In here we share what's the NEST Protocol, how it works and everything you need to know about the NEST token.

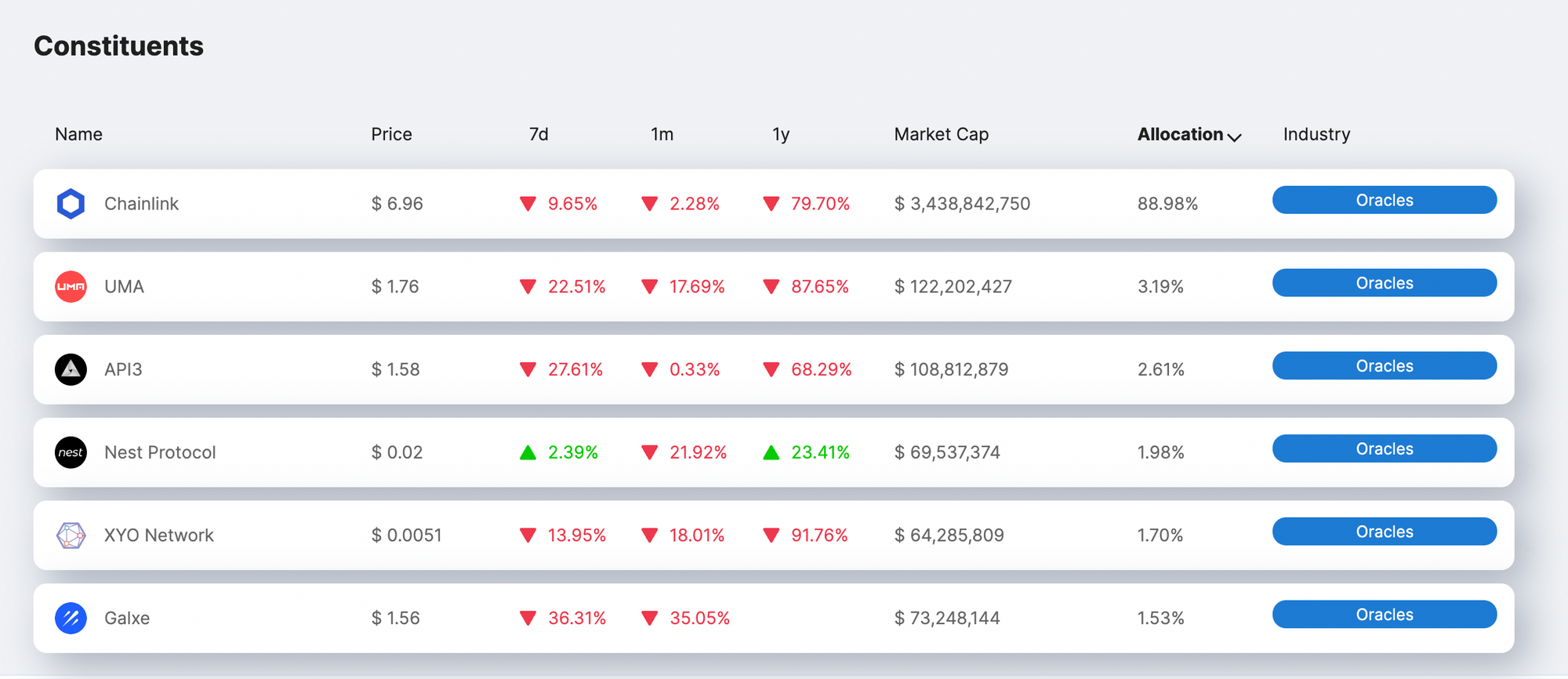

NEST Protocol is a price prediction platform based on the Ethereum blockchain. It aims to provide reliable information and data to DeFi projects and is part of the Arch Oracle Industry Index.

The NEST token in the NEST protocol's native token is used to meet the liquidity need of the platform.

The company uses a unique "quote mining" system to synchronize off-chain value information on-chain.

But before diving deeper into what NEST protocol is and what they want to do, let's understand what an oracle is.

What's an oracle

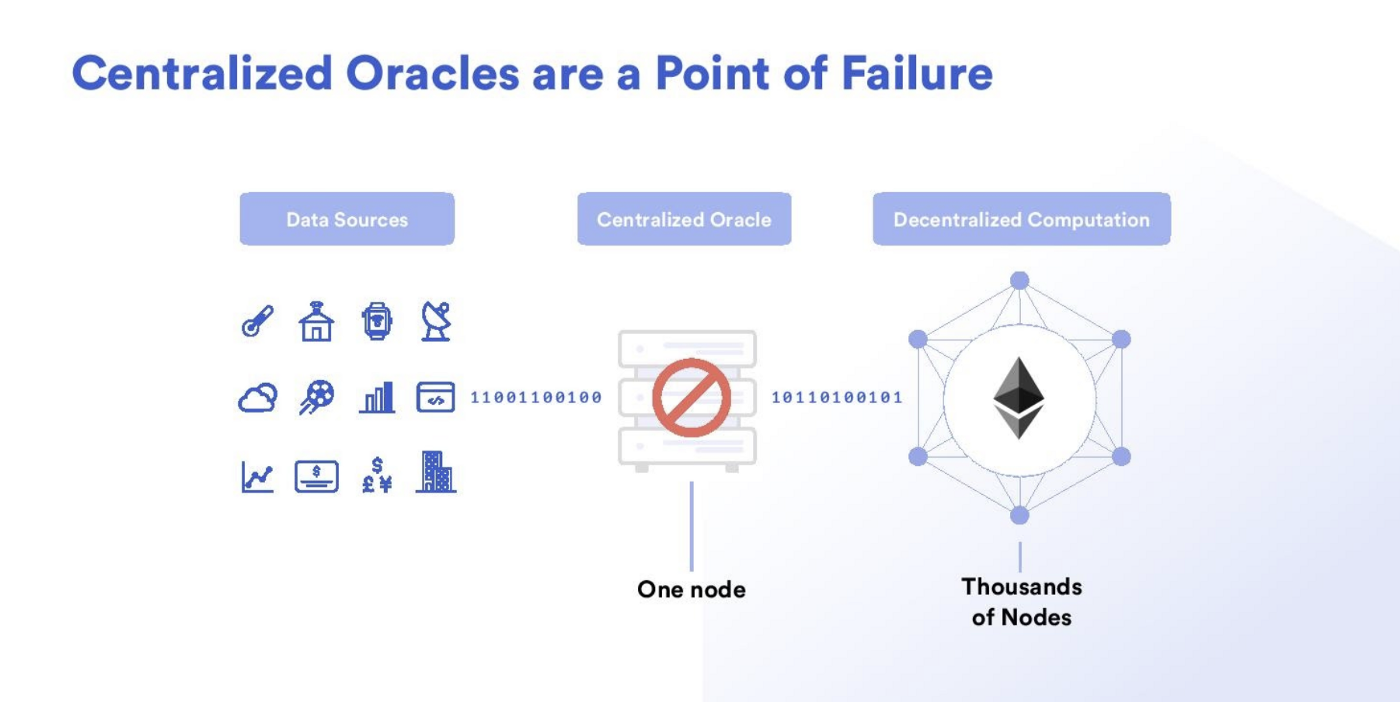

Oracles are lines of code that connect real-world information with contracts and other agreements on a blockchain. They serve as a bridge between the chain, every interaction on the blockchain, and the off-chain data.

This connection allows smart contracts, or lines of code that initiate unstoppable commands, to execute transactions based on information not on the blockchain, such as interest rates, temperatures, and third-party lists, safe in the knowledge that the information has not been manipulated.

Oracles are not the source of real-world information but instead collect it from existing databases and reliably communicate the data to the blockchain. The relationship between oracles and blockchains is reciprocal. Oracles can receive data on-chain for distribution to external applications, such as banking applications.

Decentralized oracles, such as NEST Protocol, solve the problem of off-chain data by giving blockchains access to real-world information without introducing a single point of failure. They do this by using distributed data sources to avoid single points of vulnerability.

And what's NEST Protocol

The NEST Protocol is an Oracle-distributed pricing network based on the Ethereum blockchain that uses a unique "quote mining" mechanism to ensure that off-chain data is synchronized with on-chain prices.

An Oracle Distributed Pricing Network provides price information outside of the blockchain in a decentralized manner, without a single point of entry or governing body.

NEST Protocol also allows anyone to build their own oracle solution providing investors with customizable stochastic information-based assets through the OMM mechanism and PVM.

How NEST Protocol works

The NEST protocol is based on a price reference system called "quote mining." This system allows users to participate and use NEST tokens, encouraging a more balanced network distribution and promoting a trustless system. There are three main network participants.

Miners

Miners are the users that provide price quotes to the network. They also secure a specific asset value and pay a commission receiving NEST tokens as a reward.

Verifiers

Verfieirs accept the quotes price the miner sent and lock a larger volume of the assets. If the quoted price the miner sent is different from the market price, verifiers trade the price and submit a new one to the chain.

Price callers

They are the DeFi protocols or institutions that pay a fee to NEST Protocol to use this information.

Price oracles are one of the pillars of the DeFi industry. However, some Defi projects use price data obtained from decentralized exchanges, but since the trading volume on these exchanges is low, the price data can be manipulated and attacked.

Oracles like NEST Protocol confirm whether the price data is accurate and timely, and the solution must be decentralized to ensure it's open.

The NEST token

The NEST tokens are used as economic incentives within the NEST Protocol.

The tokens are issued on the Ethereum blockchain, following the ERC20 standard. The maximum number of NEST tokens is set to 10 billion.

What's unique about the NEST project is that the tokens are not issued in advance and can only be issued through quote mining, with quote miners receiving the tokens as a reward. Additionally, fees charged by the Ethereum network when submitting quotes will be returned to token holders, encouraging users to keep their NEST tokens.