With the Ethereum Merge inching closer by the minute, staking is also becoming more popular.

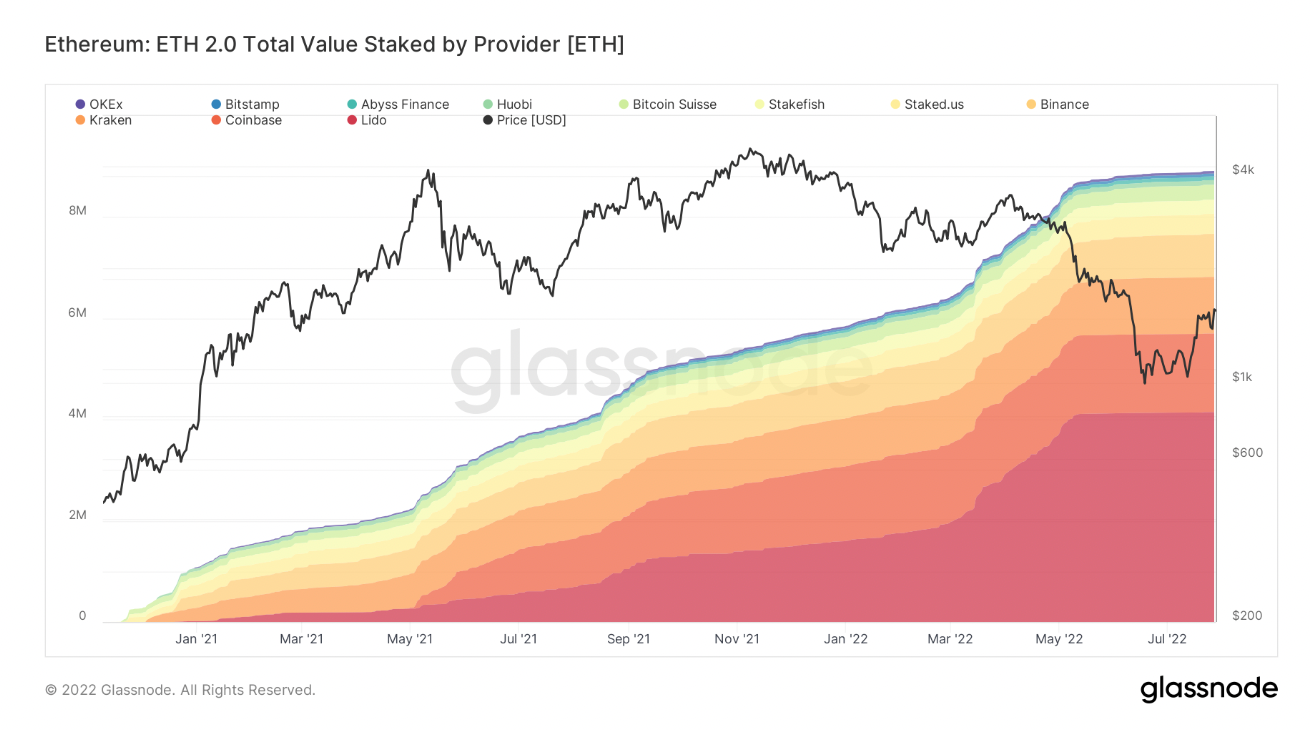

Lido, a platform that makes it easier for investors to stake in Ethereum without minimums, has been making headlines. Their native token price is rising, and the amount of staked Ether they have on the Ethereum blockchain is more than 30% of the whole pool.

In this post, we explore what Lido is, how it works, and the tokenomics behind LDO, their native token also part of the Arch Ethereum Web3 token.

But first things first, what's Lido

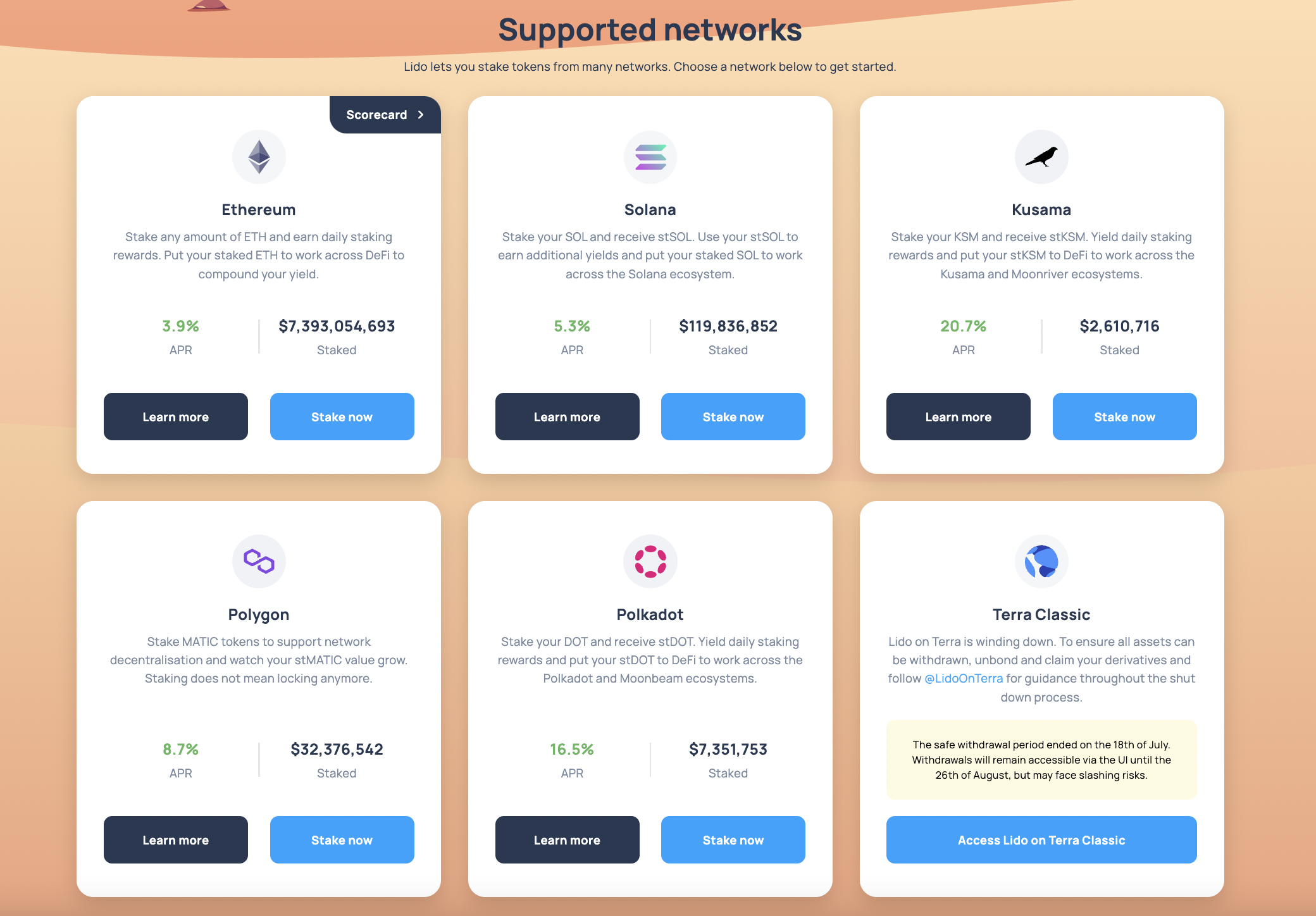

Lido is a platform that, initially, provided the possibility of performing "liquid staking" in the "Beacon Chain," the Ethereum Proof of Stake network. However, the project has evolved, providing staking solutions for other networks.

As many will already know, Ethereum is undergoing a transformation process. It will go from a Proof-of-Work network, where miners deliver their computational power and electrical energy to validate transactions and create blocks, to a Proof-of-Stake one.

Ethereum's new consensus mechanism will become Proof of Stake. With this new consensus mechanism, miners will change to validators. Instead of solving that complex mathematical formula that leads to the creation of a block, the new block's creator will be selected randomly through an algorithm designed for that purpose. But will anyone be a validator? Of course not.

To be a validator, it's necessary to stake (similar to a deposit) 32 ETH as collateral. In case of not complying with the rules, the validator will be penalized with a removal of his stake.

Lido allows participants to stake any amount of ETH instead of requiring a minimum. Through their liquid staking platform, they look to increase the participation of retail investors in the staking process.

What is liquid staking

Proof-of-Stake (PoS), and staking, are transforming the way blockchains work.

Staking innovation is transforming the functionality of the blockchain. As an alternative to the high energy consumption and highly competitive nature of Proof-of-Work blockchains, PoS Blockchains allow for better energy efficiency: an estimated 99.95% reduction in energy use.

Instead of competing against miners, crypto owners stake a portion of their crypto for a chance to be chosen as a validator and win associated rewards. As blockchains move to PoS, staking has lowered the barriers to entry for many cryptocurrency enthusiasts.

But staking hasn't completely removed the barriers. One of the main reasons why cryptocurrency holders are reluctant to stake is because of the lock-up period and the minimum amounts required.

How do you get crypto owners on board while allowing them to continue using their assets? Liquid staking has the solution by providing those who stake their crypto with a derivative token that they can use in other yield-generating activities, such as DeFi.

To participate in staking directly through Ethereum, users need 32 ETH. They also need to set up a validator which can imply a prohibitive investment of time and hardware for the "common" user.

Most crypto-users cannot carry out such a task and don't have 32 ETH in their wallets either.

Lido pursues the goal of allowing this vast group of people to participate in the rewards of block validation in Ethereum without meeting any of these requirements.

In Lido, users can deposit their ETH, choose a validator who will receive it, and get a return. And get an estimated between 4 and 5% for participating in validating blocks in the Beacon Chain.

The "liquid" characteristic of the staking that users can do on Lido is given by the possibility of having funds immediately. But how does this happen?

Users who select a validator and deposit our ETH on Lido receive a token in return.

This token, stETH, is the representation of the staked ETH. Through different mechanisms, such as liquidity pools, stETH maintains a 1:1 parity with ETH and its price.

Users can then use their stETH for any yield-generating activity, making the staking through Lido liquid staking.

How Lido works

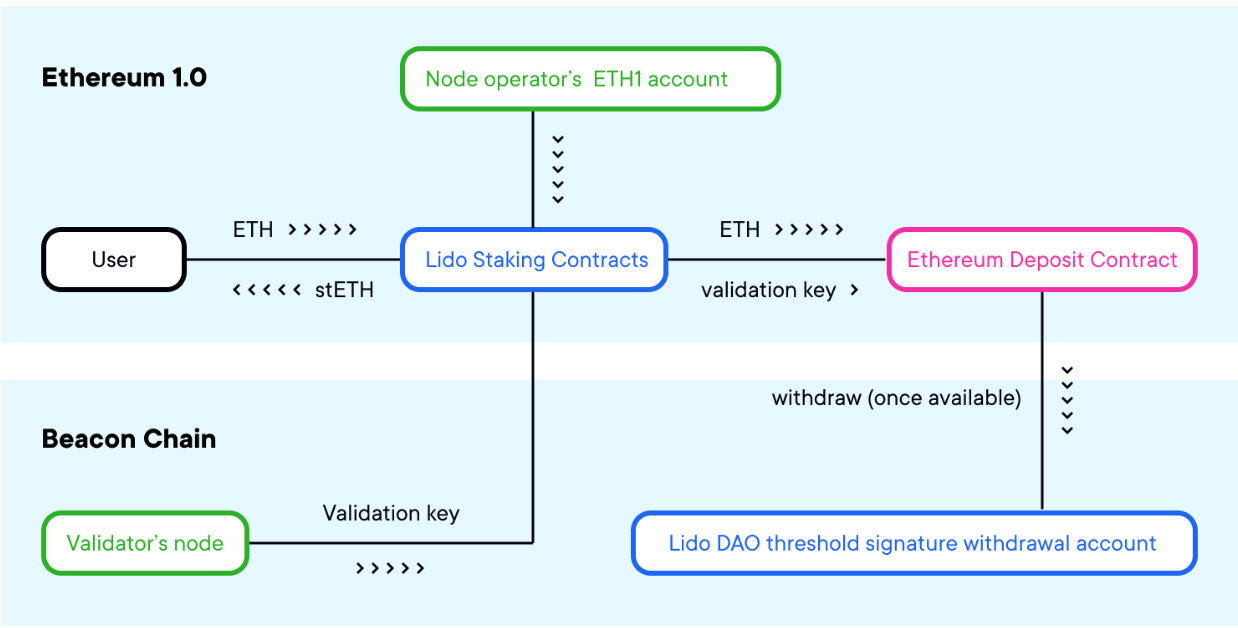

After users click "deposit" on the Lido interface, send their tokens to the protocol's staking contracts. These contracts pool all user funds and then distribute them to DAO-selected node operators, of which there are currently nine in batches of 32 ETH.

These node operators are the entities responsible for managing and maintaining the validators, which means that they are the ones that manage the Ethereum staking.

There are two essential things to note about this system:

- As user funds are made in a communal pool, if there were penalties for mismanagement of nodes, they would affect all users. Lido minimizes this risk by dividing the management of the nodes into various entities.

- On the other hand, it is essential to mention that the node operators do not have access to the funds. That is, they cannot withdraw them. What they have is a public validation key that allows them to stake on behalf of users.

Lido is said to be non-custodial as 'sensitive' information such as withdrawal keys is registered in a smart contract and under the control of the DAO.

In addition to doling out tokens among node operators, Lido smart contracts are also responsible for issuing and burning stETH tokens, Lido's staking derivative.

The stETH relates 1:1 to the ETH deposited for staking and the accumulated rewards.

The LDO token

LDO token is the native token of the platform, and its tokenomics depends on it.

The token supports the protocol's voting and governance system, two factors that affect the economic variables the protocol applies to the staking pools it helps.

For example, if the ETH staking pool offers a 3% APR (interest rate), it is through the DAO and the decentralized governance it exercises. The community can change the performance values of the said pool to adapt it to the economic and financial reality of said pool.

Therefore, LDO makes it possible to make the decisions that govern the protocol and maintain its operation.

Lido simplifies ETH staking, making it as easy as any other DeFi protocol, transferring technical and loss risk to world-class operators.