liquidations than the ones we saw during the FTX collapse.

But that's not the only thing that happened to crypto.

⏱ If you only have time for the quick and dirty

- PayPal 🤝 crypto. The payments giant launched its stablecoin

- The SEC wants to come back for XRP (yes after a judge ruled in XRP's favor)

- Trump is, apparently, an NFT millionaire

☕️ If you want the full scoop

🪙 On PayPal dabbling into stablecoins: They've just unveiled their USD-pegged crypto called PayPal USD (PYUSD). A stablecoin is like a crypto cousin of the US dollar but with a cool twist. It's built on the Ethereum blockchain.

PayPal's stablecoin debut has everyone crossing their fingers for more precise crypto regulations in the US, and some exciting adoption, while some critics are buzzing about how PYUSD might be too cozy with centralization.

🥊 On round 2 of the SEC Vs. Ripple: A federal judge - Judge Analisa Torres from the U.S. District Court for the Southern District of New York - has granted the SEC the opportunity to appeal. This appeal aims to challenge her previous ruling, which stated that Ripple hadn't violated securities laws when making XRP accessible to retail traders through exchanges.

As legal proceedings continue, the industry watches with interest to see how the SEC's appeal will impact the outcome of the previous ruling.

🧑🎨 On Trump being an NFT millionaire: Fresh disclosures have shed new light on former President Donald Trump's involvement in the crypto world, revealing a larger stake than previously known. According to official documents received by the governmental ethics watchdog Citizens for Responsibility and Ethics in Washington, as of early August, Donald Trump held a substantial $2.8 million in a crypto wallet.

It also turns out that, despite being a skeptic when he was a president, Trump isn't just a holder – he's also a collector. The former president raked in a noteworthy $4.87 million in licensing fees from his non-fungible token (NFT) collection.

🗞 In other news - Powered by The Defiant

- Coinbase Wins Approval to Offer Crypto Futures to US Clients

- Singapore Finalizes Regulatory Framework For Stablecoins

- PayPal Teams Up With Ledger On Fiat Onramp For US Users

📺 Look mom, we’re on the news!

Analyzing what's been happening with crypto markets

And talking about how high-net-worth individuals are interested in crypto now more than ever

Disclaimer: The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations. The views reflected in the commentary are subject to change without notice