GM Architects!

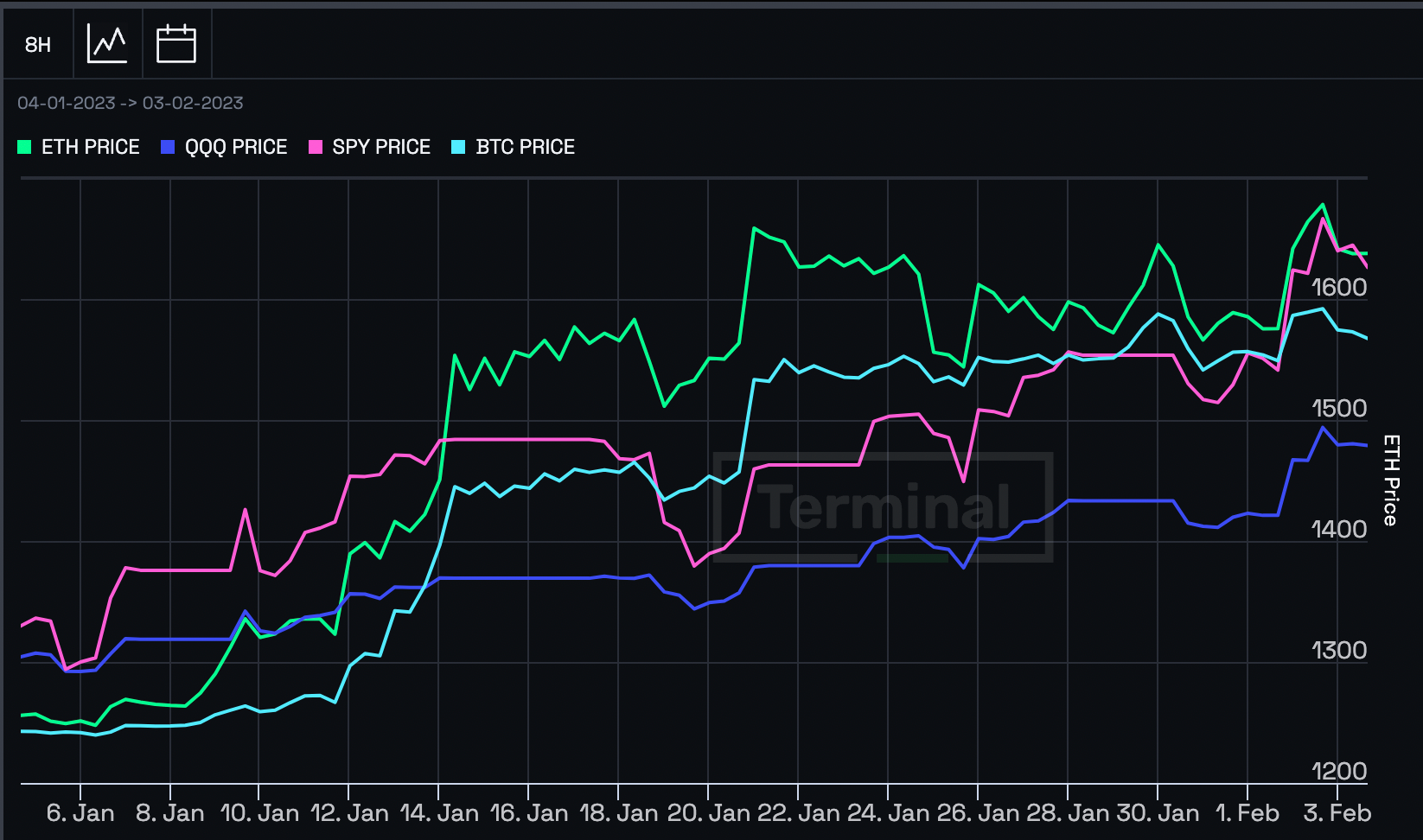

The Fed raised interest rates by another 25 basis points on February 1st, giving some large-cap crypto projects a post-rate-hike momentum. More on that below.

Cryptocurrencies are up by 3% week to date, while major protocols went up by 3%. In TradFi, the S&P500 is up by 3% in the last five days, while the tech-heavy Nasdaq Composite is up by 6%.

This newsletter edition covers this week's market movers, shares some highlights from our monthly Arch indices rebalancing process, explores the potential of NFTs, and deep dives into what yield farming is.

☕️ This week in crypto

- The European Investment Bank - is leveraging Ethereum in its quest to tokenize capital markets while issuing the first-ever digital pound sterling (GBP) bond on a separate private blockchain. According to a statement, the bank opted for a private network for privacy and efficiency, and to increase transparency, it also recorded it on Ethereum.

- Jack Dorsey - the former Twitter CEO, is backing up a new Web3 app aiming to become the next Twitter. Nostr, a censorship-resistant global social network, officially went live on mobile app stores on Wednesday. Vitalik Buterin, Ethereum founder, has also shown support and has an account on the app.

- eBay - partners with virtual events platform Notable Live to combine eBay's collectible marketplace with an immersive experience and provide sports fans with a platform to connect with players through NFTs.

- ARK Invest - the asset manager created by Cathie Wood, claims in its latest Big Ideas report that blockchain will be one of the most significant technologies to shape an already technological era along with artificial intelligence, energy storage, robotics, and multiomic sequencing. "The financial ecosystem is likely to reconfigure to accommodate the rise of cryptocurrencies and smart contracts," the report states.

Sentiment is mostly bullish. But what about February?

The Fed chair, Jerome Powell, announced on Wednesday a 25 basis points hike in interest rates.

And what markets did? Ether briefly traded about $1,700 while bitcoin reached the $24,000 price point, hitting a five-month high.

And while the positive momentum is more prominent on ETH and BTC, the TradFi market is also feeling a positive impact. The correlation between crypto and TradFi assets has been a recurring theme since March 2022.

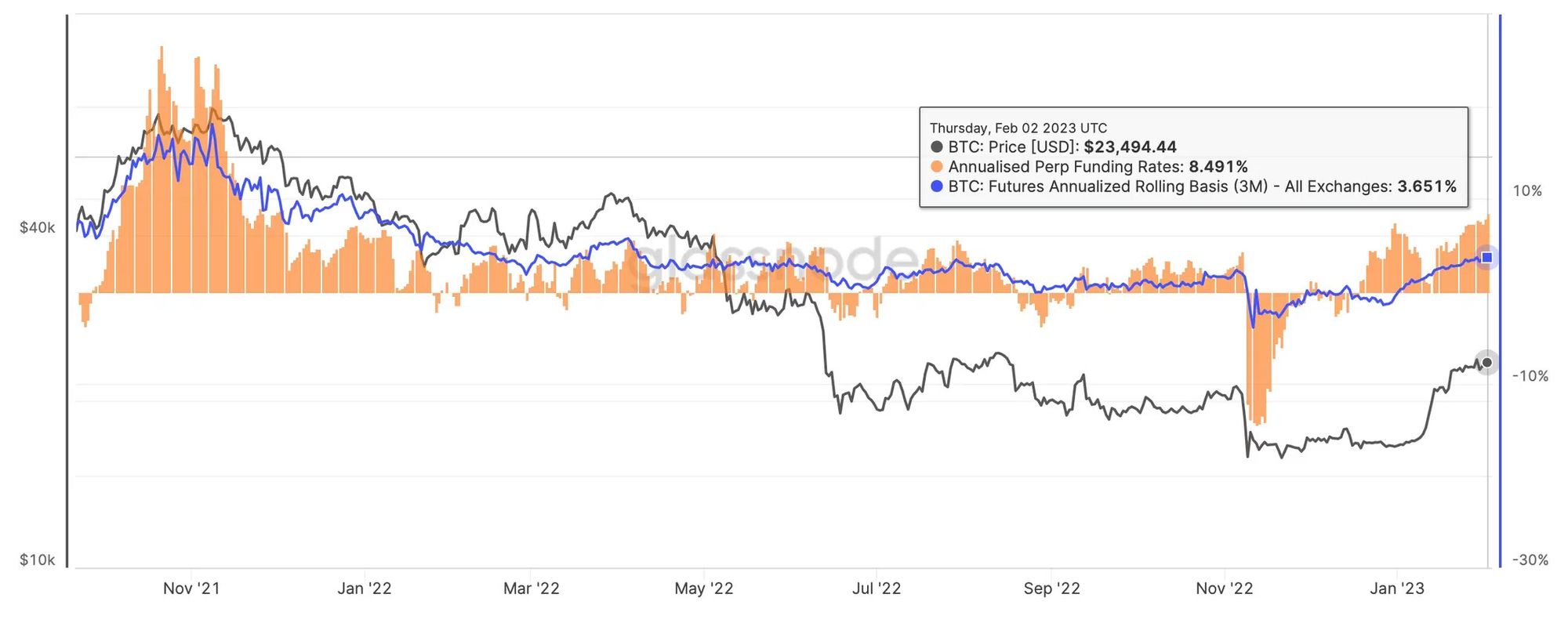

Bitcoin funding rates - a mechanism that keeps the prices of bitcoin perpetual futures contracts in sync with the spot market price - also show bullish signals.

Positive funding rates indicate that long-position traders are dominant and are willing to pay short traders to keep their positions. Negative funding rates indicate that short-position traders are prevalent and are willing to pay long traders. A positive funding rate is usually considered a bullish signal.

On Thursday, the annualized bitcoin perpetual funding rates across major exchanges reached 8.49%, the highest since December 3rd, 2021, according to Glassnode, the blockchain analytics firm.

What to expect in February

No one can predict what will happen with markets, but there are some important things to be prepared for during the next month.

- The Consumer Price Index (CPI) inflation reading will be on February 14th. We have seen volatility every time a new CPI reading happens.

- The Personal Consumption Expenditure Price Index (PCE) reading - one of the primary measures of inflation and consumer spending trends in the U.S. economy - will also be happening on February 14th.

- Both readings will give investors a clearer outlook of how inflation is reacting to the Fed's measures and how they might continue moving forward. And let's keep in mind that these measures are affecting the market as a whole.

- During the 15th and 17th of February, the European Blockchain Convention - the most influential blockchain and crypto event in Europe - will take place in Barcelona with more than 200 speakers.

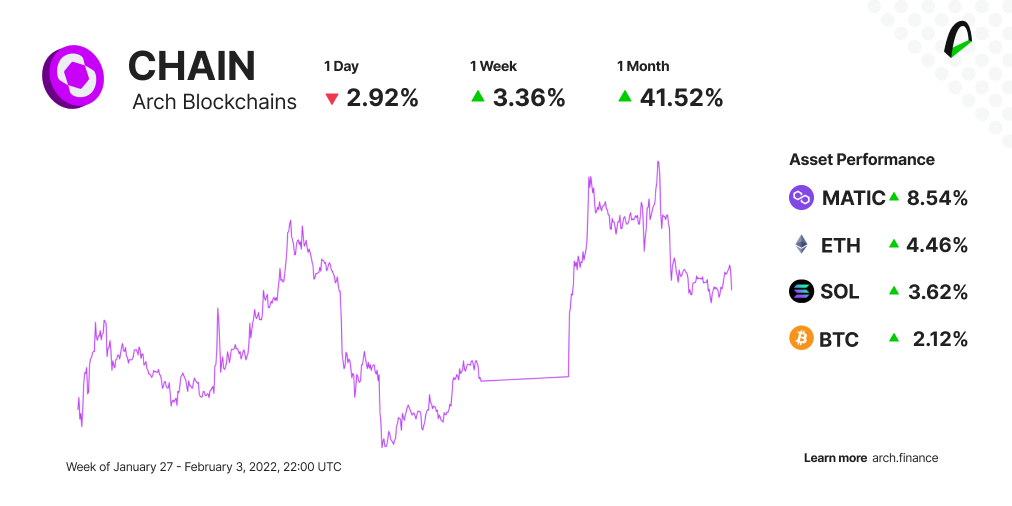

⛓ Cryptocurrencies: $CHAIN is up by 3.3%

The Arch Blockchains token (CHAIN) traded 3.3% higher than in the last seven days.

- Bitcoin (BTC) is seeing some intriguing news. Ordinals Protocol is using the Bitcoin blockchain to store NFTs driving a wedge between Bitcoin purists and innovators. The new protocol has reignited an age-old debate on whether Bitcoin should be used for non-financial purposes.

- Ethereum (ETH) is preparing to trial staking withdrawals with a user-facing rehearsal of its anticipated Shanghai upgrade on a public testnet of the software. The public testnet, dubbed Zhejiang, will allow any Ethereum user to simulate the process of withdrawing staked ETH.

- Solana's (SOL) DeFi protocol, Everlend Finance, is closing down its operations. The company announced the decision on Twitter.

- Polygon (MATIC) has been outperforming Ethereum in the number of NFT transactions for the second consecutive month. The rise in NFT lending is partly responsible for the increase in activity. BendDAO had the most significant volume in January at $36 million.

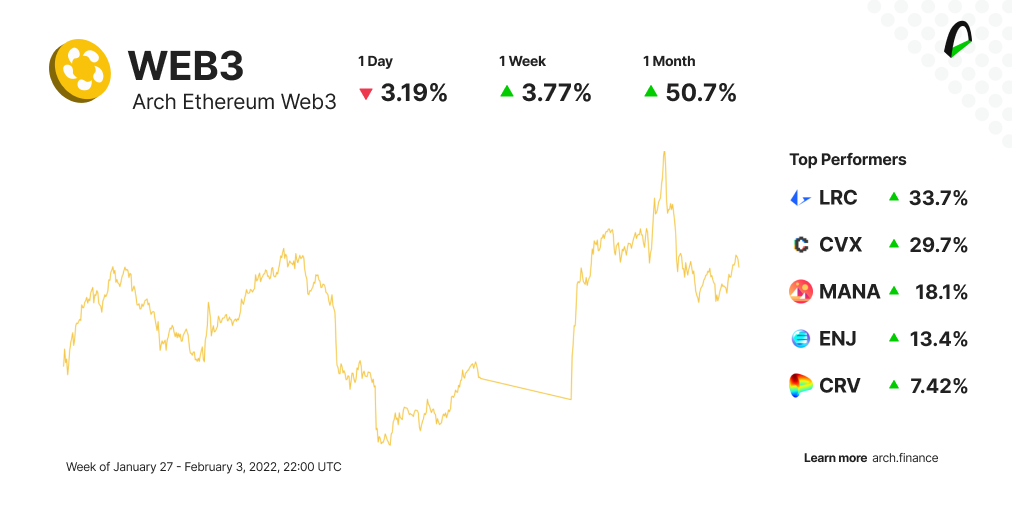

📈 Protocols: WEB3 is up by 3.7%

At the time of writing, The Arch Ethereum Web3 token (WEB3) traded 3.7% higher than last week.

- Decentraland (MANA) is experiencing some bullish momentum. There isn't an apparent reason why the token might be on an uptick, but institutional adoption is helping with brands like Pedigree releasing experiences on the metaverse.

- Uniswap's DAO (UNI) has approved a second non-binding proposal, called a "temperature check," to make Wormhole the official bridge for cross-chain governance of the protocol between BNB Chain and Ethereum. And on 31 January, Uniswap released details related to its new Permit2 smart contract - a token approval contract that can share and manage token approvals of different smart contracts. Permit2 smart contract allows seamless token approvals across web3 dApps. WhaleStat states that UNI is among the top 10 purchased tokens among the 100 biggest ETH whales.

- Aave (AAVE) officially launched Aave V3 last Friday. Aave V3 deployment includes seven cryptocurrencies, such as DAI, USDC, AAVE, LINK, ETH, WBTC, and wsETH. Since it became operational on Ethereum, ETH's supply on Aave V3 has been the highest of all the assets.

- Lido DAO (LDO) is preparing a proposal to allow withdrawal from stETH as Ethereum's Shanghai fork gets closer. While the proposal hasn't been put for voting yet, some investors feel there are some serious issues with the proposal as it currently stands.

👩🎨 Beyond a JPG: The potential of NFTs

Did you know that the value of NFTs multiplied by more than 15 times in 2021 and that in 2022 they had less than 10% of their value? Anyone would say that they are useless and that they were a colossal failure.

People think that when we talk about NFTs, we only talk about digital art, but the underlying technology allows us to do much more.

Here are other use cases that will undoubtedly revolutionize the industry soon.

🧑🌾 What is yield farming

Yield farming is a way of taking advantage of DeFi technology to maximize returns. By lending and borrowing crypto on decentralized finance platforms, users can access rewards in crypto.

Disclaimer: The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations. The views reflected in the commentary are subject to change without notice.