GM Architects!

Web3 continues on a positive upswing across the board.

Cryptocurrencies are up by 2% week to date, while major protocols went up by 6%. In TradFi, the S&P500 is up by 2% in the last five days, while the tech-heavy Nasdaq Composite is up by 3%.

This newsletter edition covers this week's market movers, shares some highlights from our monthly Arch indices rebalancing process, argues why calling crypto a Ponzi scheme is wrong, and deep dives into LooksRare.

☕️ This week in crypto

- Visa's - CEO, Al Kelly, said the company believes CBDCs and stablecoins could play a meaningful role in payments in the future. Over the years, Visa has been working on several crypto-related projects.

- Goldman Sachs - ranks bitcoin as the top-performing asset in the world in 2023. The prominent financial institution ranked BTC above gold, real estate, 10-year US Treasury, energy, Nasdaq 100, and twenty other investment instruments.

- Nike's - NFT platform .SWOOSH community members are invited to participate in a contest called #YourForce1 that challenges users to build a visual storyboard on Instagram showcasing their footwear design. The winning creators of digital sneakers will earn a $5,000 prize and the opportunity to collaborate with Nike designers on a virtual sneaker.

- Pedigree - the pet food maker, is launching the FOSTERVERSE to allow users to foster virtual dogs on Decentraland. They are looking to raise awareness about pet homelessness and hope that by allowing users to foster pets in a virtual space, they might be more inclined to adopt a dog in real life.

Bullish momentum: a Crypto Summer in the middle of Winter?

One thing is for sure. Markets are having a positive streak, and we are almost ending the month with excellent returns. Bitcoin has jumped nearly 40% to $23,000 this month, making us reminiscent of the 2019 bull revival.

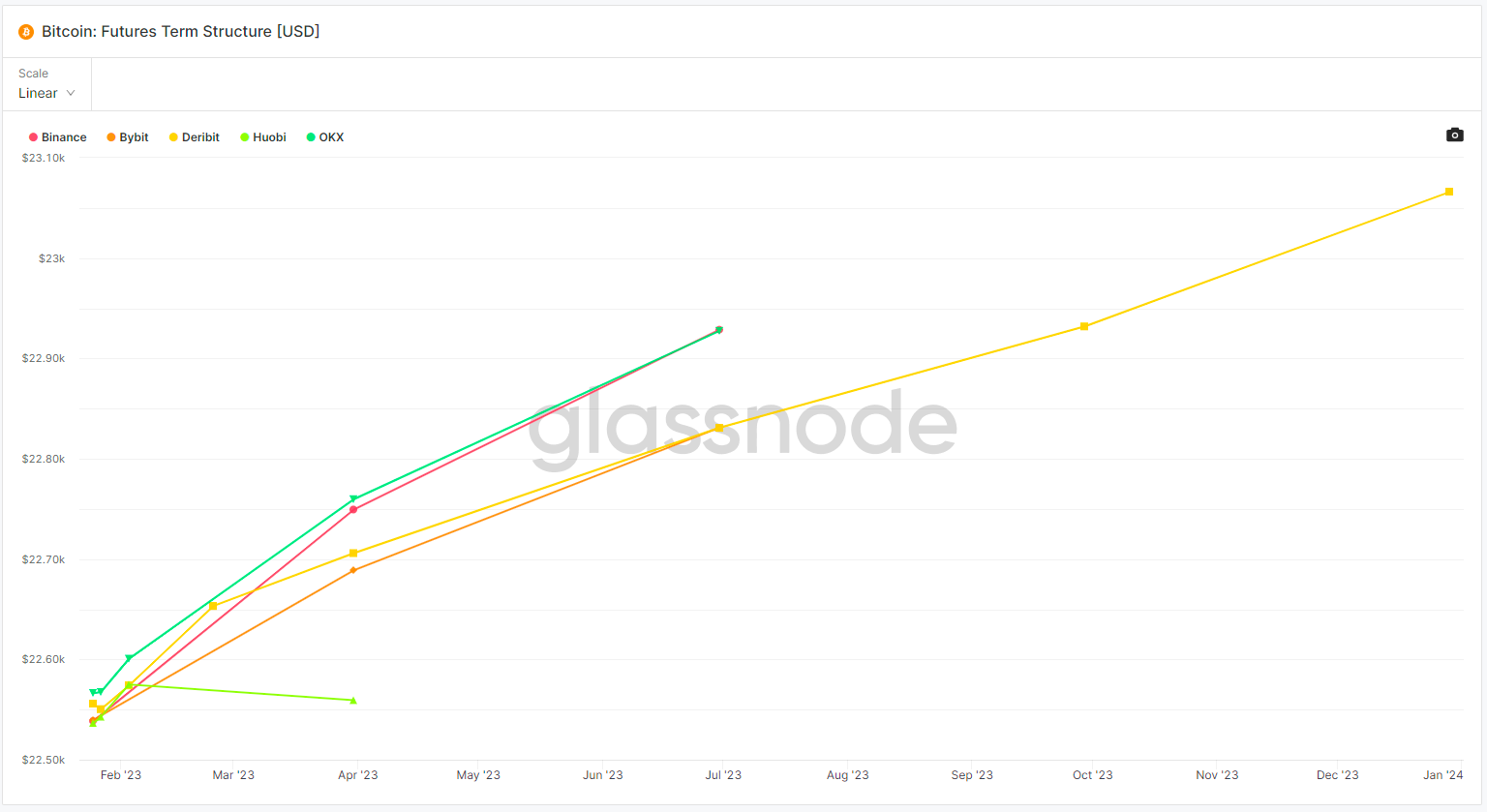

Derivatives markets are also signaling a positive sentiment for bitcoin. The futures price exceeds the bitcoin price in spot markets.

This condition is called contango, and while many factors interfere with a price forward curve steepness (interest rates, asset lending yields, etc.), this pattern is generally considered a positive market signal.

Another way to read market sentiment through the forward curve price is to look at the evolution of the premium to be paid for having the asset in the future.

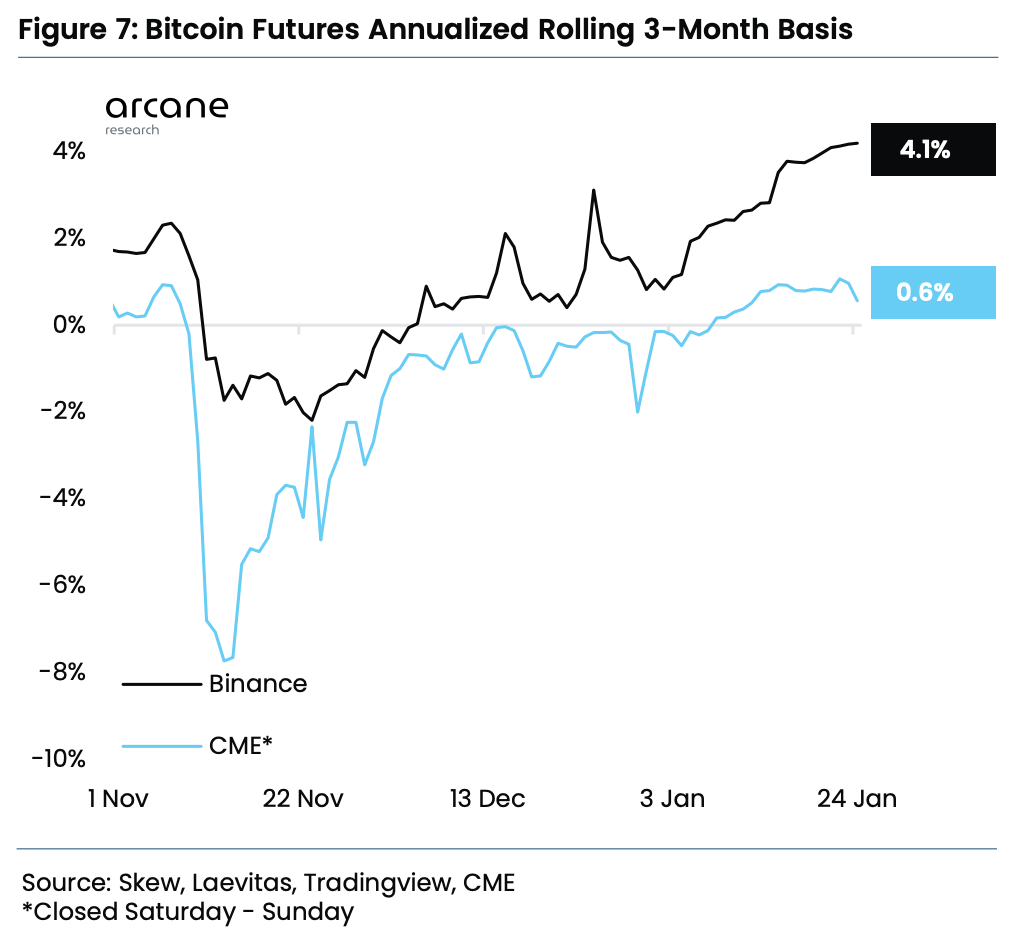

As depicted below, the premium - for a 3-months delivery - has turned positive since early January, exiting the negative territory. That means investors are not demanding discounts anymore to buy future bitcoin.

Monthly updates to Arch Indices

Amidst these market conditions, Arch Intelligence carried out its monthly rebalance of crypto indices.

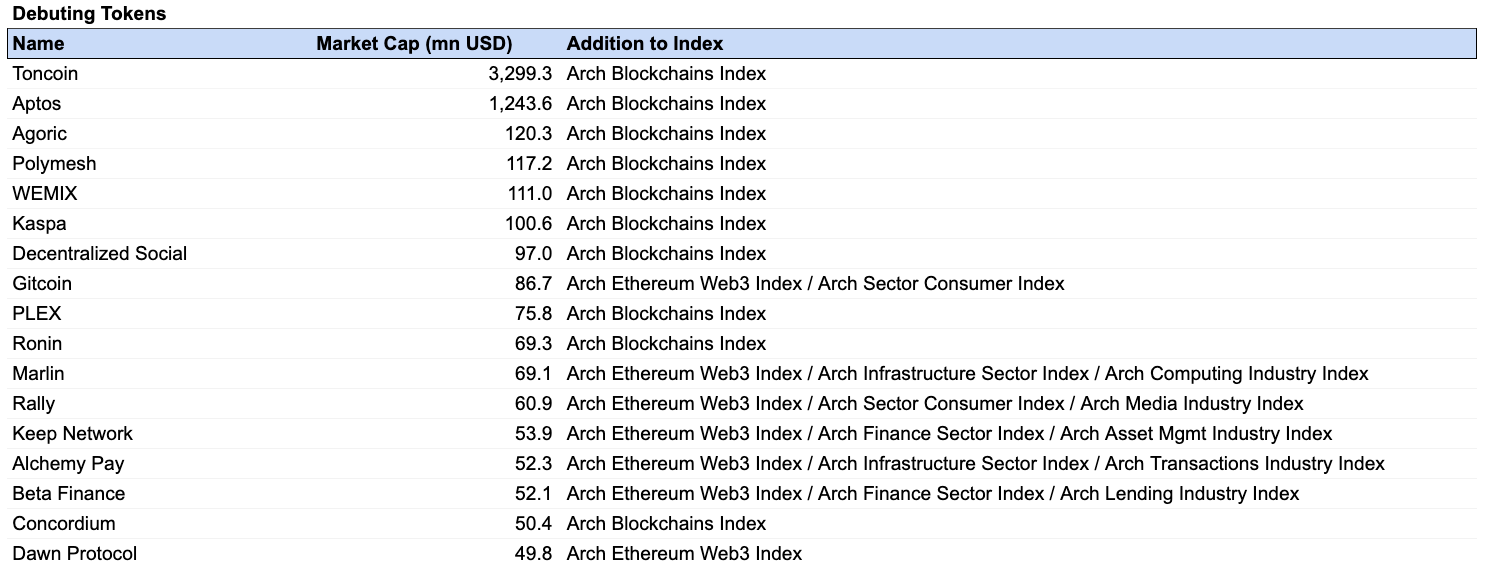

Among all indices, there were 46 movements of inclusions or exclusions of tokens, and 17 new tokens debuted in our tracked universe.

Arch Blockchain Index had the most considerable net token additions: 8 new names. At the same time, three indices had a reduction in the number of constituents: Arch Derivatives (1 token), Arch Asset Management (2 tokens), and Arch Finance Sector (3 tokens).

Arch's token rebalances show that not all sectors or industries move in tandem. While some indices lost representative share, others gained.

Among the tokens that gained the most space are Decentraland (MANA) in the Metaverse Index and Consumer Index. AAVE keeps showing a strong dominance of the Lending Index with more than 49% of industry dominance from the 44% it had last month.

The most negatively affected index in terms of loss of market share was Arch Oracle Industry, which reduced its share by 13.7%.

That's why having a diversified portfolio is so important. In crypto, just like in traditional assets, all industries and sectors, as well as projects and companies, behave differently, and having broad exposure reduces the impact and volatility of portfolios.

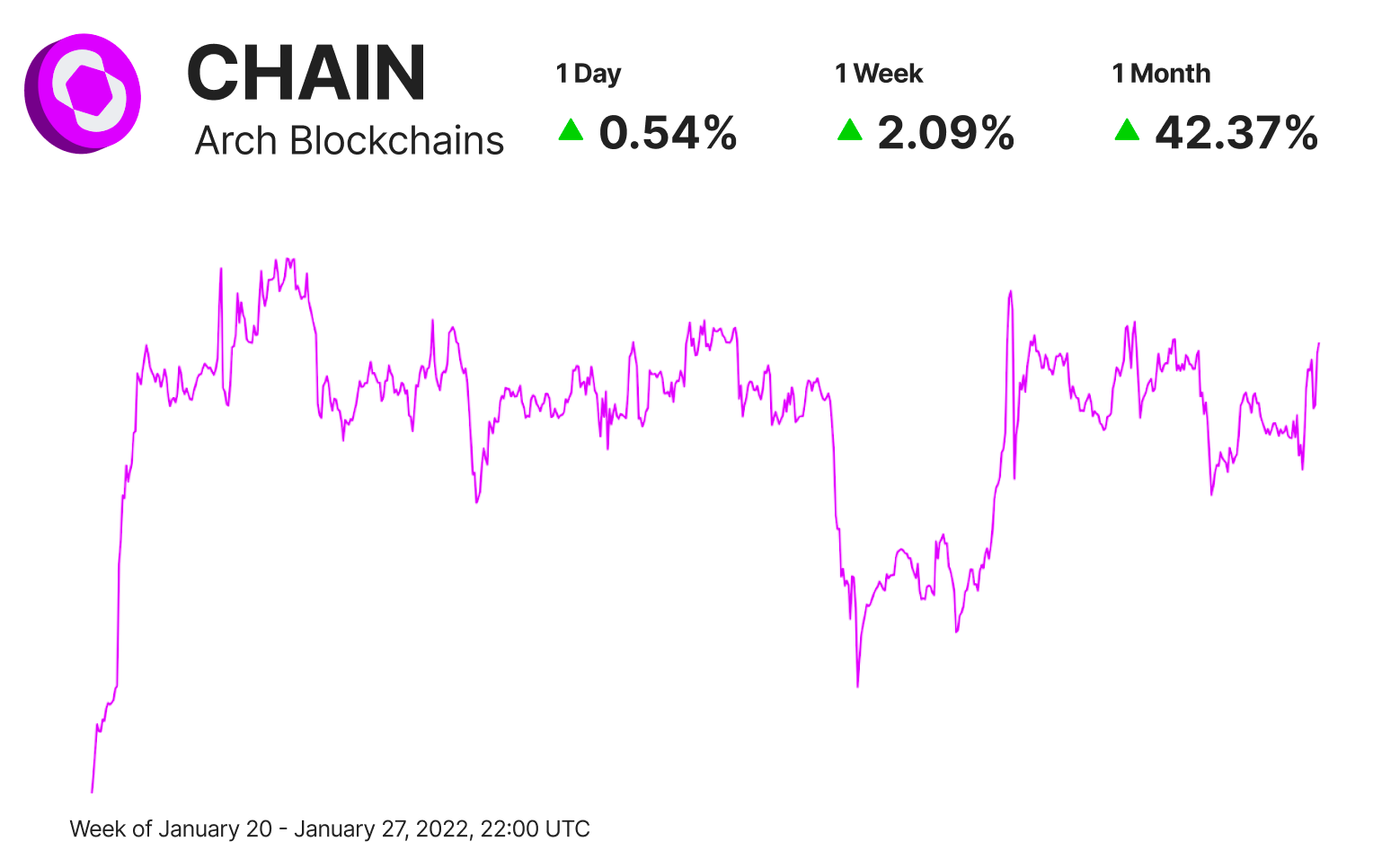

⛓ Cryptocurrencies: $CHAIN is up by 2.1%

The Arch Blockchains token (CHAIN) traded 2.09% higher than in the last seven days.

- Bitcoin (BTC) continues to reach new highs during this rally. Tesla published its latest earning reports showing that it did not sell any bitcoin during the fourth quarter during the bear market.

- Ethereum (ETH) is also seeing exciting project action built on its blockchain. For example, the Porsche NFT collection, built on Ethereum, surged 180% over the last 24 hours.

- Solana (SOL) seems to have recovered from the FTX debacle. Their innovative new phone, Saga, will be released by Solana Mobile soon. They also announced a “dApp store” pre-installed on the phone that would act as a centralized location where users could access all Solana network’s decentralized applications.

- Polygon (MATIC) is also experiencing positive price action, surrounded by positive news. Fractal, the gaming marketplace founded by Twitch co-founder Justin Kan, is expanding to Polygon. ZenGo, a seedless wallet launched on Polygon, becoming the first of this type of wallet on the network, and Pudgy Penguins, one of the top NFT projects, announced that it is using Layer-0 to allow cross-chain transactions adding Polygon.

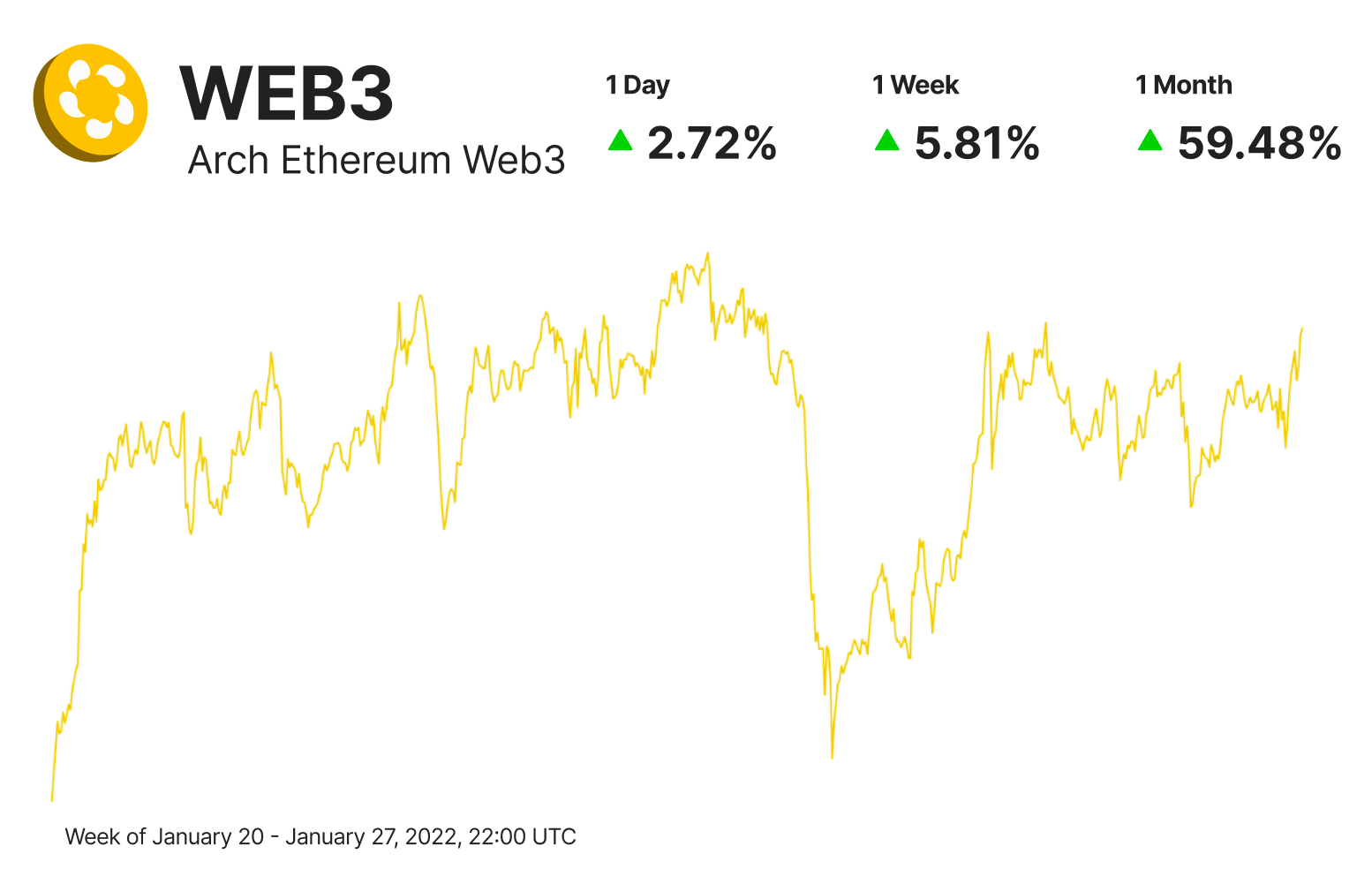

📈 Protocols: WEB3 is up by 5.8%

At the time of writing, The Arch Ethereum Web3 token (WEB3) traded 12.19% higher than last week.

- ApeCoin (APE) is having some positive momentum after Yuga Labs - the Bored Apes Yacth Club ecosystem creators - announced the launch of Dookey Dash. This "endless runner" style game requires an NFT to play and promises as-yet-unrevealed rewards for top scores. Yuga Labs also minted a new NFT collection, Sewer Pass, that's now trending. Holders of a Bored Ape Yacht Club or Mutant Ape Yacht Club NFTs were eligible to claim a free Sewer Pass, which is the key to playing a skill-based game called Dookey Dash.

- Loopring (LRC) partners with Protocol: Gemini to create new Web3 gaming solutions. Protocol: Gemini is a development studio that blends blockchain, augmented reality, and metaverses to create engaging experiences. The partnership will help bring Web3 games to Ethereum L2.

- AAVE (AAVE) is set to launch the third version of its protocol on Ethereum after a successful DAO vote. Aave v3 on Ethereum will launch with support for seven assets: wrapped bitcoin, wrapped ether, wrapped staked ether, USDC, DAI, link, and AAVE.

- Liquid staking projects like Lido DAO (LDO) and Rocket Pool (RPL), as well as the liquid staking solution from Frax Share (FXS), continue having a positive momentum, with all tokens trading over 20% higher than the last seven days. Liquid staking is having a rally after Ethereum developers announced they are working on allowing staked ETH withdrawals in March.

💰 On why crypto is not a Ponzi scheme

Let's see item by item what a Ponzi scheme is and why crypto projects like Bitcoin or Ethereum are not.

👁🗨 LooksRare

LooksRare is an NFT marketplace gaining traction in the industry. With a 40% growth in the last month it's looking to create the best environment for Ethereum NFT trading. LooksRare is part of the Arch Marketplaces Industry Index.

Disclaimer: The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations. The views reflected in the commentary are subject to change without notice.