Gm fellow Architects;

Crypto won a big battle with the SEC, the FED is launching a blockchain instant payment service, and a third of Family Offices already have crypto on their portfolios.

We bring all the insider information you need to talk about crypto like a pro.

• Family offices and high net-worth investors include crypto in their portfolios (and get better performance).

• Ripple Labs wins a crucial legal battle in the name of crypto.

• Japan and Turkey investors are going all in on crypto, NFTs continue to rise, and we follow up on the TradFi/SEC saga.

A third of Family Offices worldwide already have crypto in their portfolios

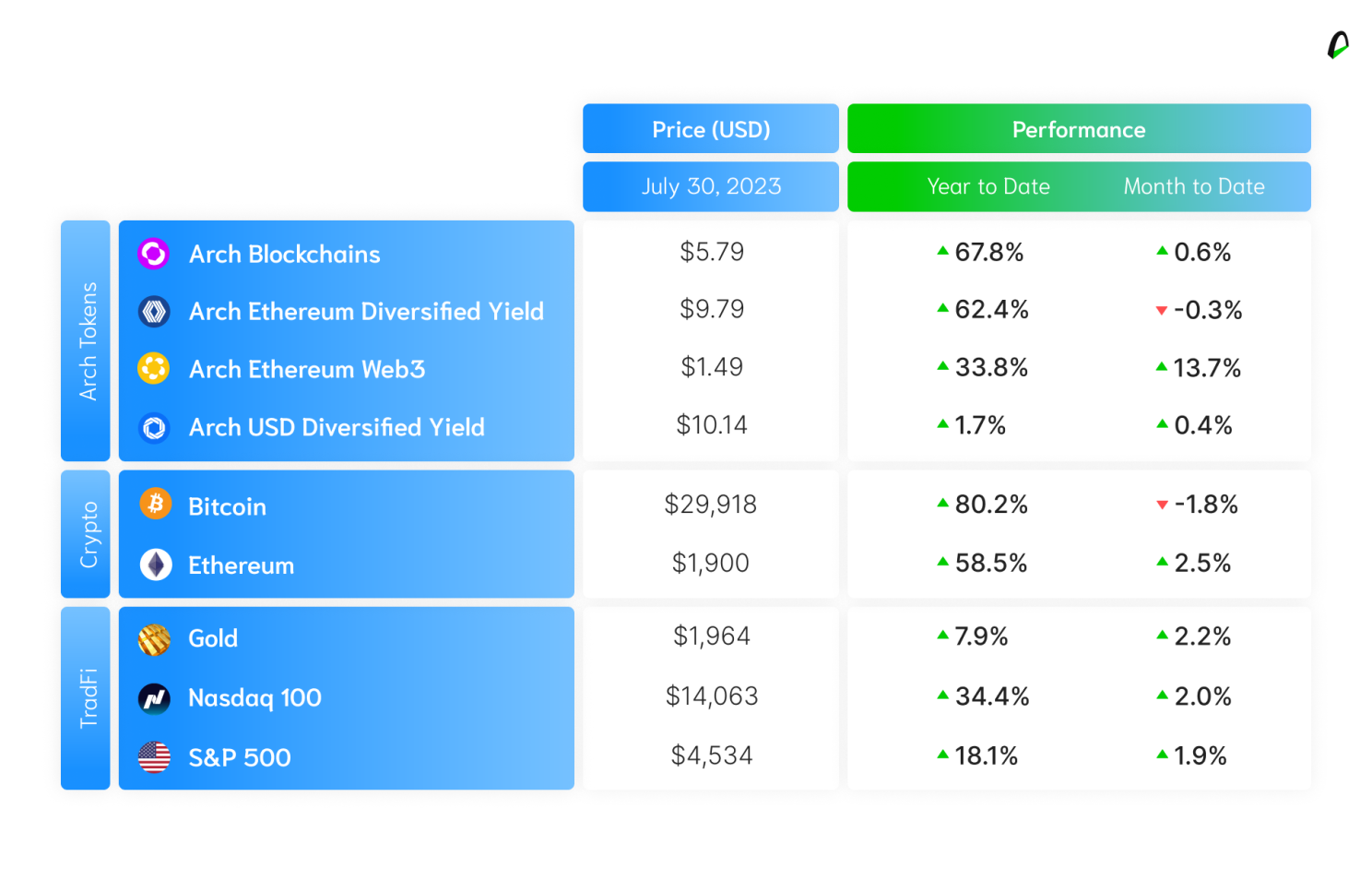

Despite their relatively short existence - with only 14 years since Bitcoin's launch and eight years since Ethereum's launch - these digital assets have showcased their potential by delivering historically high returns and exhibiting low correlation with other asset classes.

Let's deep dive into what professional investors think, please

Well, a report from Goldman Sachs reveals that 32% of Family Offices worldwide contemplate adding cryptocurrencies to their investment portfolios.

This marks a significant shift in the mindset of high-net-worth and professional investors who recognize the potential of this emerging asset class.

And what about high-net-worth investors?

They like crypto too. A Bank of America survey indicates that high-net-worth investors under 42 are particularly enthusiastic about digital assets, making them the most popular asset class within this demographic.

But why?

Short answer: High returns, decreasing volatility, low correlation to other asset classes.

Long answer: According to our most recent research, the combination of Bitcoin and Ethereum has historically provided high returns, with a Compound Annual Growth Rate (CAGR) of 40.51% over the last five years.

Moreover, these assets demonstrate a low correlation with other classes, with a correlation coefficient of 0.15 for Bitcoin compared to Nasdaq. This makes them attractive choices for diversifying investment portfolios.

Tell me more about this study

Simulation analyses of traditional portfolios (comprising 60% stocks and 40% fixed income) that include a modest allocation to cryptocurrencies (between 1% and 5%) have shown significant improvements in portfolio performance.

Both absolute and risk-adjusted returns have historically benefited from such an allocation, rebalanced quarterly.

For instance, a portfolio with a 2.5% allocation to crypto would have achieved an annualized rate of 9.70% and a risk-adjusted return (Sharpe ratio) of 0.87. A traditional portfolio would have only returned an annualized rate of 6.51% with a risk-adjusted return of 0.63.

But what about volatility?

Here's where things get interesting. Although cryptocurrencies were once known for their high volatility, there has been a noticeable decrease. Annualized volatility, around 130% in 2013, has now dropped to 55% in 2023.

As demand for cryptocurrencies rises and more institutional players enter the market, this downward trend is expected to continue, making them appear more attractive to traditional investors.

That sounds nice, but what about the portfolio's performance and risk metrics?

Despite the significant price fluctuations of cryptocurrencies, a 2.5% allocation to crypto has only led to a minor deterioration in the maximum drawdown metric over the past seven years (-23.98% versus -22.36% for the traditional benchmark portfolio).

Additionally, the proportion of positive versus negative months has improved with the inclusion of crypto, indicating a greater degree of diversification.

In plain English, please

Data supports the notion that a modest allocation to cryptocurrencies can substantially enhance portfolio performance, improve risk/return metrics, and contribute positively to overall performance.

As cryptocurrencies evolve and gain wider acceptance, they become an increasingly attractive option for professional investors.

I want in

If you also want to know how crypto could fit into your portfolio, schedule a meeting with Nicolas Jaramillo, our Co-Founder, who can answer any questions you may have.

You lose some. You win some. And this time, crypto won

The past couple of weeks were full of themes in crypto. Once again, the U.S. financial regulator - the SEC - is in the middle of it all. But this time, the SEC has lost a critical court case that many see as a big win for crypto companies and the industry.

It's Ripple's time

On July 13th, a judge in New York said that Ripple Labs didn't break any federal laws when it sold its XRP digital currency to the public.

This decision is the complete opposite of what the SEC accused Ripple of, making it a significant milestone in a lawsuit that's been going on since 2020.

And why it's a big deal for crypto

This legal win is a big deal for the crypto world. It gives projects more power to question the SEC's control over their offerings when they're made public.

Even though the SEC might still be able to challenge this decision, doing so could help clarify how much power the SEC really has to regulate crypto companies and protocols.

Markets loved it

It's clear that the court's decision has had a positive effect on Web3 protocols, especially those tokens that the SEC had previously marked as securities.

XRP - the directly related token - is up 66%, while Solana and Matic (two of the most significant token tagged as security) are 17% and 7% up since the resolution came out.

In the middle of all this, Arch Ethereum Web3 has seen a 10.5% increase in the last two weeks, making its total gains in 2023 a solid 29.8%.

📰 Let's take a look at what's going on with crypto

You can consider this the spar notes version of all the news surrounding your favorite asset.

⏱ If you only have time for the quick and dirty

- The Fed (yes, THE Fed) launched today a blockchain-based payments system

- Nasdaq pushes back the crypto custody service. The SEC finally accepted BlackRock's ETF application

- Japan and Turkey are falling in love with crypto

- Even National Museums are launching NFTs

☕️ If you want the full scoop

🔵 On the Fed launching a payment service: Introducing FedNow, an instant payment system that allows banks and credit unions to transfer money 24/7. JP Morgan and Wells Fargo have already signed up.

The good news for crypto? It's using the Metal blockchain, proving again that blockchain technology is here to stay. The bad news? Many think that government and crypto go together like oil and vinegar (aka they don't mix), which could lead to other things like CBDCs and more surveillance.

🪙 On the TradFi saga: Last year, Nasdaq said it was launching a crypto custody service for institutional investors. This year? They said they are parking their plans for a while. The reason? An unfriendly regulatory environment.

But on more friendly news, the SEC officially accepted BlackRock's Bitcoin ETF application. And now? We just sit and wait for the verdict.

🇯🇵🇹🇷 On Japan & Turkey: The yen is depreciating heavily, and it's actually registering one of the most severe exchange rate turbulences on record. That's a lot. Japanese investors are turning to crypto, increasing the Bitcoin trading volume on Japanese exchanges from 69% to 80% in the first six months of 2023.

Turkey is in a similar boat, with the Lira (their national currency) losing around 30% of its value against the dollar; they also have a 40% inflation rate, so Turkish investors are also turning to crypto. This shows that crypto is proving to be a hedge when things go south.

🎨 On NFTs and everyone launching one: One of Spain's National Museums is launching an NFT collection featuring masterpieces from Vang Gogh. Puma and Roc Nation (that's Jay-Z entertainment company) are dropping a "digitally-enhanced" shoe that comes with and NFT and exclusive music content and mixtapes. And Doodles, one of the most significant NFT projects, is launching a real-life play experience that's looking to offer a "part toy store, part venue, part immersive theater space" experience in Chicago. The line between digital and real is becoming more blurry by the minute.

🗞 In other news - Powered by The Defiant

- Aave launches GHO stablecoin on Ethereum mainnet

- DeFi assets consolidate gains as market cools

- MetaMask to support cross-chain interactions with 'Snaps' by 2024

📺 Look mom, we’re on the news!

Talking about Bitcoin's price rally

And sharing some cool insights about our study on Family Offices' increased interest in crypto.

Disclaimer: The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations. The views reflected in the commentary are subject to change without notice