Fellow Architects;

We are thrilled to introduce Arch Portfolios, the most efficient and hassle-free way to invest in crypto and web3.

Arch Portfolios are tokenized investment products that match your risk appetite and investment goals. Each portfolio is engineered to maximize returns while minimizing risk:

Our portfolios are built using cutting-edge optimization methods to allocate investments across a selection of index-style and yield-bearing Arch tokens for maximum efficiency. Portfolio composition is periodically reevaluated and automatically updated based on market conditions, completely eliminating the need for manual rebalancing.

Arch Portfolios are the easiest way to invest in crypto like a pro.

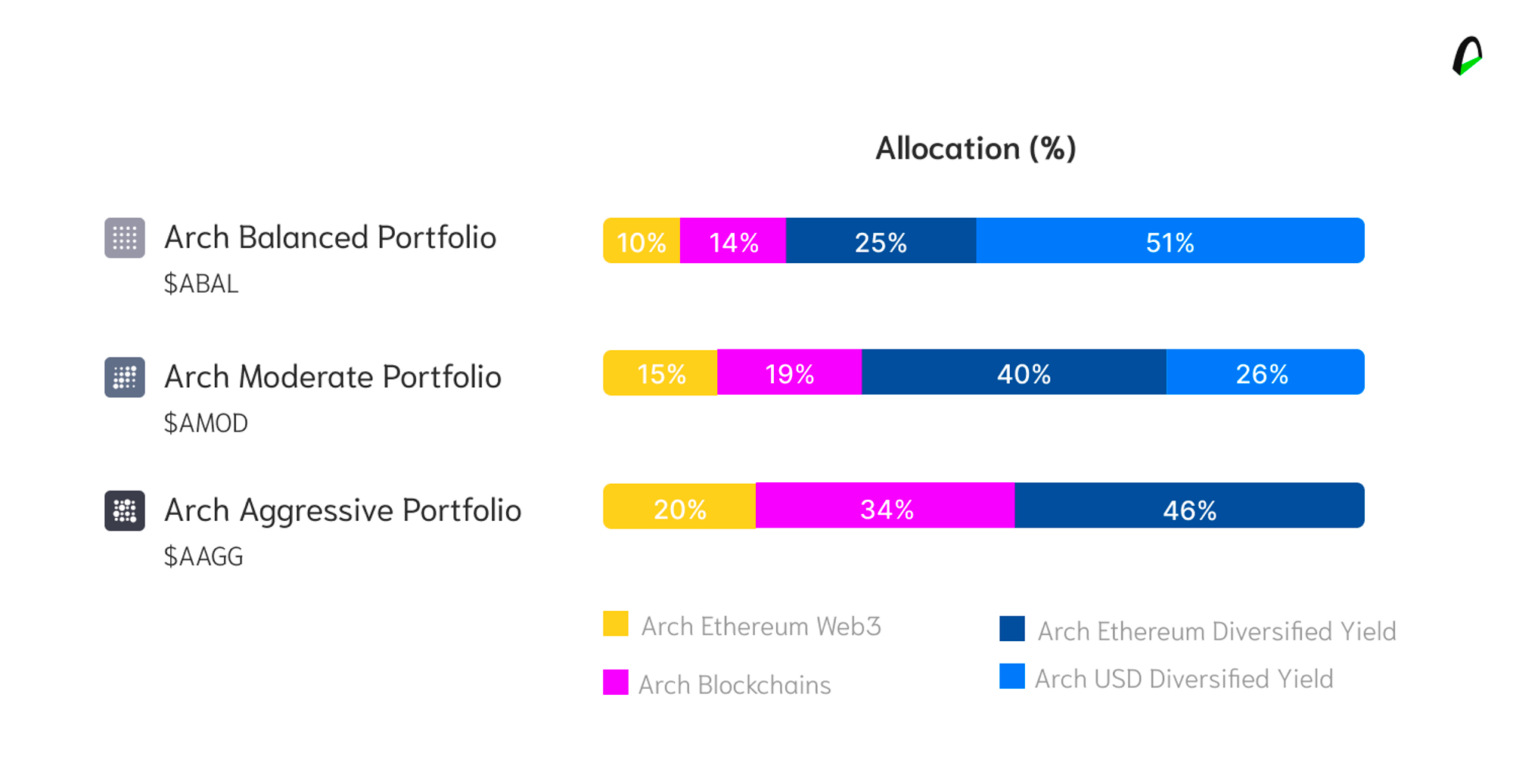

Arch Aggressive Portfolio (AAGG): Maximum Exposure to Growth-Oriented Assets

Capture the full potential of crypto with the Arch Moderate Portfolio - a blend of assets that aggressively embraces the cutting edge of web3.

This portfolio has a concentrated exposure to Ethereum and Ethereum-based projects (protocol tokens), offering maximum exposure to growth-oriented assets including staking and yield farming.

This higher-risk portfolio has no dollar-pegged stablecoin allocation, meaning you're completely exposed to the ebb and flow of crypto markets.

Arch Moderate Portfolio (AMOD): Embrace Growth Opportunities with Confidence

Embrace growth opportunities with confidence with the Arch Moderate Portfolio - a well-rounded blend of growth-oriented and stable assets.

Our Moderate Portfolio combines yield-bearing exposure to Ethereum (the native token powering the world's largest smart-contract platform) and protocol tokens, with a significant allocation in dollar-pegged yield-bearing assets.

This strategic allocation allows you to participate in the potential of leading web3 protocols, optimizing your chances for growth.

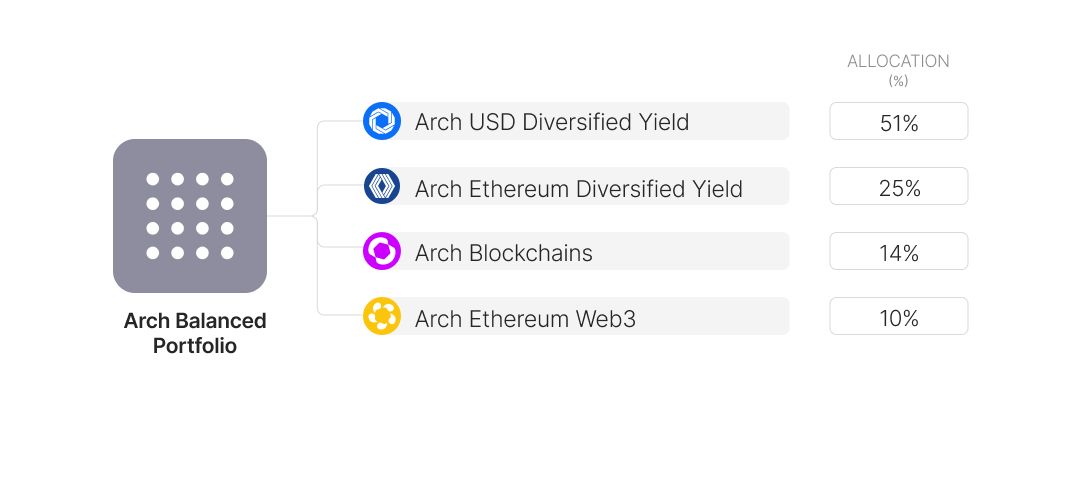

Arch Balanced Portfolio (ABAL): Stability while capitalizing on the crypto market potential

Strike the perfect balance for steady growth with the Arch Balanced Portfolio - a curated selection of assets providing stability through USD-pegged yield-bearing strategies, with exposure to major cryptocurrencies, and Web3 protocol tokens.

This approach de-risks your crypto exposure while still leaving ample room to capitalize from breakthrough returns during the good times.

Building a crypto portfolio aimed at long-term success

Portfolio optimization is a simple (Nobel prize-winning) idea that has been around for over 70 years. While simple in theory, its implementation in crypto poses multiple challenges. For starters, volatility is massive, and we don't enjoy the luxury of several decades of market data like our TradFi counterparts do.

At Arch, we employ cutting-edge techniques, from covariance shrinkage to subset re-sampling to address these challenges and to ensure that your investment is strategically allocated, aiming at long-term success. The following lines are meant to provide an outline of what happens behind the counter of our portfolio-building process.

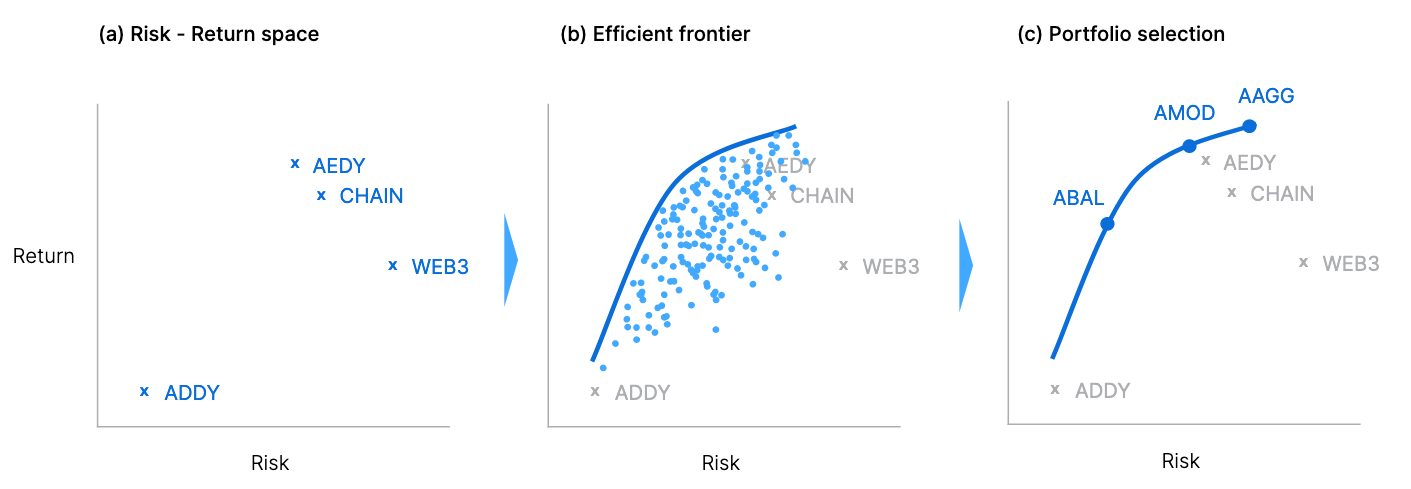

We begin by curating a set of assets that represent the unique facets of the web3 market to serve as our portfolio building blocks. This includes our families of index-style and yield-bearing tokens.

As the first panel (a) on the figure above shows, each asset has a unique risk /return profile. We also examine how correlated movements in these assets' prices are (do they move in tandem?) – this comes in handy in the next step.

Then the real magic happens. Out of all the potential combinations of assets to make up a portfolio, we optimize for those that provide the greatest return per unit of risk – we call this an 'efficient' portfolio. These efficient portfolios line up forming a 'frontier' in the risk-return space (the line in panel b), dominating all the other potential alternatives (light blue dots on the figure).

The next step is selecting a subset of the portfolios along the efficient frontier to call our Balanced, Moderate, and Aggressive products. We choose to align with investors' preference around exposure to riskier assets and investment horizons.

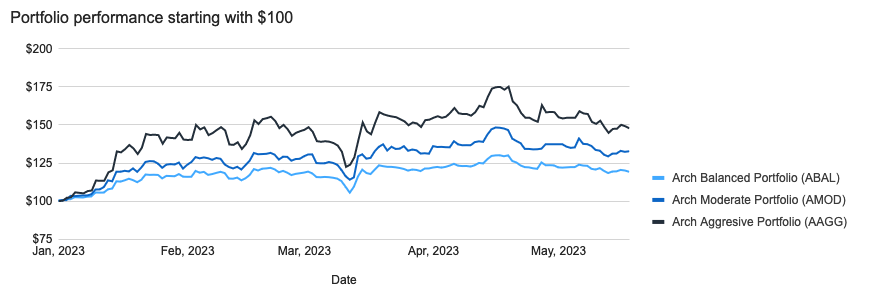

How do these portfolios perform? The image below highlights how each portfolio delivers a different investment profile. This year has been overwhelmingly positive for crypto and risk-takers have been consequently rewarded.

Disclaimer: The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations. The views reflected in the commentary are subject to change without notice.