The Ethereum blockchain is close to a radical change. The merge is looking to make that blockchain more eco-friendly and ether (ETH) deflationary. But what it's going to happen? And how will it impact the value of ether?

Ethereum is the second largest cryptocurrency in the world in terms of market cap, only behind Bitcoin. Since its launch, this blockchain has become preferred for hosting decentralized finance projects, NFTs, and fan tokens. And this year, it will make its most significant evolutionary leap thanks to the merge.

What is the merge

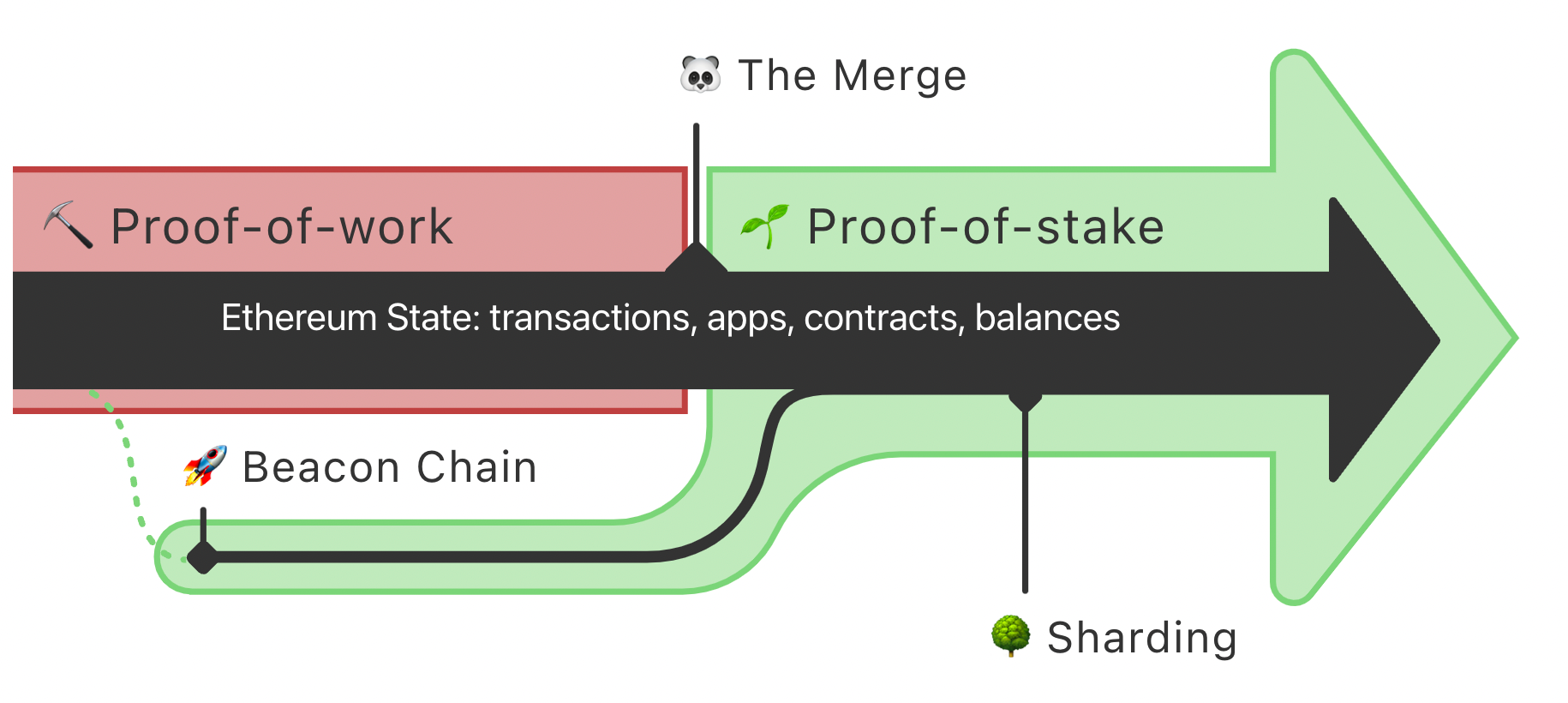

The merge is the name that has been chosen to identify the transition process of Ethereum from the Proof-of-Work (PoW) system to Proof-of-Stake (PoS).

The most salient point of this change – at least for the general public – is that it will no longer depend on miners to add new blocks to the blockchain but on validators.

The Ethereum merge is a hard fork that moves the consensus on all blocks from the current PoW chain to the already running PoS layer called the Beacon Chain.

Launched in late 2020, Beacon Chain has been running parallel to the Ethereum Mainnet.

After the merge is implemented, the roadmap contemplates the implementation of sharding. This means breaking the blockchain into pieces or shards. In this way, nodes will deal with smaller amounts of data rather than addressing the entire blockchain as they usually would.

So more transactions can be processed simultaneously without significant sacrifices to security or decentralization.

Sharding will help increase the speed of transactions, which is a crucial step in increasing capacity. However, this won't happen to at least 2024.

With Ethereum currently limited to around 30 transactions per second (TPS), the network is often congested, driving up gas rates. With the sharding, along with other technical updates, the hope is that the TPS can be increased to 100,000 per second.

That's a high-level summary of the substantial technical overhaul of the merge. Still, the goals are much simpler to articulate: increase sustainability and make the token deflationary trough a burn mechanism.

The part were news outlets speculate about lower gas fees? That won't happen until the sharing is implemented.

It's important to note that the merge will not affect gas fees, one common misconception that has been repeated.

According to the Ethereum foundation

Gas fees are a product of network demand relative to the capacity of the network. The merge deprecates the use of proof-of-work, transitioning to proof-of-stake for consensus, but does not significantly change any parameters that directly influence network capacity or throughput.

Why is this change necessary

The move to PoS consensus on Beacon Chain is a further step towards Ethereum's long-term vision mentioned above, which focuses on.

- Security: Requires a minimum of 16,384 validating nodes and will eventually run on hardware equivalent to a PC.

- Sustainability: PoS uses about 99% less energy than the PoW consensus.

The transition has experienced several delays on its way to adoption. However, a couple of days ago, members of the Ethereum development team announced a perpetual merger deadline during a conference call.

In the conference call, Ethereum lead developer Tim Beiko, who leads the protocol meetings, proposed September 19 as a potential date for the merge. The proposed target date was met with no resistance from core developers.

Understanding the new consensus

The fundamental change for the merge is shifting the blockchain's consensus protocol from proof-of-work, which uses miners to power the network, to proof-of-stake, in which validators holding ETH run the chain.

In exchange for maintaining the network secure, they receive a percentage return on their Ethereum.

To become a Beacon Chain validator, users must deposit a minimum of 32 ETH on the Launchpad, which beats the vast majority of retail users at the time of writing and with the current prices. Another obstacle to becoming a validator is the liquidity lock: the ETH staked cannot be sold until the merge happens.

These obstacles have created space for services like Lido and Rocket Pool to enter the market, where users earn interest on ETH and pool their resources together to participate as validators.

To decentralize or centralize, that's the question

With the high minimum requirement to be a validator and solutions like Lido coming into play, an important question is asked about the decentralization of a Proof-of-Stake Ethereum: is it more centralized?.

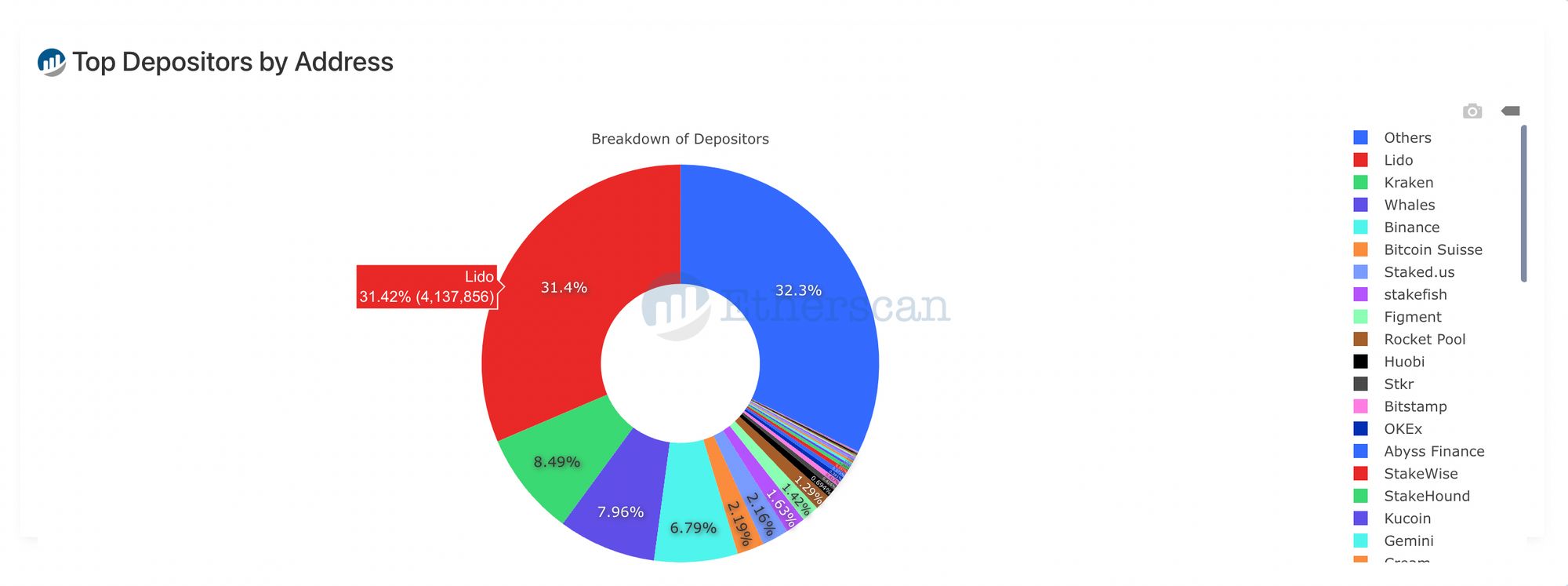

Lido was the first liquid staking solution to launch after the Ethereum Beacon Chain went live and has come to dominate the market. Data compiled by Delphi Digital shows that Lido's Ethereum staking deposit percentage has grown exponentially compared to its competitors.

Regarding validators, Lido controls more than 30% of the pool, one of the highest stakers.

The naysayers argue that if Lido's dominance continues to grow from its network effects, it can gain control of the majority of all ETH staked. This could allow Lido to censor Ethereum transactions or launch a 51% attack on the network.

An additional factor weighing on Lido is its distribution of governance tokens. Since the protocol works as DAO if Lido could attract the majority of staked ETH, LDO token holders of the protocol would gain power over the Ethereum network.

It is worth noting that for the average Ethereum user, nothing will change at a glance on their exchange or wallet. Ethereum will remain Ethereum.

The changes will involve the technical foundations of the Ethereum blockchain, that is, the infrastructure that executes, verifies, and documents transactions.

New processes will improve the blockchain, making it faster, somewhat cheaper, and more reliable.