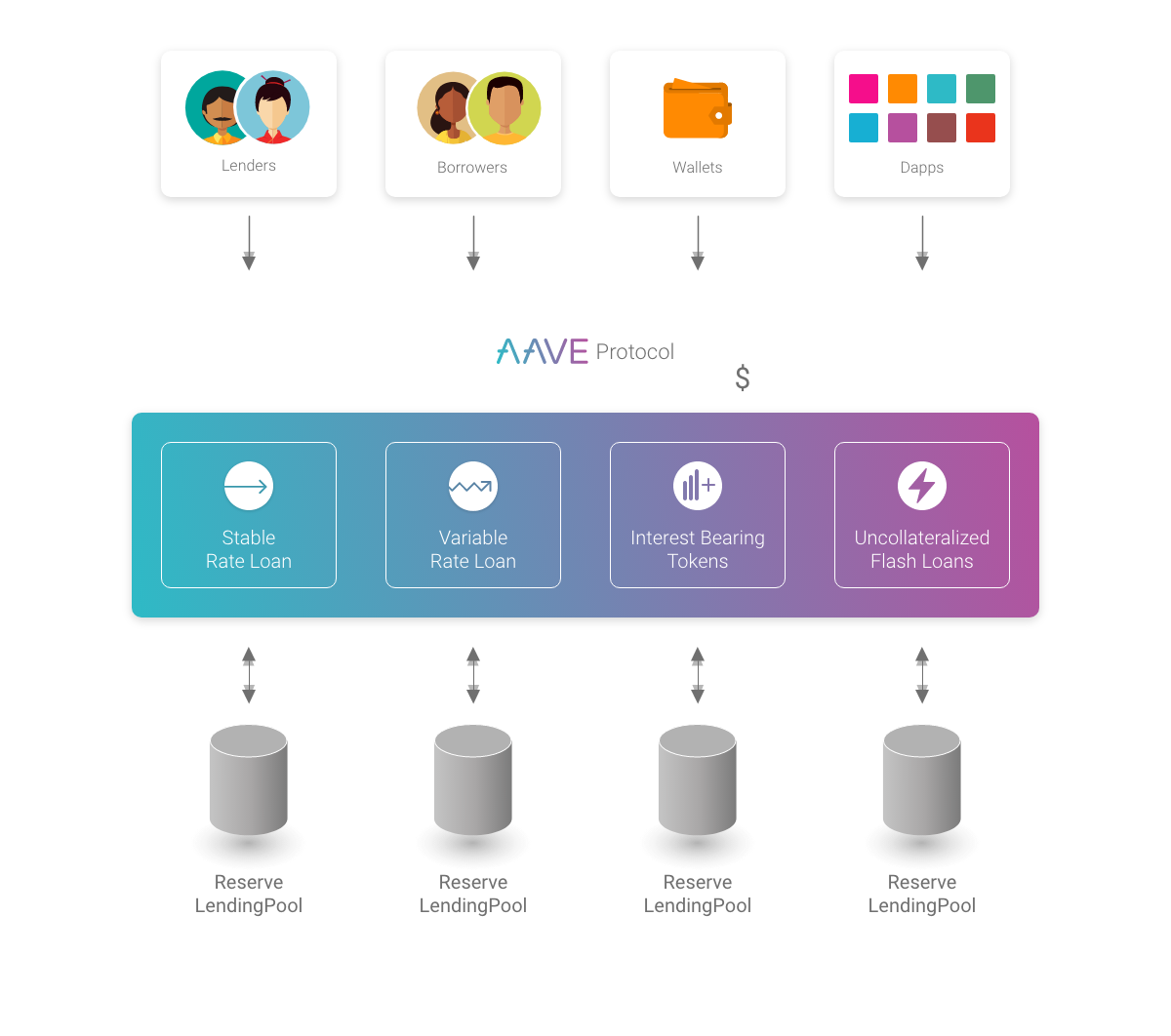

Aave is a decentralized lending protocol where users can participate as lenders or borrowers.

Lenders provide liquidity to the market for passive income, while borrowers can borrow on an over-collateralized or under-collateralized (flash-loan) basis.

Aave is open-source and non-custodial. It runs on the Ethereum blockchain, making it completely transparent, traceable, accessible, and auditable by anyone.

Users can deposit certain assets into the Aave reserve fund and earn interest on those assets (with higher yields than most traditional banks); they can also borrow certain assets from the pool, as long as they have sufficient collateral.

Borrowers can also switch between fixed and variable interest rates to get the best interest rate possible.

Aave is part of the Arch Ethereum Web3 Token and it's also part of the Arch Asset Lending Index.

How Aave works

Aave runs on the Ethereum blockchain and allows the creation of fully decentralized reserve pools.

Anyone, without restrictions, can interact with Aave's smart contracts, deposit certain assets in a shared reserve fund and earn interest paid with the interest of users willing to borrow certain assets from the reserve pool.

The birth of the Aave Protocol marks the change from a decentralized P2P lending strategy (direct lending relationship between lenders and borrowers, as in ETHLend, the first version of Aave) to a pool-based approach.

Lenders provide liquidity by depositing cryptocurrencies in the smart contract of a pool.

Simultaneously, users can borrow funds from the pool in the same contract by adding collateral.

Borrowers and lenders do not need to match individually, as this falls on the pool of funds and the amounts borrowed and their collateral. This allows instant loans based on the pool's state.

The interest rate for borrowers and lenders is decided algorithmically:

• For borrowers, it depends on the number of funds available in the pool at a specific time. As funds are borrowed from the pool, the amount of available funds decreases, which increases the interest rate.

• For lenders, this interest rate depends on the speed of profit, with the algorithm safeguarding a liquidity reserve to guarantee withdrawals at any time.

To understand the concept of a loan pool, it's vital to understand the idea of a reserve. Each pool holds reserves in multiple tokens, with the total amount defined as total liquidity.

A reserve accepts deposits from lenders. Users can borrow these funds as they lock up an asset as collateral, supporting the loan position.

The specific tokens in each reserve pool can be used as collateral or not to open loan positions; the collateralization index will depend on the risk of the asset that's frozen as collateral.

The amount that can be borrowed depends on its availability within the reserve. Each collateral will have a specific liquidation threshold and loan-to-value ratio, which means that riskier collaterals will allow smaller loans and liquidate sooner to ensure the protocol's security.

Users can open a loan position with a stable or variable rate. The loans have infinite duration, and there is no payment schedule: users can make partial or complete payments at any time.

In the event of price fluctuations, a loan position could be liquidated. A liquidation event occurs when the collateral price falls below the LQ threshold, called the liquidation threshold.

When a position is liquidated, a liquidation bonus is generated, which incentivizes liquidators to buy the collateral of the liquidated position at a discount price.

Each reserve has a specific liquidation threshold, following the same approach as for the LTV (loan-to-value).

The calculation of the average liquidation threshold is done dynamically, using the weighted average of the liquidation thresholds of the underlying assets of the collateral.

At any point in time, a loan position can be characterized by its health factor, a function of total collateral, and total loans, which determines how close or far a loan is from being undercollateralized.

The protocol features a decentralized insurance fund, which will collect a small portion of the pool's revenue to cover losses in the event of settlement issues.

Flash loans

The most well-known use of the Aave protocol is flash loans. Flash loans are designed for developers or users with technical knowledge of the Solidity language.

Flash loans allow users to instantly take a loan from a reserve pool without posting any collateral. The loan must be used and returned in the same transaction. If not, the loan is returned to the reserve pool, and all actions executed up to that point are reversed. This is done to ensure the safety of the pool funds.

The potential of flash loans is immense since it allows users to create as many transactions as they need within the same period in which the loan is requested and then paid. These procedures are known as "circuit" procedures that always happen in the time it takes for a block to complete.

For example, imagine that a user has an open CDP (Collateral Debt Position) but finds a CDP from another platform with a lower interest rate.

The user in question would like to change the CDPs but cannot because they don't have enough capital to release their current CDP.

Flash loans could solve this problem since they don't need collateral. They would allow the user in question to obtain enough Dai to close the CDP in progress, transfer the unlocked collateral to the new CDP with lower interest, and return the Dai received from the CDP. TAll the actions would happen in a single transaction.

The possibilities for developers to create applications in the future based on this feature are extensive.

Flash loans can be used in arbitrations, as a source of liquidity, or for refinancing. By eliminating the need to have the capital to obtain a flash loan, the liquidation market is democratized, and it is achieved that these are faster and easier.

At the same time, the security of the entire ecosystem is improved, and the risk of "bad debts" is reduced.

Flash loans also provide endless liquidity to the DeFi ecosystem instead of keeping assets locked up, lowering the entry barrier and allowing more people to participate in the DeFi ecosystem.

aTokens

Aave's a-Token model proposes an exciting way to earn interest from deposited tokens.

All deposits in the Aave Protocol have a corresponding "aToken." This differentiates this protocol from other similar ones, such as Compound.

In other protocols, users obtain tokens that generate interest when depositing tokens in the pool. However, the exchange ratio is not 1:1 as with aTokens. If, for example, a user deposits 100 DAI in the Aave reserve pool, they'll obtain 100 aDAI in return.

This 1:1 ratio of the aTokens is efficient when we want to move or exchange the aDAI, for example, because users can quickly know the actual amount of what they have.

Aave and Chainlink

Shortly after the launch of the Aave protocol mainnet, the project announced a collaboration with decentralized oracle network Chainlink to secure cryptocurrency price feeds.

Aave uses Chainlink to access off-chain data so they can calculate loan rates using the decentralized network of pricing oracles provided by them.

Aave was the first DeFi project to officially start using Chainlink oracles, something many other projects are working on.

The use of Chainlink helped reduce operations time while providing a greater guarantee of data integrity, decentralization, and security.

Aave token

AAVE is the native token of the Aave protocol. Additionally, AAVE acts as a governance token that allows the community to decide in which direction the protocol should move forward collectively.

The Aave protocol follows a decentralized governance model. This model allows protocol users to vote on proposals for change and the future direction the protocol should take.

The purpose of the AAVE token is, above all else, to give holders the ability to vote on proposals. The token allows its holders to act as governors of the protocol itself.

Additionally, AAVE holders can stake their tokens and earn passive income. Staking means participating in validating transactions on a Proof-of-Stake (PoS) blockchain. Any user who has the required minimum balance of, in this case, AAVE can join a staking pool. Users then validate transactions and earn staking rewards.

The Aave protocol essentially brings liquidity to the decentralized finance space, allowing anyone to earn interests or borrow through their assets. The project allows investors to retain their working capital.